Deutschland Unter Allen!

Since ‘Donald Copperfield’ marched back into the White House on January 20th, his smoke-and-mirrors routine has dominated the field—distracting many investors from the broader battlefield.

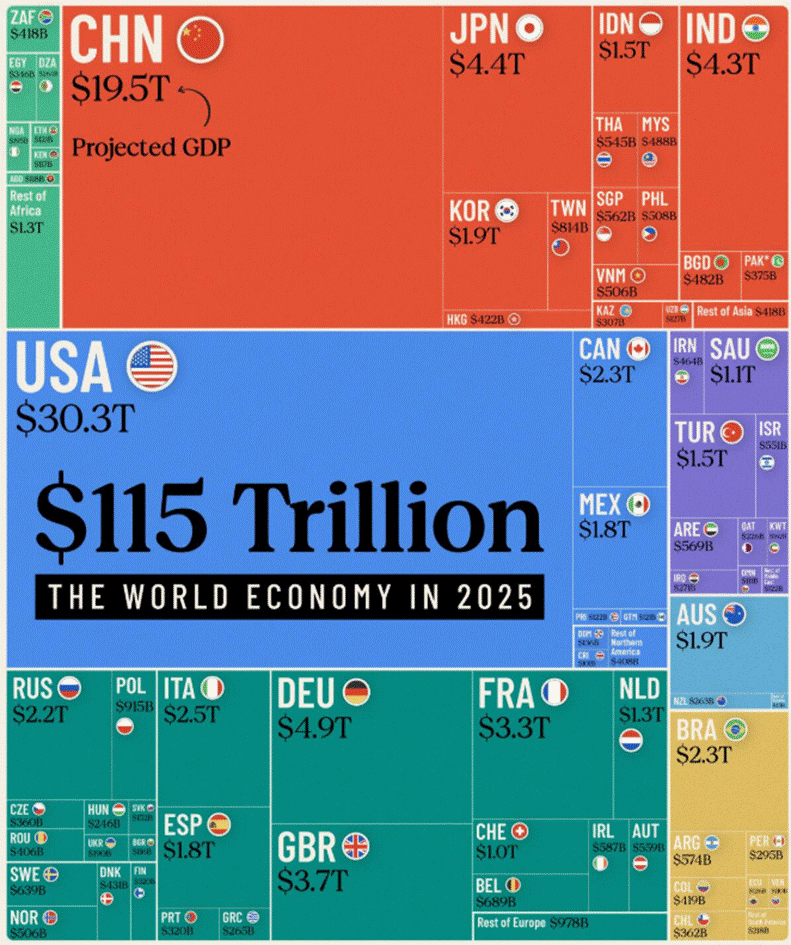

But here’s the strategic reality: while the U.S. commands roughly 24–25% of global GDP, it’s just one force among 195. China holds the second front with 17–18%, backed by its manufacturing arsenal. Japan, Germany, and India follow as key economic brigades, each controlling 3–5% of global output. The rest of the top 10—UK, France, Brazil, Italy, and Canada—hold the line with 1.5–3% each.

