BRICS’ Gold Glory: The Dawn of a New Era

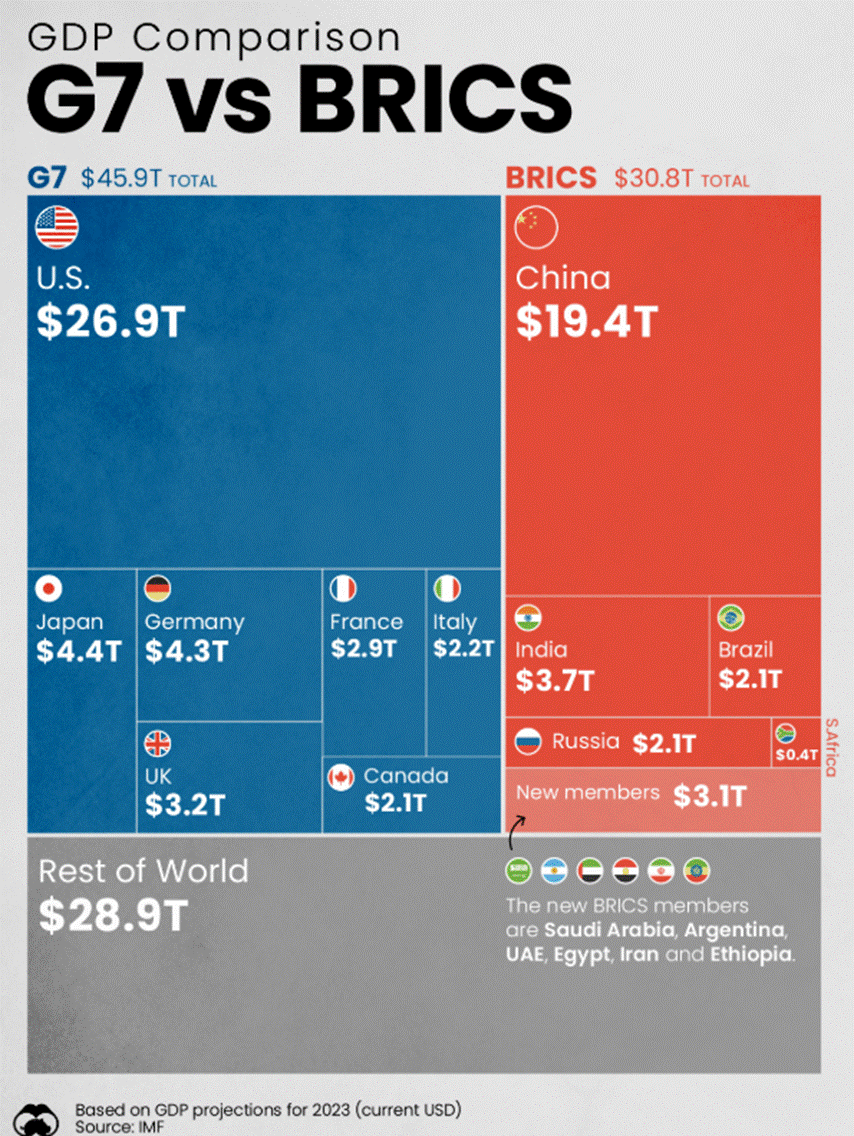

Beyond the fading grandeur of the G7 and G20—clubs of nations forged in the aftermath of World War II and now mired in economic stagnation and demographic decay—a new alliance has emerged on the geoeconomic map: BRICS+.

This coalition—Brazil, Russia, India, China, and South Africa—represents a rising league of nations determined to expand their trade influence, secure resource flows, and accumulate the economic surpluses that once enriched Europe’s great empires.

First conceived in 2001 by ‘Government Sachs’ economist Jim O’Neill as “BRIC,” the term began as a mere market classification for economies whose growth threatened to redraw the balance of global commerce. But what began as a banker’s shorthand swiftly became a council of ambition. By 2006, the original four were already meeting to strengthen commercial ties, coordinate investment, and align political strategies. In 2009, their first official summit in Yekaterinburg marked more than diplomacy—it signalled the return of a multipolar world, where the trade routes, resources, and bullion no longer flowed solely to the old imperial capitals, but to new centres of wealth creation.

