The Price Of Chaos…

What’s behind the numbers?

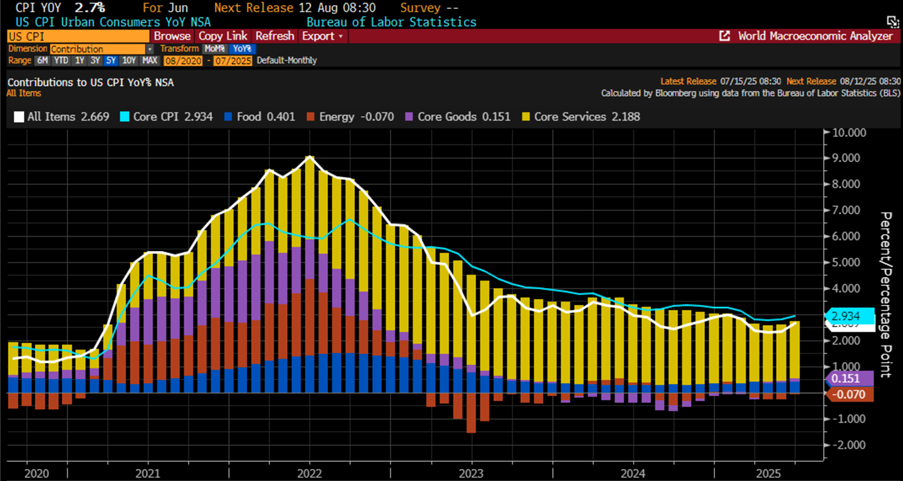

The sixth CPI print of this grand Jubilee Year strutted onto the stage with a +0.3% MoM rise—exactly as forecast, but still a jump from May’s sleepy +0.1%. Year-on-year reflation made a dramatic entrance at +2.7%, beating the +2.6% estimate and marking its flashiest performance since last February—back when tariffs and wars were just PowerPoint slides in the ‘Disruptor In Chief’s’ inbox. Energy once again threw on its superhero cape and saved the deflation narrative (thanks, oil), while goods inflation made its biggest comeback since July 2023. Meanwhile, food prices kept climbing like egg prices on roller skates, and core services quietly kept grinding higher at an annualized 2.2% pace.

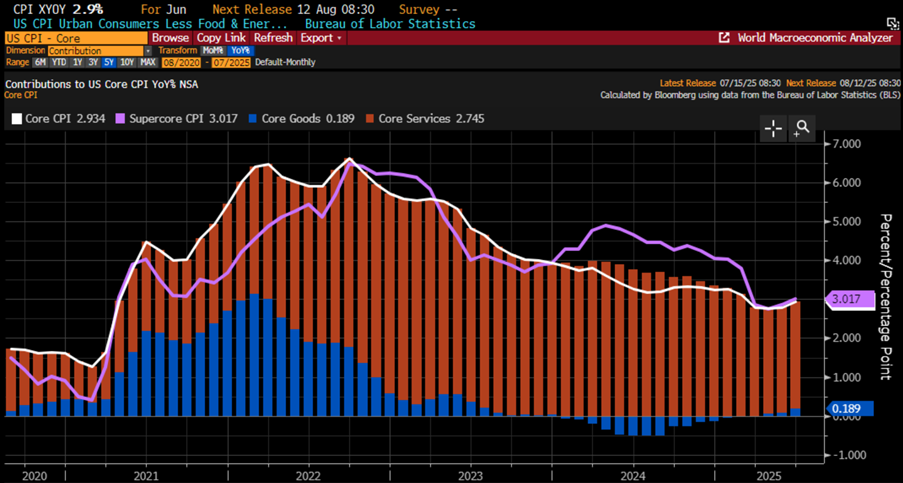

Core CPI rose +0.2% in June—not as hot as the expected +0.3%, but still warmer than May’s tame +0.1%. Year-on-year, it ticked up to 2.9%, right in line with forecasts but slightly up from May’s 2.8%, signalling a not-so-subtle reacceleration. Core services (76% of the index, aka the main course on the inflation buffet) picked up to 2.74% YoY, while core goods turned inflationary again for the first time since December 2023. Oh, and for those keeping score at home—this is month 61 of consecutive core CPI gains. But hey, who’s counting? Just economists, investors, central bankers… and anyone buying groceries.

