Energy is the new play.

Subscribe to our research. www.gmgresearch.com

Our private list is now active! Thank you for the support over the years. More to come!

Market will continue higher

Bitcoin has led markets, tracking M2 just as we expected.

Trading cards continue to outperform among alternative assets.

Chemours moved higher following our note on its immersion cooling tech +15%

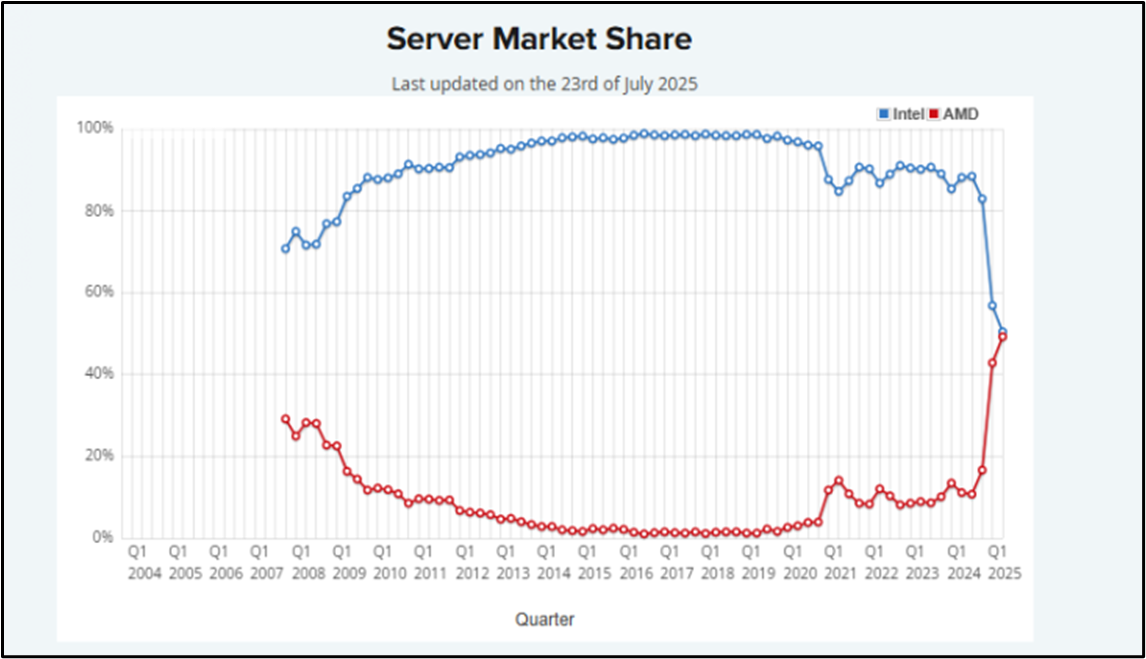

AMD’s ROCm platform is starting to challenge Nvidia's dominance

Capital quickly is moving out of Pokemon into Magic The Gathering

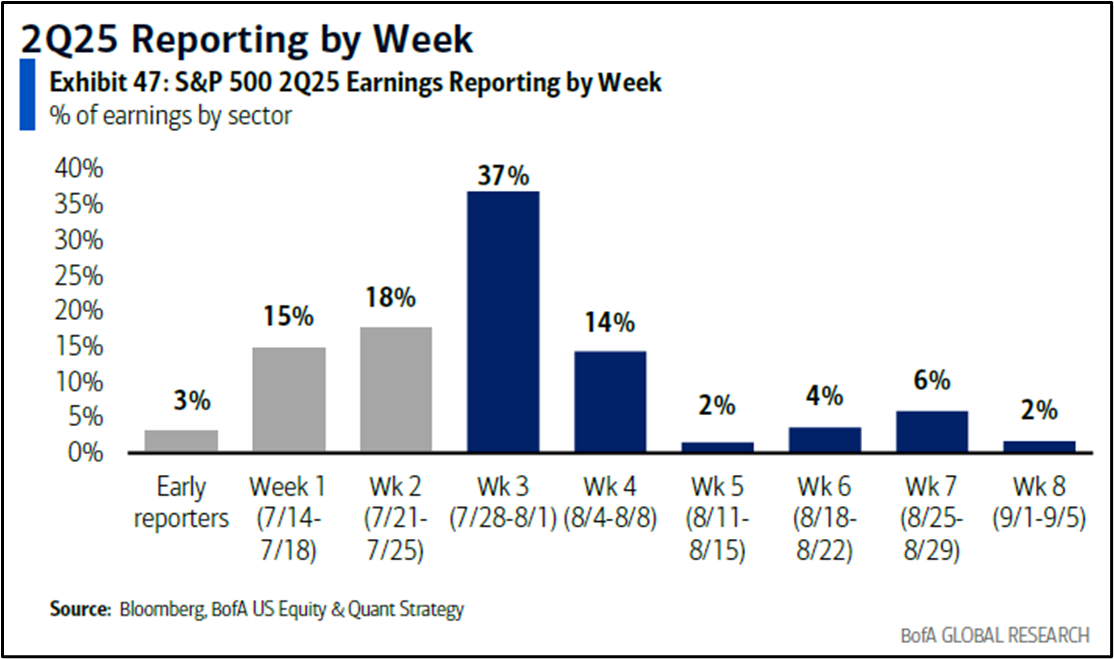

This is a HUGE week for earnings.

Palantir: No Ceilings.

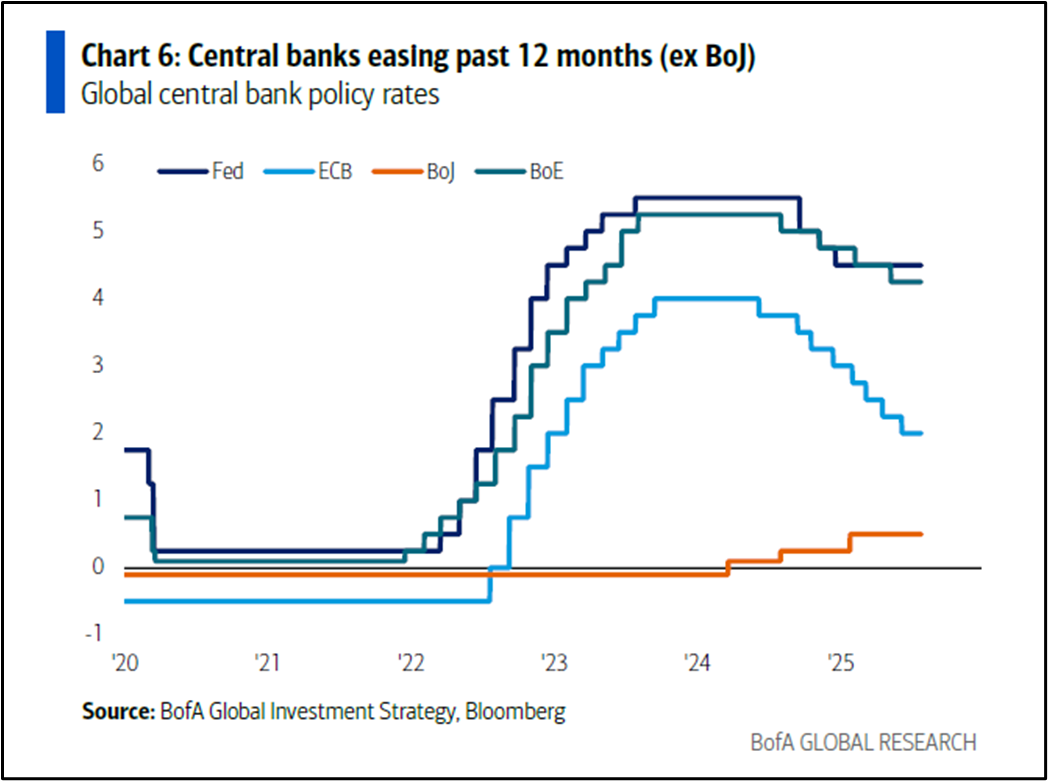

If anything derails the global economy and this rally it will be Japan. Bookmark this.