In 2010, South Africa was brought into the fold, transforming BRIC into BRICS and extending the league’s reach to Africa’s mineral-rich shores. From that moment, BRICS matured from a market label into a trading and political bloc with imperial ambitions of its own—determined to tilt the scales of global commerce away from Western monopolies, rewrite the rules of finance, and channel trade and investment flows along routes they control, not those dictated by the G7, the G20, the IMF, or the World Bank.

By 2025, BRICS had grown into BRICS+, a formidable trading confederation of eleven full members—Brazil, Russia, India, China, South Africa, Saudi Arabia, Egypt, the United Arab Emirates, Ethiopia, Indonesia, and Iran—controlling vast reserves of commodities and strategic goods, alongside the markets and labour forces to refine and consume them. Further expanding its reach, the bloc introduced a new “partner country” category on January 1, 2025, bringing Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Thailand, Uganda, Uzbekistan, and Nigeria into its orbit. While not full members, these partners now participate in BRICS+ summits and ministerial meetings, and may endorse the bloc’s declarations, deepening their integration into its growing sphere of economic and political influence.

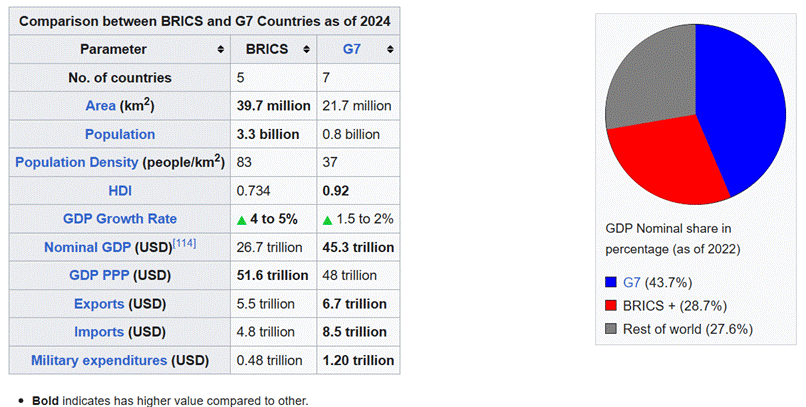

Together, these nations now command roughly 40% of global output in purchasing power terms, according to IMF figures from April 2025—surpassing the economic might of the old developed market powers in key arenas of trade and production. By year’s end, their share is set to climb to 41%, leaving the G7’s diminished 28% in their wake. The tide of bullion, commodities, and commerce is no longer flowing to the aging imperial ports of the West, but toward a rising consortium of resource-laden, market-hardened economies intent on securing the world’s wealth under their own flags.

In population terms, the BRICS command over 40% of the world’s people—a share that swells to an estimated 55.6% when their partner states, known collectively as BRICS+, are counted. This vast reservoir of labour, consumers, and soldiers of commerce forms the backbone of the bloc’s expanding economic power, ensuring that its markets grow not merely through trade, but through the sheer demographic force that has always underpinned great mercantile empires.

