Gold's Intrinsic Value and How Not To Be a Turkey

The Intrinsic Value of Gold and Folly of Government Intervention

Government intervention never changes direction of trend. It can only change trend speed, either slowing it down to obfuscate an error or speeding it up to accelerate one

Written after Gold plummeted in 2012-2013 by Dylan Grice, his piece implicitly asked if gold was a sale. This is understandable given the brutal selloff back then. His conclusion in 2013 was there was no way he’d sell gold now as none of the problems plaguing markets were fixed. This week, reminded of this piece by SG’s Albert Edwards, we circled back to see what, if anything, had changed since the last time we read Grice’s missive. It seems not much has (changed) and in many ways things are worse than ever.1 His analysis is fresh 12 years later. Find our summary and breakdown of his 7500 word missive.

Contents (950 words)

- Introduction:The 2013 Bear Market

- Manufactured Stability and Fragility

- Healers That Cause Harm

- Unintended Consequences and Systemic Risk

- Real vs. Nominal Capital Preservation

- The Case for Gold

- Structural Implications

- Full original PDF

Here is a translation with some graphics added. The original 7500 word piece is at bottom

Introduction: The 2013 Bear Market

Authored by GoldFix, ZH Edit

The observable decline in the price of gold—its largest quarterly drop since the collapse of Bretton Woods—has prompted a widespread reevaluation. Public sentiment has shifted rapidly from enthusiasm to hostility. Yet the despised state of gold today may render it more interesting, not less.

This analysis refrains from speculating on short-term causality and instead focuses on structural fragilities, drawing from Taleb’s Antifragile and historical precedent to explain why gold remains a singular instrument of long-term capital preservation. It is against this backdrop Grice concludes one must be nuts to sell their gold. Turning to present day; given the world is about to go into a spending spree with competitive currency devaluation while opening the fiscal floodgates; Given that and with this piece in mind we say, nothing, absolutely nothing has changed for the better.

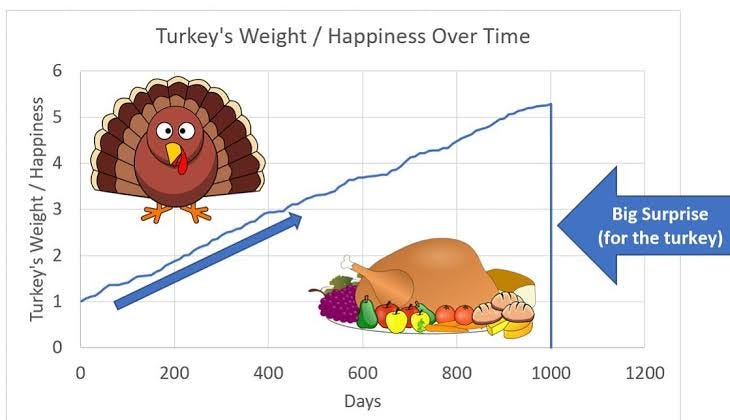

Modern policy interventions are often rooted in a foundational error: mistaking the absence of evidence for evidence of absence. Theories that once promised equilibrium and growth have, when implemented, induced systemic fragility. The US housing market, the dot-com era, and Japan’s babaru bubble each offer examples of false calm masking structural instability.

Confidence peaks just before catastrophe….