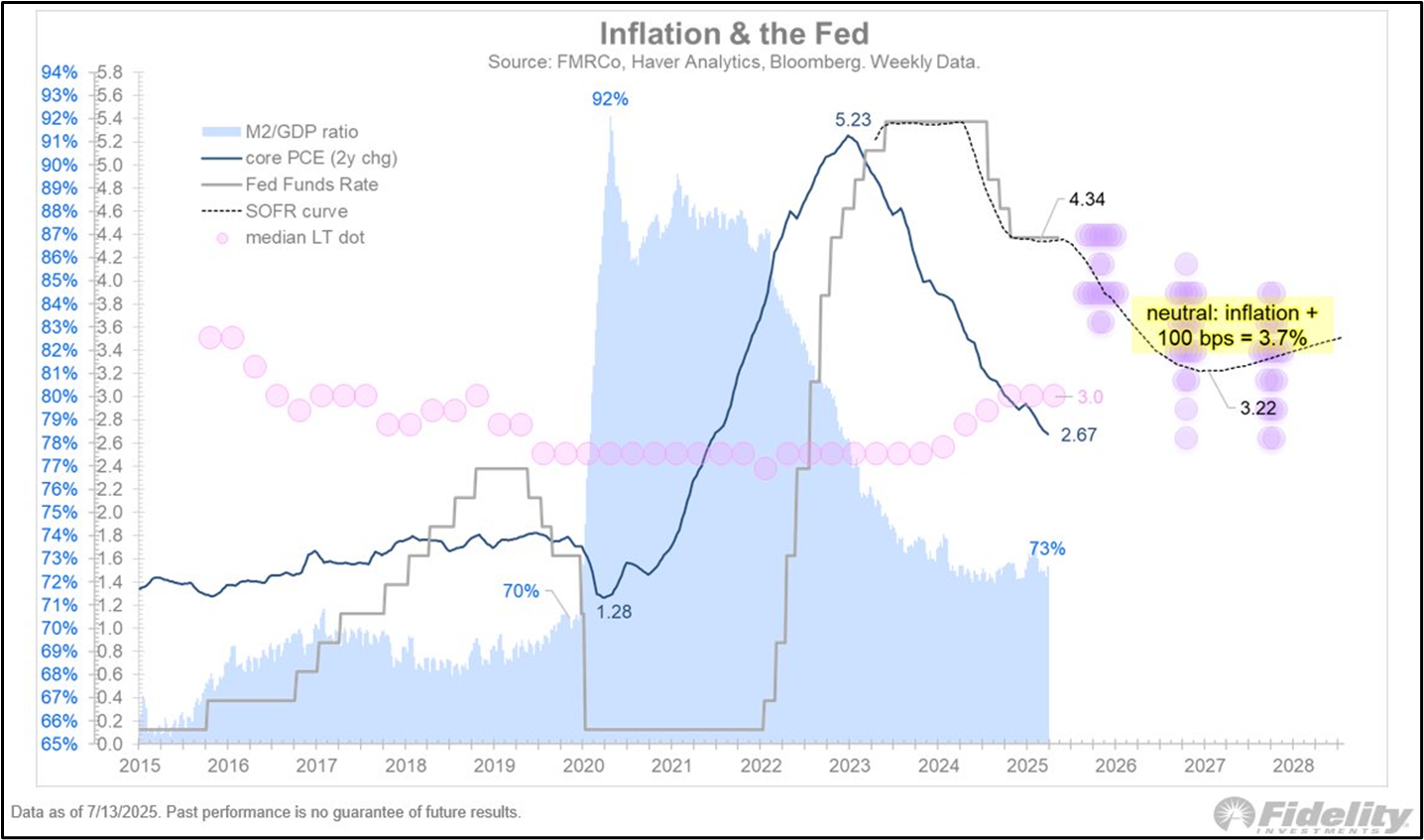

With inflation still high and low unemployment, only a few cuts are needed to move toward neutral. The Taylor Rule supports staying slightly above that level.