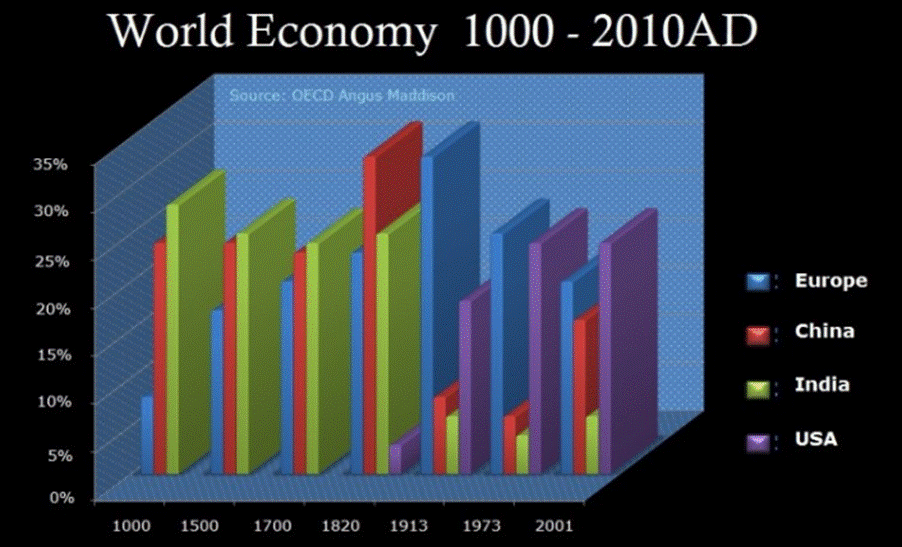

If you’ve read a bit of history—or even just skimmed the CliffsNotes—you know the U.S. and the West haven’t been calling the economic shots forever. The global crown has passed through more hands than a cheap bottle of wine: Mesopotamia, Egypt, Persia, Greece, Rome, China, the Caliphates, Portugal, Spain, the Netherlands, Britain… all took their turn strutting on the world stage before bowing out. Now BRICS+—Brazil, Russia, India, China, and South Africa—are lining up for their shot. And if history teaches us anything, it’s that the economic game of musical chairs never really ends—someone’s always about to grab the seat, and someone else is about to hit the floor.

When great powers start fearing the future, the script rarely changes—they stagnate, sulk, and fade. Ming China once thought it had reached eternal perfection, so it banned ocean voyages, shunned foreign trade, and replaced science with Confucian trivia. Meanwhile, Europe was busy tripping over the New World and inventing trading empires. Fast forward to today, and America seems to be auditioning for a Ming Dynasty reboot—unable to finance domestic infrastructure costs, allergic to global trade, and comforted by the idea that being top dog last century guarantees the same this one. History suggests otherwise.