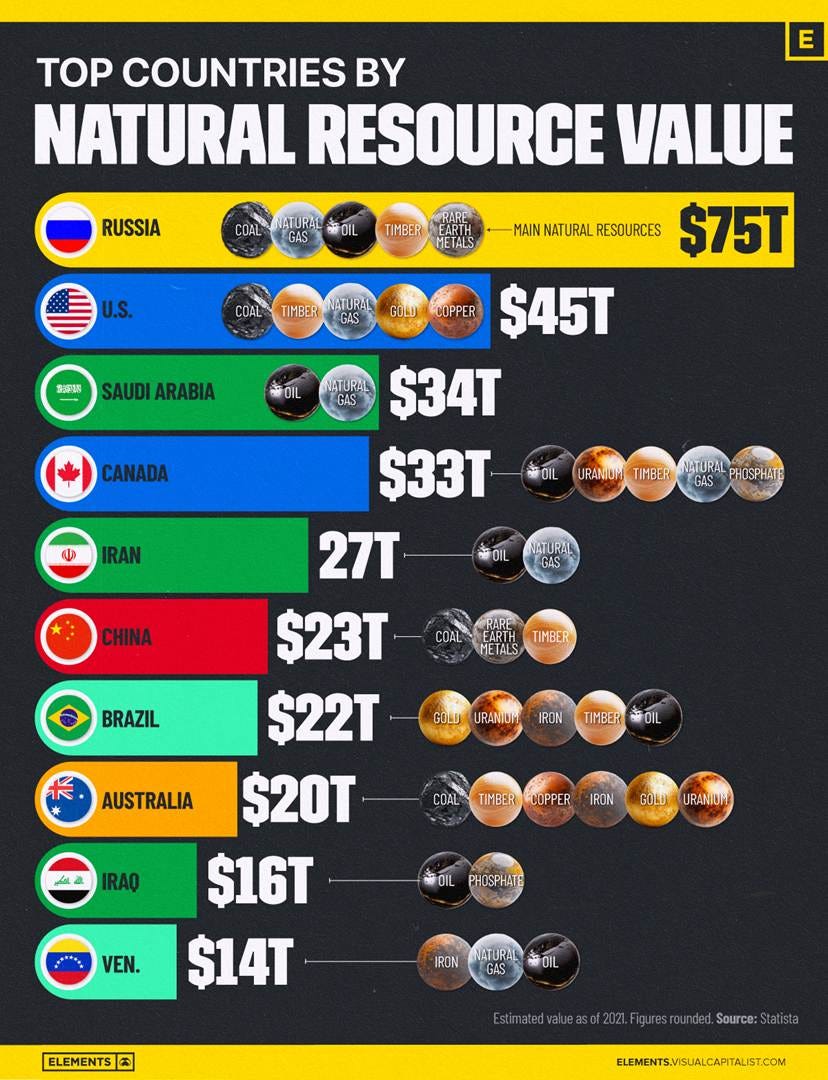

Outside of China—which keeps Washington’s war machine buzzing and defence contractors bathing in gold—the real threat to global stability isn’t what the media screams about. While the usual talking heads hype Bitcoin, the euro, or other fiat rivals to the dollar, they conveniently ignore Europe’s deeper rot. The continent is suffocating under chronic budget deficits, open-door immigration madness, and a DEI-Malthusian cocktail pushed by unelected bureaucrats and lamed duck politicians. All this, wrapped in the absurd narrative of a looming Russian invasion—a threat so laughable it insults intelligence. Anyone with half a brain knows Russia, sitting on the world’s richest trove of commodities, has zero interest in conquering a region drowning in red tape, bloated welfare, and demographic decay. Europe offers no prize—only a pension-heavy population, rising social unrest, and no natural resources to speak of. The real conquest already happened—from within by the illegal aliens who were used as a trojan horse by reckless Keynesian politicians.

Anyone who has studied the economic foundations of post-war Europe knows that Germany has long been its engine—accounting for roughly 25% of the EU’s GDP. This powerhouse model, rooted in centuries-old mercantilist strategy, thrived by combining efficient manufacturing with cheap Russian energy. That formula generated real wealth.