“Don’t look now but Chemours just created 2 state of the art immersion cooling systems for datacenters. Looks like it bottomed.” Up more than 15% since.

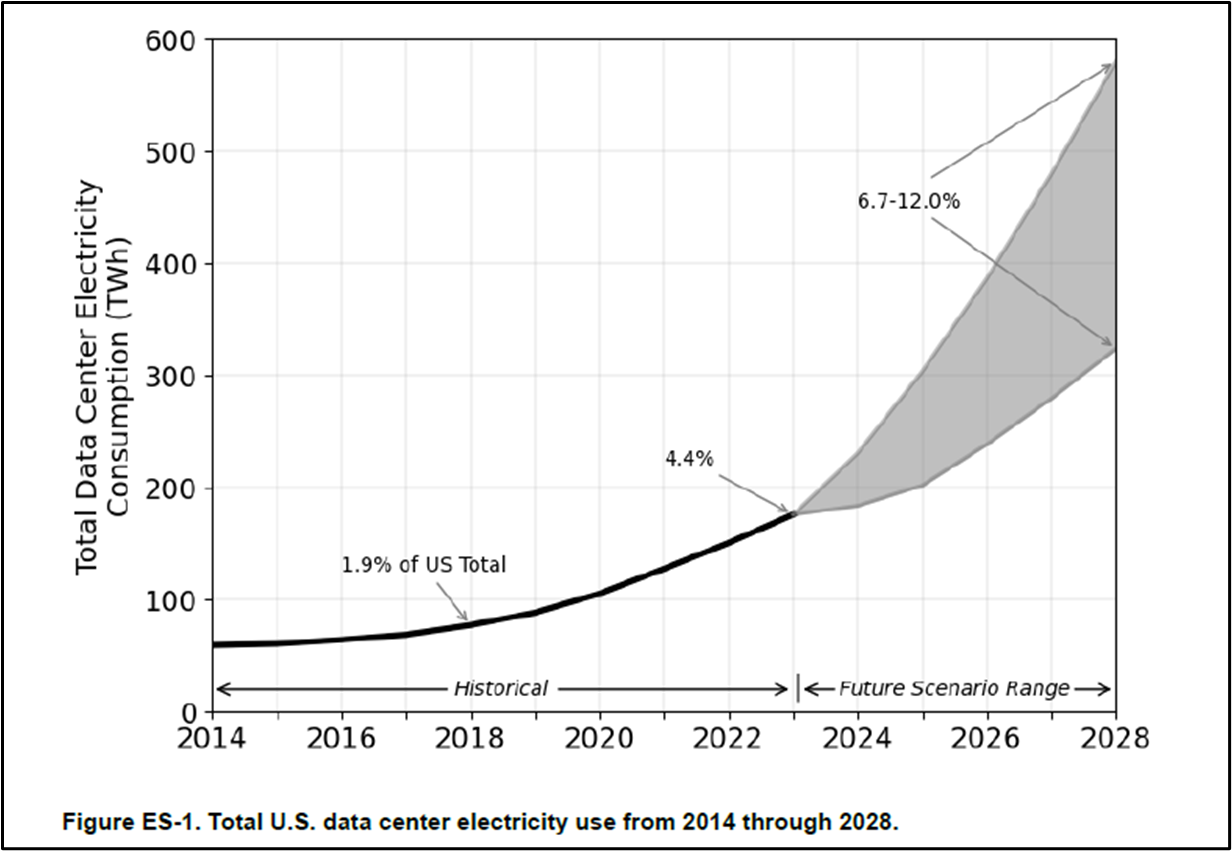

Energy is the foundation of economic and industrial expansion. From reshoring manufacturing to building next-gen industries like AI, none of it happens without reliable, scalable energy. If we want to lead in innovation and production, energy comes first. A new AI & Power Infrastructure ETF (AIPO) just came out.

Energy will account for +12% of all US energy use by 2028.

Vertiv (Energy) is picking up momentum breaking out to fresh highs.

On 7/17, BlackRock Disclosed a 7% STAKE in EOS Energy. PUT THIS ON YOUR RADAR.

