Is the Fed TRYING to Trigger a Debt Crisis?

Let’s cut through the smoke and mirrors here… it is clear to anyone paying attention that the Powell Fed HATES President Trump.

Regardless of your political leaning, this should be cause for concern, because a political Fed is a VERY dangerous entity for investors’ portfolios. Case in point, back in 2018 during President Trump’s first term, the Fed embarked on one of its most aggressive tightening cycles in history, raising rates repeatedly while also draining liquidity via Quantitative Tightening (QT).

The Fed maintained both policies despite:

- Multiple stock market sectors with close ties to the real economy peaking and beginning to collapse (February- March 2018).

- U.S. Treasury yields rising rapidly, breaking out of a 20+year downtrend (July-September 2018) signifying that the bull market in bonds was ending.

- Corporate junk bonds collapsing rapidly with other signs of duress appearing in the financial system (October-November 2018).

- Stocks breaking down, losing 11% of their total value in a single month October-November 2018).

- The corporate junk bond market freezing (December 2018)

Despite these warnings, the Fed raised rates a fourth time on December 20th 2018, at which point the stock market CRASHED erasing trillions in Americans’ wealth.

Later, former Vice Chair Stanley Fischer stated in an interview that he believed the Fed did this intentionally to hurt the Trump administration’s economic agenda. Again, regardless of your political leanings, the Fed’s actions triggered a stock market crash, badly damaging Americans’ net worth/ retirement. And there is good reason to believe the Fed did this on purpose to hurt the Trump administration.

By the look of things, the Fed is doing something similar today… only this time, the Fed is going to hurt the U.S.’s sovereign bank account, rather than individual investors’ retirements.

The Fed is refusing to cut rates or end its QT program today… despite inflation being lower and unemployment being higher than either was in August 2024 when the Fed cut rates by 0.5%. For some reason, once Donald Trump won the Presidential election in November, the Fed pivoted and stopped easing monetary conditions.

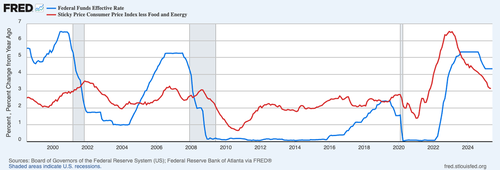

Depending on which inflation measure you use (CPI or PCE) inflation is either at 2.5% or 2.4%... but the Fed has rates at 4.5%. This is EXTREMELY restrictive monetary policy. Since 1998, any time the Fed has maintained real rates of positive 2% like this, something has broken in the financial system soon after.

See for yourself.

In this sense, by refusing to cut rates or end QT, the Fed could potentially trigger a recession in the U.S. I wish that was the full extent of the danger presented by the Fed’s actions today, but it’s not.

As I noted in a recent article, the U.S. needs to roll over $9 trillion in debt in the next 12 months. By refusing to cut rates today due to fears of potential inflation from the tariffs despite ZERO signs of inflation reappearing, the Powell Fed is ensuring that the U.S. will roll over this debt at HIGHER rates, resulting in dramatically higher interest payments.

I’m not the only one saying this. Over the weekend President Trump noted that the Fed’s actions could cost the U.S. as much as $900 BILLION in interest payments.

SOURCE: https://x.com/unusual_whales/status/1941995827179762116

Remember, interest payments on the national debt have already exceeding $1 trillion per year. Indeed, they are the second largest government outlay behind social security. Adding $900 billion to this would mean that over a QUARTER of government outlays would have to go towards interest payments on the debt.

That would trigger a debt crisis in short order.

So again, I ask… is the Fed TRYING to trigger a debt crisis? If so, Americans could once again find themselves a lot poorer courtesy of the Powell Fed’s politics.

If you find yourself worried about another crash, or bear market hitting, we have a proprietary signal that you can use to insure you get out of the markets well before a collapse hits.

This signal has accurately predicted every major market collapse in the last 40 years. And we detail it, how it works and what it’s saying about the markets today in a Special Investment Report How to Predict a Crash.

Normally we’d sell this report for $499, but in light of what’s happening with the Fed today, we’re making just 99 copies available to the investing public.

To pick one up…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research