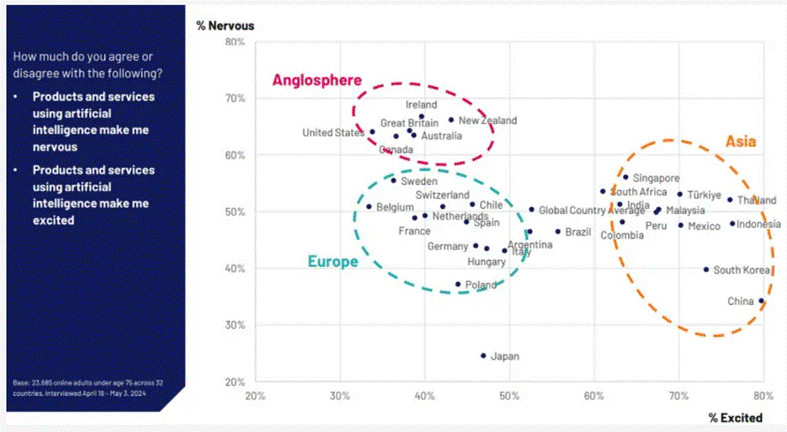

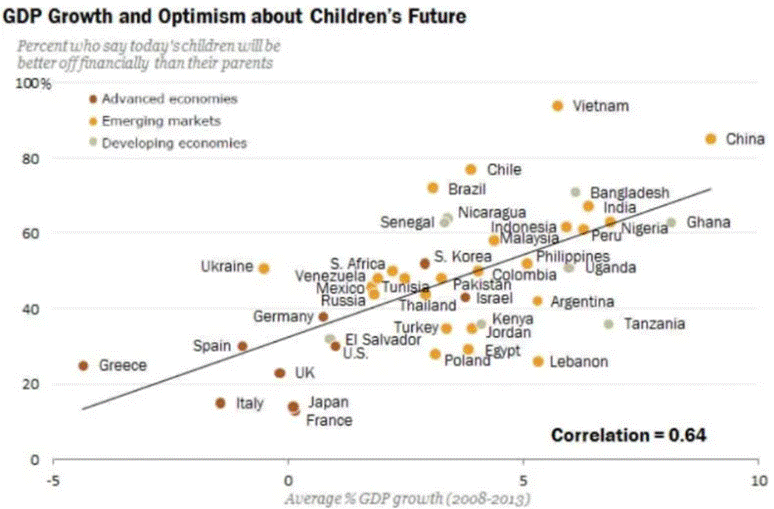

Americans have spent decades in a 2% growth bubble—enough to quadruple living standards over a lifetime, but slow enough that any five-year stretch feels like watching paint dry, punctuated only by random disasters. Lose your job, your house value, or a government contract, and years of “progress” vanish. No wonder change feels like a threat. In the U.S., new tech means layoffs—encyclopaedia salesmen, carmakers, flip-phone giants, floor traders—one innovation at a time. In modern China, it’s the opposite: tech has been a golden escalator, lifting almost everyone up so fast that losing a job often just means finding a better one. The result? Americans see change as a wrecking ball; the Chinese see it as a construction crane.

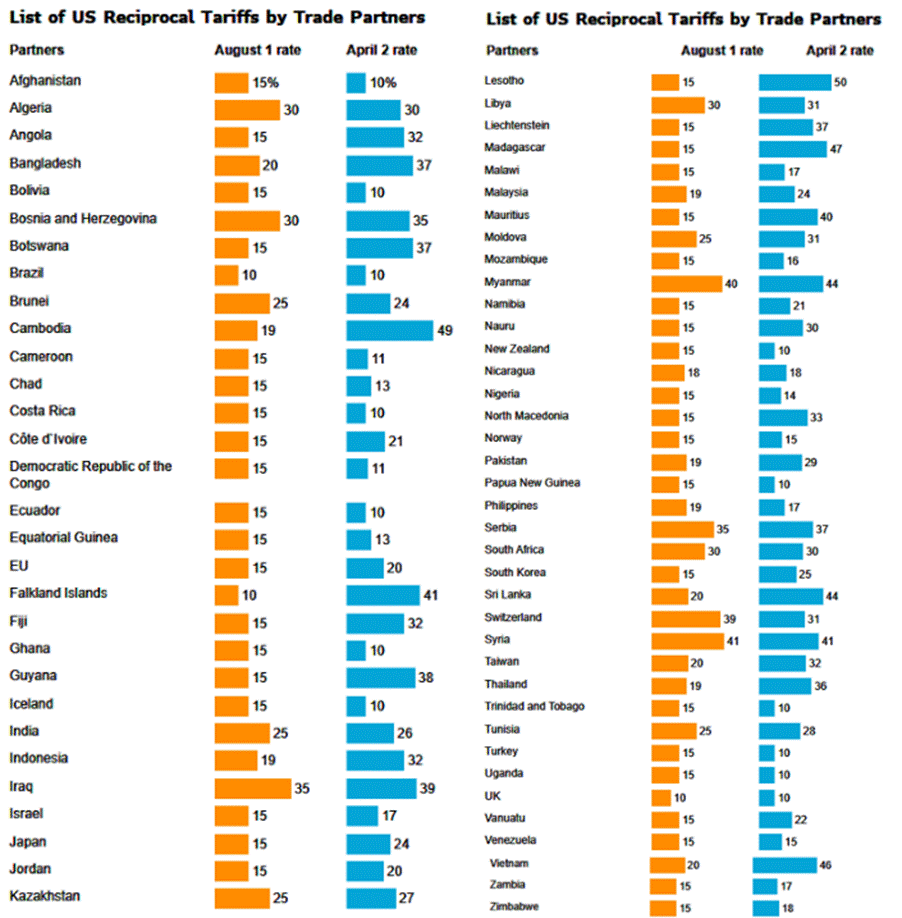

On August 7th, Donald Copperfield waved his magic tariff wand once again, proving tariffs aren’t just economic tools anymore—they’re geopolitical weapons aimed at BRICS and anyone daring to say “no thanks” to ‘Trumperialism’. Apparently, the Washington swamp’s favourite pastime remains spreading chaos under the guise of a Malthusian depopulation agenda, all while slapping new tariffs on the globe. Starting August 8th at midnight ET, planet earth braced itself for a 10% global minimum tariff on imports. Canada’s tariff jumped from 25% to 35%—unless you’re playing nice under USMCA. Switzerland got hit harder, up to 39%, causing some diplomatic huffing. Meanwhile, 40 countries got a 15% slap, a dozen-plus economies faced even nastier hikes, and China and Mexico got a 90-day stay of execution. Tariffs: the world’s new favourite geopolitical toy.