A favourite stat for the “inflation is over” crowd: Owners' Equivalent Rent—the undead of CPI—held steady at a 4.2% YoY rise in June, its "coolest" print since Jan 2022. So yes, inflation is totally tamed... if you squint hard, ignore rent, food, and reality, and maybe take a deep breath of ‘hopium’.

Even less comforting for the “inflation is dead” cheerleaders: SuperCore CPI—core services ex-housing, a.k.a. the Fed’s favorite excuse to stay “data dependent”—jumped to 3.02% YoY in June, up from 2.86% in May and hitting its highest level since last February. So much for that victory lap—seems the only thing cooling is common sense.

Thoughts.

June’s CPI confirmed what anyone buying groceries already knew: the deflation blip was a fluke, and the Trump Reflation train has left the station—tariff tax and all. While the “Manipulator in Chief” and his central bank sidekick toast their imaginary 2% victory, aggregate inflation still jogged around 3.15% YoY. But hey, nothing says “success” like reducing corporate margins and taxing consumers with a smile.

US Umbrella inflation Index (Average of CPI; Core CPI; PPI; Core PPI; Core PCE, 1-year consumer inflation expectations)

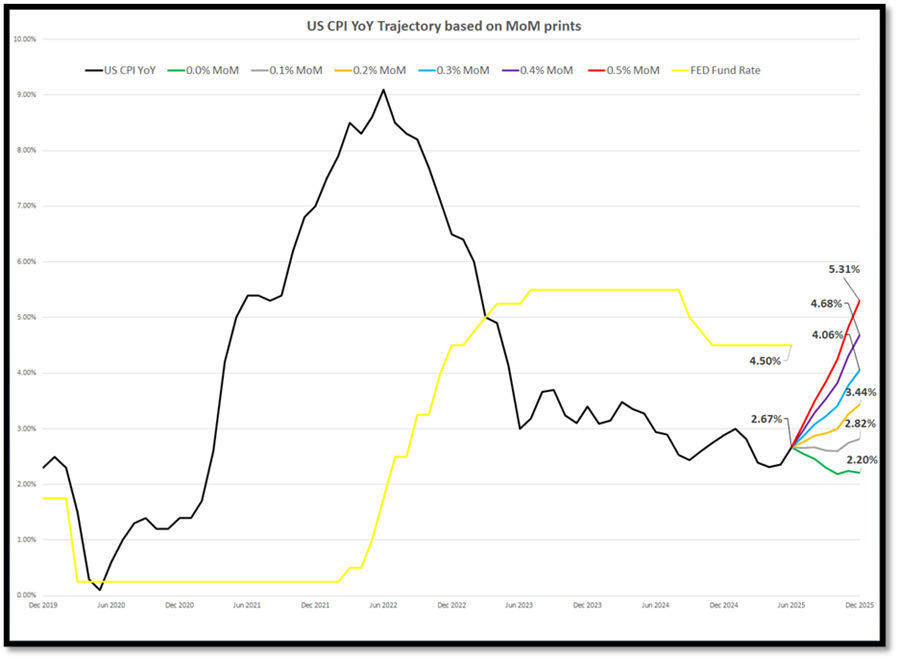

Instead of fantasizing about 2% inflation magically arriving before the end of the Jubilee Year (cue harp music and sparkles), seasoned investors—unlike the caffeine-fuelled PhD army at the FED—know better. In a world stuffed with tariffs and trillion-dollar tabs, math is still a thing.

To hit that 2% dream. CPI would need to moonwalk below 0% monthly—basically, a unicorn riding a flying spreadsheet.

But if those prints inch up to just 0.2% or higher? Get ready for CPI to land somewhere between 3.4% and 5.3% by year’s end.

And in that case, not even Donald Copperfield threatening to saw the “Central Banker in Chief” in half will stop the FED from awkwardly admitting that cutting rates during an inflationary boom might not have been their brightest moment. Rate hike for the autumn, anyone?

