The Big Beautiful Bullion

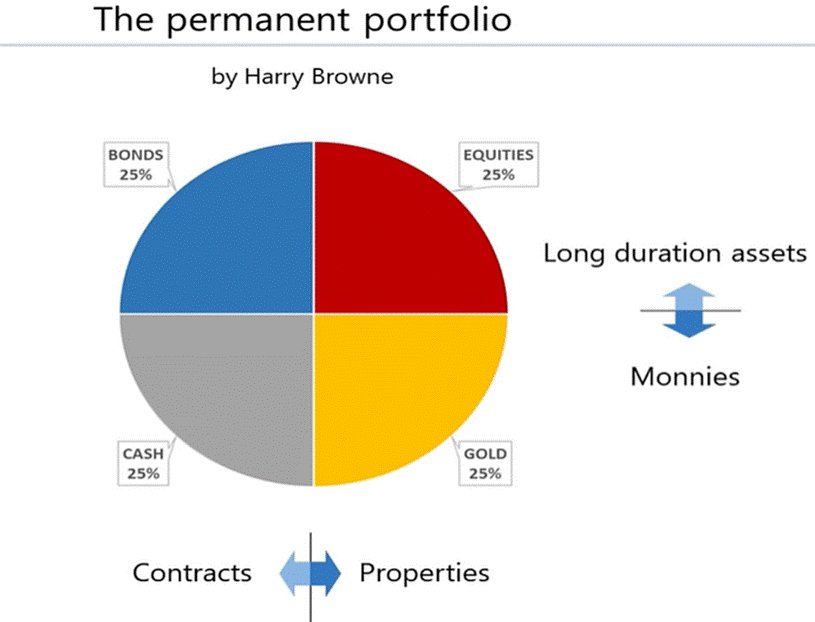

Investors who have done more investing homework than just bingeing Wall Street pundits or tuning into finance soap operas hosted by clueless journalists, will know they basically have two flavours to choose from: contracts and properties.

Harry Browne, an economist with a knack for common sense, cooked up the Permanent Portfolio—a no-nonsense, all-weather mix of four uncorrelated assets: stocks, bonds, gold, and cash, each at 25%. Simple, balanced, and built to survive just about any economic circus.

On one side we have contracts made of Cash and Bonds which can be seen as IOUs with fancy suits.

Cash (or short-term Treasuries) is investors’ financial mattress—comfy during recessions and ready to pounce when deals appear. Fiat, yes, but not a hostage to long-term drama.

Bonds are polite loans to governments or companies, paying you interest while you wait for your money back. They shine when rates fall but melt in default or inflation tantrums.

On the other side, properties are made of Gold and Stocks These are the “real” stuff—no promises, just ownership. Gold doesn’t care about central banks or election cycles. It’s your shiny insurance policy against global chaos and government meltdowns.

Stocks let you own a slice of capitalism. Great in growth spurts, but they do throw the occasional tantrum when the economy catches a cold.

In short: Contracts say, “Trust me,” while properties say, “Own me.”

By mixing contracts (which can go poof via default or inflation) with properties (which stubbornly hold their value), Harry Browne built a portfolio that’s basically a financial Swiss Army knife—ready for inflation, deflation, booms, busts, and everything in between. The magic? Balancing risk and resilience across totally different asset personalities.

Now enter the old-school 60/40 portfolio—60% stocks, 40% bonds—the beloved brainchild of post-WWII finance and the go-to playbook for wealth managers. It rode high through decades of falling interest rates and rising markets, delivering growth with a side of stability. For years, it was the financial equivalent of a Volvo: safe, steady, and mildly exciting.

But today? That same portfolio looks like it’s stuck in the wrong era—kind of like showing up to a tech startup in a pinstripe suit. With inflation throwing punches, rates climbing, and geopolitics on edge, the once-golden 60/40 is now getting side-eyed as investors ask: Is this thing still built for the road ahead?

Performance of $100 invested in the US 60/40 Portfolio (blue line); US Browne Portfolio (red line) since December 31st, 1999.

