Gold: Germany (and Now Italy) Want $245 Billion Back

Germany, Italy Face Pressure to Repatriate $245 Billion in US-Held Gold

Authored by GoldFix, ZH Edit

FRANKFURT/ROME — Recall back in April of this year when GoldFix raised reader awareness by breaking the news that Germany had a nascent but growing movement to repatriate its Gold from the US. Of chief importance was the longstanding assumption that Germany’s gold reserves were safe in New York is no longer taken for granted. Political shifts in Washington, public calls for increased transparency, and broader concerns about U.S. reserve integrity are prompting parts of Berlin’s political establishment to reassess the wisdom of maintaining large-scale gold holdings abroad. Turns out this is now a growing risk to global bullion markets spreading both internally in Germany and externally into Italy.

Germany: Bring our gold back from the USA immediately!

— VBL’s Ghost (@Sorenthek) April 1, 2025

Prediction. when the US is done repatriating its gold... Germany will begin calling the rest of its back from the US and UK.. and it will also be bullish price and bearish LBMA

This started with Germany.. it will end with… pic.twitter.com/xoW24j9Gfd

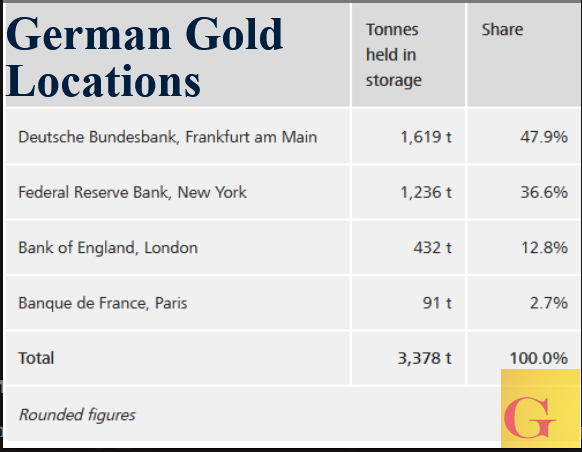

Germany and Italy hold the second- and third-largest official gold reserves in the world (3,352 and 2,452 tonnes respectively), and each stores over a third of that in the vaults of the New York Federal Reserve. The total combined market value exceeds $245 billion, according to FT estimates.

Central Bank Gold Reserves…

Critics across Europe are questioning the prudence of outsourcing custody to the U.S., particularly under the specter of political volatility. Fabio De Masi of Germany’s BSW party told the Financial Times that relocating gold to Europe during “turbulent times” is a logical risk-management step. Former conservative MP Peter Gauweiler echoed this, noting the Bundesbank must re-evaluate the security and stability of foreign storage.

A letter from the Taxpayers Association of Europe to both countries’ finance ministries raised alarms about Trump’s sway over Fed independence. “Our recommendation is to bring the gold home,” said TAE president Michael Jäger.

Italy’s Giorgia Meloni, who once vowed to repatriate Italy’s bullion, has since taken a more muted stance as Prime Minister. Her party now calls the gold’s location “of relative importance.”

“Gold is an asset of last resort for central banks. It needs to be stored without any third-party risk.” — Peter Boehringer, AfD MP

Repatriation has historical precedent. Germany moved 674 tonnes from New York and Paris between 2013 and 2017 following a grassroots campaign. France brought most of its overseas gold back in the 1960s.

German Gold by Storage Location…