When bombs start flying Pt. 2

Subscribe to our research. www.gmgresearch.com

We anticipate some chop this week in equities. Be patient.

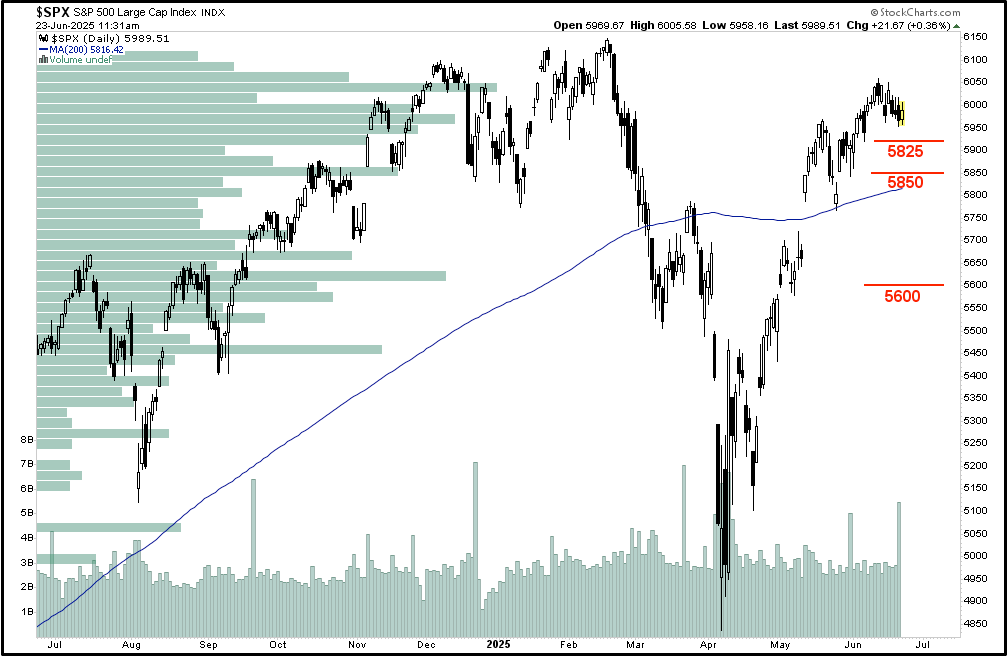

S&P: Levels to watch

Markets typically bottom 5 months before GDP.

Tesla is accelerating. Just wait till Optimus comes out. Bullish

Meta continues to poach all the AI leaders. Nothing is stopping them.

Tim Cook needs to go.

Brent fading into resistance and low seasonality.

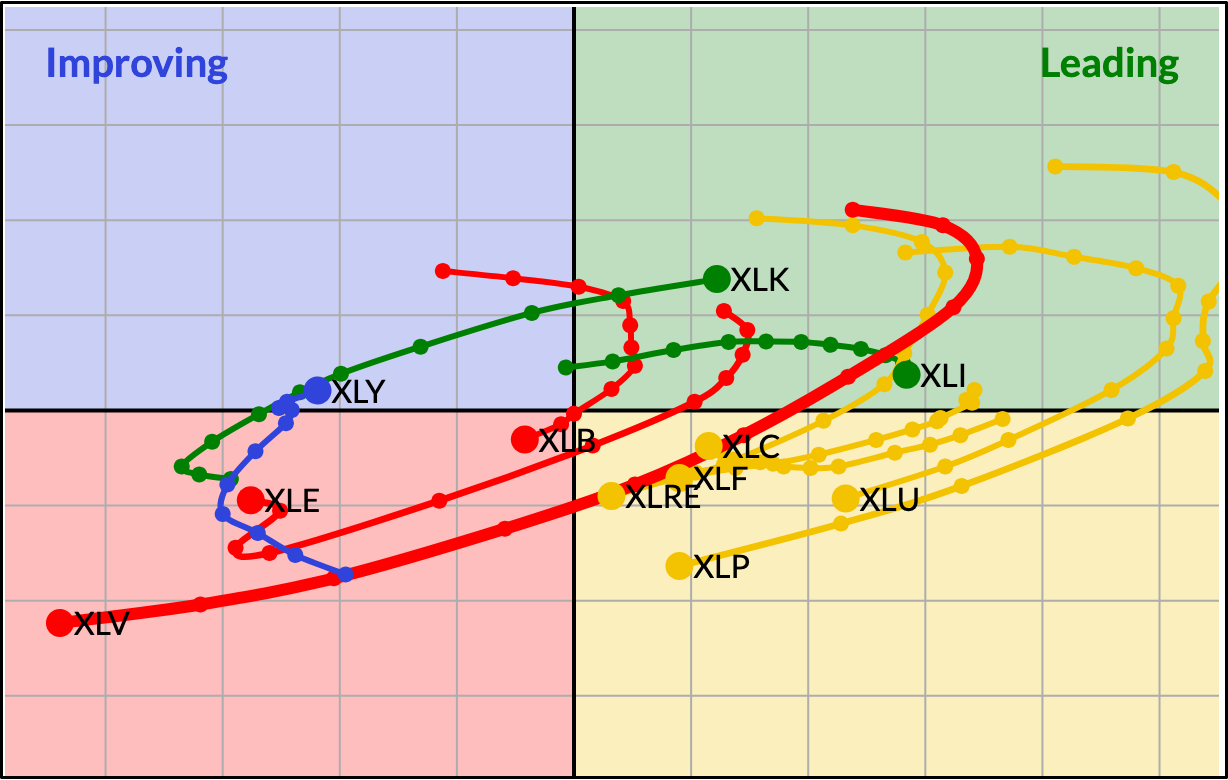

Relative performance of sectors. XLY is coming around.

China is the main destination of the Straight of Hormuz oil flows.

Two week ago we wrote:

“This asset, MTG’s Final Fantasy Collector Booster Box, will go up over 30-40% in 6 months or less. One of the best asset classes of our lifetime (trading cards).” It is already up +70%

LEARN SOMETHING

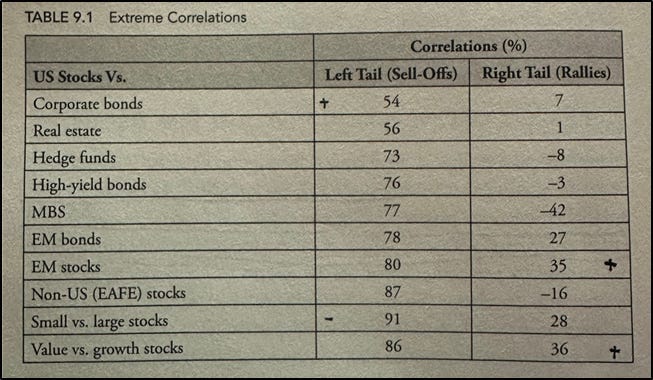

IMPORTANT: Correlations between asset classes are asymmetrical; they behave differently in good times versus bad. Essentially, diversification tends to work well when you don’t want it to (during rallies), but it fails to protect us during downturns. This challenges the traditional investment strategy of diversification, highlighting the need for a more nuanced approach to managing portfolio risk, especially in volatile markets.

Risk Barometers to use yourself.

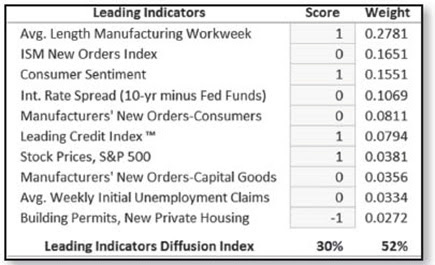

Leading Indicators

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

Loading...