Chasing A Cure For Type 1 Diabetes

Follow-Up: Sana Biotechnology

6-Month Data, +150 % Rally, and Morgan Stanley’s New Overweight Call

In a public post in May (“The End Of The T1 Diabetes Industry?”), I wrote about Sana Biotechnology (SANA 5.00%↑), a biotech that has developed a potential cure for type 1 diabetes. Here’s an update on developments since.

1. Quick Recap of the May 19 Thesis

Functional-cure potential. Sana’s hypo-immune (HIP) edits let donor islet cells make insulin without triggering rejection—no immunosuppression required.

Moat = immune stealth. Removing MHC I/II and adding “don’t-eat-me” CD47 is the core advantage.

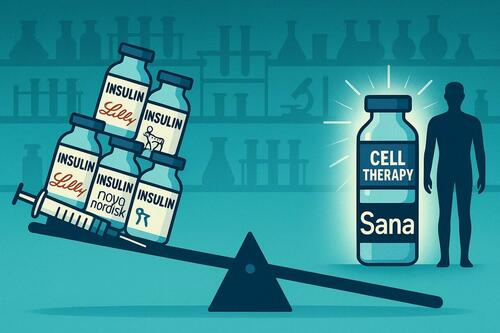

Industry disruption. If HIP-edited, stem-cell–derived islets (program SC451) scale, legacy diabetes franchises at Novo Nordisk (NVO -1.37%↓), Eli Lilly (LLY 0.72%↑), DexCom (DXCM -2.29%↓), Insulet (PODD -2.33%↓), etc., may be at risk.

(See original post for full details.)

2. Stock Performance Since the Post

In under eight weeks, SANA has nearly tripled, reflecting a shift from speculative promise to emerging proof-of-concept.

3. Six-Month Human Data (June 23)

“Cells survived, secreted insulin, and responded to meals six months after transplant—without immunosuppression and with no safety issues.” GlobeNewswire

Why it matters

Durability: Continued C-peptide production and meal-stimulated spikes confirm functional beta-cell activity.

Immune evasion: Persistent graft survival validates HIP edits.

Safety: No cell- or procedure-related adverse events.

Path forward: Larger dose-escalation cohorts; IND for stem-cell version (SC451) targeted for 2026.

4. Morgan Stanley Joins the Bull Camp (July 2)

Initiation: Overweight rating, $12 price target (~3× Friday’s close).

Rationale: Six- and 12-week human data “de-risk the platform”; broad cell-engineering pipeline offers additional upside. Investing.com

5. What Could Move the Stock Next

| Catalyst | Expected Timing | Significance |

|---|---|---|

| Additional patients dosed | 2H 2025 – 1H 2026 | Reproducibility & dose-response |

| Peer-review / ADA + IPITA presentations | 2025 conf. season | External validation |

| SC451 IND filing | 2026 | Scalable, off-the-shelf therapy |

| Non-dilutive partnerships or grants | Anytime | Cash-burn mitigation |

6. Bottom Line

Data + Duration: The six-month update converts “interesting science” into early evidence of durable clinical benefit.

Momentum: A ~150 % rally since May 19 shows the market is starting to price in that shift.

Institutional validation: Morgan Stanley’s fresh Overweight adds credibility—and a higher-quality buyer base.

If you sized SANA small after the May post, the thesis is tracking; consider letting winners run while watching for pullbacks to add. New capital? Size cautiously—it’s still a single-patient read-out—but the upside/skew remains attractive as more data roll in.

And if you’re long legacy diabetes treatment companies, consider hedging them. Although Sana is aiming to cure T1 diabetes, its treatment could potentially impact the market for management of some forms of T2 diabetes as well (e.g., insulin therapy). As a reminder, you can use Portfolio Armor’s website or iPhone app to scan for cost-effective hedges.

And if you want a heads up when we place our next trade, you can subscribe to the Portfolio Armor trading Substack below.

7. Update: State Of Sana's Competition

| Company / program | How they dodge the immune system | Where they are now | Approx. lag vs. Sana* |

|---|---|---|---|

| Eli Lilly / Sigilon — SIG-002 | Encapsulates stem-cell islets in Afibromer™ alginate “Shielded Living Therapeutics” spheres that physically block immune attack—no gene edits, no systemic immunosuppression required. (Lippincott Journals) | Pre-clinical; Lilly has guided to an IND filing in 2026. | ≈ 2–3 yrs to first 6-month human data. |

| CRISPR Therapeutics — CTX211 | Knocks out MHC I/II and adds PD-L1 in stem-cell islets, then puts them in a retrievable device; designed to work without chronic immunosuppression. (GlobeNewswire) | Phase 1 under way (first patient dosed Q4 2024); company expects a data update late 2025. | ~ 6-12 months behind on durability read-out. |

| Seraxis — SR-03 | Gene-edits donor-derived endocrine clusters (HLA-KO ± PD-L1) to make them “universal,” eliminating the need for lifelong immune suppression. (Synapse) | IND-enabling now, Maryland grant fast-tracking work; IND target 2026. | ≥ 2 yrs. |

| eGenesis — HuCo™ pig islets | ~70 CRISPR edits delete xeno-antigens & PERVs and insert human proteins to make porcine islets “human-compatible,” aiming to obviate immunosuppression. (egenesisbio.com) | Large-animal work; planning first-in-human pilot 2026-27. | 2½-3 yrs. |

| Sernova / Evotec — QR-Beta + Cell Pouch | iPSC β-cells plus a vascularised pouch with local immune shielding so patients avoid systemic drugs (concept in pre-clinical). (BioSpace) | Device β-cell combo in pre-clinical validation; clinical timing not yet set. | Multiple years. |