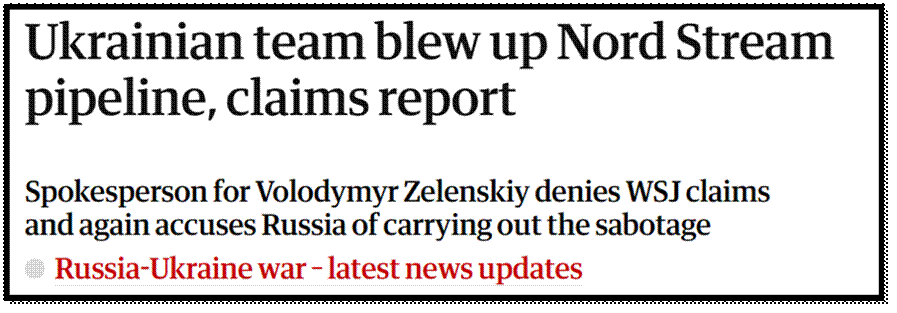

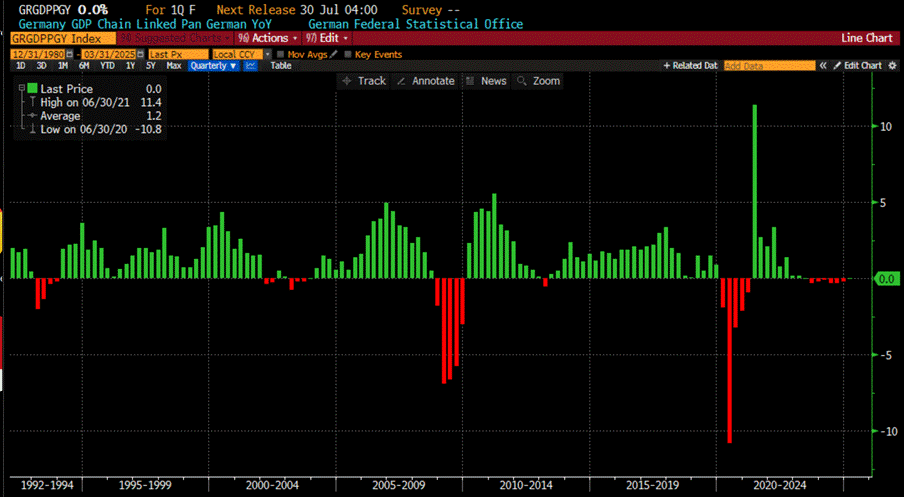

But in blindly following Washington’s "Russia, Russia" hoax, Berlin committed strategic suicide. The sabotage of Nord Stream marked more than the end of a pipeline—it symbolized the wilful destruction of Germany’s competitive edge. By severing ties with its main energy supplier and embracing sanctions, Germany didn’t just shoot itself in the foot—it amputated its economic leg.

In 2023, the result was clear: a -0.2% GDP contraction, making Germany the worst-performing major advanced economy on Earth. A limp 0.2% growth in Q1 2024 only delayed deeper structural decay. Q4 2023 GDP was revised down to -0.5%, confirming the downward trajectory. Sanctions turned into self-inflicted wounds. Skyrocketing energy prices hammered Germany’s export-led industrial base. Add to this the bureaucratic red tape, a shrinking skilled labour pool, and a rising tide of unskilled, unintegrated migrants—costs went up, productivity fell, and growth stalled. ECB rate hikes only compounded the damage, stifling industrial investment. The German model didn’t fail—it was sabotaged.

German GDP Growth YoY.

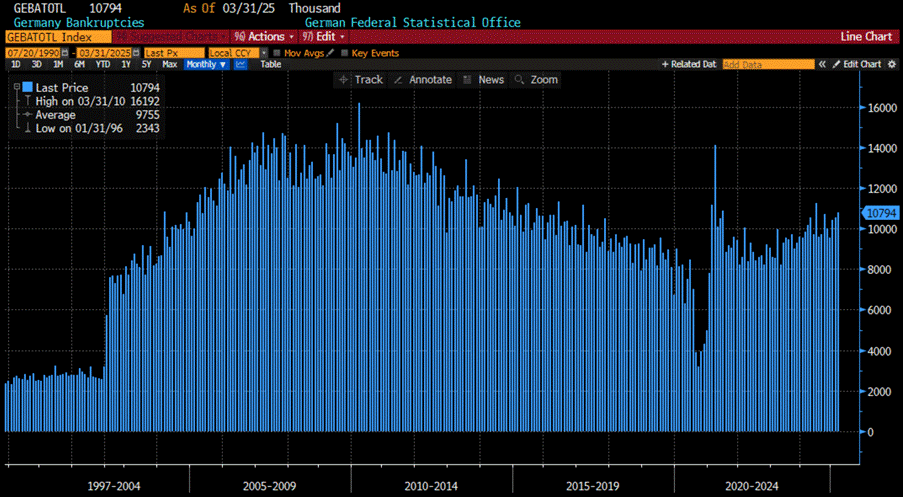

Germany, once the industrial backbone of Europe, is now bracing for another wave of corporate collapses well into 2025 and 2026. But don’t worry—it’s just the natural progression of an economy that decided economic self-harm was a virtue. After a spectacularly bad 2024, which saw bankruptcies surge to record highs, the trend is only gaining steam. For historical context: post-reform insolvencies peaked in 2003, spiked again after the 2008 financial crisis, and then lulled us into complacency with a long decline from 2010 to 2021—fuelled by cheap money, stable growth, and the illusion of competence. Then came COVID, where insolvencies magically disappeared thanks to state-sponsored life support: subsidies, loans, and moratoriums. But the bill came due. Once the fiscal morphine wore off, the backlog hit hard—+16.7% in 2022, another +19% in 2023, and a jaw-dropping +26.6% in Q1 2024. Still not back to 2003 or 2009 levels, but who’s counting? Certainly not policymakers. Inflation, sky-high energy prices, ECB mismanagement, and collapsing industrial output—what could possibly go wrong? With insolvency rates now well above pre-pandemic levels (+15.7% vs. Q1 2019), all indicators flash red for 2025 and beyond. Germany’s unravelling isn’t just a local issue—it’s a systemic risk. If the eurozone’s economic "anchor" keeps sinking, confidence in the entire project could go down with it. But hey, at least they’re saving the planet one protest at a time.

