Frozen Rates, Flowing Liquidity Ahead?

What’s behind the numbers?

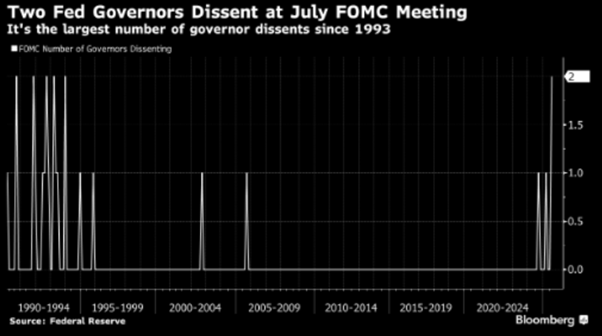

As expected, (because bold moves aren’t really their thing), the Federal Open Market Committee hit the snooze button for the fifth consecutive meeting, keeping rates nice and cozy at 4.25%–4.5%. Powell & Co. are still in full “wait-and-see” mode, squinting at economic data like it’s a malfunctioning Magic 8-Ball. Meanwhile, global chaos—from tariff tantrums to actual wars—keeps piling up. But here’s the twist: for the first time since 1993, two Fed board governors, Waller and Bowman, actually dared to dissent. That’s right—decades of groupthink momentarily interrupted. A true revolution… or just a glitch in the matrix?

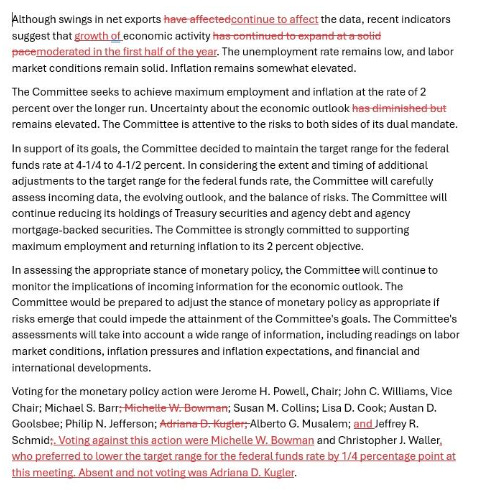

The FOMC statement, likely crafted as a compromise, struck a more dovish tone than expected. It signalled a subtle shift in the Fed’s assessment of the economy, with two key changes:

· The previous phrase “economic activity has continued to expand at a solid pace” was replaced with “growth of economic activity moderated in the first half of the year,” acknowledging a cooling in momentum.

· The word “diminished” was removed from the sentence on risks, changing it from “uncertainty about the economic outlook has diminished but remains elevated” to simply “uncertainty about the economic outlook remains elevated.” This reintroduced a sense of caution.

Adding yet another log to the bonfire of uncertainty, the Fed announced—almost cheerfully—that it will keep trimming its balance sheet by $5 billion a month. Because nothing screams “we’ve got this under control” quite like tiptoeing away from a $7 trillion mountain of IOUs with scissors and a prayer.

FED Balance Sheet (blue line); US Unemployment Rate (red line).

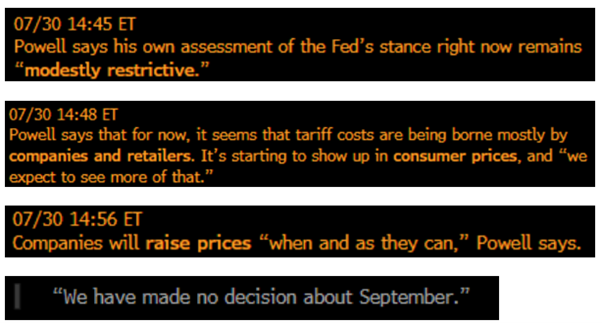

Powell tried to sound tough at the press conference—probably to appease the dissenters—but the policy statement was all soft and cuddly. Classic Fed compromise.

He threw out a couple of hawkish zingers. But don’t worry, the usual dovish undertones were still there. Powell brushed off tariff effects as margin squeezers (not consumer inflation), suggested companies might not be able to pass on costs, and admitted labor market risks are "certainly apparent."

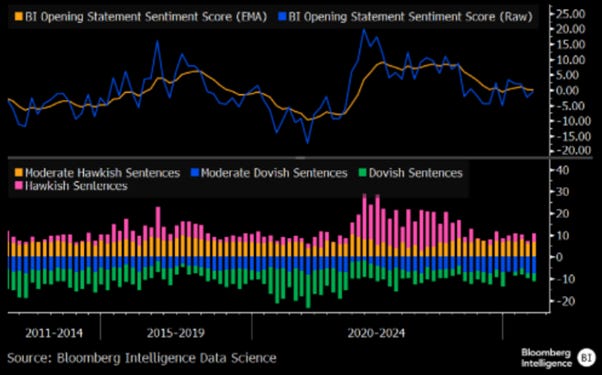

Powell’s opening remarks stuck safely more hawkish than in June fewer dovish jabs, a bit more feather-soft talk, but still no clear off-ramp in sight.

