Pillow-Gold: Turkey Has $311 Billion Untracked and Untaxed

Pillow-Gold, Türkiye’s Hidden Treasury

“$311 billion in private gold—largely unregistered—forms the silent core of Türkiye’s household finance.”

Contents

- Türkiye’s Hidden Treasury

- Untaxed, Unseen, and Untracked

- Cultural Habits Work

- Gold Over Banks: A Rational Choice

- Best Economic Shock Absorber

- Historical Attempts at Integration

- Policy Tradeoffs and Missed Potential

Authored by GoldFix, ZH Edit

Having read an interesting and very informative piece by Onur Erdogan for Turkiye Today coming in at over 2000 words we thought it appropriate to break down and summarize it for subscribers while preserving the substance. It’s pretty amazing the amount of Gold undeclared in Turkey. But that’s Nobody’s business but the Turks, as the song goes. Likely Erdogan himself has done the same thing.

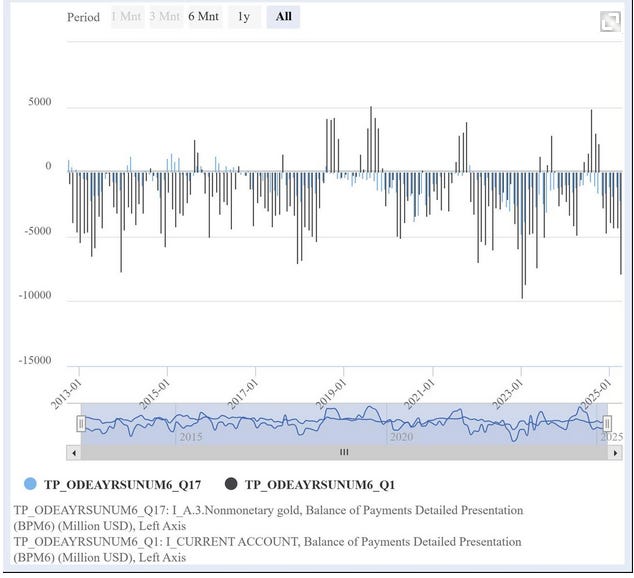

Between January and April 2025, Türkiye’s current account deficit widened to $20.3 billion, up from $14.5 billion the year prior. A significant portion—$6.27 billion—was attributed to the imbalance in gold trade. Gold imports continue to strain the country’s external accounts, with most of the metal never entering the formal financial system.

This economic pressure spotlights the longstanding Turkish tradition of holding gold outside the banking sector. “Under-the-pillow” savings—gold kept at home—serve as both financial refuge and cultural artifact. But the cost to national accounts is mounting.

Untaxed, Unseen, and Untracked

“Gold is not only untaxed; it is also unseen, unfined, and untracked.”