Total Number of Germany Bankruptcies.

Like their American counterparts who still cling to the myth that U.S. Treasuries are “risk-free,” many European wealth managers have long viewed German Bunds as the sacred safe haven of the old continent. But anyone who’s actually studied the business cycle—or understands that governments can default just as easily by taxation, inflation, or regulation—knows better.

Germany’s reputation for fiscal prudence, rooted in its post-Weimar terror of inflation, has long kept default risk off the table. But that illusion is cracking. The economy is shrinking, deficits are ballooning, and Berlin’s sacred austerity doctrine is being quietly buried under a pile of stimulus packages and military build-up. The pivot to deficit spending isn’t some Keynesian revival—it’s a desperate manoeuvre in response to twin crises: economic decay and a growing appetite for confrontation with Russia. The energy crisis—entirely self-inflicted by severing Russian gas—crippled the industrial backbone of the country and lit the fuse on inflation and recession. Germany isn’t just drifting from orthodoxy; it’s sailing full speed toward a fiscal cliff. There is no recovery in sight —only stagnation—well into 2028.

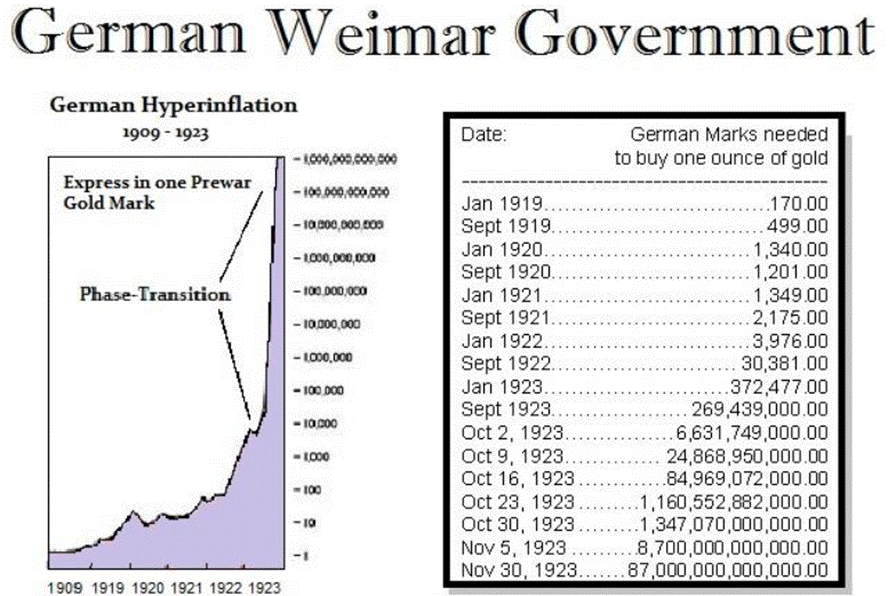

It’s ironic—if not outright tragic—that Germany still lives in fear of inflation based on a flawed understanding of its own history. The hyperinflation of the 1920s wasn’t simply about printing money, as textbooks lazily suggest. The real trigger was the December 1922 asset confiscation: a forced 10% “loan” taken from citizens in exchange for worthless bonds. That sparked a full-blown capital flight. Then came Hitler’s 1933 law criminalizing foreign accounts, which in turn led to Switzerland’s invention of the infamous numbered accounts in 1934. But hey, why let facts get in the way of dogma?

Fast forward to today: Germany, once the poster child of fiscal discipline, is now trapped in the jaws of stagflation—shrinking growth, persistent inflation, and clueless leadership. After the blunders of COVID lockdowns, the costly climate agenda, and blind allegiance to U.S. sanctions (including silence on the Nord Stream sabotage), Berlin is desperately trying to patch up the wreckage with subsidies, price caps, household handouts, and green spending sprees. None of it is working.