For the first time in history AMD has reached a 50% market share in server CPUs. AMD got xAI as a client. Our readers know how much we like AMD and Lisa Su

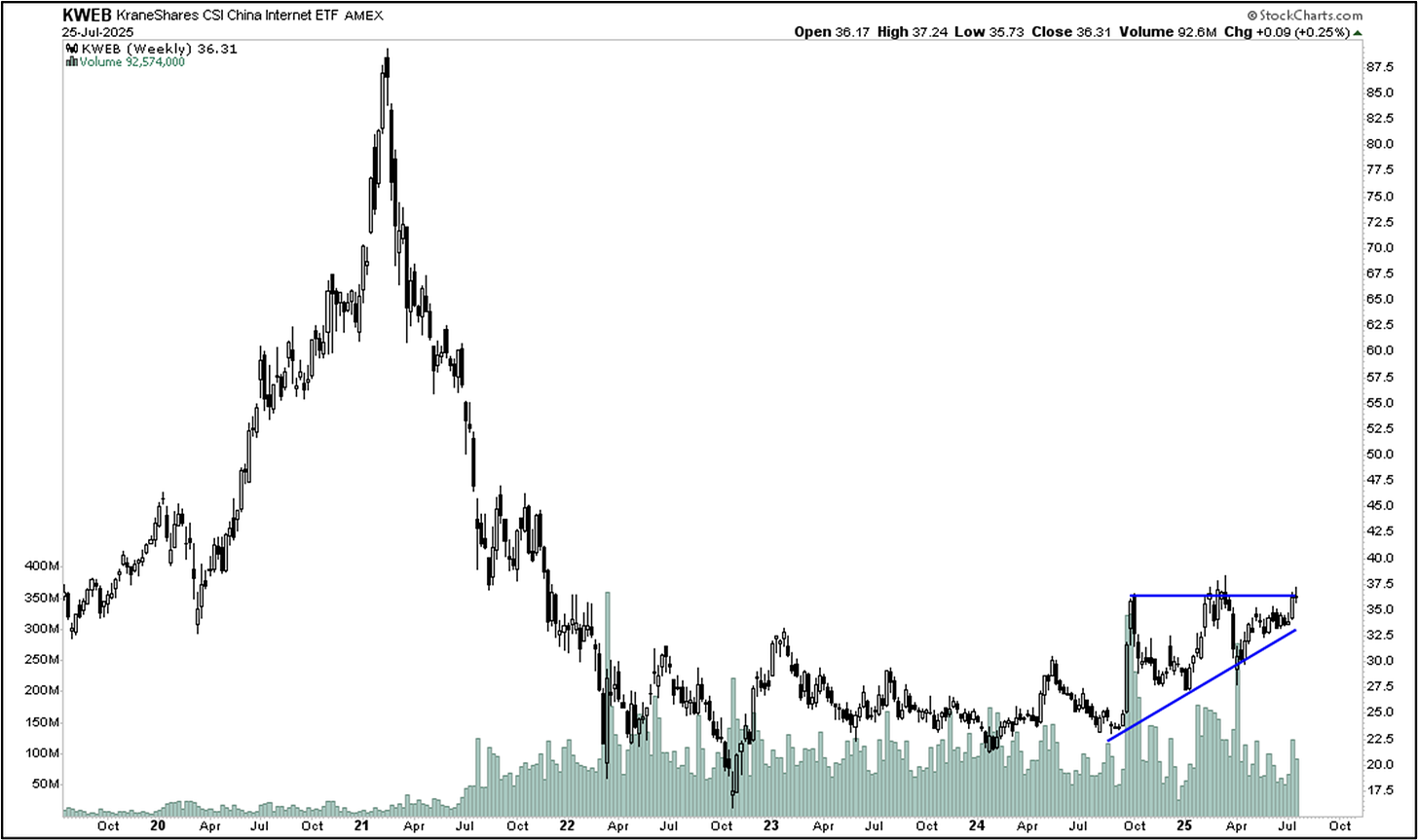

China will likely explode much higher.

The higher risk/reward play will be the China STAR 50 Index (Innovation Index)

Some insight into central bank strategy.