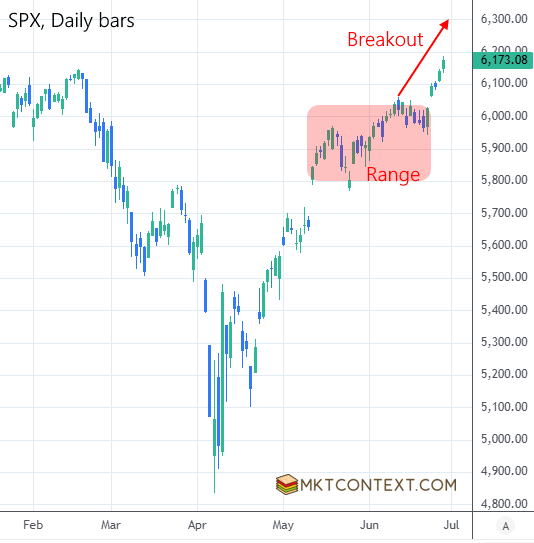

SPX Decisive Breakout!

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

With the ceasefire between Iran and Israel announced, SPX broke decisively out of its 6-week trading range. A huge positive for the bulls as it means the rally can continue. The pullback that we were predicting was shallower than thought (we assumed it would retest the bottom of the range at $5800). That's just how strong it is.

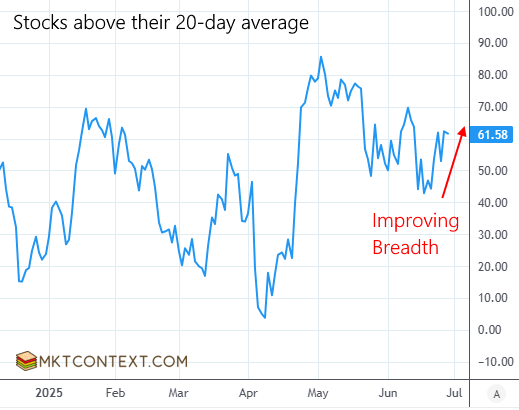

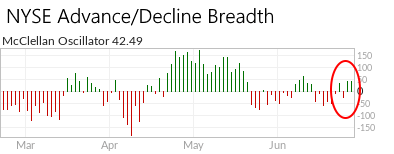

This rally is firing on all cylinders. Breadth has been excellent, as most stocks and sectors participate in the jump. And as SPX reaches new highs, so too does an increasing number of individual stocks (now up to 90 per day in there entire NYSE). We always want to see new index highs backed by new highs in constituents, as evidence of fundamental support.

As we like to say, “highs are meant to be broken”. In other words, it is more likely for the market to continue making new highs rather than hit a ceiling and fall back under. This is psychologically difficult for investors to accept, as they think highs mean “too expensive”. Indeed, lately we have seen a swarm of analysts and prognosticators turning skeptical of this rally. Do not fall for this mental trap.

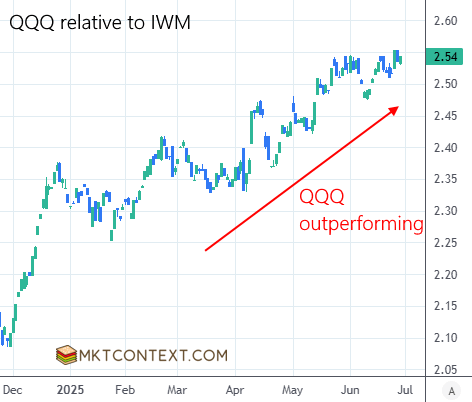

Last but not least, the small cap index (Russel 2000 or IWM) remains weak, especially relative to the tech-heavy Nasdaq. We made the call several months ago to overweight Nasdaq instead of small caps, and it is paying off handsomely. In a slow-growth environment, mega cap tech should continue to perform well. Small caps are struggling due to the lack of economic impulse and rising costs (oil, labor, interest rates, etc).

To see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!