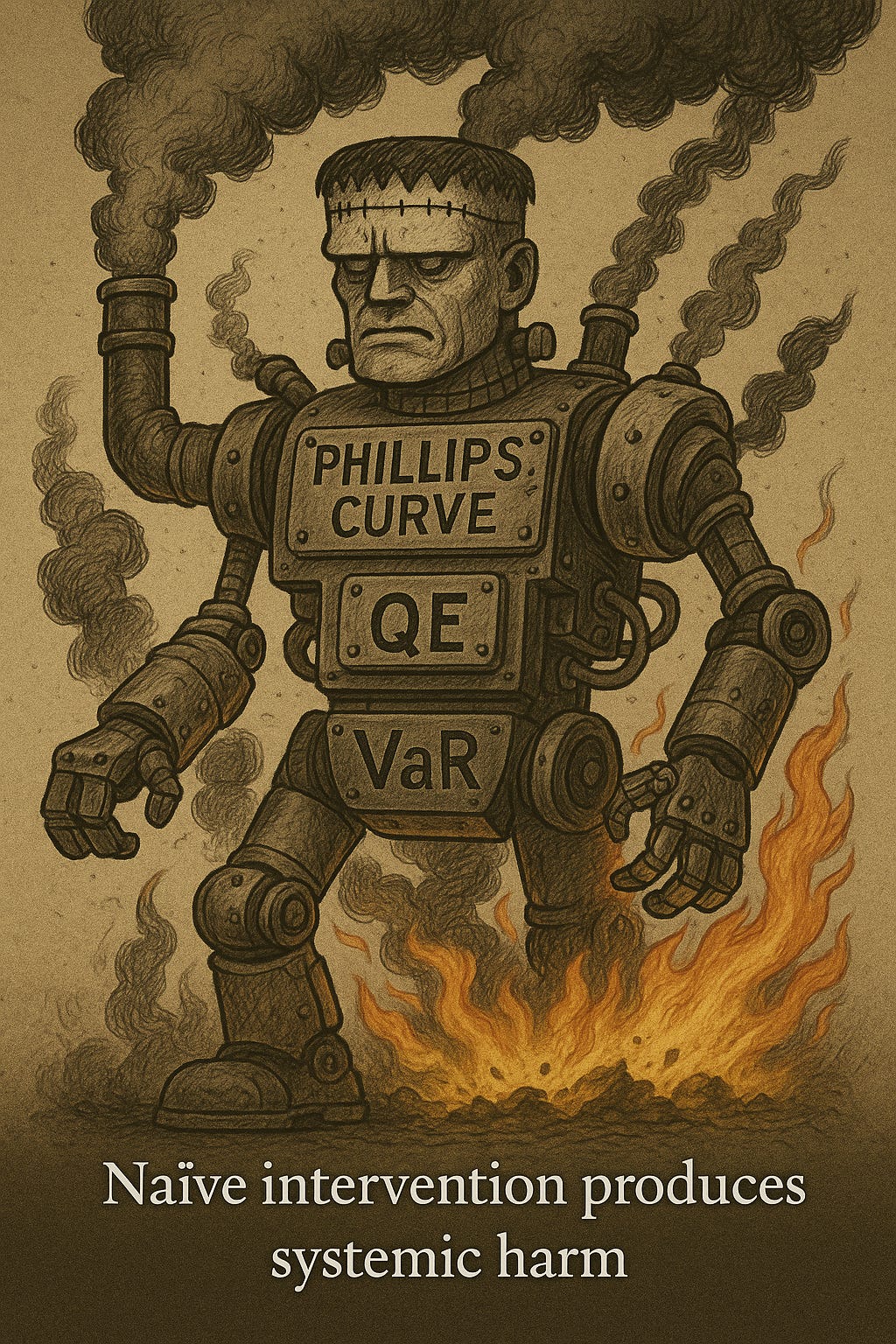

The Phillips Curve provided policymakers with the illusion of choice: trade higher inflation for lower unemployment. When oil shocks tested that theory, inflation and joblessness both surged. Intervention followed theory, and theory failed. What appeared as control revealed itself to be model error.

Standard Charter Talking Gold, And it is Bullishhttps://t.co/xCme0aZQkO

— VBL’s Ghost (@Sorenthek) July 21, 2025

Healers That Cause Harm

Taleb’s concept of iatrogenics (harm caused by the healer) applies across modern economics. Like medieval doctors using leeches, today’s policymakers rely on flawed models: Value-at-Risk assumptions, ratings-based structures, and inflation targeting mechanisms. The more faithfully these models are used, the more fragile the system becomes.

A recent example of this is when the whole world was telling us gold would drop in 2023 because “the rate correlations say it should”. Dogmatic adherence to things that have worked in the past in combination with an existential need to justify your existence as a bureaucrat often leads to errors like this.

Feynman warned of disciplines that haven’t earned their knowledge. Hayek called it the “fatal conceit.” In both cases, the critique is the same: top-down control applied to complex systems by those who overestimate their understanding. The cost is not merely theoretical; it accumulates as real economic harm over time.

Dr. Frankenstein, PhD in Economics I presume…

From the collapse of Asian exchange rate regimes to the sovereign crises of the Eurozone, major economic ruptures should be viewed as consequences of mistaken intervention. The modern constellation—zero or negative real interest rates, persistent unemployment, sovereign risk, and asset distortion—is not a fluke. It is the direct result of past campaigns of economic firefighting.

Crisis response today merely lays groundwork for future disorder. QE, forward guidance, and the push for nominal GDP targeting are not innovations; they are iterations of a broken model. Symptoms are masked, causes are unadressed. Fragility deepens, usually to be handled by the next elected or appointed official.

Shortsightedness plus job fears creates quick fixes and diminishing returns…

The landscape of capital preservation has been transformed. Where once it was possible to earn positive real returns on risk-free deposits, today’s interest rate environment guarantees erosion. To preserve nominal wealth is to sacrifice purchasing power. Long-term safety now requires accepting short-term volatility.

The dilemma is unavoidable: hold cash and lose value, or accept fluctuation in pursuit of real preservation. Even sovereign bonds no longer provide assurance. Only assets immune to policy distortion retain intrinsic utility.

Gold demands no yield. It offers permanence instead. It requires no trust in management, no policy intervention, and no productivity promise. Its physical durability matches its monetary history. Unlike equities or currencies, gold remains stable across centuries. It is not consumed. It is held.

Critics argue gold has no use. But its value is not industrial. It is monetary. Gold is everyone’s foreign exchange, the original hard currency. To say gold has “no use” is to misunderstand money itself. Gold’s utility is social, not mechanical. When money loses credibility, gold’s value becomes self-evident.

Gold requires no belief in that strategy. It simply endures. Its value arises precisely because others’ values are manipulated. In an era defined by policy overreach and model failure, gold remains not a hedge, but a foundation.

Continues here