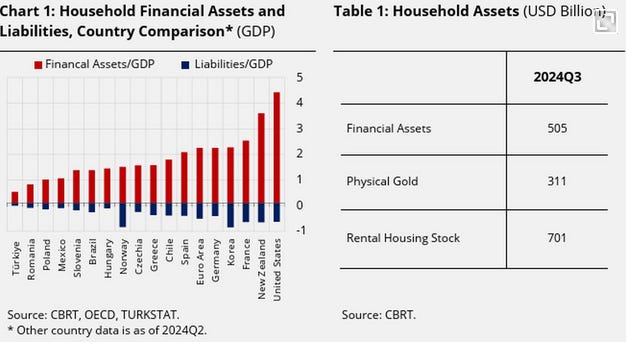

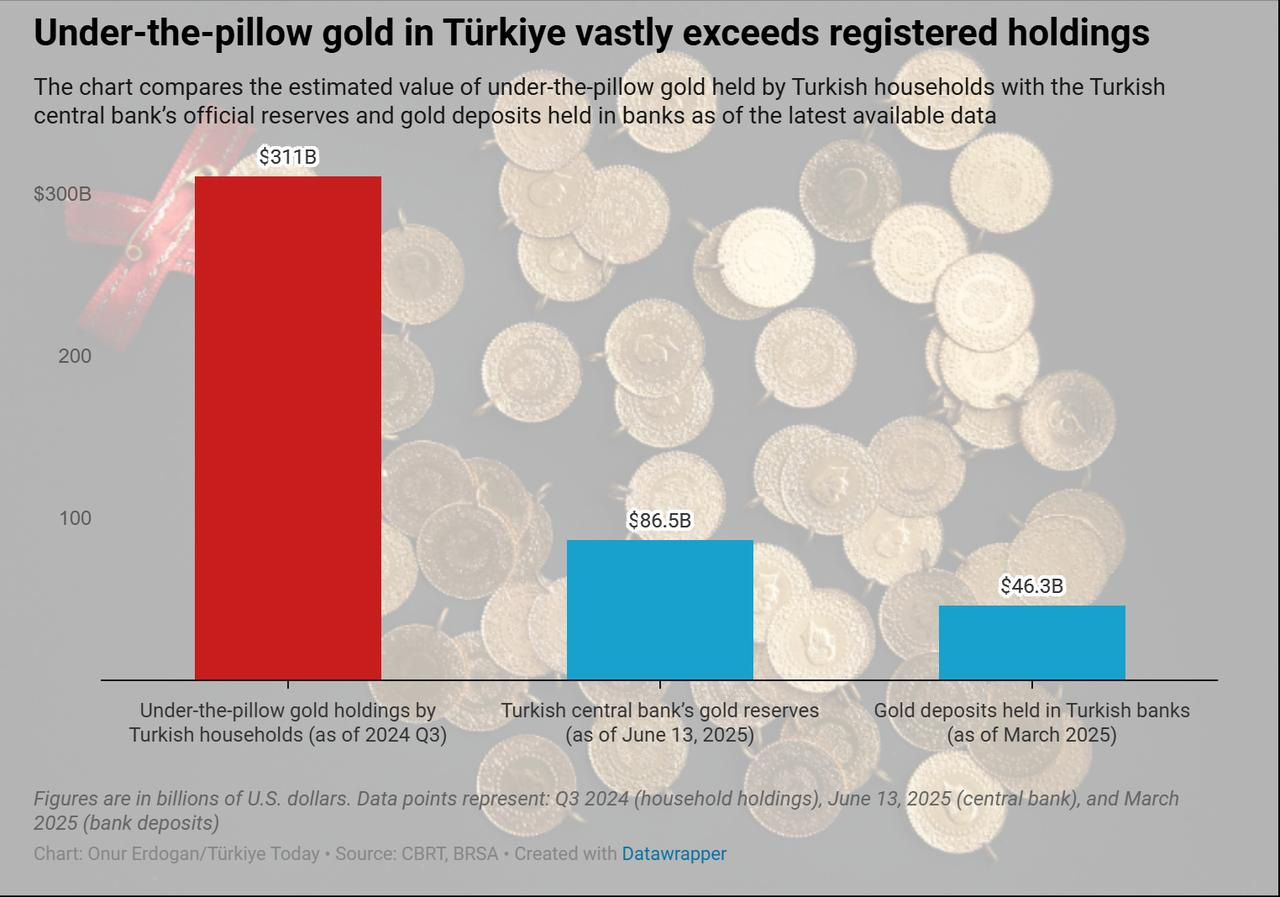

The Central Bank of Türkiye (CBRT) estimates that Turkish households held approximately $311 billion in physical gold as of Q3 2024. This unregistered stockpile dwarfs the central bank’s own reserves ($86.5 billion) and far exceeds the $46.3 billion in gold deposits recorded in Turkish banks.

Comparison of household financial assets and liabilities..

According to the World Gold Council, the total gold volume in Türkiye now surpasses 4,500 tonnes, most of it held by private individuals. It is one of the most extreme examples globally of wealth being stored outside the banking system. The column chart just below shows the estimated value of under-the-pillow gold held by Turkish households compared to the Turkish central bank’s gold reserves and gold deposits in banks, created on June 26, 2025.