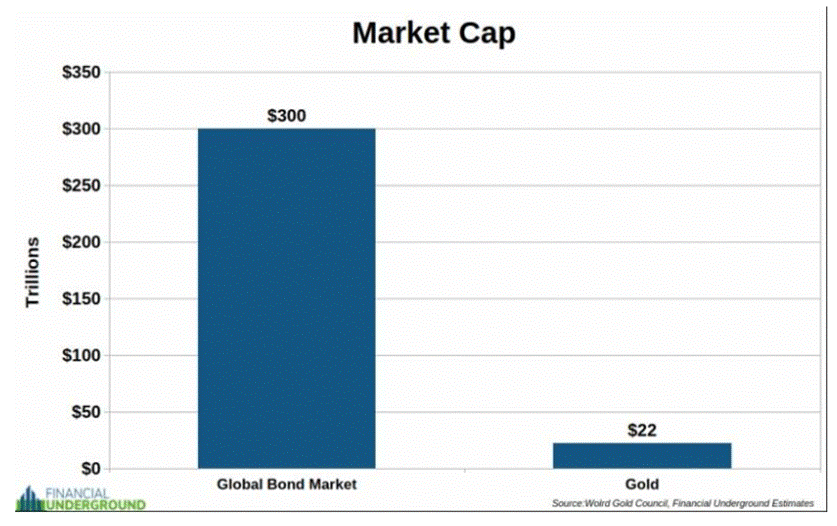

Thanks to decades of Wall Street brainwashing—and their loyal media parrots—there’s a laughably persistent myth in finance: that U.S. Treasuries are “risk-free.” It’s repeated like a sacred chant. Banks build entire portfolios on it. Advisors treat it as gospel. And most investors never question it. Since Nixon unshackled the dollar from gold in 1971, bonds—especially Treasuries—have become the default adult piggy bank. Safe, steady, and oh-so-respectable. The result? The global bond market has ballooned into a $300 trillion beast, all because everyone was told, “This is the smart move.”

Now, compare that to all the gold ever mined in human history—about $22 trillion. That’s barely 7% of the bond market. So much for “barbarous relics.” Apparently, what’s really smart is still trusting politicians with your savings.

Even before the Big, Beautiful Bill that promises to Make America Great Again hits the ground running, anyone who’s paid attention to the business cycle—or the impact of trade wars, capital wars, and actual wars—could tell you this: long-term yields aren't going anywhere but sideways or up, unless a miracle bring peace and lower government spending in the foreseeable future.

Inflation’s still sticky, fiscal risks are ballooning, and foreign buyers (like BRIC’s pension managers) are repeatedly threatening to dump Treasuries if Uncle Sam keeps spending like a drunken sailor while spreading ‘Turmperialism’ to rest of the world.

US 10-Year Yield (blue line); US CPI YoY Change (red line) & Spread between US 10-Year Yield & US CPI YoY Change (histogram).

The self-declared “Treasurer-in-Chief”—a former hedge fund manager with a less-than-stellar track record and a loyal graduate of the George Soros school of speculation and regime change—once mocked the gospel of “Yellenomics” from outside the Washington swamp. But the moment he got a taste of political power? He dropped the critique and grabbed Yellen’s playbook with both hands—the very one he used to scoff at. Turns out, nothing turns a critic into a copycat faster than a seat at the table.

On July 1, 3 days before it was signed by the ‘Manipulator In Chief’, the Congressional Budget Office gave the Senate’s “Big Beautiful Bill” a glowing review—claiming it would slash deficits by $0.4 trillion. Sounds great, right? Well, hold your applause. This magic trick relies on a baseline cooked up by Senate Budget Chief Lindsay Graham, the ‘Regime Changer In Chief’.

The real cost disappears like Houdini’s best trick. Graham even bragged, “I’m the king of the numbers, I’m Zeus, the budget king.” Meanwhile, the bipartisan CBO quietly notes the bill actually increases deficits by $3.4 trillion over the next decade. But wait, there’s more: the bill front-loads tax cuts and delays spending cuts, setting up a fiscal cliff in 2028—right before crucial elections. This cliff almost guarantees another round of tax-cut extensions and likely undoing of deficit reductions, potentially pushing the deficit impact from $3.4 trillion to $4.8 trillion, according to the Committee for a Responsible Federal Budget. In other words, like the 2017 TCJA, these “temporary” sunset provisions are just a fancy way of making permanent promises that blow up the deficit down the line. Welcome to the ultimate political accounting magic show.

Despite the soaring budget deficit, the impact on U.S. economic growth will likely be minimal. Most of the so-called “tax cuts” in the One Big Beautiful Bill are just extensions of the TCJA’s income tax provisions—basically removing the fiscal cliff Republicans feared would tank their election chances. So, no surprise here, growth projections stay put. The actual new stimulus? Much smaller. Fiscal discipline? Out the window on Capitol Hill. The few hawks left can only slow the debt’s upward march. That leaves bond vigilantes as enforcers—. As they diversify away, expect demands for higher yields. Eventually, either rising interest rates or tax hikes will force lawmakers to get serious—or slow growth will do it for them. For now, enjoy the extended low taxes and fresh cuts—just don’t bet on tomorrow.

US 10-Year Yield since 1961.

Despite all the hype around Trump’s “grand strategy,” defence spending in the One Big Beautiful Bill doesn’t exactly scream “military dominance.” With tax cuts extended and Social Security and Medicare untouchable, there’s barely any wiggle room to boost defence budgets. Translation: America’s foreign policy ambitions are about to hit the brakes. So, while the recent US strike on Iran might be a quick win for the globalist, the One Big Beautiful Bill hands the long-term advantage to the isolationists.

