Forget About Iran, the Real Danger to the Markets Is Coming From Japan

While the world obsesses over the situation in the Middle East, another crisis is starting to unfold.

That crisis?

Japan’s debt markets are beginning to blow up.

Japan is the grandfather of monetary policy insanity. Every crazy move western central banks have introduced in the last 15 years was first introduced by Japan a decade earlier. The U.S. first introduced Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE) in 2008. Japan’s central bank, the Bank of Japan (BoJ) introduced that lunacy in 1999 and 2001, respectively.

Since that, the BoJ has:

- Bought so many shares in Japanese stocks that it is the largest shareholder of Japanese stocks in the world. Indeed, it is a top 10-shareholder in 40% of the companies trading on Japan’s stock market: the Nikkei.

- Acquired over 50% of Japan’s debt outstanding.

- Launched a single QE program equal to 25% of Japan’s GDP.

- Cut interest rates to NEGATIVE

By the look of things, Japan is reaching the endgame for this insanity.

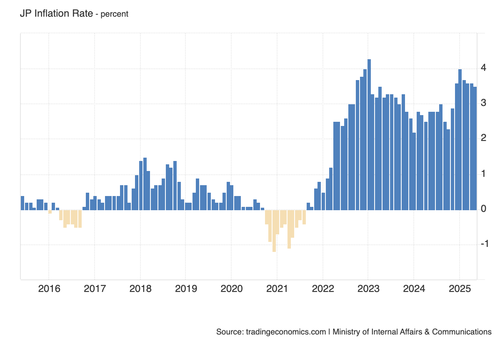

Inflation has arrived in Japan: core inflation hit a 2-year high for the month of May, rising to 3.7% year over year, above expectations of 3.6%. And this is AFTER the BoJ has begun tightening monetary conditions for the first time in decades. As the below chart shows, inflation is NOT coming down in any meaningful manner.

As a result of this, the yield on Japanese Government Bonds have exploded higher to levels not seen since 2008.

This presents a HUGE problem for BoJ. For one thing, as the largest owner of Japanese debt in the world, it will soon be sitting on hundreds of billions of dollars’ worth of losses.

On top of this, Japan has a debt to GDP ratio of 260%: its total debt outstanding is equal to roughly $8.5 trillion. If yields continue to rise on this mountain of debt, it won’t be long before the nation faces a debt crisis.

The markets got their first taste of this last August when the BoJ was forced to raise rates for the first time since 2007. Japan’s currency exploded higher on the news, triggering a systemic deleveraging as the Yen carry trade (borrowing in Yen to buy other higher yielding risk assets) began to blow up.

Japan’s stock market cratered 12% that day. The entire world felt the effect of this with U.S. stocks collapsing 8% in just three trading sessions.

The issues outlined above are not over by any stretch of the imagination. In fact, Japan’s Finance Minister was forced to change the country’s long-term debt issuance earlier this week in order to calm the country’s debt markets. How long that will last is anyone’s guess.

With this in mind, investors should ride the current bull market in stocks while keeping one eye on the exits. We are urging our clients to do precisely this with a tool we’ve developed that has accurately predicted every major market collapse in the last 40 years.

We detail it, how it works and what it’s saying about the markets today in How to Predict a Crash. Normally we’d sell this report for $499, but in light of what’s happening in Japan today, we’re making just 99 copies available to the investing public.

To pick one up…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research