Cultural Habits That Work

Gold has deep roots in Turkish society. Jewelry serves as both ornament and store of value. Weddings and other ceremonies traditionally involve gifting gold, reinforcing its role in family finance.

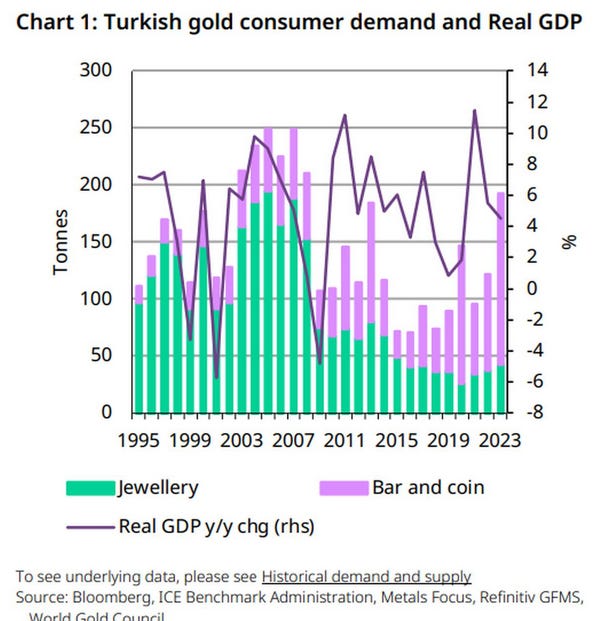

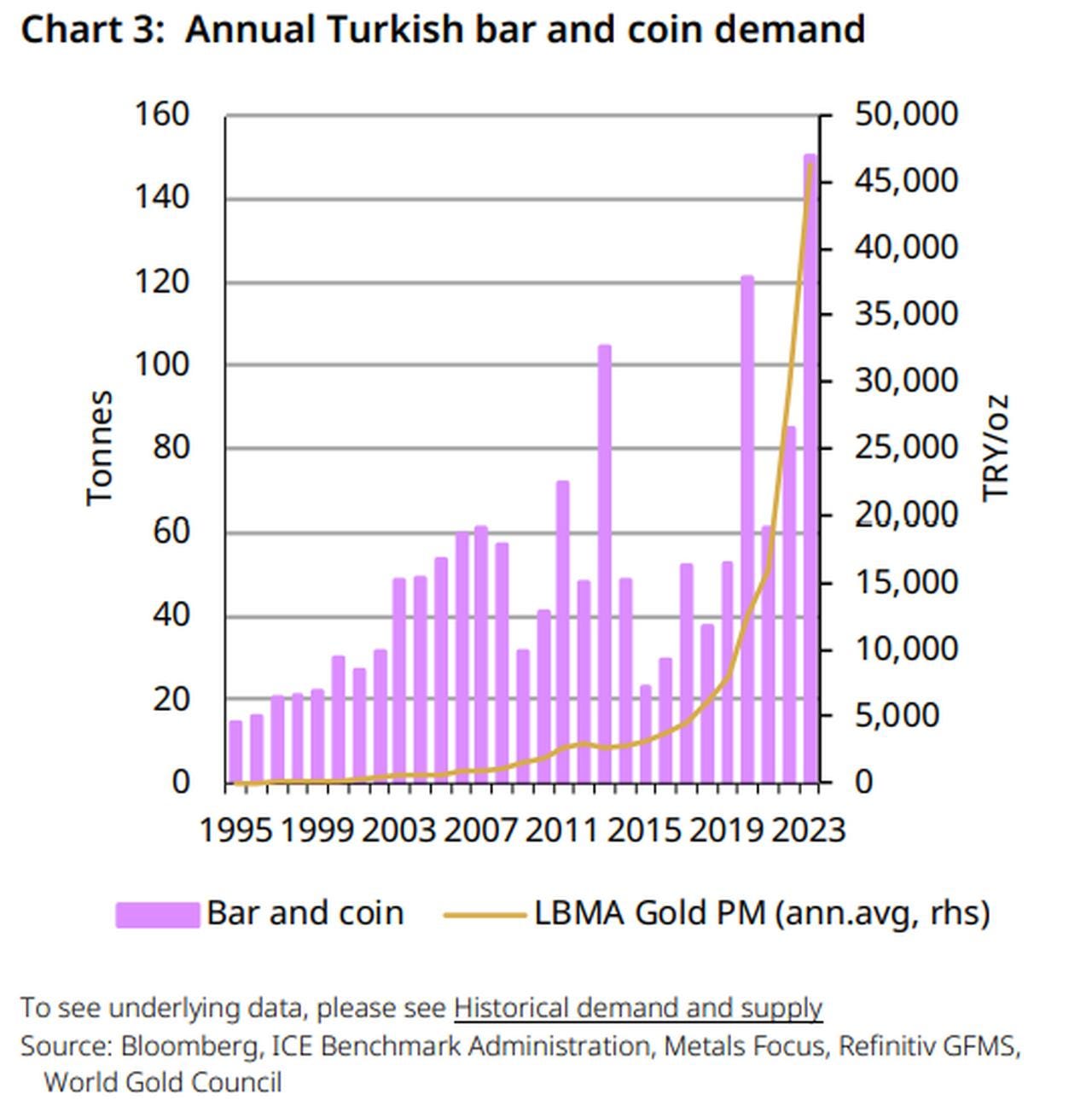

Annual consumer demand for gold jewelry (in green) and investment products such as bars and coins (in purple)...

In 2023, Türkiye ranked fourth globally in gold jewelry demand, with 42 tonnes consumed. Historically, annual demand exceeded 150 tonnes during periods of lower inflation and stronger growth. That demand has since diverged. Jewelry consumption declined after 2007, but bar and coin purchases remained steady and even rose during times of macroeconomic stress.

