Silver's Perfect Storm Begins- $50 and Beyond Awaits

Contents

- Silver Market Summary

- Drivers and Catalysts

- Tariff Risk

- Mineral Wars

- London Has No Metal

- India Wants Silver- Brics ETF Demand

- Key Analysis breakdowns: BOA, GS, UBS

- Technicals

1. Silver Market Summary

Authored by GoldFix, ZH Edit

Silver prices soared last week, touching levels not seen since 2011, as signs of physical market tightness and speculative flows collided with macro crosscurrents.

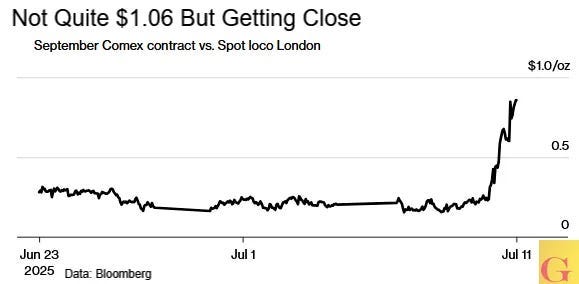

Spot silver rallied as much as 4% to $38.47/oz, while COMEX September futures peaked at $39.12/oz, creating an unusually wide arbitrage spread. The dislocation echoed the premium spike seen earlier this year when U.S. tariff threats distorted pricing between domestic and global markets. Lease rates firmed as traders scrambled for deliverable supply.

Market participants also pointed to growing concerns over Chinese scrap flows, with efforts underway to restrict outbound shipments that might tighten refining supply further.

2. Drivers and Catalysts

There are many drivers bringing us to this point. Few are new but many have gotten more obvious recently. The recent headline events ( tariffs, LBMA shortfalls, etc) that catalyzed market players to focus on these drivers have brought new (and unwanted as far as short players go) attention to the metal driving prices much higher, with still more to go. Lets run through some of the main ones.

Tariff Risk

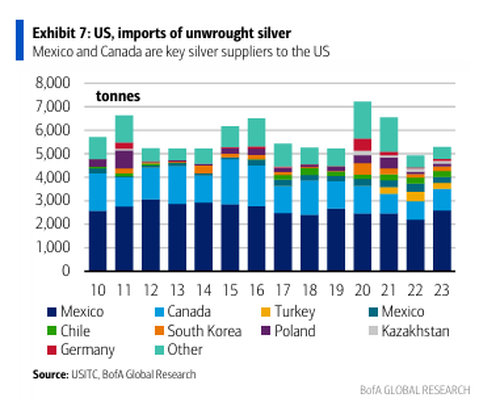

Tariffs , especially those on base metals, have exerted a sharp impact on silver prices by disrupting the delicate balance between industrial demand and market supply. As noted in a GoldFix analysis of COMEX silver and gold, “case studies: Chinese‑origin and Russian‑origin metals” show how tariffs can elevate costs and reroute global flows

Silver EFPs and Trump-Tariff Risk

Jan 29th- This brings us to silver, and perhaps gold as well. If tariffs are implemented, then that could have a very disruptive effect on the flow of the metal from these two key countries into the US.

The silver EFP has been reflecting a concern for this eventuality. The Comex vaults have been transferring metal from London to the US in what is likely preparation for the tariffs threatened to be implemented.

When tariffs are imposed on key industrial metals like copper or aluminum, they often ripple into silver. Silver serves both as a monetary asset and an industrial input: higher tariffs can drive up the cost of metal-intensive manufacturing, reducing consumption. On the supply side, tariff barriers curb cross-border metal shipments—especially from large producers like China or Russia—creating sourcing tightness. That tightness can tighten the physical silver market, pushing spot premiums higher and even encouraging speculative positioning on COMEX futures.

In short: tariffs raise industrial production costs, choke off metal flows, and bring physical-market strain—each element feeding upward pressure on silver’s price.