All these rescue measures require massive borrowing—shattering the sacred “Schwarze Null” balanced-budget mantra. The emergency override of the constitutional debt brake in 2022 and 2023 wasn’t a policy tweak; it was a full-blown capitulation. Now, there are open debates about rewriting the rules entirely, which signals the end of Germany’s fiscal conservatism.

And that’s where the real risk lies. For decades, the euro derived its credibility from Germany’s discipline. But as Germany slips into fiscal mismanagement and political delusion, confidence in the euro erodes in tandem. Forget debt-to-GDP ratios—confidence is the real metric, and it's bleeding.

Worse, the government’s borrowing spree crowds out private investment. When Berlin demands capital, it bids against businesses and households, driving up borrowing costs across the board. The “AAA” rating may impress the ratings agencies, but it does little for the Mittelstand firms trying to keep the economy afloat. And let’s not forget the wild idea that unskilled migrants—many of whom arrived expecting welfare, not warfare—could be conscripted in the event of a broader conflict. As if a few subsidies and slogans will turn them into frontline patriots. Germany’s collapse into stagflation and fiscal delusion isn’t just a national tragedy—it’s a European time bomb. Confidence, once lost, doesn’t return on demand.

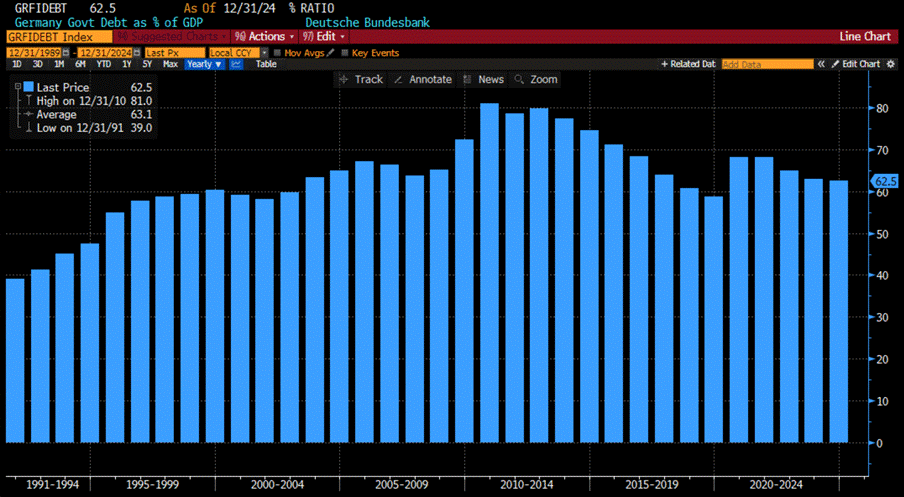

Germany Government Debt as % of GDP.

