The Case Against The Market's Gravity-Defying Act

Submitted by QTR's Fringe Finance

My readers know I believe there are only a handful of fund managers truly worth paying attention to—and one of them is Mark Spiegel, who’s been bearish on the market in recent years. And, like me, he’s been “wrong” as our market continues to defy gravity, reality, the laws of economics and common sense.

I mean, let’s be honest. These days, there’s a real case floating around for eventual hyperinflation and the market never going down again in nominal terms. Recently, I see the most likely scenario as an eventual quick crash lower before a pornographic printing session by the Fed which should send sound money assets scorching higher, after a sharp deleveraging.

Don’t ask me about timing or the initial catalyst, because unlike other financial writers I’m not going to lie to you and tell you I know when or how it’s going to happen — only that it is eventually likely.

Spiegel’s latest note also compliments the dynamics I warned about a couple weeks ago with regard to the passive bid. Put these two views together—the structural fragility of the passive bid and the fundamental overvaluation Spiegel outlines—and you get a picture of a market that’s far more precarious than the record-high indexes suggest. And that’s before we even talk options gamma…

Anyway, if you still believe in gravity and reality—like I do—take note of some of the metrics he is watching.

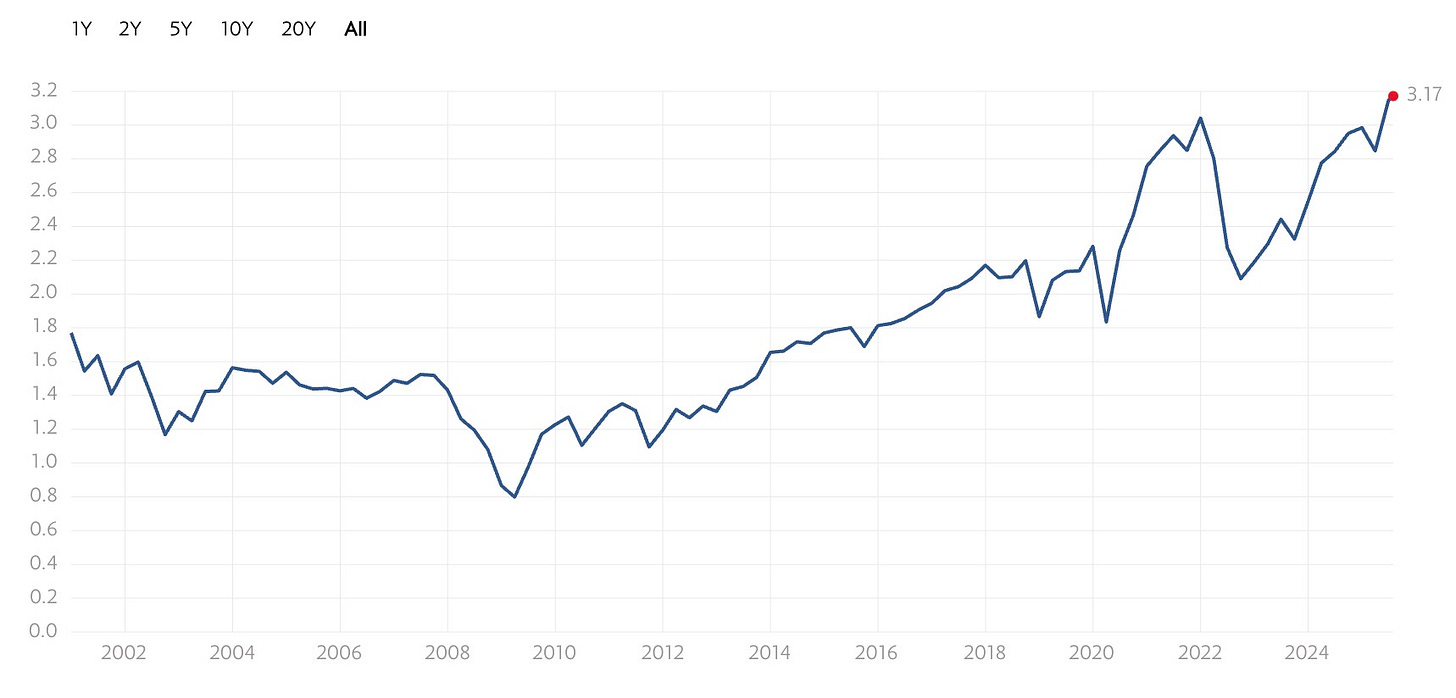

Spiegel points out that valuations are stretched to extremes rarely seen outside of historic bubbles. As he writes, “Stocks are extremely expensive, with the S&P 500 selling for over 25× Q2 annualized operating earnings at a 3.2× price-to-sales ratio that’s the 2nd-highest ever, only slightly exceeded at the peak of the 1999 bubble.”

The famous “Buffett Indicator” is also at “its highest value ever,” a sign that the market is priced for perfection. I noted a similar theme in my July 13, 2025 article The Passive Bid Crash Awaits.

For the last year or two, I’ve harped on the idea that the market is being artificially bid up by...(READ THIS FULL ARTICLE HERE).