Thoughts.

While Wall Street still worships the Fed like it's some all-knowing oracle with a magic lever marked “soft landing,” reality keeps crashing the party. Just look at the Fed Funds rate and the S&P 500-to-oil ratio — every time they start cutting rates, it’s like ringing the dinner bell for the bust cycle. That ratio peaks, then dives like a kamikaze seagull, always crashing below its 7-year moving average. Sorry Jerome, but you can’t fight gravity with spreadsheets.

Upper Panel: FED Fund Rate (purple line); Lower Panel: S&P 500 to WTI ratio (green line); 7-Year Moving Average of the S&P 500 to Oil ratio (red line).

Investors would do well to remember that while Wall Street loves pretending the Fed is the all-powerful puppeteer of interest rates, reality is far less flattering. The Fed may twiddle with short-term rates like it's playing a video game, but the real economy runs on long-dated yields — the 10-Year and 30-Year — which are set by the market, not by the ‘Central Banker In Chief’s mood swings. Whether you're buying a house, a car, or trying to grow a business, it's these long-term rates that matter. And guess what? The Fed has about as much control over them as it does over the weather.

US 30-Year Yield (blue line); US FED Fund Rate (red line) & Correlation.

A glance at the June meeting minutes already made it clear: the Fed wasn't about to play Santa in July. And while the consensus crowd still clings to the hope of a 25-basis point gift in September, reality is starting to seep in — even at the Fed. Like their central banking cousins abroad, they've begun to grasp the inconvenient truth: playing with rates doesn’t exactly tame inflation when Uncle Sam is out there binge-borrowing like a teenager with their first credit card. Dompting supply and demand? Good luck with that — when the government is the demand.

US FED Fund Rate (blue line); US Total Public Debt Outstanding to US GDP (green histogram).

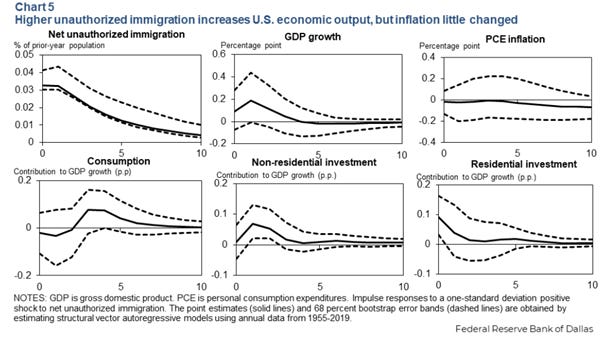

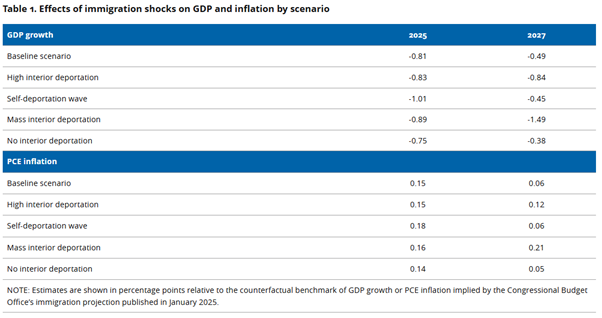

Instead of pointing out the obvious — that the government borrows like it's trying to win a lifetime achievement award in debt accumulation — Fed members chose to wring their hands over tariff tantrums and immigration headlines. According to the Dallas Fed, a mass deportation drive could shave nearly a full percentage point off GDP in 2025, with more cuts to follow. But as stagflation creeps in, the usual suspects from the 2020–2024 D.C. swamp will be quick to pin the blame on the "Disruptor in Chief." Of course, those who actually study business cycles — rather than cable news panels — know better: the train was already headed for a bust well before the conductor changed.

https://www.dallasfed.org/research/economics/2025/0708

The Dallas Fed ran a study assuming 2.4 million deportations in 2025 and concluded GDP would shrink 0.8%. In a more dramatic scenario — 1 million deportations per year through 2027 — GDP could dip 1.5% by then. Gasp! Why? Because they claim the labor force will shrink. Never mind that Americans are already stepping into jobs once held by migrants. The real issue? The utterly deranged way GDP is calculated. Since government spending is part of the formula (yes, paying bureaucrats counts as “growth”), slashing public expenses magically “hurts” GDP.

GDP = C + I + G + (X – M)

Where G is the federal money cannon.

