In Stablecoins We Patch

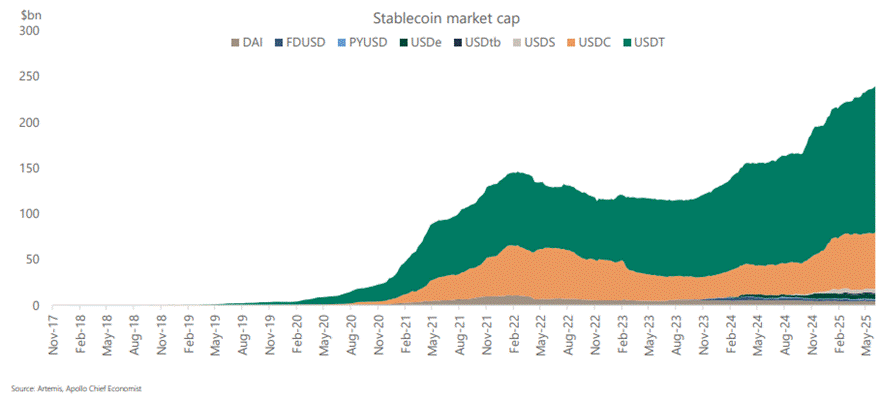

While the world has been busy drooling over the latest “Big Beautiful Bill” — which, let’s be honest, is more like a “Big Beautiful Joke” — and the media keeps dangling the Epstein distraction like a shiny object for the masses, Washington quietly dropped another gem. Enter the GENUIS Act (because of course they’d name it that), short for Guiding and Establishing National Innovation for U.S. Stablecoins — which sounds impressive until you realize it’s just a fancy way for the government to finally sink its claws into the $250 billion stablecoin market. Thanks to Senator Bill Hagerty (R-Tennessee), Uncle Sam now wants to play babysitter to crypto too — because if there's one thing bureaucrats love more than overspending, it’s regulating things they don’t understand.

Outside of the GENIUS Act, Congress also quietly slipped in two more laws with names only a PR team could love: the CBDC Anti-Surveillance State Act and the CLARITY Act. Sounds like freedom, right?

The CLARITY Act tries to finally answer the trillion-dollar question: is your favourite token a security or just digital Monopoly money? The CFTC gets to play with the “commodities,” while the SEC still looms over anything that might smell like an “investment.” But don’t worry—just because your token launched like a security doesn’t mean it’s forever cursed. If it matures on a decentralized network (think Bitcoin, Ethereum), it can graduate from “SEC target” to “free asset.” Kind of like crypto puberty.

Then there’s the CBDC Anti-Surveillance State Act, which sounds badass until you read the fine print: it bans the Fed from issuing a CBDC directly to American citizens. Basically, the Fed can't slide into your digital wallet uninvited—unless, of course, Congress gives them a golden ticket. So it’s a “no,” but also a “maybe later.” And while everyone’s pointing fingers at the Fed, it turns out they weren’t even the ones pushing for a digital dollar. Nope. That honor goes to the international banking cabal—BIS, commercial banks, and the Davos crowd—who dream of killing cash, forcing negative rates, and locking up capital like it’s 1933 all over again. The Fed, for once, played the reluctant villain.

https://www.whitehouse.gov/wp-content/uploads/2025/07/SAP-HR1919.pdf

So, what is a stablecoin, really? Think of it as crypto’s straight-A student — supposedly boring, predictable, and pegged to the U.S. dollar like it's clinging to a security blanket.

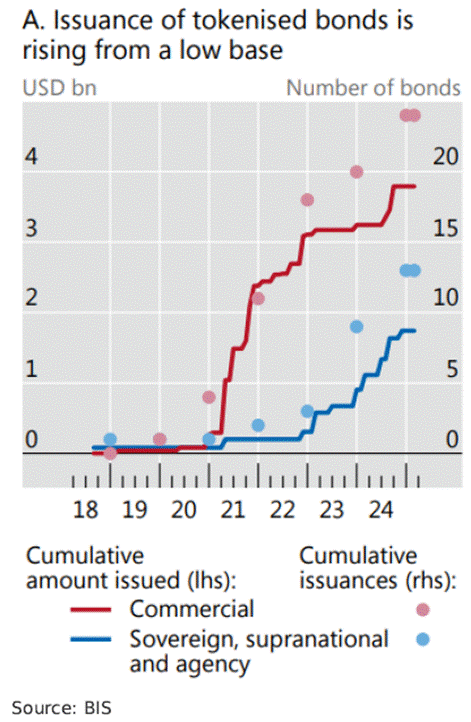

The term “tokenization” gets thrown around like confetti at a blockchain party, but it basically means slapping real-world stuff — like stocks, bonds, bank deposits, or even grandma’s condo — onto a blockchain. You get a shiny little digital token that says, “Hey, I represent something real!” These tokens live in crypto wallets, trade like Bitcoin, but (ideally) don’t throw tantrums like it.