Mineral Wars

Mercantilism has returned, this time through the lens of mineral policy. As Josh Phair, Scottsdale Mint CEO noted: “Countries are clearly saying we want the value here.” That mindset now governs critical mineral trade. Export restrictions, domestic value-add mandates, and cartel-like behaviors are proliferating. Nations such as Indonesia and India are tightening control over mineral flows to support internal industrialization.

These are not isolated policy shifts. As Phair emphasized, “we’re seeing a shift to mineral nationalism.” This strategic pivot transforms minerals from commodities into instruments of statecraft. Supply security, once managed through trade, is now managed through ownership, extraction, and exclusion.

Ground Zero in the Global Mineral Wars

July 12- The recent movement in silver is a front-running indicator of deeper structural change. Physical demand has outpaced paper pricing. The EFP spike and spot rally are signals that the material world is reasserting control over the financial one. The United States has begun to act with urgency. It is building out capacity, restricting exports, and solidifying regional alliances. The market has responded quickly. Silver moved higher, and the premium to obtain real ounces widened significantly. Read full story

The resulting mineral wars are less about bullets ( so far) and more about permits, tariffs, and bilateral agreements. Import-reliant economies face rising costs and decreasing leverage. In this new framework, metals like copper, lithium, and silver are no longer just industrial inputs. They are geopolitical assets.

London Has No Metal to Sell

London serves as the global vault for Precious metals. They have been the above ground source and repository for Gold and Silver for decades. But not any more. LBMA stockouts, lease rates, and Exchange-for-Physical (EFP) premiums are core symptoms of a tightening silver market. LBMA vault inventories have declined significantly, while silver lease rates surged above 7 percent earlier this year—a sign that access to physical silver is becoming more difficult. At the same time, EFP spreads have widened, reflecting pressure to move futures positions into physical delivery.

Daniel Ghali frames these market dislocations as interlocking signs of physical scarcity.

“We’re seeing some of the most extreme readings in lease rates and EFPs since the pandemic,” he noted in commentary published this quarter. “The message is simple—silver is increasingly hard to source.”

Breaking: Silver Nears 2011 Highs as Physical Market Fractures

July 12- In January during the US Gold Repatriation event and the Tariff fears, the spread between US Silver prices and London Silver prices reached $1.06 while Gold reached $50 differential (chart below), an unheard of and completely irrational event if the metal London says it holds was actually available.Read full story

These stress signals are not abstract, quite the opposite. Reality is running over abstractions now. Historically, lease rate spikes above 2 percent have preceded price rallies of 20 to 50 percent within 6 to 12 months. When coupled with shrinking inventories and delivery pressure, the case becomes stronger: the silver market is entering a phase where scarcity, rather than sentiment, could become the dominant price driver.

Global silver ETF demand is surging in 2025, led by explosive growth in India and China. Investors in both countries view silver as a dual-purpose asset—both industrial gauge and financial hedge—fueling a wave of ETF inflows. India’s expanding middle class and a shift toward diversified household portfolios are driving persistent buying, while China’s capital constraints and monetary diversification are channeling funds into silver.

India Wants Silver Over Gold in 2025

-July 13 -Silver exchange-traded funds (ETFs) have recorded an exceptional rise in assets under management (AUM) over the past year, signaling a structural shift in investor behavior. From June 2024 to May 2025, silver ETF AUM in India rose from ₹7,473 crore to ₹16,866 crore—a 125 percent increase. By comparison, gold ETFs grew 81 percent during the same period, expanding from ₹34,355 crore to ₹62,452 crore. Read full story

The demand has shifted significantly in BRICS nations recently away from Gold and towards Silver and Platinum with India buying the Silver, and China opting for Platinum thus far. We fell the East is on a mission to make all metals great again by reinstating historic correlations based on natural occurrence and not financial abstractions. Where does that put silver with Gold at $3500? We believe somewhere between 70 and 15 to one.

3. Key Bank Analysis

Find attached GoldFix breakdowns of the most important Bank reports covering Silver since March. ht ZH

Continues here