Market Pullback to Continue

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

Short Term Pullback

After the furious 25% bounce in SPX from the April lows, the sentiment is very clearly changing. The market started to crack this week and there’s risk the pullback continues. Over the past two weeks, the market has been unable to hold its daily highs and was systematically sold into the afternoon. Watching intraday price action gives us clues to the changing tides.

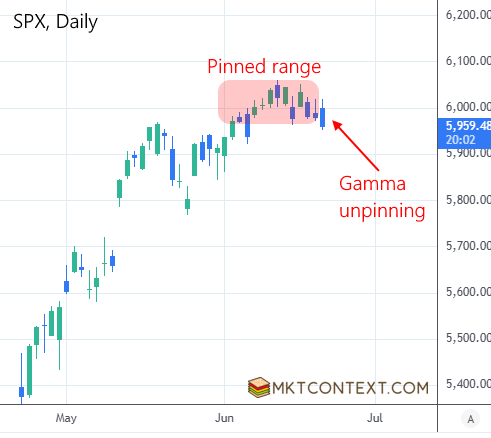

With the rapid shift in geopolitics and the July 9th tariff deadline looming, traders have been taking profit and de-risking. This past Friday was quarterly options expiry, which led to an “unpinning” of gamma. Meaning: dealer activity that previously pinned the market in a narrow range (due to two-sided hedging) is now unleashed and free to move in a more volatile fashion. We have written about gamma unpinning in the past.

As evident, SPX was pinned in the highlighted range for the past two weeks. Soon after the morning expiry on Friday, all major indices sold off aggressively (chart below). Expect this kind of volatile price action to continue into next week.

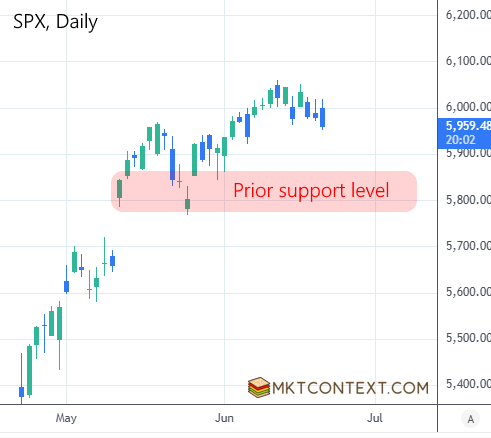

In light of this, we have become a bit more cautious in our stance. We think there is some consolidation to get through in the near-term. That said, any pullbacks are likely to be shallow, and the war with Iran won’t derail the bull thesis. The market was already overdue for a pullback before the Israel/Iran news hit, so this is not a huge change to trajectory. Short-term traders can look for short trades here or sell calls. Longer-term investors can look for dips to buy in the 5800 support area in SPX:

Long Term Thesis Intact

Longer term, the bull thesis remains intact. The three pillars of our thesis are economic resilience, corporate earnings, and resolution of the trade war:

The economy is slowing modestly but still remains resilient, as the data proves, and far from recessionary. We expect this to continue even as it seems to defy gravity. This is because labor supply is tight, wages continue to rise, and spending is still good.

Corporate earnings are still good. For Q2, earnings came in stronger than consensus expectations. Earnings revisions breadth is improving from -25% at the April lows to now -9%. This means more analysts are raising earnings estimates than lowering them. Clearly the negative headlines have not been hurting companies as much as previously thought.

The end of the trade war is near. Countries are working towards deals with the US, and tariff rhetoric has taken a back seat to geopolitics and fiscal support. Soon, companies and consumers will feel comfortable investing, hiring, and spending again.

Sidenote: it is worth noting that cost efficiencies are helping many companies improve their margins. During this earnings cycle, many CEOs noted the use of AI to streamline operations. Hiring at large companies has declined, particularly in major tech companies and entry-level recruitment, and in areas like marketing, HR, and legal. AI is excellent at handling routine, low-risk tasks which were previously assigned to entry-level roles. Amazon CEO Andy Jassy has made it clear this is the direction they are headed in:

Anyway, back to our bull thesis. As long as the three pillars continue to hold, we should see valuation multiples expand and SPX breaking new highs. Secondary to the thesis, financial conditions are currently loose and getting looser (chart below) which generally supports the economy and equity valuations:

A common pushback we get from clients is that SPX valuation multiples are elevated. For example, the current forward Price/Earnings multiple is ~22x. Longer averages are typically in the 19x-20x range. In our experience though, valuation multiples are a poor market timing tool.

Also, investors like to compare Price/Earnings ratios between countries to show that the US market is expensive. In reality, US markets have higher growth and better companies, which deserve a richer multiple. It’s like comparing the price-per-horsepower of a Toyota and a Ferrari, and arguing that latter is expensive. They are not the same.

Historically when SPX earnings are growing faster than 7% per year, and short-term interest rates are coming down, valuations tend to rise regardless of the starting point. Add in the fact that we recently experienced a 20% correction, and valuations should be higher by 2026.

Last but not least, we have several positive catalysts over the coming year which may further juice the markets. A weaker US dollar (tailwind for corporate earnings), Trump’s tax bill, increasing AI productivity, and Fed cuts are all bullish for the market and could spark further buying.

To see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!