BOA's Hartnett: Why Gold Revaluation Will Happen

“Everything else is very gold and crypto bullish."

- Michael Hartnett Aug 9, 2025

Contents

- Structural Inflation and Dollar Debasement

- The Mechanics of Revaluation in the Anti Goldilocks Era

- Policy Cycles and Market Positioning

- The Peace Variable and Its Limits

- Bottom Line

Authored by GoldFix, ZH Edit

Hartnett’s Flow show this week frames gold’s near-term dynamics within a broader macroeconomic and policy backdrop. His central observation is that while the prospect of peace in certain geopolitical flashpoints (particularly Ukraine) can act as a short-term headwind for gold, structural forces remain firmly in its favor.

“Peace, not war equals gold bearish, but we remain gold bingers.”

The anticipation of peace is a “buy the rumor, sell the news” moment for risk assets. A negotiated settlement between Russia, China, and the US could be the signal for equity market highs, particularly if accompanied by symbolic events such as high-profile diplomatic handshakes. In this framework, the initial market reaction to peace should be a reduction of flows into gold for sure. However, Hartnett underscores that this short-term effect does not override the underlying bullish drivers for the metal.

Housekeeping: We think this is one of the better ones; Strong topics including vindication on Producer-selling (and why it matters), why China’s consumer is a patient monster, and Hartnett’s one-paragraph case for gold as the must-own asset of the decade.

Structural Inflation and Dollar Debasement

He re-identifies the 2020s as a decade defined by several interlinked forces:

- Sustained inflationary pressures- onshoring, rebuilding, and re-arming

- Geopolitical isolationism- Deglobalization necessitates protectionism

- Stricter immigration controls- immigration will strain social safety nets

- Greater state intervention in economy- steer towards needed retooled results

- Reduced central bank independence.- Fiscal dominance/fiscal stimulus means Monetary prudence

These themes, he argues, contribute to a long-term weakening of the U.S. dollar as well as all other Fiat held by Central Banks

“US dollar debasement also equals gold up.”

You just cannot keep printing money to spend without your currency weakening, even if that spending retools and benefits the economy in thelong run.

One scenario receiving increasing attention by BOA is that central banks (collectively holding about 20% of global foreign exchange reserves in gold on their way to 30%) may be compelled to revalue their holdings.

Central Banks Say More Gold for FX Reserves Coming

Bloomberg reported yesterday [Oct 2024] from the LBMA’s Miami conference. Here is a breakdown of what they saw. Read full story

Such a move would directly improve sovereign balance sheets by reducing domestic debt burdens. The possibility of reserve revaluation adds another strategic dimension to gold’s investment case, particularly for countries seeking alternatives to dollar reserves.

The Mechanics of Revaluation in the Anti Goldilocks Era

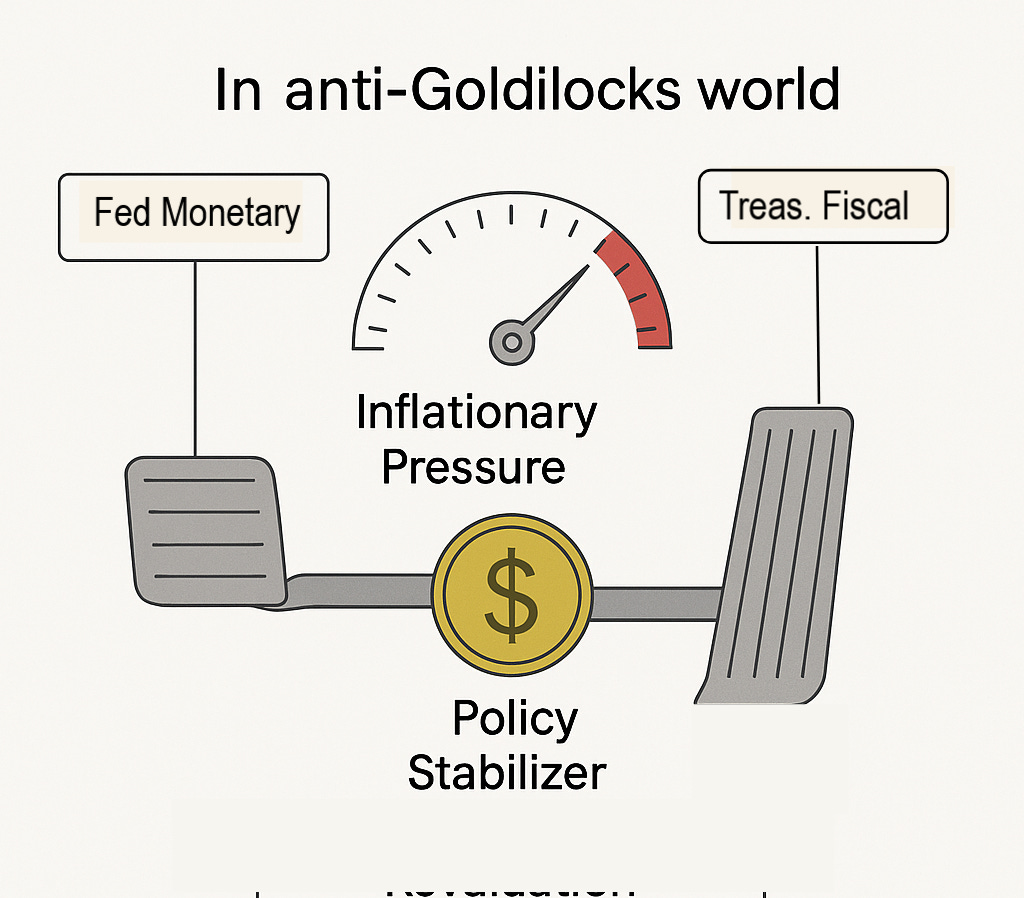

Such a step would also be a tacit acknowledgment of the subordination of monetary policy to fiscal dominance. In an environment that is the opposite of “Goldilocks,” monetary policy would act as the brake while fiscal policy presses the gas pedal. Revaluing gold in this context would not only preserve central bank credibility but also serve as a bridge between the needs of fiscal authorities and the constraints of inflation control.

“In an anti-Goldilocks world, monetary policy becomes the brake while fiscal policy presses the gas pedal.”

Policy metaphor showing the simultaneous application of fiscal stimulus and monetary tightening in a non-Goldilocks macroeconomic environment. Persistent inflationary pressures and elevated debt levels create a policy mix in which central banks may rely on gold reserve revaluation as a stabilizing tool, providing space for rate hikes without undermining fiscal liquidity.

Policy Cycles and Market Positioning

Within this environment, gold benefits not only from dollar debasement but also from market expectations that central banks will continue to add to their reserves. These expectations are reinforced by recent buying trends, with official sector demand forming a substantial base for the market.

Continues here

Free Posts To Your Mailbox