Stablecoins are just tokenized dollars trying really hard not to freak out. For every $1 stablecoin, there’s supposed to be $1 sitting quietly in a vault somewhere (allegedly). Unlike Bitcoin or Ethereum, they don’t moon or crash on a whim — they're here to keep calm and carry value.

They’re supposed to be handy for sending money across borders without dealing with banks or their pesky paperwork. Critics say that makes them the criminal's Venmo. Supporters say they’re a lifeline in places where the banking system is stuck in the Stone Age. Either way, they’re the blockchain’s version of duct tape: not flashy, but surprisingly useful.

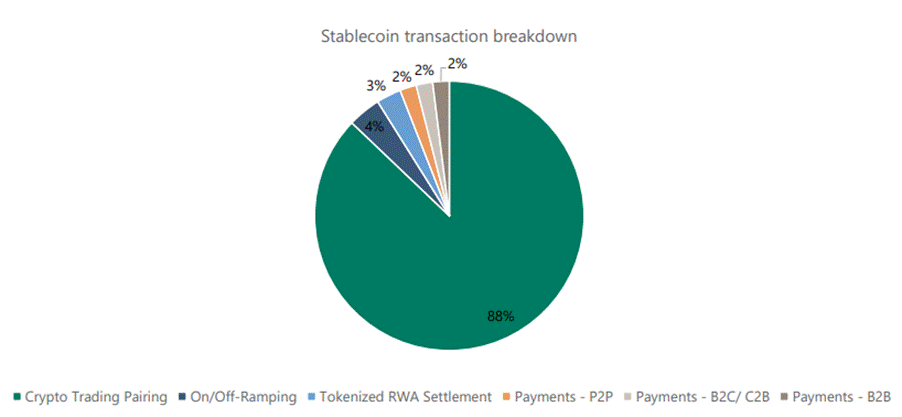

Stablecoins are not yet widely used for everyday retail purchases, but they already play a key role in crypto trading, cross-border payments, B2B settlements, remittances, and in emerging markets. As their adoption grows, so too will their demand for short-term, liquid assets—particularly U.S. Treasury bills—positioning stablecoins as increasingly significant buyers of U.S. government debt.

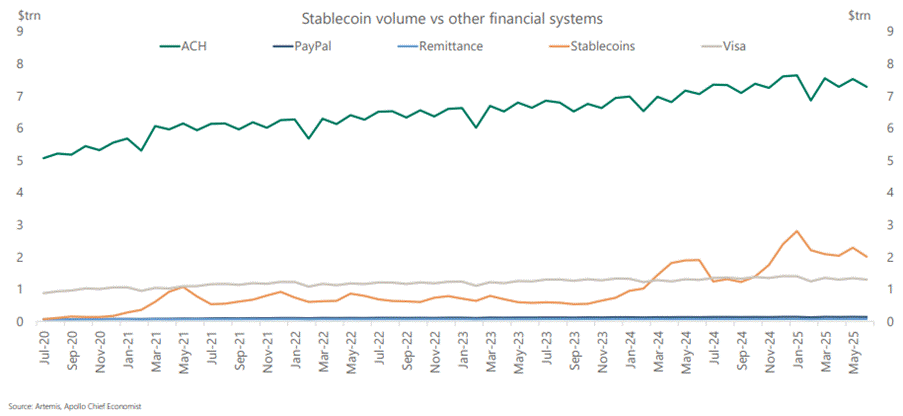

However, stablecoins are increasingly muscling into the payments arena—and since November 2024, their transaction volumes have even outpaced Visa’s quarterly totals. Not bad for what started as crypto’s nerdy sidekick.

The rise of stablecoins and the signing of the GENIUS Act could be more than just crypto chatter — it is the opening act of a full-blown monetary shake-up. With stablecoins now getting the regulatory red carpet, we could be looking at a steeper yield curve, wider swap spreads, and yes, even more inflation. The GENIUS Act brings dollar-pegged digital tokens into the official fold — and potentially sets the stage for the biggest overhaul of the U.S. (and global) monetary system since Bretton Woods bit the dust over 50 years ago.

For now, stablecoins are basically the USD’s loyal fan club—because when it comes to stablecoin supply by currency, it’s the dollar’s world and everyone else is just borrowing bandwidth.

