Plaza Accord 2.0 Happens One (Trade) Deal at a time.

De-Dollarization has Become the Monetary Reset

Authored by GoldFix, ZH Edit

Contents (970 words)

- Introduction

- A World Fleeing All G7 Fiat

- That Last Chart Above is The Reset Manifesting

- ECB: Gold Has Overtaken the Euro

- The Ghost of Bretton Woods Returns

- Gold’s Demand Spiral

- Toward a Post-Dollar Reserve Order

Introduction:

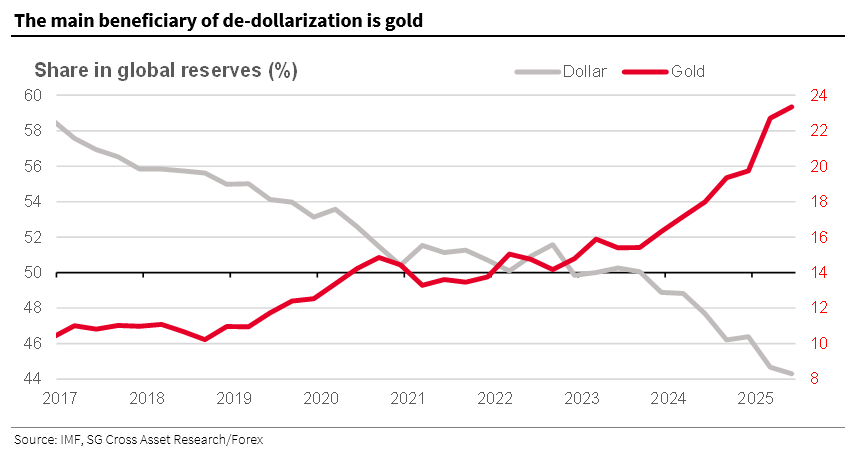

What began as speculation has become structural. The decline in the U.S. dollar’s dominance is not a cyclical correction or a flash reaction to policy. It is a secular shift. According to analysis from Societe Generale and the European Central Bank (h/t ZH), the post-2022 global monetary landscape reflects a lasting reallocation away from fiat currencies—one that has not benefited other reserve currencies, but gold.

A World Fleeing All G7 Fiat

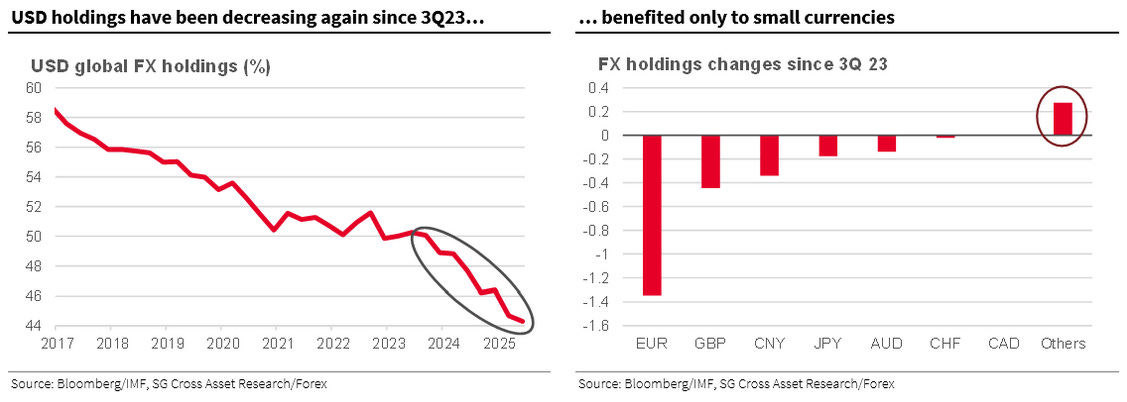

One of the most striking elements of the post-2022 reserve shift is what didn’t happen. As Societe Generale notes, the dollar’s loss has not translated into gains for the euro, yen, pound, or even the Chinese yuan. Since 3Q 2023, the share of dollar-denominated FX reserves has dropped by 5.8%, falling below 50% for the first time in modern memory.

