Momentum Crash

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

Last week we saw a crash in momentum stocks. Meaning, the stocks that had been performing the best lately (namely AI stocks) fell the hardest. In fact, it was the biggest move since the DeepSeek announcement that crushed AI stocks. The AI-related basket took a tumble after a blistering 3 month rally as investors took profit.

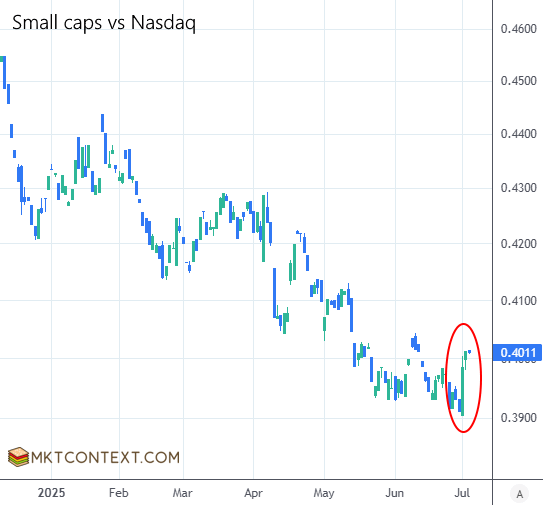

Momentum crashes are not uncommon, but what’s interesting about this one is small caps and cyclical stocks (that are tethered to broader US economic growth) outperformed greatly this week. Indeed, it was a rotation from the tech sector into traditional sectors. Small cap stocks outperformed Nasdaq greatly on the day:

The rotation was triggered by the passage of the BBB tax bill, as tax cuts disproportionately benefit small companies who pay a higher rate than large multinationals. The bill also allows certain capital intensive sectors like manufacturing and industrials to deduct more of their asset depreciation. In all, this was like a shot in the arm for small, cyclical companies.

Recall we had a similar dynamic post the presidential election last year as Trump’s policies were supposed to boost the economy. Given that we hold a large portion of Nasdaq in our current portfolio (30% QQQ, to be exact) is now the time to switch into small caps?

Long-time readers will remember we had been calling for a small cap rotation since as early as July 2024. It came in fits and starts, and eventually fizzled out. After having been burned a few times, we have learned to be skeptical of calling the bottom in small caps. We will monitor this sector closely in the coming weeks.

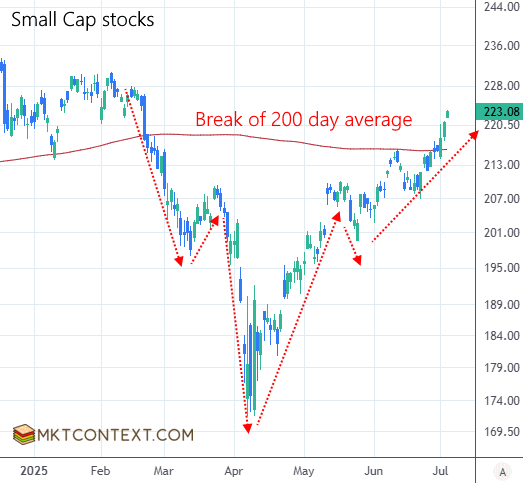

As we wrote just a month ago, we are still waiting for an economic growth impulse to provide further fuel for the small-cap rally. That being said, the inverse head-and-shoulder pattern that we called out at the time is performing very nicely. Note the decisive break of the 200-day moving average to the upside:

To see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!