From One Bubble to the Next

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,500 subscribers at MktContext.com in improving your portfolio returns — it’s free!

This week the crypto bubble receded from fever pitch. Bitcoin and Ethereum pulled back modestly, as did many of the crypto-adjacent stocks (HOOD, COIN, CRCL, BMNR). It appears the much anticipated “Crypto Week”, which culminated in the passing of three new regulations into law, was a sell-the-news event. When investors bid up stocks leading into a known event, they sell once the event passes.

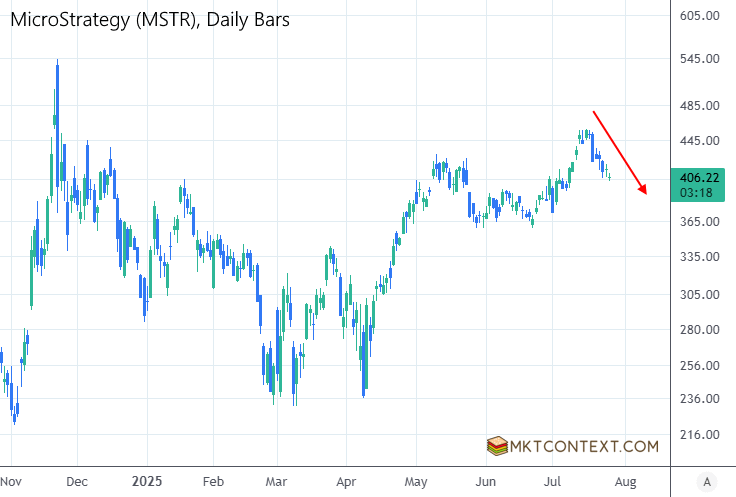

When frothy stocks pull back, there is often an air pocket on the downside. Here is MicroStrategy (MSTR) which runs a 2x-levered strategy issuing billions in convertible debt to buy BTC:

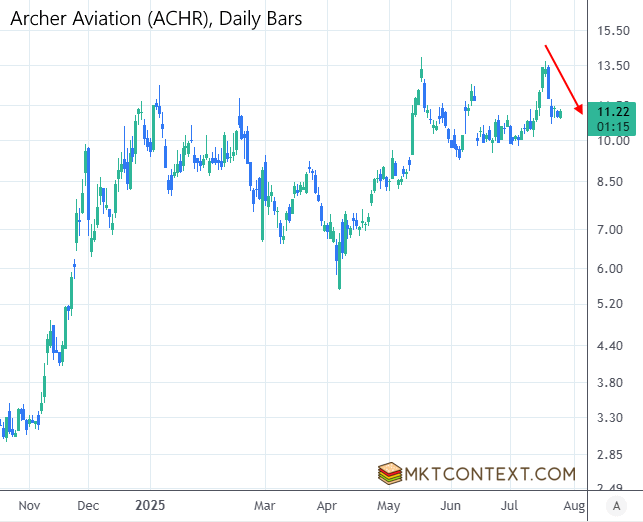

Similarly, there were pullbacks in other over-extended thematic sectors like eVTOL stocks (ACHR, JOBY, UMAC), space stocks (RKLB, RDW, ASTS, BKSY), and batteries (QS).

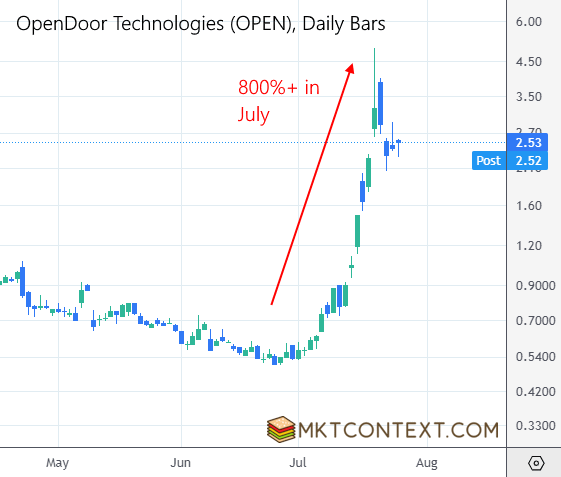

But no sooner had these stocks deflated, a new bubble emerges. That is of high-short-float meme stocks, pushed by Reddit’s WallStreetBets in effectively a mass short squeeze. Names like OPEN, KSS, DNUT, RKT, GPRO, WEN saw mindboggling rallies (some up 800%+) despite having almost no viable business model nor earnings.

What does this bubble rotation mean for the rest of the stock market? Speculative money moving from bubble to bubble is a sign that things are still running hot (duh!). This is bullish for the overall market. The price action we’re seeing is reminiscent of the 2021 broad market rally as GameStop, Bed Bath Beyond, and AMC were squeezed to the moon by WallStreetBets retail traders. It suggests the mood continues to be bullish and money supply ample.

Does this mean the market will collapse imminently? No. Recall that after the GME squeeze in May 2021, the broader market didn’t peak for another 7 months. However, it does suggest we are late in the cycle so that bears watching. We could be in for an air pocket in SPX and QQQ as soon as early-2026.

Are we selling stocks? Again, no. Most people, when they identify a bubble, feel the urge to sell into it or short it. Unintuitively, the correct course of action is to go with the trend. Traders who tried to short the 2000s Dot-Com mania and 2006 housing bubble, both of which were obvious at the time, had their faces ripped off.

Michael Burry is an excellent example of this, as depicted in the popular film “The Big Short”. He bet against the 2008 subprime mortgage market, but was 3 years early. Although he was ultimately correct in his analysis, the bubble continued to rise for a period of time, causing him severe liquidity issues and client withdrawals that almost bankrupted his hedge fund, Scion Capital.

The lesson here is, do not be like Michael Burry. Ride the wave while the going is good, be that in stocks or crypto. But do so responsibly, and have a plan to exit when the tide turns. Once you are certain the bubble is imploding, with requisite catalysts triggered, only then should you attempt to short it. But never before the market shows its hand first. This philosophy is espoused by several traders in Jack Schwager’s Market Wizards book series (which I highly recommend):

“Never sell the strongest markets until they fail first.” — Scott Ramsey

“The natural way to trade a bubble is from the long side, not the short side.” — Colm O’Shea

“I never use valuation to time the market. I use liquidity considerations and technical analysis for timing.” — Stanley Druckenmiller

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!