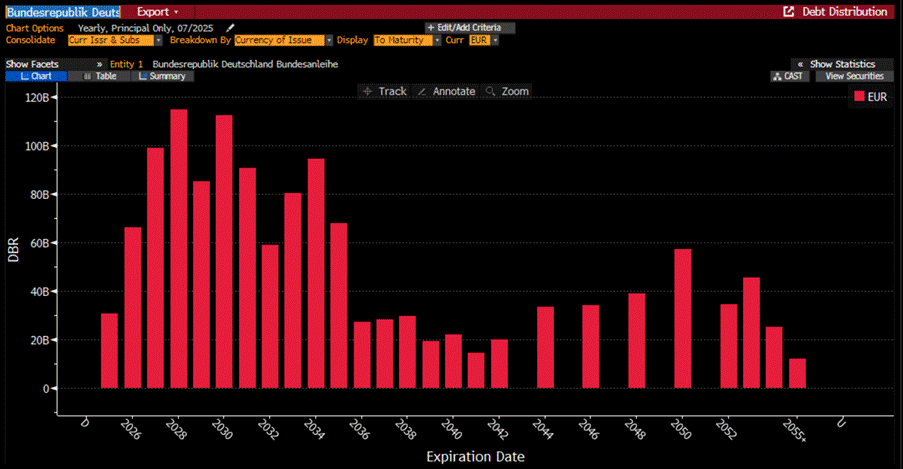

While all eyes are on Washington’s looming $7 trillion refinancing wall before the end of this Jubilee year, Germany’s situation appears—at first glance—more stable. The Bundesrepublik only needs to roll over around EUR30 billion by year-end. But don’t be fooled by the short-term optics. Looking further out, Germany faces a steep maturity cliff: EUR66 billion in 2026, EUR99 billion in 2027, and a staggering EUR115 billion in 2028. And that’s before factoring in the additional debt Berlin plans to issue to fund its newfound enthusiasm for militarization. So while the headlines may praise German prudence, the debt trajectory says otherwise. The “black zero” is dead, and the bill for abandoning fiscal discipline is only beginning to arrive.

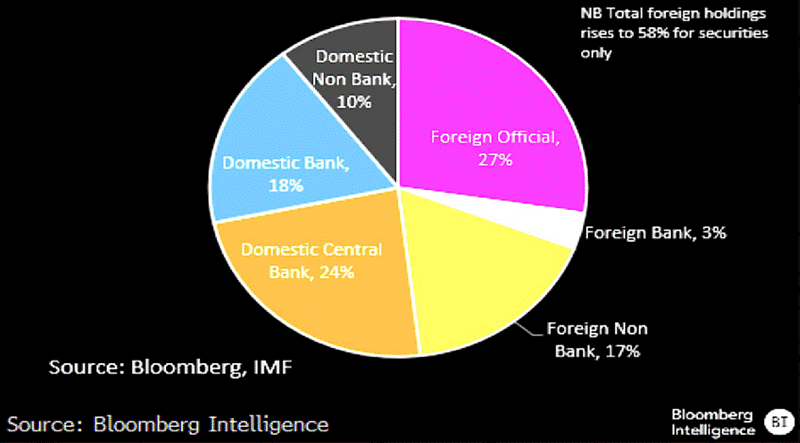

As Germany's debt is swelling, the vultures are circling. Foreign hands now clutch 47% of Berlin’s EUR2.69 trillion IOUs, nearly double Italy’s exposure. The ECB’s QE once shielded them, but those days are gone. With QT in full swing, the Bundesbank is retreating, holding a mere 24%. The old gods of monetary order are fading—and the debt feast has begun.

German Bunds have long been the supposed gold standard of "risk-free" in the Eurozone—sought after in every crisis, priced for perfection, and yielding next to nothing, often negative in real terms. Virtually everyone—markets, institutions, and ratings agencies—assigns near-zero risk to a German sovereign default. AAA/Aaa ratings remain intact, propped up by decades of fiscal discipline, strong fundamentals, and the ECB’s implicit backstop. But that assumption may soon meet its reckoning. The wildcard is war. Germany’s shift toward military expansion, alongside energy and demographic headwinds, will inevitably strain even its fortress balance sheet.

Spread between 10-Year French Government Bonds and 10-Year German Government Bonds (blue line); 10-Year Italy Government Bonds and 10-Year German Government Bonds (red line).

