The Silver Bull Is Finally Here

Submitted by QTR's Fringe Finance

As I noted days ago, at the halfway mark of 2025, my “25 Stocks I’m Watching for 2025” are crushing the broader market — on an equal-weighted basis, the basket is up 24.55%, compared to a modest 1.26% gain in the S&P 500.

The stellar performance can largely be attributed to the growing momentum in precious metals and mining stocks—specifically gold and silver miners, which are finally beginning to outpace the metals themselves. After years of trailing the physical commodities due to higher risk profiles and capital demands, miners now appear to be entering the spotlight as confidence in the metals market surges, though higher oil prices must also be factored into the cost equation for these names.

Increased geopolitical tensions, ballooning debt levels, and fiscal instability have all converged to push gold and silver higher—and now, miners are benefitting from what may be the early stages of a full-blown FOMO trade. As the global monetary system teeters and traditional assets wobble, gold and silver have found renewed strength—and the miners are starting to run.

Back in February, I wrote not to sleep on silver. Now, as my friend Peter Schiff notes below, the sleeping giant has awakened.

The Silver Bull Is Finally Here

With silver classically lagging behind gold during the yellow metal’s stunning recent rise, the long-anticipated bull market for silver is finally here in earnest. And in a bull market, silver tends to outperform gold—once it finally catches up.

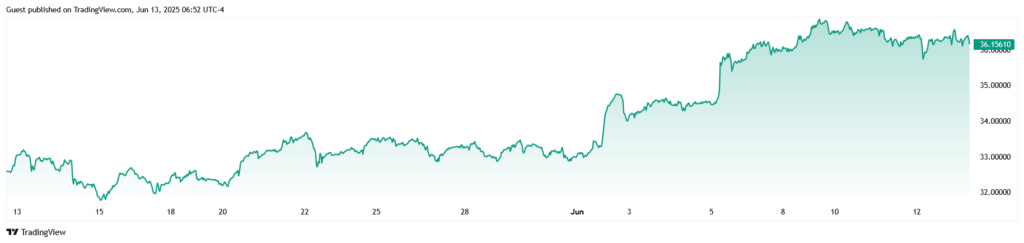

Anyone watching the gold-silver ratio this year could clearly see that a breakout was coming for gold’s closest companion. As May turned to June, the market heated up and silver rocketed upward.

Silver to USD, 1-Month Chart

The gold-silver ratio, which had stubbornly hovered above 80:1 for much of the past year, began collapsing toward 70:1—a clear signal that silver was catching up. Silver is finally stepping out of gold’s shadow, and the reasons are as fundamental as they are undeniable.

Silver’s unique dual role as both a monetary metal and an industrial commodity makes it a powerhouse in today’s economy, especially with the never ending obsession with green energy. From solar panels to typical electronics and medical applications, demand has......(READ THIS FULL ARTICLE 100% FREE HERE).