Bull Thesis Intact

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

We currently remain on our long-term bull signal. Many of the worst-case geopolitical and policy scenarios (tensions with Iran, fiscal cuts, tariffs, deportations, AI capex deceleration) have passed without damage. Historically, after major geopolitical shocks, markets rally in the subsequent 6-12 months.

The key reason markets rallied so much this week was because of lower oil prices (and hence lower inflation) keeping the prospect of rate cuts this year. In response to the Israel/Iran ceasefire announcement, rate cut expectations jumped up to the highest in six weeks and stocks rallied hard. The market’s resilience and capital inflows suggest the rally is likely to continue.

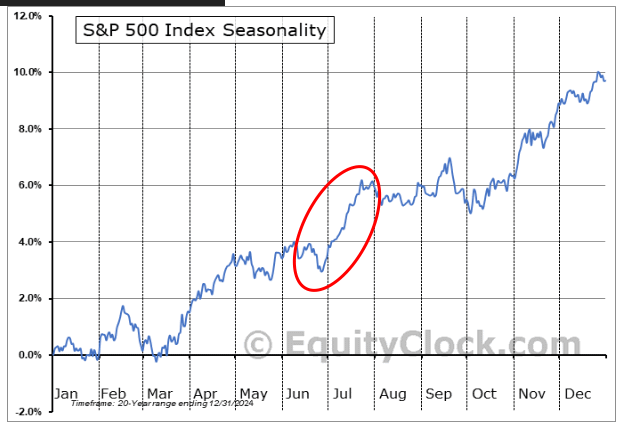

And as predicted, the late-June/early-July calendar tailwinds are working:

Furthermore, our backtests show that after major breadth thrusts (the recent one occurred in April) the 3-month, 6-month, and 12-month subsequent performance are strong with a high success rate. Needless to say, the ongoing rebound is on track. In fact, the performance since April is on the high end of expected outcomes. We are on track for 24% gains by next year, which gives an SPX target of $6800 (coincidentally, this is an important Fibonacci extension level).

Last week we outlined our three pillar thesis for the market rebound to continue. In short, we want resilient economic data, solid corporate earnings, and an end to the trade war. All of these things are playing out nicely, which means we likely won’t see a big drop in stock prices anytime soon.

To see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!