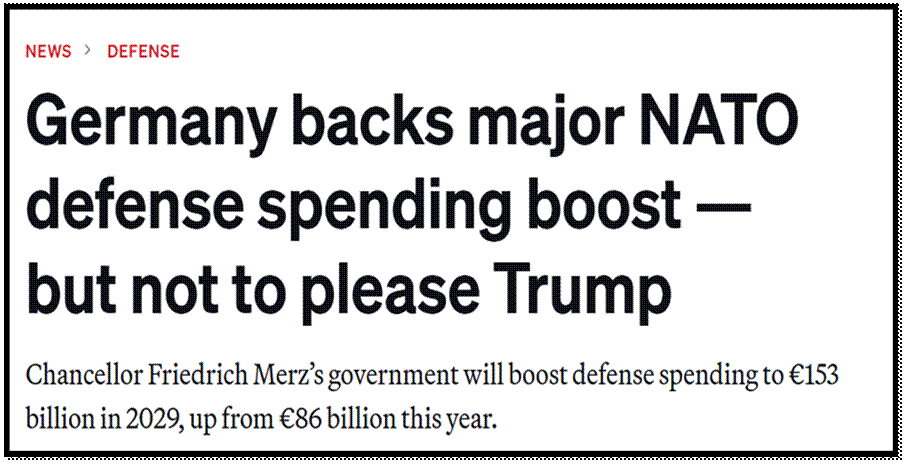

Germany’s rearmament marks a “historic shift” in European security—or so we’re told—as Berlin suddenly remembers it’s a major power… under the watchful guidance of the North Atlantic Terror Organization aka NATO, also known as the Neocon Malthusian Retirement Club. Now juggling social spending, climate fantasies, and war ambitions, Germany is learning the hard way: you can’t fund three crusades at once. So, what’s the solution? Deficit spending, of course sold as an "emergency tool" to clean up the mess from COVID theatrics, green dogma, and the self-inflicted energy crisis, all while scrambling to meet NATO’s latest demand: prepare for war with Russia. Never mind that NATO should’ve retired with the Berlin Wall. This reversal of Germany’s postwar fiscal restraint isn’t just a policy shift—it’s a full-blown identity crisis. For decades, Berlin prided itself on budget discipline and military humility. Now, it's burning through cash and doctrine alike, driven by a cocktail of fear and fantasy.

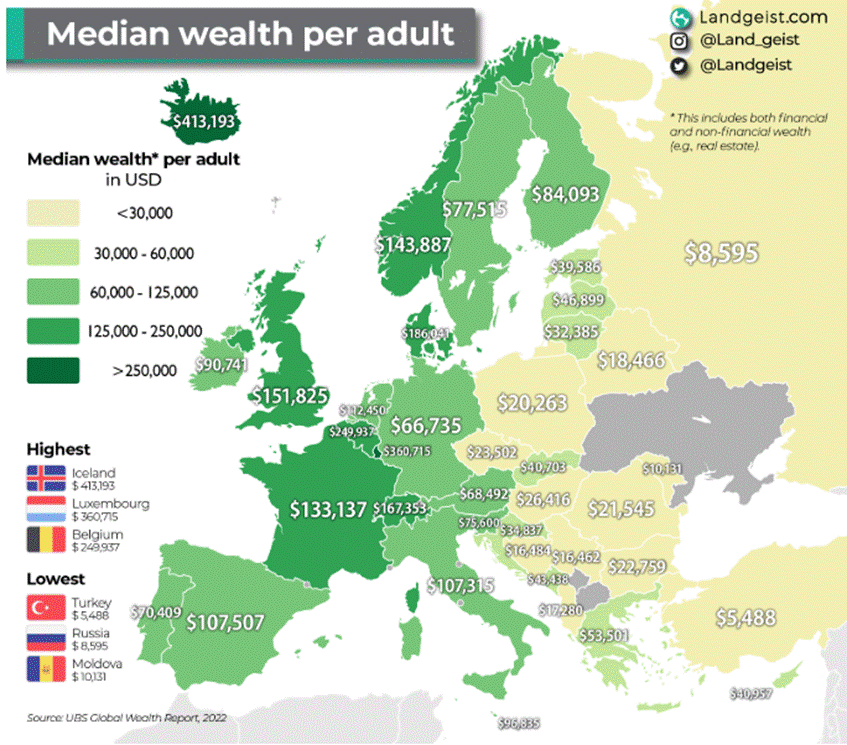

Yes, the debt-to-GDP ratio is still “respectable” at 63%—well below the Eurozone average, and lightyears behind the U.S. or Japan. But unlike those consumer-driven economies, Germany relies on exports. And its economy is shrinking. Worse, the average German is now poorer than the average Italian—thanks, austerity! Meanwhile, the sacred constitutional limit of 0.35% for structural deficits is being shredded under the banner of "emergency"—again. How convenient. In the end, Germany isn’t just rearming—it’s unraveling. And with it, the fragile foundation of the entire EU.

Friedrich Merz—the new German ‘Chancelor In Chief’ and a former BlackRock “Executive In Chief’ —is playing a masterclass in doublespeak. While publicly defending the constitutional "Schuldenbremse" (debt brake), he’s quietly engineering ways to sidestep it to bankroll Germany’s military buildup. All under the familiar NEOCON/NATO narrative that Russia’s 2022 invasion of Ukraine was “unprovoked”—a story everyone with a modicum of common sense know is pure fiction. After all, there was a peace deal on the table for Donbas to vote on separation, much like the ethnic splits in Czechoslovakia and Yugoslavia. Merkel herself admitted Berlin never sought peace but war—to buy time for Ukraine to build an army.

