Two Trump Policies The Market Hasn't Priced In Yet

Macro Backdrop: Deportations And Secondary Sanctions

Deportation flights – already happening, and about to accelerate. ICE removals have been trending higher all year, and the new One Big Beautiful Bill (“OBBB”) gives the agency fresh money for detention beds and charter flights. Car accidents are already down 10% in major cities, but this doesn’t seem priced in yet in shares of the largest publicly-traded auto insurer in the U.S., The Progressive Corporation (PGR 0.00%↑).

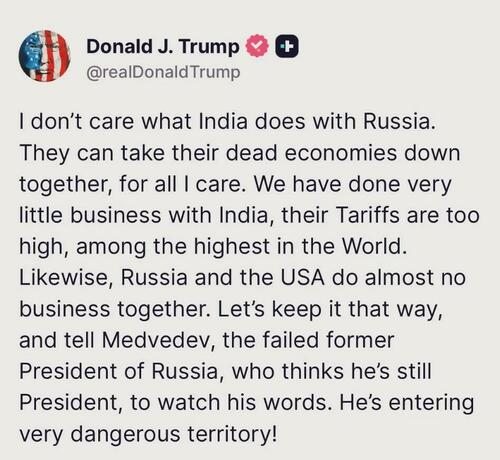

Secondary sanctions on Russian oil – proposed but not yet implemented. President Trump said last Sunday that he would move up the deadline for 100 % tariffs on any country that keeps buying Russian crude. Trump followed that with this Truth Social post early on Thursday:

India- and China-linked ETFs have barely blinked: iShares MSCI India (INDA 0.00%↑) was only down about 2% from last Friday’s close as of last night. It looks like the odds—and the potential fallout of secondary tariffs—are under-discounted.

Why Trump is likely to act

| Driver | What’s changed | Why it boosts the odds |

|---|---|---|

| U.S. economy | S&P 500 erased April’s dip, Q2 GDP grew 3 %, and June ran a federal surplus. | Strength backs the idea that tariffs don’t wreck growth. |

| Hill politics | Senate still eager to punish Russia. | “Secondary sanctions” give cover for steep tariffs that would otherwise draw flak. |

| Trade agenda | Re-industrialization and lower deficits. | Sanctions let Trump levy > 100 % tariffs without looking reckless. |

Why China and India will keep buying Russian oil

| China | India | |

|---|---|---|

| Share of imports | 15–20 % (~2 mbpd) | 35–40 % (~1.9 mbpd) |

| Strategic logic | Cuts reliance on seaborne oil that the U.S. Navy could blockade. | Cheapest feedstock for a price-sensitive economy. |

| Work-arounds | Yuan settlement, dark-fleet tankers, pipeline crude. | Limited: would need to pay up in spot markets. |

India’s bigger downside if sanctions hit

Oil shock – Losing 40 % of supply would slam the rupee and spike CPI.

U.S. export exposure – America takes 18 % of India’s exports; 100 % tariffs would hammer IT services, pharma, and textiles.

Economic buffers – Lower per-capita income and thinner fiscal space than China.

Few substitutes – Middle-East or U.S. barrels cost more and take longer to ship.

China, by contrast, has a $18 trillion economy, state bank financing, and years of experience dodging Iran/Venezuela sanctions.

Trading the mispricing

Secondary Sanctions: We’re going to use the Portfolio Armor iPhone app to find the optimal puts to hedge against a >10% drop in INDA over the next several months and buy those.

Deportations: We’ve got a custom options trade designed to profit from PGR climbing over the next ~18 months while reducing cost and theta burn.

Both positions play on moves the market hasn’t fully priced: one policy that’s already denting accident data, and another with a real chance of landing on India. If you want a heads up with the details when we place both trades, you can subscribe to the Portfolio Armor Substack below.