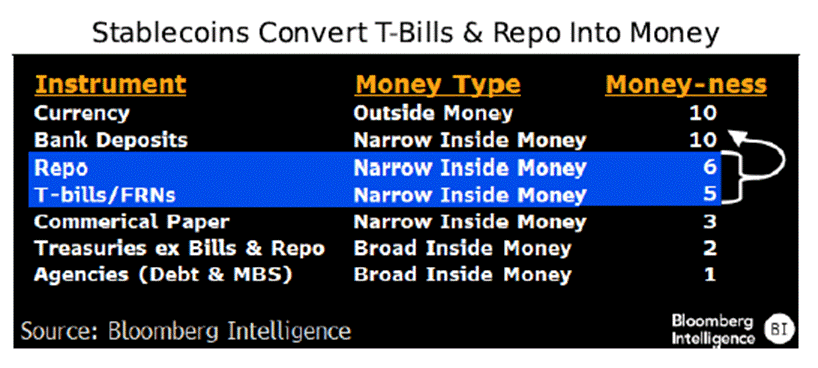

Stablecoins aren’t your average blockchain tokens. Unlike your typical crypto rollercoaster, they cling to the U.S. dollar for dear life — but with a twist. They don’t just sit pretty; they actively buy up U.S. Treasuries and money market instruments, essentially monetizing government debt in digital form. For those who are thinking about traditional money supply measures like M1 or M2 — forget it. Stablecoins don’t neatly fit into either. M1 covers cash and bank deposits, M2 adds savings and money-market funds. Stablecoins? They're off in their own lane, pretending to be dollars while bypassing the banking system entirely. Unlike other real-time payment systems that still tether themselves to bank deposits, stablecoins skip the middleman. Instead of just parking cash, they’re buying short-term government debt and repo deals — making them feel even more like money than your standard money fund. So yes, they're not just mimicking money anymore… they’re becoming it.

Stablecoins aren’t just causing a stir in crypto—they’re poised to shake up the Treasury market, lending rates, and inflation too. As adoption grows, expect a steeper yield curve, wider swap spreads, and yes, even more upward pressure on prices. Not exactly ideal when U.S. inflation is already starting to feel like an unwelcome houseguest who won’t leave.

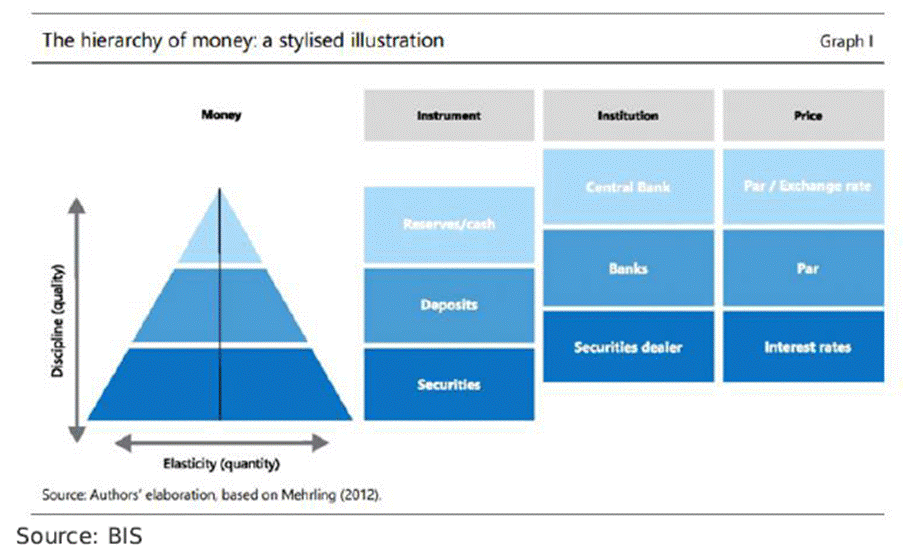

To really get what’s going on, you’ve got to look at the hierarchy of money. Perry Mehrling, in his book Money and Empire, lays it out like a financial pyramid: central bank reserves at the top (rock-solid, ultra-safe), followed by bank deposits, and then securities. Stablecoins? They hang out near the bottom of the second tier — kind of like bank deposits, but with zero yield and limited settlement power. In short, they’re trying to act like money… just without all the perks. But as they soak up Treasuries and operate outside traditional banking rails, their growing influence could start bending the rules of the monetary game.