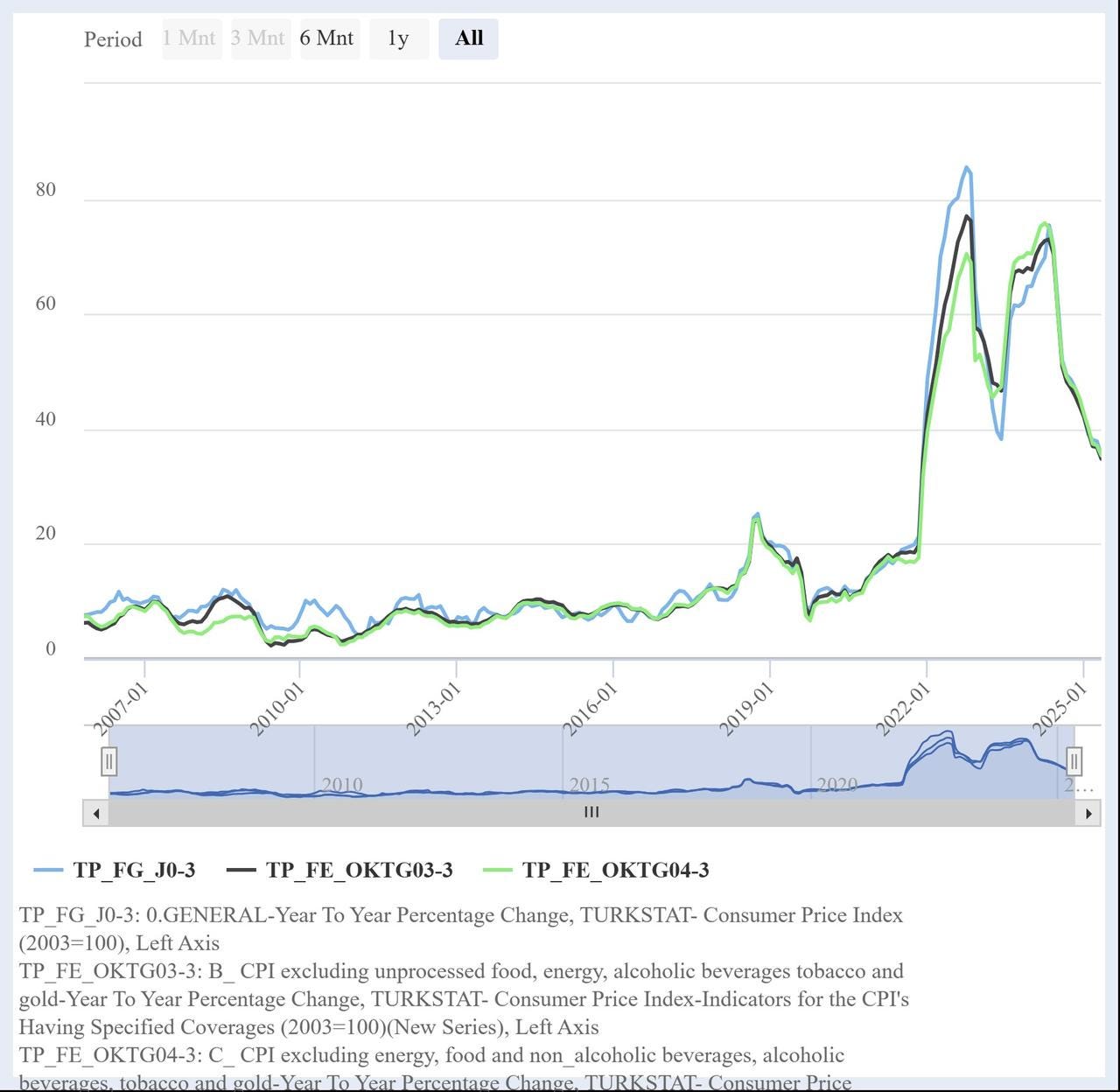

Türkiye’s annual consumer inflation trends between 2007 and 2025,

This divergence widened following Türkiye’s 2022 inflation peak of 85.5%. In response to currency weakness and inflation, households shifted toward physical bullion over jewelry.

Gold Over Banks: A Rational Choice

The choice to hold physical gold instead of bank deposits is rational in Türkiye’s fiscal and regulatory environment. Interest earned in banks is taxed. Transactions above certain thresholds are flagged. In contrast, physical gold remains untaxed and private.

Recent measures have reinforced this behavior. In March 2025, the government imposed a 0.2% transaction tax on gold trades through banks. Jewelry purchases over ₺185,000 now require ID. Uncertified gold bar sales were banned. These moves aim to tighten oversight but have arguably pushed savers further into informal channels.

Best Economic Shock Absorber

Economist Mahfi Egilmez describes off-the-record gold as a form of household-level risk management. These assets are drawn down during crises and replenished during periods of relative calm. They provide liquidity when formal credit is tight and banks cannot help.

This behavior explains Türkiye’s recurring “Net Errors and Omissions” line in its balance of payments. Capital enters the system without traceable origin, likely from informal gold sales and remittances. It helps stabilize the economy during turbulence but remains unrecorded and untaxed.

“Off-the-record gold is Türkiye’s informal central bank—operating beneath pillows, not policies.”

The downside: none of this gold supports credit expansion or monetary policy. Its invisibility helps individuals, but limits national-level economic planning.

Historical Attempts at Integration

Successive governments have tried to mobilize household gold. The first serious effort came under Prime Minister Turgut Özal in the 1980s. Citizens were offered deposit accounts payable in currency or gold equivalents. But concerns over liquidity and redemption risks limited uptake.

President Erdogan revived the appeal in 2016, encouraging citizens to convert their gold and foreign currency into Turkish lira. The call was framed as both patriotic and economic. The response was modest.

In 2022, the Treasury launched a Gold Conversion System. Citizens could deposit gold through contracted jewelers, converting it into bank deposits or certificates. Borsa Istanbul also began offering gold certificates backed by physical reserves. These products offer insurance, tax exemption, and competitive pricing.

Continues here