Inevitable Dollar Devaluation: A Structured Analysis

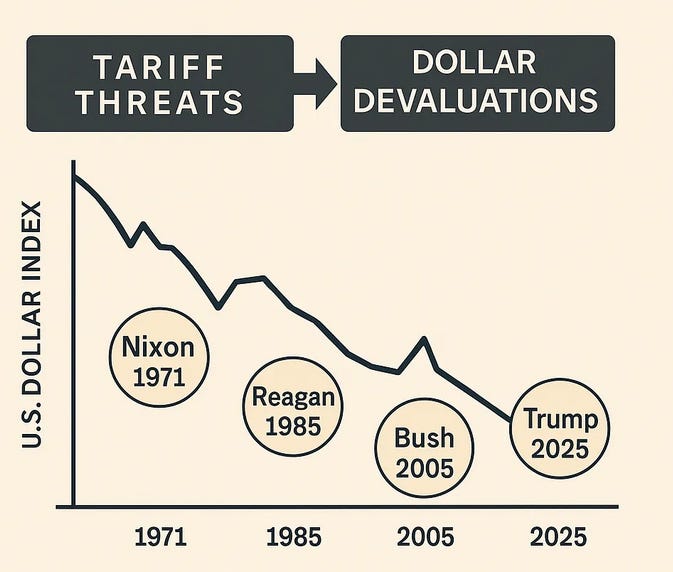

The Inevitable Effect of Tariffs is USD Devaluation

Authored by GoldFix, ZH Edit

Contents (1300 words)

- The Pavlovian Reflex of U.S. Trade Policy

- Historical Replays: Nixon, Reagan, Bush—and Trump

- Nixon 1971

- Reagan 1985:

- Bush 2005

- Trump 1.0

- The Mechanism: Why the Dollar Must Weaken

- The Return of Devaluation Diplomacy

- The British Pound: A Telling Symptom

- Conclusion

Introduction:

Economist Savvas Savouri recently put out an interesting piece cataloguing Trump's Dollar Policy in context of three prior US Presidents. His Quantmetriks analysis says a second Trump term would likely weaken the U.S. dollar—consistent with past presidencies. From Nixon in 1971 to Reagan and Bush Jr., tariff pressure led to dollar declines. Trump’s trade stance fits this historical pattern. This time, global shifts may give the yuan more influence.

The Pavlovian Reflex of U.S. Trade Policy

Dr. Savvas Savouri’s April 2025 QuantMetriks report argues with historical clarity that a second Trump presidency would predictably result in a weaker U.S. dollar. This would not be a deviation from American precedent, but a continuation of a well-worn script. Tariff threats provoke currency realignments, leading to dollar devaluations that placate trade tensions. Trump’s actions, while cast in disruptive rhetoric, are fundamentally traditional in their mechanics.

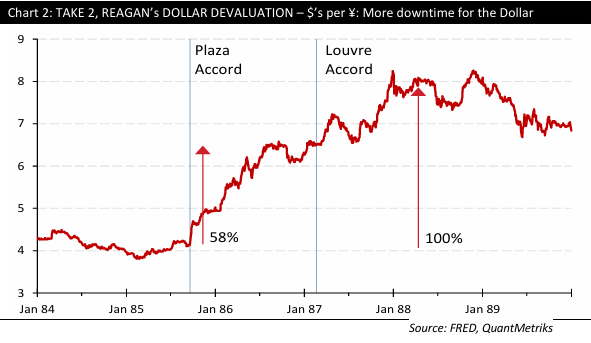

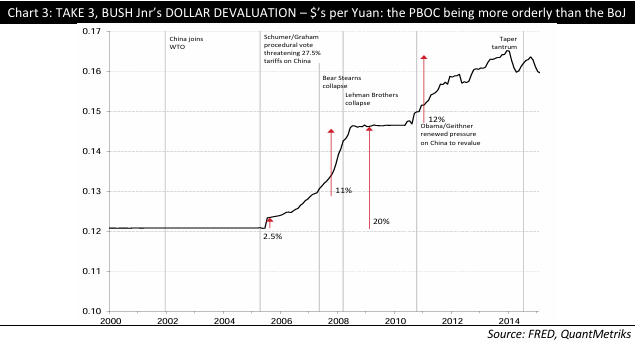

The report places him squarely in the lineage of Nixon (1971), Reagan (1985), and Bush Jr. (2005), all of whom relied on weakening the dollar to neutralize mounting trade imbalances and restore perceived competitiveness.

Savouri’s argument is less about ideology and more about conditioned economic reflex. In the face of repeated cause-and-effect trade conflicts, denying the likely outcome (dollar devaluation) is to ignore fifty years of monetary precedent. This essay summarizes and analyzes that core argument, placing Trump's trade policy and likely monetary outcome within its historical and structural context.

On "The potential loss of USD safe-haven status."

"The potential loss of the dollar's safe-haven status: We do not write this lightly. We highlight a few developments since the start of the year providing tentative signs in this direction." - George Concalves, Global Head of FX, DB

Historical Replays: Nixon, Reagan, Bush—and Soon Trump

Savouri constructs his thesis around three historical precedents.

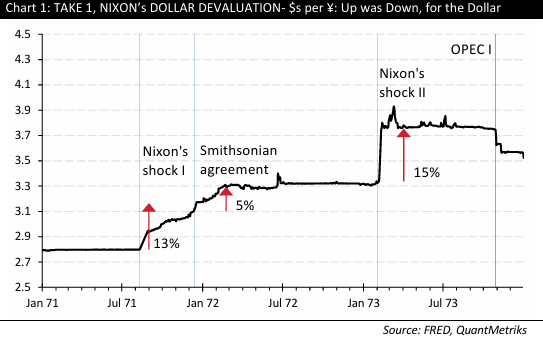

1. Nixon, 1971 Bretton Woods Abandoned

Faced with a weakening U.S. trade position and mounting external deficits, Richard Nixon ended the dollar’s convertibility to gold in August 1971. This triggered a devaluation even as Nixon called it a fictitious “bugaboo” risk. Nixon also introduced Tariffs and Wage Freezes when he ended the Gold standard…

It was the first clear example of weaponized monetary adjustment as a substitute for direct trade intervention. The Smithsonian Agreement later that year attempted to put a floor under the falling dollar. However, the damage was already done. The dollar dropped, and trade competitiveness was temporarily restored. A new era of floating exchange rates began.

Richard Nixon Closes the Gold Window, Freezes wages, and tariffs imports pic.twitter.com/D7RKR16QqN

— VBL’s Ghost (@Sorenthek) June 24, 2025

Trump’s First Term: A Disrupted Sequence

Trump’s first term (2016–2020) complicates the narrative at the surface level. As Savouri notes, during Year 1 of his presidency, China’s yuan actually strengthened against the dollar. Beijing was, in effect, playing the traditional game. But Trump surprised them by imposing tariffs anyway in 2018, violating the unwritten quid-pro-quo logic of trade diplomacy. The yuan then weakened in retaliation. This reversed historical norms.

That breakdown does not negate the core pattern. Instead, Savouri sees a likely correction in Trump’s second term. Should Trumps return to office and escalation tariffs escalation of tariffs the yuan may fall. Ultimately, however, as with Nixon, Reagan, and Bush Jr., the dollar will again be weakened to resolve trade tensions. China, already far along in its process of dollar disintermediation (via swap lines and yuan-priced oil), will have structural leverage in a post-dollar settlement framework.

The Mechanism: Why the Dollar Must Weaken

Continues here with audio commentary

Free Posts To Your Mailbox