At the heart of the monetary system is a simple idea: bank deposits and central bank reserves settle at par. Enter the GENIUS Act, which boldly declares that stablecoins — backed by oh-so-safe assets like Treasury bills and money market funds — should also settle at par. In theory. Because nothing ever goes wrong with “very safe” assets, right? So now we’ve got ourselves a shiny new kind of bank deposit — and effectively, a new dollar. Perry Mehrling likens it to Eurodollars, except this time it's on-chain. Think of it as offshore money... but for the blockchain crowd.

The implications? Potentially massive. Stablecoins don’t just create a new kind of dollar — they also hoover up short-term government debt to back themselves, diverting capital and reshaping money flows in the process.

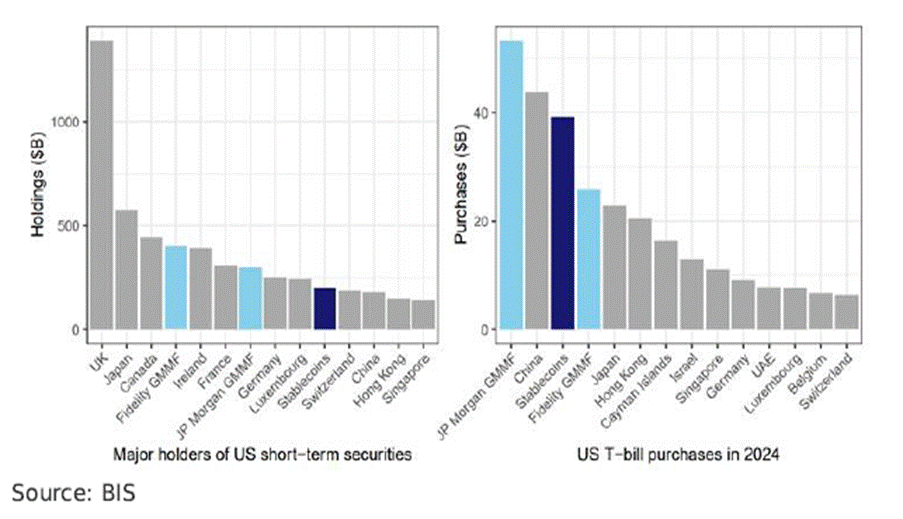

As stablecoin adoption ramps up, it’s all about how money velocity and asset duration evolve. Janet Yellen and friends were already banking on stablecoins driving demand for T-bills — and surprise! They were the third-largest buyer of bills in 2024. A coincidence, surely. So yes, this all looks like part of a carefully choreographed plan: replace the Fed chair, juice the short end of the curve, cut borrowing costs, and let stablecoins do the heavy lifting — all while pretending it’s just innovation, not a monetary workaround.

But whether stablecoins actually create fresh demand for T-bills depends on one key thing: how they reshape duration. If they're just recycling money already in the short end — say, pulling funds from money market accounts that already hoard bills — then congratulations, we’ve just shuffled deck chairs. No real savings for the government there. That would basically mirror 2023’s “fiscal QE” stunt, when the Treasury flooded the market with bills. Money parked in the Fed’s reverse repo facility gobbled them up, while the shortage of longer-dated assets nudged investors into riskier stuff — like stocks — keeping the market afloat even as the deficit ballooned. From the Treasury’s view? Not bad. Cheap funding and happy markets.

What’s not to like?

Well, inflation, for starters. More demand for riskier assets, lower funding costs, and a bigger pile of low-duration, money-like assets floating around all tend to light a fire under prices. So yes, it may look clever… but don’t be surprised if it ends with sticker shock.

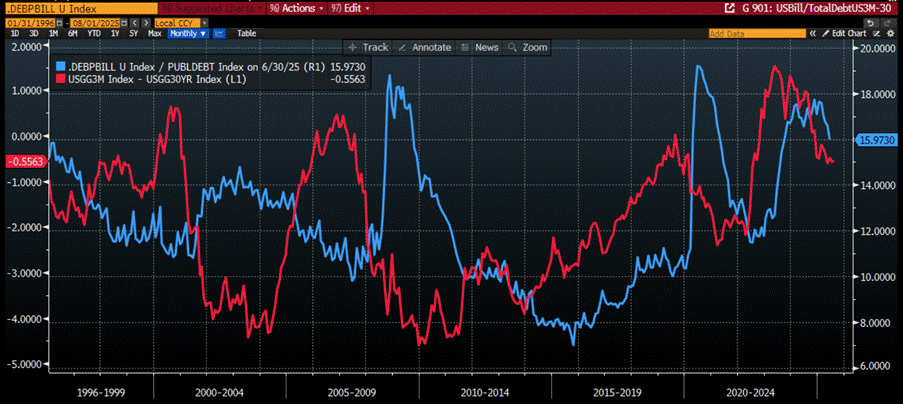

% of US Total Debt Outstanding Bills to US Total Government debt (blue line); US CPI YoY Change (red line).