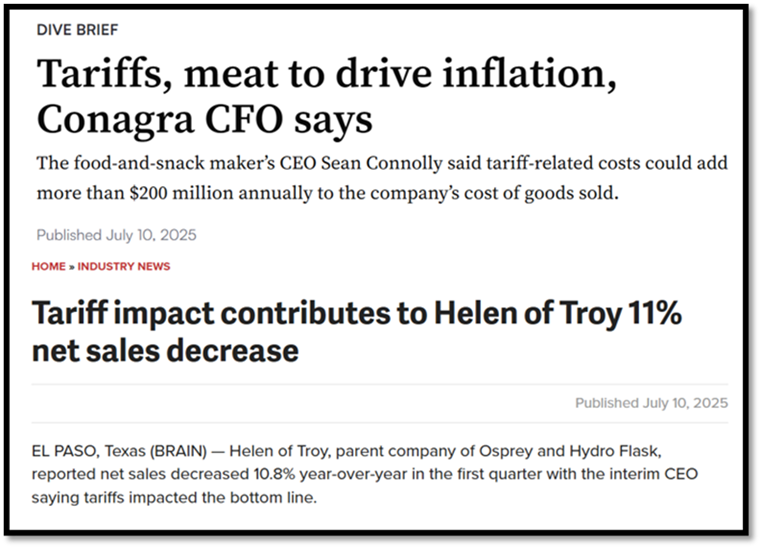

Tariffs aren’t inflationary, says the “Treasurer in Chief.” True—it’s not inflation, it’s just a massive tax someone pays. Like Conagra and Helen of Troy, now choking on 7% cost inflation and a cool $200 million tariff hit. But who cares if margins collapse and hiring freezes, as long as elites can chant “Making America Great Again” into the void. Meanwhile, Washington is quietly raising corporate taxes through the back door—because nothing screams pro-business like a tariff bomb.

Investors who’ve truly studied the rhythms of history and the brutal logic of business cycles understand inflation isn’t some mysterious force—it’s born of scarcity, surging demand, and the slow death of trust in public institutions. When tariffs tighten the noose, trade wars ignite, and U.S. imperial bravado fans the flames, the outcome is inevitable: prices rise, confidence crumbles. And if ‘Donald Copperfield’s policies unleash another inflationary spiral or plunge the world into conflict, his political capital will evaporate faster than the promises he made to earn it.

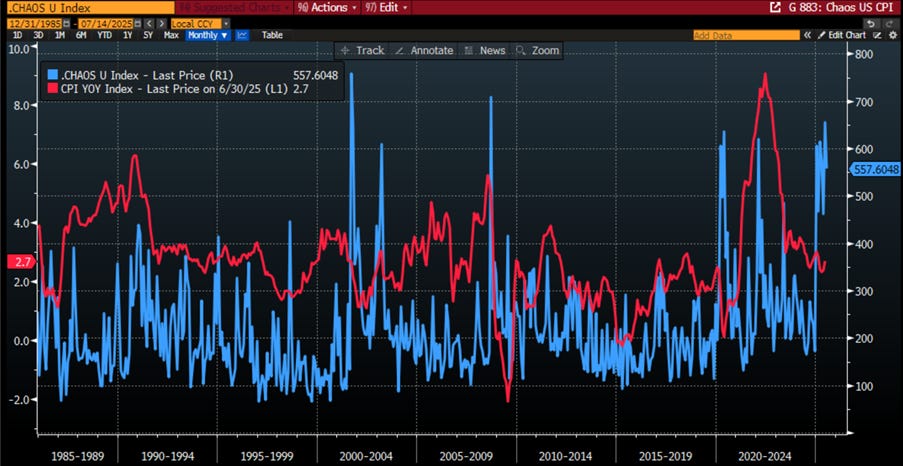

At the end of the day, nobody needs a PhD in economics—or even a full attention span—to see the obvious: when governments spew mixed signals and geopolitics turns into a dramatic soap opera, investors and consumers are left scratching their heads. Confidence erodes faster than a campaign promise, and guess what comes next? Inflation. Rising policy chaos—whether at home or abroad—inevitably fuels rising CPI. It’s not rocket science; it’s just economic gravity… with a side of unhinged social media posts.

Chaos Index (US Economic Policy Uncertainty Index + Caldara Iacoviello Geopolitical Risk (GPR) Uncertainty Daily ) (blue line); US CPI YoY Change (red line).