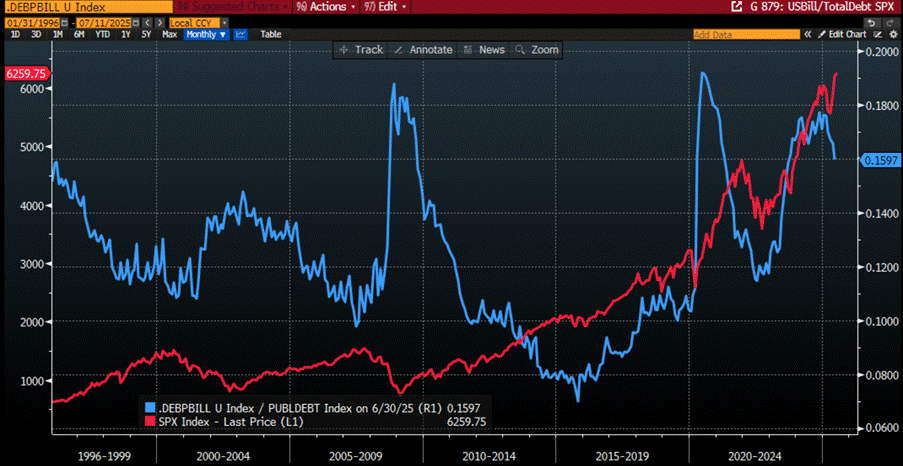

Before the “Big Beautiful Bill” took effect, the self-styled “Treasurer-in-Chief” made it clear: his team isn’t too fond of locking in debt at longer maturities. Instead, they’re leaning into short-term bill issuance—a move ‘The Manipulator In Chief’ himself echoed with his fantasy of issuing only sub-nine-month debt, something that isn’t happening even in the most honky-dory MAGA dreams.

Issuing more bills and less long-term debt juices reserve velocity and gives a sugar high to risk assets.

Ratio of US Total Debt Outstanding Bills to US Total Government Debt (blue line); S&P 500 Index (red line).

Financing America’s abyssal deficit with short-term Bills instead of longer-term coupons is basically the fiscal equivalent of buying groceries with a credit card—and yes, tragically, that’s the real-life budget strategy of millions of Americans still clinging to the hope that their vote for a better life wasn’t hijacked by the PayPal Mafia and their Wall Street pals. And while Washington juggles debt like it’s running a late-night infomercial (“Why lock in rates when you can just roll it over forever?”), gold quietly benefits. Every time Uncle Sam chooses Bills over bonds, it’s just one more tailwind pushing the shiny metal higher.

Ratio of US Total Debt Outstanding Bills to US Total Government Debt (blue line); Gold price in USD Terms (red line).

Cranking up bill issuance isn’t technically quantitative easing—after all, the FED’s balance sheet doesn’t balloon automatically. But let’s not kid ourselves: by shortening the average maturity of U.S. debt, Treasury makes it feel a whole lot more like cash. More “money-ness” means investors chasing yield elsewhere, inflating risk assets in a fiscal-led version of QE—just without the FED doing the printing.

With the debt ceiling being raised (surprise!), the Treasury is also looking to refill its FED checking account (Treasury General Account) from $360 billion back up to a more comfy $750–800 billion. But let’s be honest—this smells like the start of a bigger plan: shift more debt into bills, prop up markets, and pretend inflation isn’t being hardwired into the system. Because what could possibly go wrong when you fund a fiscal black hole with IOUs that mature faster than American’s attention span on TikTok?

While retail investors—and even many HNWIs—still cling to the bedtime story that U.S. Treasuries are “risk-free,” central bankers, particularly those in the American-imperialism-free world of the Global South, have long known the truth: physical gold—not government IOUs printed on a whim—is the real antifragile asset: zero counterparty risk, no political drama.

So, it shouldn’t shock anyone not fully hypnotized by Wall Street’s honky-dory narrative that gold has now overtaken the euro as the second-largest reserve asset in the world, according to the ECB’s review of 2024 holdings. As the curtain fell on the year, reserves broke down like this: 46% USD, 20% gold, 16% euro, and the rest just rounding errors.

That 20% gold share might even be lowballing it—central banks don’t exactly advertise their gold shopping sprees. But here’s what we do know: they’ve been scooping up over 1,000 tons annually since 2022, bringing official holdings to the highest weight since the 1970s and near the all-time high from 1965. That’s a quarter of global mined production vanishing into vaults.

Why? Well, the ECB, ever the diplomat, blames it on Russia’s invasion of Ukraine and the ensuing sanctions. Translation: once the U.S. started using the dollar like a geopolitical sledgehammer, central banks took the hint—grab gold before your reserves end up in a financial freezer.

In fact, in five of the ten biggest annual gold-buying binges since 1999, the buyers were either under sanctions or getting their “you're next” warning. Of course, the ECB tiptoes around the more awkward truth: Western governments printing trillions to fund their latest political pet projects. But sure—this gold rush is definitely all about peace of mind and stability for those who are looking to remain independent from the agenda spread by those following the elites of Davos.

So, while Wall Street and the White House cheer for digital dollars and deficit spending, the central banks mostly in the Global South are quietly stuffing their vaults with shiny yellow “barbarous relics.” Who’s the reckless one now?

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/the-big-beautiful-bullion

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.