Thesis: Trump Will Spend or Die Trying Now

Must Read: The US Must Spend or Die Trying

Bottom Line: Trump’s New Plan is “Spend to Grow”

Authored by GoldFix, ZH Edit

(The following is a breakdown of a sharp note by Eric Peters, read on ZH Premium (whose perspective as a Tech CIO is on display) wrote on Sunday what we’ve been thinking for months: spending is now the only way out.)

America now faces a choice: spend more, or fall behind. Below, we break down key points from a sharp analysis by a hedge fund executive we just read, showing:

- Why a new spending boom is all but certain

- Why this boom (not geopolitics) will drive the next surge in gold

- Why stablecoins may matter more than AI

Everyone now agrees: spending caused the problem. Spending will be the solution. As the saying goes: if you're going through hell, keep going.

If you follow our work read this to get a better feel for Trump's pivot form cutting to spending for the remainder of his term.

Thesis: The US Must Spend or Die Now

Michael Hartnett often says the world must spend more as the U.S. spends less. So far, he’s been right about America’s thrift and the strength of foreign stocks. But that divergence can’t last. If it does, the U.S. falls behind at a moment it can’t afford to. He made this clear June 1st in his missive on bubbles

To stay in this economic race, (barring free energy or technology we keep completely proprietary) the U.S. must outspend its rivals. That means weakening the dollar, selling its resources, rebuilding industry, and spending without restraint. A global economic arms race is coming.

Thus, The US will move to outspend competitors and a global arms race for economic supremacy will be born.

We can only hope the new bridges built will not “lead to nowhere”, but the spending must happen. Everything discussed below points to more spending as a cure for what ails us. Frugality is done.That is Gold's next driver.

The Business of America Is Spending-Booms Again

"If 30-year yields can’t hold above 5% with war and deficits, why can’t stocks trade at 30x earnings?"

- On Wall Street Stimulus Logic

In the theater of global finance, markets now find themselves staring at a familiar Keynesian script. Political leaders, under the guise of prudence, are turning once more to stimulus as a strategy through raw industrial and military spending. One Wall Street strategist, known for his cynical wit, summed Trump’s sitaution up nicely: “He tried peace to cut spending. Then tried to dodge discretionary cuts. Neither worked. Now? He's going for broke.” In a world where B-2 bombers and bunker busters replace fiscal restraint, the message is clear: grow or die trying.

“If American oil execs won’t drill, then release suppressed barrels elsewhere.”

- On Geopolitics as Supply-Side Strategy

The U.S. recently bombed three major Iranian nuclear sites. Days later, Donald Trump negotiated a ceasefire that could end what may be known as the “Twelve-Day War.” The geopolitical subtext is economic: if Trump can de-escalate with Iran, scale back threats of regime change, and accept a denuclearization framework, the floodgates could open for sanctioned Iranian oil. The logic is brutally simple: if American oil executives won’t drill, then release suppressed barrels elsewhere.

Europe Folds, Industry Wins

Trump’s approach—profanity included—is transactional. As NATO’s Secretary General Mark Rutte remarked, referencing Trump’s rhetorical style: “Daddy sometimes has to use strong language to get them to stop.” The global stage reacted. NATO allies agreed to spend 5% of GDP on defense. A boon for U.S. and European defense firms. A tailwind for industrials. Cold wars, after all, have always driven innovation and capital spending.

“Cold wars are great for business. And even better for industrial equities.”

With Europe finally opening its wallet, a settlement in Ukraine becomes more plausible. And if that happens, Russian energy—long weaponized—is poised to surge back into global markets. Cheap oil and gas are not just deflationary; they are accelerants for profit margins, growth, and market multiples.

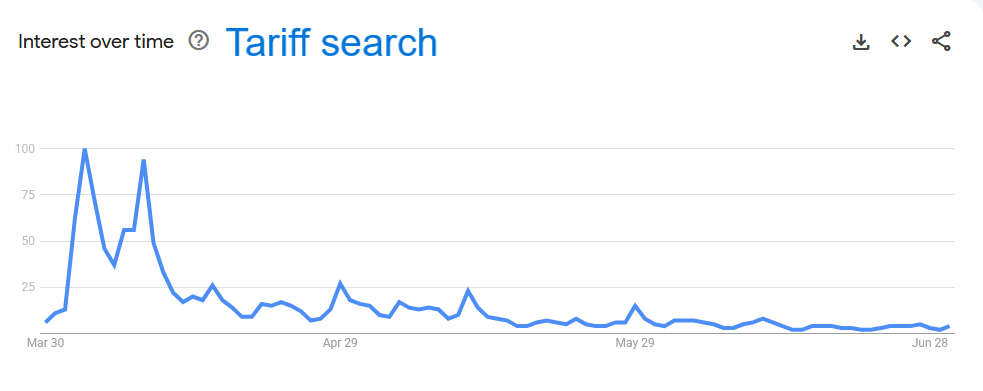

More Trade Deals and Less Tariff-Talk

Simultaneously, the Trump administration is closing deals at a pace that borders on aggressive. A framework agreement with China is now in place. Nine additional countries are reportedly lining up. Europe has capitulated, shelving its plans to tax U.S. tech companies. Domestic legislation—described as One Big Beautiful Bill—is expected soon, likely frontloaded with supply-side incentives.

What’s missing is the threat of tariffs. With midterms approaching, there’s little political upside in rattling markets. Liberation Day-style protectionism is off the table for now. The path is clear: all engines go. The U.S. will stimulate through investment, deregulation, and diplomacy—because at its core, America is still a business.

China Consumption Shift Starts a Chain-Reaction

“We will grow a mega-sized consumer powerhouse on top of our manufacturing base.”

- Premier Li, signaling China’s pivot to domestic demand.

Premier Li Keqiang addressed the World Economic Forum with a message that echoed U.S. strategy: grow first, balance later. China is leaning into consumption-driven expansion on top of its manufacturing base. The goal? To present itself as a stable engine of demand for global enterprises. Growth is now a global contagion—every nation, willingly or not, is catching the fever.

Payment Chain Infrastructure as Monetary Policy

“Gold is not reacting to chaos anymore. It is responding to the certainty of an architecture being rebuilt.”2

Trump’s return marks a reversion to a Darwinian model of statecraft. Nations will build again—not just physically, but monetarily. NATO’s 5% pledge is one early signal. Infrastructure (digital, military, energy, and monetary) is the new form of Keynesianism. In that framework, the rising price of gold is a signal. Geopolitical mercantilism got us this far. Plain old spending to remain competitive will take Gold higher form here. This is now a global economic arms race. Crypto infrastructure, similarly, is being built to last in an environment devoid of centralized trust. Payment Chain Infrastructure is being built just as supply chains are being rebuilt.

Continues here

Free Posts To Your Mailbox