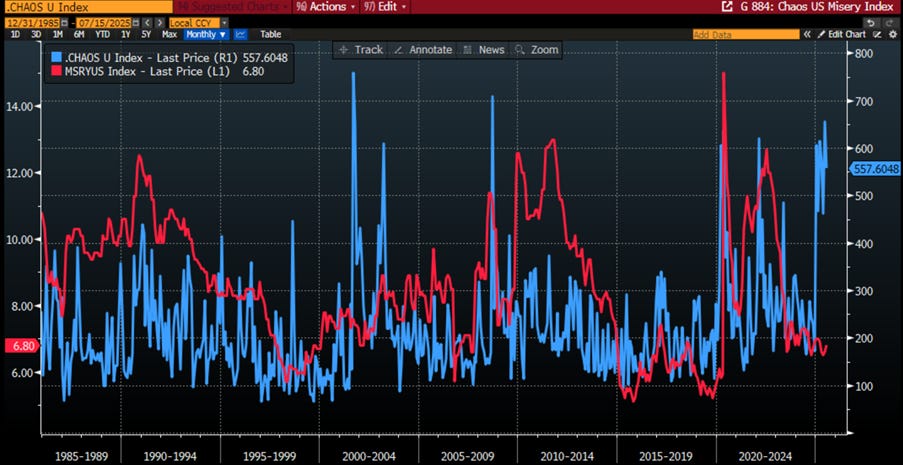

In this kind of policy circus, where uncertainty reigns supreme, it doesn’t take an MBA to figure out that business owners will slam the brakes on hiring and capex. And when spending stalls and layoffs creep in, guess what follows? A nice spike in the misery index. So yes, rising chaos doesn’t just dent confidence—it eventually lands everyone in a full-blown economic hangover.

Chaos Index (US Economic Policy Uncertainty Index + Caldara Iacoviello Geopolitical Risk (GPR) Uncertainty Daily ) (blue line); US Misery Index (red line).

While Keynesians still cling to the fantasy that central bankers and bureaucrats can tame inflation like it’s a house pet, those who’ve studied a chart or two know better. Inflation isn’t summoned by interest rates or buried under mountains of freshly minted toilet-paper dollars—it’s driven by the business cycle and, more specifically, three classic culprits: shortages, strong demand, and eroding trust.

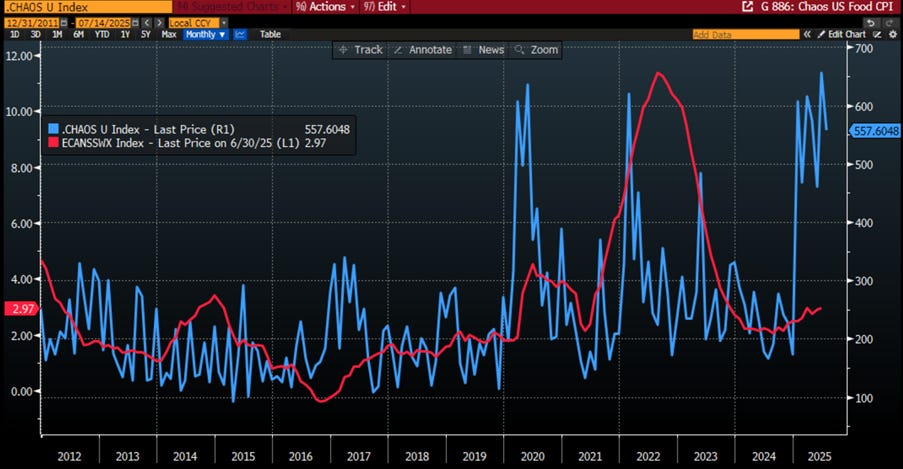

Need proof? Just look at the tight dance between food inflation and the global chaos index. Raising or lowering the Fed funds rate won’t magically grow more wheat. When wars break out or some genius regulators decide to save the world by wrecking supply chains, food gets scarce—and prices soar. And yes, the sun’s solar cycle still beats Jerome Powell’s Excel spreadsheet when it comes to crops.

Chaos Index (US Economic Policy Uncertainty Index + Caldara Iacoviello Geopolitical Risk (GPR) Uncertainty Daily ) (blue line); US CPI Food YoY Change (red line).