The rise of BRICS+ was practically scripted by the Biden administration’s move to kick Russia off the SWIFT system—a clear message that the U.S. is acting like the world’s financial dictator: comply or get cut off. Threatening China with the same fate if it helped Russia only accelerated BRICS’ birth as a geopolitical counterstrike. The plan to bankrupt Russia with sanctions backfired spectacularly. China dumped U.S. debt, and the Global South caught on—U.S. financial hegemony isn’t just wielded; it’s weaponized. The so-called GENIUS Act? Just the latest chapter in the “control the money, control the world” playbook, this time with a QR code. Meanwhile, Europe, the U.S., and allies booted several Russian banks from SWIFT in early 2022—except Gazprombank, because Europe still needs its Russian gas. The attempt to isolate Russia only fuelled a new economic bloc determined to break the dollar’s stranglehold—and rewrite the global order.

The self-anointed “Peacemaker in Chief,” who in truth is the “Warmonger in Chief,” claws desperately to crush BRICS+ and cling to the dollar’s fading throne—a laughable charade. You can’t drag nations to your dark altar with threats and expect them to leap blindly into your abyss. BRICS+ rose like a phoenix from the ashes of these Neocon iron fists, the true puppeteers of U.S. foreign policy. Meanwhile, those who have played the revolving door game between Government Sachs and the US institutions pop champagne, basking in the chaos as the ‘Manipulator In Chief’ dances to their sinister tune, a marionette bound to their infernal rulebook as ‘Government Sachs’ and other are looking to seize the resources of the Global South as they tried to on the eve of the Asian Financial Crisis in 1998.

The Neocon bill—shamelessly backed by ruthless, un-American operatives from both parties—is a dark threat looming over international security. It hasn’t passed yet, but any lawmaker who supports it deserves to be dragged out screaming, for they serve masters, not the people. Alongside this nightmare lurks the Trade Review Act of 2025, aiming to shackle tariffs with congressional chains—though the White House snarls with veto threats. Meanwhile, courts unravel the twisted legality of Trump’s tariffs, slapped on under a dubious emergency law. Judges, from both sides, see this as a monstrous power grab—the likes of which hasn’t been witnessed in two centuries.

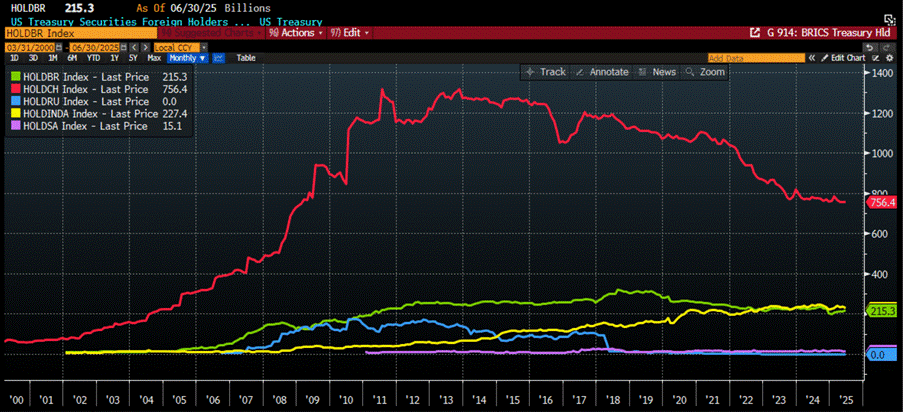

As holding USD assets suddenly turned into a geopolitical headache, it’s no shock that BRICS countries started dumping their U.S. Treasury holdings faster than you can say “unreliable trade partner.” After all, why stick around when the U.S. might just confiscate your assets on a whim for not toeing their “American way or the highway” agenda? Especially when that agenda conveniently involves stealing resources from rebellious countries like Russia—those brave souls who dare to question the Malthusian depopulation plans cooked up by the American plutocracy. Who wouldn’t want out of that party?