But no major fiat currency has stepped in to fill the void. Instead, gold has emerged as the primary beneficiary.

“Since 2024, de-dollarization has not benefited any of the major reserve currencies… the share of gold in the IMF’s classification has increased.”

That Last Chart Above is The Reset Manifesting

G7 Fiat has not benefited from USD weakness; Only Gold and BRICS currencies have. Not only would we contend BRICS fiat and Gold occupy the same space, but they have equally been depressed for decades by USD dominance. That suited the US until now, since we were buyers of goods. Now it no longer suits us as we need to sell goods.

ECB: Gold Has Overtaken the Euro

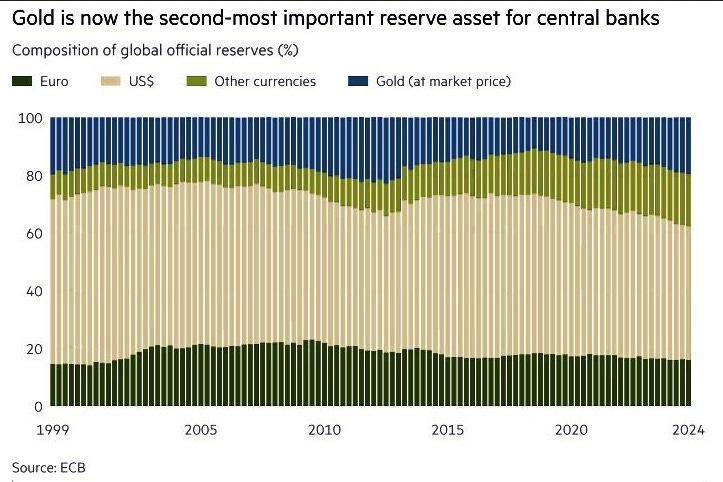

According to the European Central Bank’s own data, gold officially surpassed the euro as the second-largest reserve asset held by central banks worldwide. In 2024, gold accounted for 20% of total official reserves. The euro stood at just 16%. The dollar remained dominant at 46%, but the direction of flows is what matters.

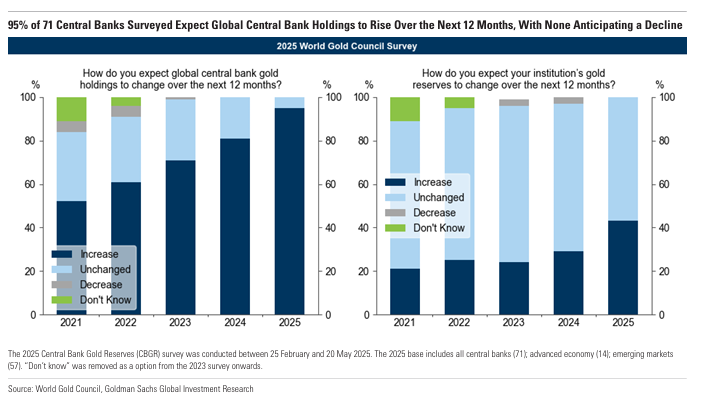

That volume, sustained over three years, places global central bank gold holdings near 36,000 tonnes—levels last seen in the 1960s under Bretton Woods. By implication, the gold standard has returned, not through legal decree, but through sovereign portfolio preference.

The Ghost of Bretton Woods Returns

Until 1971, the dollar was convertible into gold at a fixed rate, forming the backbone of postwar monetary stability. The Nixon Shock ended that convertibility, launching the modern fiat system. For fifty years, gold was demonetized—relegated to a relic of a monetary past.

“Central banks worldwide now hold almost as much gold as they did in 1965.” — ECB

The Demand Spiral: Gold as Veblen Good

What makes this moment particularly notable is the behavior of demand. In theory, rising prices should suppress consumption. But in gold’s case, the opposite has occurred.

Continues here

Free Posts To Your Mailbox