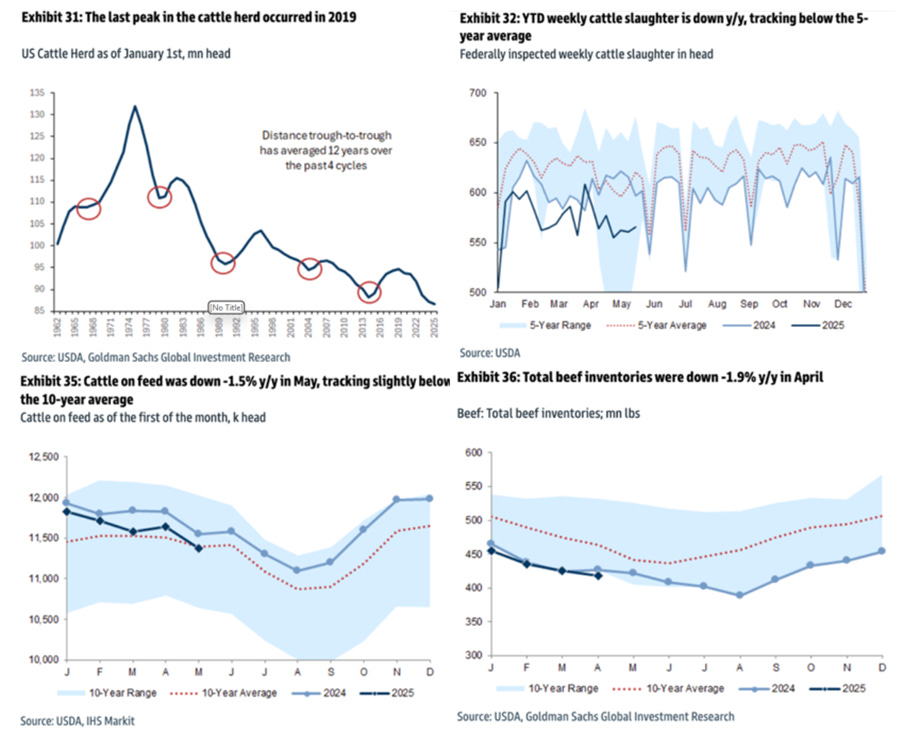

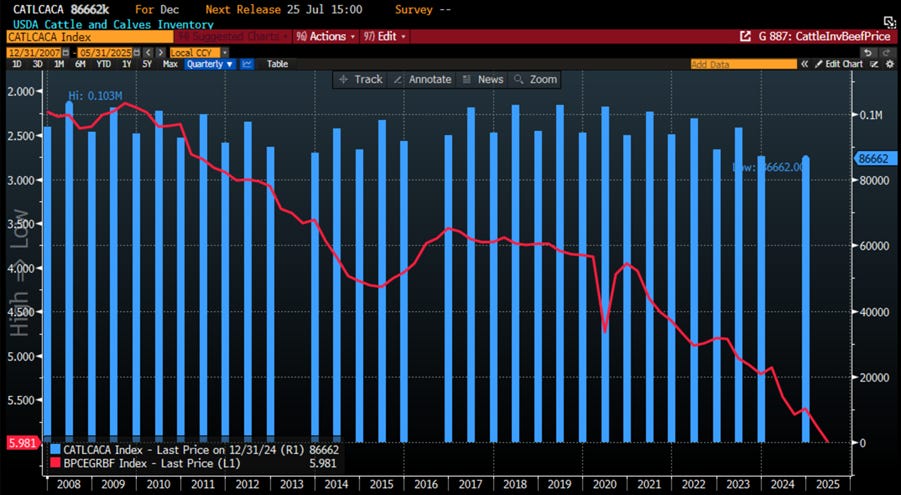

Want to understand how food cycles work? Just follow the cows. The U.S. beef industry runs on a 12-year herd cycle, and after years of liquidation since 2019, the cattle count is now at its lowest since the 1950s—hello, 86.7 million. Rebuilding may be near (thanks to pricey calves and cheap feed), but don’t expect juicy margins anytime soon: tight herds = fewer steaks = squeezed packers.

During Tyson Foods’ May earnings call, Brady Stewart, head of beef and pork operations, signalled the U.S. cattle herd may be bottoming out, with inventory at a 73-year low of 86.7 million head. Record animal weights are easing the supply crunch, but year-over-year volumes remain down. USDA data showed ground beef hitting a new high of nearly $6 per pound in May, but tight supplies and high prices could persist for years. With the MAHA movement gaining traction, more Americans are turning to clean, locally raised beef and distancing themselves from global food giants—perhaps it's time to shake hands with your neighbourhood rancher if you want to survive the next volcanic winter, which could make eating protein daily a luxury akin to owning a Porsche Cayenne for a hedge fund manager on the eve of a bear market.

USDA Cattle & Calves Inventory (histogram); USDA Ground Beef Retail Price Index (axis inverted; red line).

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/the-price-of-chaos

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.