So, if you stop blowing billions on border chaos — like NYC’s projected $12 billion migrant tab by mid-2025 — GDP takes a hit. Meanwhile, taxpayers are stuck with the bill, and the swampy chorus will still blame the “Disruptor in Chief” for stagflation, ignoring the fact that this cycle was baked into the cake long before he re-entered the kitchen.

The drama between Donald Copperfield and the ‘Central Banker In Chief’ is no longer just a subplot—it’s leaking into policy like a busted fire hydrant. Despite over 2 million jobs shifting to non-foreign-born citizens thanks to deportation efforts, the Fed is wringing its hands over a supposedly “weakened” labour market. Almost all FOMC participants have been highlighting that upside risks to the inflation outlook had increased, blaming it on hotter-than-expected inflation and potential shifts in trade and immigration policy. Translation: deporting cheap labor might upset the inflation gods. Meanwhile, unemployment fell to 4.1%, and June added 147,000 new jobs.

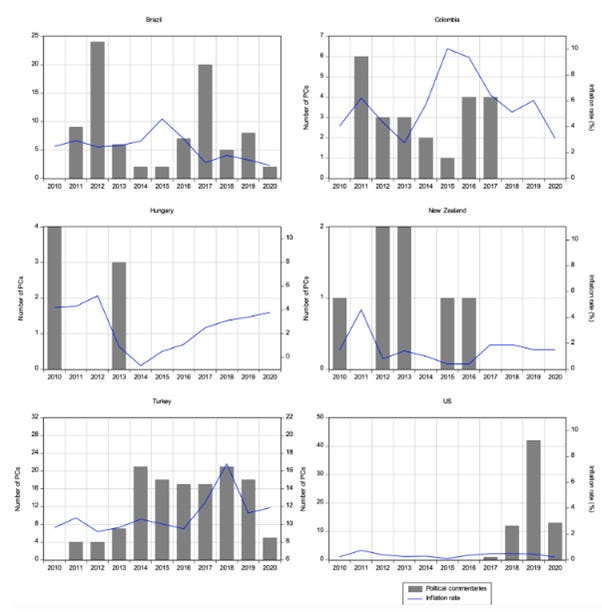

By poking around the Fed’s toolbox, the “Manipulator in Chief” is dragging the U.S. closer to the banana republic playbook — where strongmen treat monetary policy like a party favour. In emerging markets, political meddling in central banks usually ends with inflation spiraling and credibility collapsing. But hey, why aim for rate cuts when you can undermine the very institutions propping up the dollar... and keep the spotlight on yourself while you're at it?

In the age of populism, politicians never tire of demanding the Fed slash rates for instant growth—because who cares about long-term stability, right? Looking at similar drama in Emerging Markets, Turkey’s central bank cracked under political pressure, swapping governors like trading cards, while the ever-resilient Fed mostly kept its cool despite the Manipulators in Chief’s relentless rate-cut fan club. Ironically, begging for lower rates just turbocharges inflation and market chaos, proving once again that quick fixes rarely work. Emerging markets like Turkey and Brazil show how political meddling sends inflation soaring, while countries with truly independent central banks keep things in check.

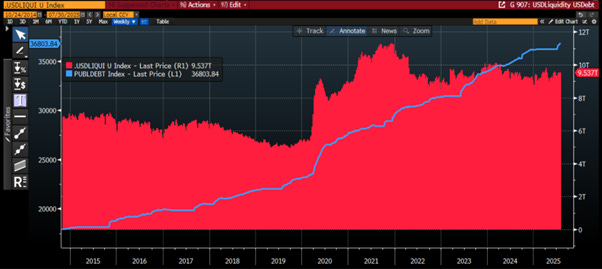

At the end of the day, it’s not the Fed Funds rate that really moves the markets — it’s the Fed’s secret stash of “shadow liquidity” pulling the strings behind the scenes. No matter what political spin doctors say, the U.S. is just going to keep piling on debt like it’s a never-ending shopping spree. So, buckle up: investors should expect the Fed to sneak in with another round of shadow money magic, kicking the debt can down the hill one more time — delaying the grand finale of the republic’s slow-motion financial faceplant.

US Total Public Debt Outstanding (blue line); USD Liquidity Proxy Index (red histogram).

While the Fed puts on its best act of independence for the fake news media, preaching monetary orthodoxy and distancing itself from the White House and Wall Street, behind the scenes the USD Liquidity Proxy Index—which includes the Fed’s balance sheet, the Treasury General Account, and the Reverse Repo Program—is once again inflating. But hey, nothing to see here—just good old-fashioned “independent” central banking at work.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/frozen-rates-flowing-liquidity-ah…

oin The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.