US Treasury Holdings by Russia (blue line); China (red line); India (Yellow line); Brazil (green line); South Africa (purple line).

The runner-up to the U.S. dollar in BRICS+ FX reserves is basically a mixed bag of other developed-market currencies, holding a combined 35% slice of the pie—while non-DM currencies barely make a dent. One big hang-up? BRICS+ countries have just 6% of the world’s external debt compared to the U.S.’s hefty 21%, making it tough for their currencies to go global.

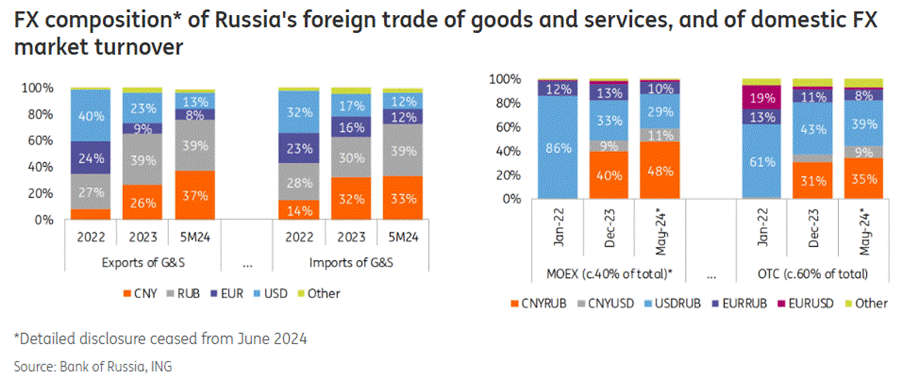

On the trade front, BRICS+ moves a solid 20-21% of global trade—about $10 trillion a year—but growth stalled after the financial crisis thanks to China’s slowdown and falling oil prices. Still, the bloc’s members are cozying up, with intra-BRICS trade climbing from 22% in 2008 to 28% now, and emerging markets trading with them even more. Fuel trade is the real star, doubling BRICS+’s share to 37%, making energy the prime playground for de-dollarisation. With non-OECD oil demand now at 55% of the global total, who pays in what currency matters. While solid stats are scarce, anecdotal reports show renminbi, UAE dirham, and rupees being tossed around for energy deals. India now pays Russia in Rubles and rupees. The renminbi’s the real heavyweight here—Russia’s foreign trade now prefers it over the dollar, thanks to the Bank of Russia stocking up on yuan, which made up 22% of its FX reserves. So, watch this space—BRICS+ might just pull off the ultimate currency mic drop.

When BRICS talks about dumping the dollar, the m-Bridge project often gets name-dropped—a fancy digital money highway led by the BIS and central banks from China, Hong Kong, UAE, and Thailand. It uses wholesale CBDCs to make big cross-border payments faster, cheaper, and nonstop. By bypassing the traditional correspondent banking network—which often routes payments through the U.S. dollar and American banks SWIFT maze—m-Bridge seeks to reduce reliance on the dollar in global trade settlements. The tech works, but getting all the banks and regulators to agree and play nice? That’s the real challenge. After three years, they’ve barely rolled out a basic version. So yes, m-Bridge could one day shake the dollar’s throne—but don’t hold your breath. The revolution’s cooking, but it’s a slow simmer.

