The AI Margin Revolution Is Just Getting Started

The AI Margin Revolution Is Just Getting Started

Invest for where the conversation is heading...

After two decades on Wall Street, I’ve learned that the most successful investors share one trait: vision. They don’t fear new highs—they understand what’s driving them. Today, that driver is AI.

While media outlets roll out guests warning that stocks are “too expensive,” they’re missing the bigger picture. AI is already putting money back into companies’ pockets. Siemens says it’s cutting conversion costs by up to 20%. UPS is saving millions through route optimization. Microsoft (MSFT) saved $500 million in its call center alone last year, helping it grow revenue 15.7% while keeping expense growth to just 1%.

As AI adoption accelerates, demand for the companies building and enabling it will surge. Their share prices rise, their weightings in tech-heavy indexes like the S&P 500 increase, and the fair value multiple of the index adjusts upward.

Let’s look at the math. The S&P 500 is market-cap weighted. As stocks like Nvidia, Microsoft, and Apple climb, they become a larger part of the index—and a bigger driver of its direction. Tech’s weighting rose from 16% in 2015 to 23% by 2019, then to 26.5% in 2022 as cloud infrastructure exploded during the pandemic. Today, it’s above 31%, and climbing.

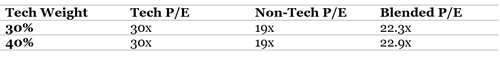

Traditionalists argue the S&P 500’s current multiple of 22.3x forward earnings is too high. But they’re ignoring the shift in composition. High-growth tech companies often trade at 30–32x. If 30% of the index deserves a 30x multiple and the rest trades at 19x, the blended fair value is 22.3x. If tech’s share rises to 40%, the multiple jumps to 22.9x.

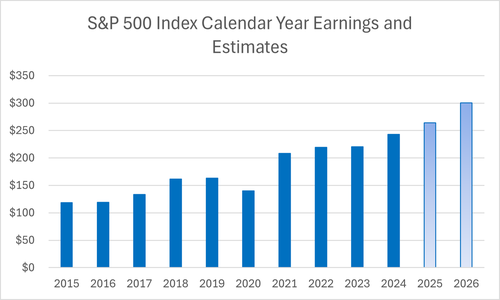

Now layer in earnings expectations: $264 for 2025 and over $300 for 2026. That gives us a 12–18 month upside target of 6,700 to 6,861—roughly 10% from here. And that's if numbers don't rise.

Bottom line: AI is driving real margin expansion. As that continues, tech valuations become more attractive, share prices rise, and indexes like the S&P 500 rally further. The future isn’t expensive—it’s evolving.

If you'd like to read the full comment, receive more commentary like this to your inbox daily, or see how I'd invest for any type of market, click here.