For equity investors, a bigger slice of T-bills financing the massive U.S. debt has historically been a tailwind. Anyone with a shred of financial sense knows that higher inflation tends to boost property (equity) —because rising prices fatten asset values—while it’s a nightmare for bondholders stuck with fixed contracts losing real value. So, more bills today could mean more green for stocks tomorrow.

% of US Total Debt Outstanding Bills to US Total Government debt (blue line); S&P 500 Index (red line).

Boosting the share of T-bills in total U.S. government debt has another side effect: it acts like a DIY yield curve steepener. Why? Because shortening the average maturity of Treasury debt pulls down the short end, while the long end stays sticky — or even rises — on inflation and duration risk. The result? A flatter wallet for bondholders and a steeper curve for everyone else.

% of US Total Debt Outstanding Bills to US Total Government debt (blue line); Spread between US 3-Month Yield and US 30-Year Yield (red line).

But that steepening might not last. As stablecoins become more accepted in mainstream finance, investors could start treating them as a gateway drug to riskier assets — like crypto — or parking them in interest-bearing platforms like Nexo. In that case, instead of piling into longer-duration bonds, capital could keep flowing toward short-term, higher-yield alternatives. That would sap demand for the long end, flatten the yield curve again, and widen swap spreads — all while stablecoins quietly reshape where the money goes and how fast it moves.

Stablecoins are gearing up to muscle in on traditional bank deposits—especially if they start paying yield or interest themselves. That could slow overall money velocity, as cash shifts from the fast lane of long-duration assets into the slow lane where stablecoins currently cruise. But here’s the twist: as payment systems get slicker, stablecoins will become almost indistinguishable from regular money. Right now, payments make up a tiny 6% of usage, but tokenizing short-term assets means stablecoin holders could soon spend fractions of T-bills or money market fund shares like pocket change.

Stablecoin adoption is anyone’s guess—fast, slow, or somewhere in between—but regulators can’t ignore the risks. If interest-paying stablecoins catch on quickly, they could trigger a mass exodus from near-zero-yield bank accounts—one of the main reasons why U.S. banks are scrambling to create their own stablecoins, hoping to retain clients while tightening their digital grip even further.

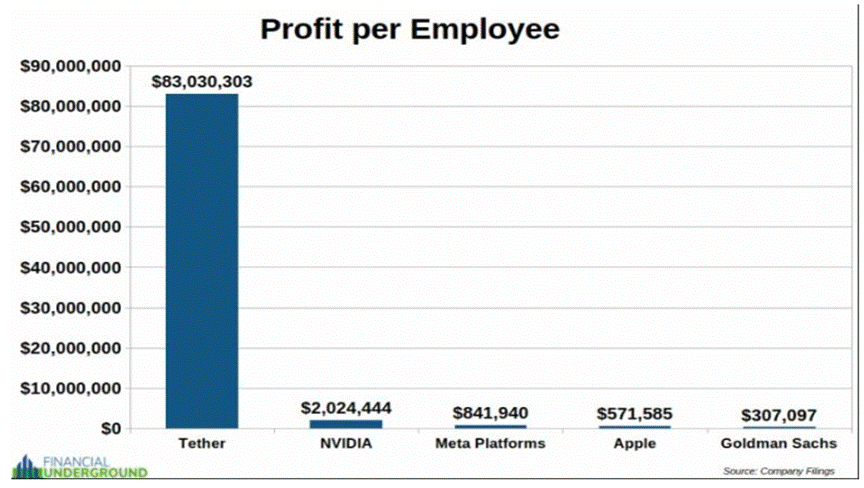

If anyone wants to grasp just how "stable" a stablecoin can be—for its issuer, not its users—look no further than Tether. Dubbed a stablecoin, USDT is really more of a “guaranteed-loss coin,” since it’s backed by fiat currencies that themselves bleed value. With over 400 million users (and 30 million more joining every quarter), Tether has become the crypto version of Facebook during its glory days—minus the social networking and plus a whole lot of arbitrage. Beloved in collapsing economies like Argentina, Venezuela, and Turkey, it’s the duct tape holding together shattered currencies. Oh, and with $13.7 billion in profit last year and just 165 employees, Tether is pulling in $83 million per head—making even NVIDIA look like it’s running a lemonade stand.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/in-stablecoins-we-patch

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.