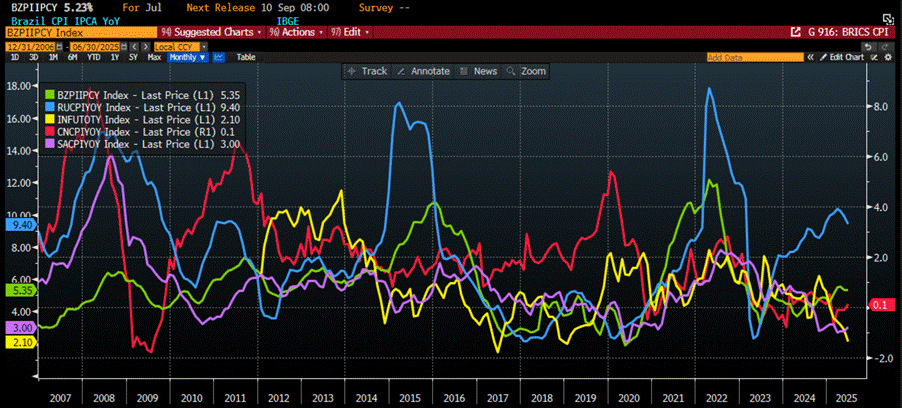

Lots of chatter about a BRICS currency to dethrone the dollar—but don’t hold your breath. First, BRICS aren’t signing up for the globalist playbook the West’s been pushing since WWII. Second, they’ve all seen how the euro turned into a sovereignty-sapping headache, with looming debt defaults all over Europe. And third, they’re not exactly marching in sync—China’s been stuck in deflation since COVID, while Brazil and India wrestle with stubborn inflation, which they actually use to weaken their currencies against the dollar and manage debt. So yeah, a unified BRICS currency? Not anytime soon.

CPI YoY Change in Russia (blue line); China (red line); India (Yellow line); Brazil (green line); South Africa (purple line).

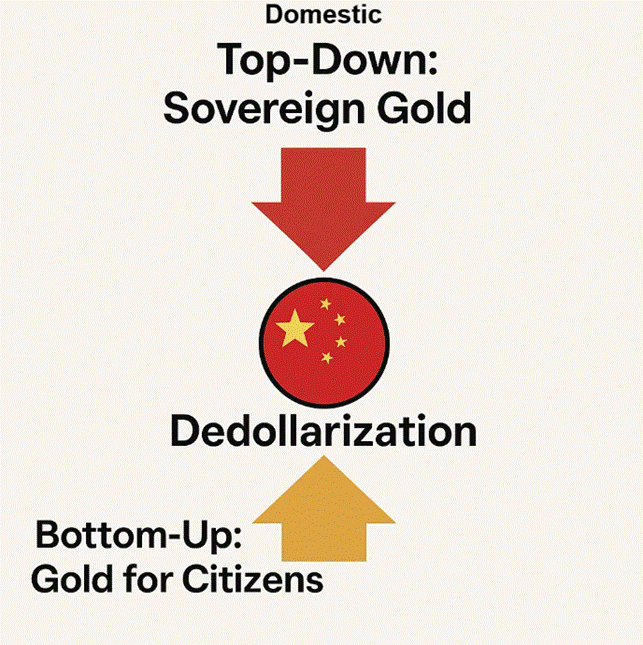

Instead of pushing for a BRICS currency or just switching to the yuan as the new reserve currency, the savvy Chinese leaders who get the headache of owning the world’s reserve currency is quietly steering its people and government away from the U.S. dollar. Citizens are being nudged to buy gold, while the state builds a parallel trade and finance system that skips the dollar altogether. The plan? Two separate tracks converging: a gold-backed domestic savings base meets a yuan-powered foreign trade engine, creating a new, stable financial middle ground.

Unlike the US which just passed the ‘Genius Act’ to finance its forever wars and spread its Malthusian agenda, China has aligned its goals with its people’s interests. It’s pushing the yuan for trade with Belt and Road countries, while promoting gold savings domestically. Internationally, gold acts as a guarantee for partners accepting the yuan. This gold-yuan combo forms a bridge between national ambitions and global trade. BRICS countries are nudged toward a yuan-based system: sell raw materials, get paid in yuan, then buy finished goods from China—closing the loop. If successful, China will issue yuan bonds to foreigners, paying interest tied to gold’s value as a hedge against currency debasement.

Think Bretton Woods 2 was the world on the USD standard backed by US gold? Bretton Woods 3 is BRICS on the RMB standard, with China on a gold-convertible standard.

