Surveillance By Inflation

Submitted by QTR's Fringe Finance

Donald Trump this week signed an executive order telling banks they can’t “debank” customers based on political or ideological beliefs. It’s a solid step—nobody wants to wake up to find Bank of America decided your checking account violates the Diversity & Inclusion Handbook.

But while it’s a nice win for free speech in finance, it’s also like throwing a single sandbag at a flood that’s been rising for decades.

Because the real problem isn’t just who gets “debanked.”

The deeper, older rot is in the government’s obsession with treating every American as a suspect in their own financial life—an obsession codified in the alphabet soup of BSA, AML, and KYC laws.

The Bank Secrecy Act, Anti-Money Laundering rules, and Know Your Customer requirements were originally sold to the public as tools to stop terrorists, mobsters, and drug cartels. In practice? They’ve turned banks into unpaid government spies.

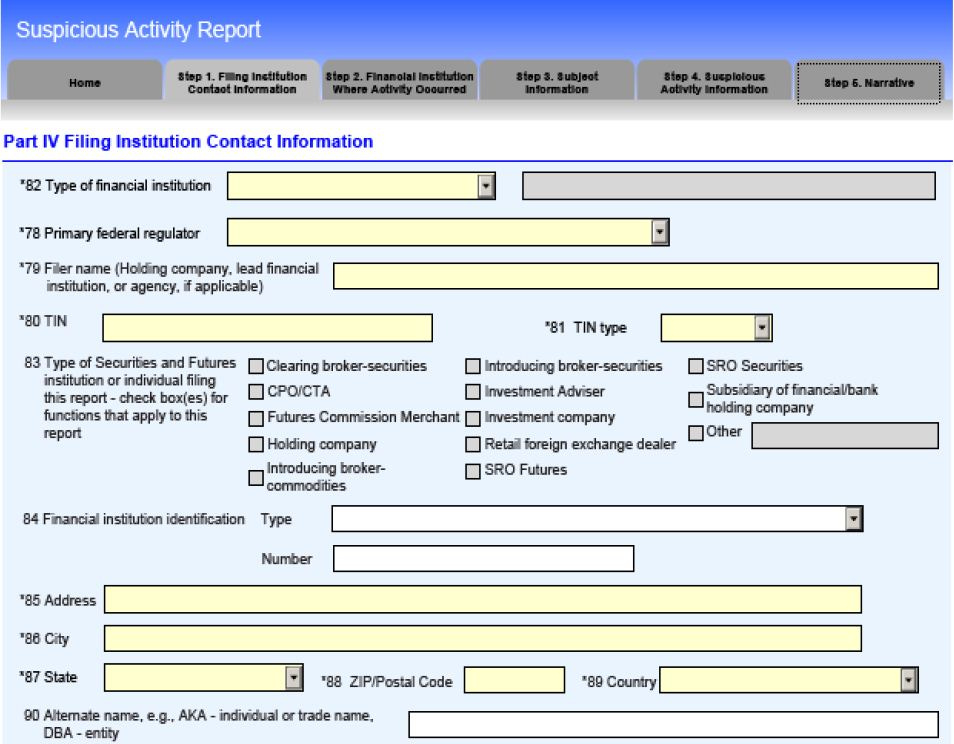

Move a few thousand between accounts? The bank files a “Suspicious Activity Report” like you’re laundering cartel cash. Withdraw enough cash to buy a decent riding lawn mower? Prepare for an inquisition.

These rules don’t just invade your privacy—they’re a form of low-grade financial harassment aimed squarely at ordinary people. And while these rules initially had bipartisan, or even Republican origins, Democrats, in particular, have spent decades not just defending these rules, but pushing to expand them.

In 2021, the Biden administration proposed one of the most sweeping expansions of financial surveillance in U.S. history—requiring banks to report all account activity over $600 annually to the IRS. Framed as a tax enforcement tool, it would have turned banks into data-collection arms, sweeping in gig workers, online sellers, and even modest personal transfers.

The backlash was swift and bipartisan, with critics warning of a “bank surveillance scheme.” Under pressure, Democrats revised the plan to a $10,000 threshold for non-payroll transactions, exempting wages and federal benefits. Still, Senate Democrats tried to fold broad IRS account-access provisions into Biden’s larger tax-and-spending bill, and internal memos suggested the $600 idea—or a similar version—could return.

Even scaled back, it marked a major step toward normalizing deep government monitoring of routine financial activity.

Why? Because for the modern Democratic Party, the goal is not just to “catch criminals” but to control the entire flow of money. Every dollar tracked. Every transaction flagged. Every decision about what you can and can’t do with your own money filtered through a bureaucratic lens...(READ THIS FULL COLUMN HERE).