https://www.wsws.org/en/articles/2022/12/22/ffci-d22.html

Germany pledged to meet NATO’s 2% GDP defence target, launching a EUR100 billion Bundeswehr fund —borrowed off the books. That fund’s nearly spent, but the demands keep mounting. Merz won’t suspend the debt brake outright; instead, he pushes shadow budgets and special funds to bypass it. The March 2025 deal carves out defence and security from debt limits and sets up a EUR500 billion infrastructure fund—EUR100 billion earmarked for green climate projects to drain resources and slow growth. States gain freer borrowing powers. In Brussels, Germany leads the hawkish charge against Russia, cloaked in “defence readiness” and “deterrence.” Merz openly threatens to supply NATO missiles to Zelensky, daring Putin to respond. When Putin called his bluff, Merz backpedalled—“just parts,” he claims, leaving Ukraine to assemble the weapons.

The reality: Germany needs war as a cover for fiscal collapse. As Germany stumbles, the EU’s fate follows. Merz and CDU/CSU push endless military spending, running shadow books like Roman emperors staging fake elections to consolidate power. Europe marches to NATO’s war drum, blaming Russia. Meanwhile, Germany is quietly drafting—whether its people know it or not.

Germany—home of fiscal virtue and Bundesbank orthodoxy—holds around $200 billion in U.S. Treasuries, including private investors. That’s right: the same country that lectures the world on austerity is knee-deep in American debt. The Bundesbank quietly stacks Treasuries as part of its reserves, while German banks, insurers, pension funds, and corporations gobble them up for "security"—because apparently, nothing says stability like funding the U.S. deficit.

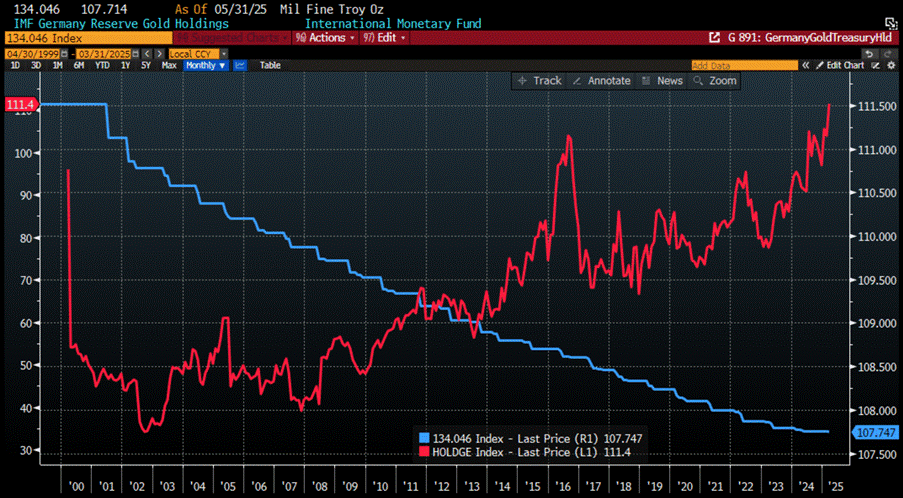

Private German holdings outpace official reserves by far—roughly $160 billion vs. $40 billion—making Germany a top-10 foreign holder of U.S. debt. Why? Because Treasuries offer better yields than Bunds, more liquidity than euros, and less drama than Brussels. And with war drums pounding across the continent, they also seem like a safer bet than the next green subsidy or defence binge. At the same time, as a model Keynesian pupil, Germany ditched gold in favour of IOUs, steadily shrinking its reserves over the past 25 years. With less than 108 million ounces left, it now trails gold-hoarding nations in the Global South.

Germany Reserve Gold Holdings (blue line); Germany Holding of US Treasury (red line).

In a nutshell, Germany—the “locomotive” of Europe—is running out of steam. And as it stalls, so does the eurozone. Remember when the Deutsche Mark was hyped as the next dollar? Then came the euro, sold as the great equalizer with a single interest rate, shared prosperity, and a combined GDP to outshine America. What Europe got instead was an accounting currency in 1999, some shiny coins in 2002, and a lot of broken promises. The eurozone project was never about economics—it was about consolidating power. The goal wasn’t just a common currency, but a common government: the United States of Europe. Nice sales pitch. Too bad the product doesn’t work.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/deutschland-unter-allen

oin The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.