It’s basically a reboot of what the US did post-WWII—building economies and influence by tying the world to its currency backed by gold. But China’s tweak? No fixed gold price and decentralized gold storage. Smart moves designed to dodge the pitfalls that sank Bretton Woods 2.

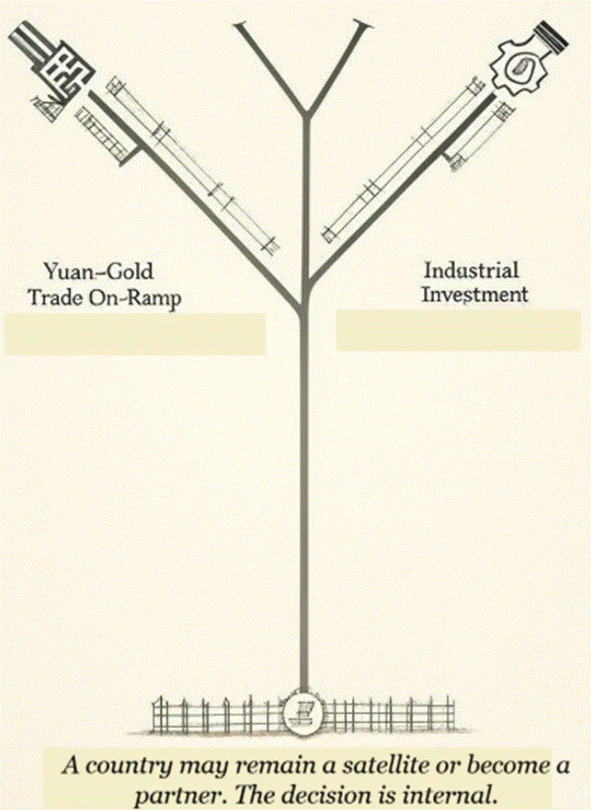

BRICS countries will get to peg their currencies to gold, the yuan, or whatever floats their boat. The yuan acts as the medium of exchange, while gold serves as the ultimate store of value. The system’s design nudges countries onto one of two paths: invest in your own economy and watch your currency strengthen or stick to exporting raw materials and become China’s economic satellite.

It will be probably voluntary—but don’t kid yourself, the pressure’s real. Build your industry, and China becomes your partner: infrastructure, goods, investment, the whole package. Ignore that, and you’re stuck dependent, much like how the US rebuilt Germany and Japan after WWII—except now China’s the one doing the financing and franchising.

China’s playing the long game at home too. It’s letting people buy gold, offering gold-linked savings accounts, and pushing gold-backed investment products. Next up? Bonds backed by gold collateral. The goal: build trust in the financial system—and reward that trust with profits. As long as the U.S. keeps looking like a threat and the Chinese government doesn’t mess up, that trust will keep growing.

Internationally, China’s opening its bond market to foreign yuan holders, with returns pegged to gold to hedge against debasement. The cycle is simple: sell resources for yuan, fall back on gold as a safety net, invest in Chinese bonds, and buy Chinese goods. Sound familiar? It’s basically WWII’s Marshall Plan 2.0.

China’s also clever about keeping high-margin manufacturing at home, selling finished goods abroad, and controlling the value in the supply chain—not just raw materials.

Gold is the glue: it reassures other countries, keeps domestic folks loyal, and steadies the ship as the dollar fades. Eventually, the plan is to shift from gold to yuan once the yuan earns enough trust—then maybe ditch gold if the time’s right. Remember, China invented abstract money and had markets before capitalism was even a thing—they’re not playing dumb.

This isn’t some secret plot—it’s history repeating. Major money system shifts follow wars. Today’s battlefield? Trade deals, savings, and bonds. The blueprint is in motion.

The BRICS didn’t exactly wait around for the “Manipulator In Chief” to sprinkle extra tariffs like confetti before dialing down their love affair with U.S. Treasuries. Nope, they started ghosting Uncle Sam’s trade party way back in 2018 during the first act of “Donald Copperfield.” Guess they saw the tariff magic coming and decided to pull a disappearing act early!

Exports from Russia (blue line); China (red line); India (Yellow line); Brazil (green line); South Africa (purple line) into the US.

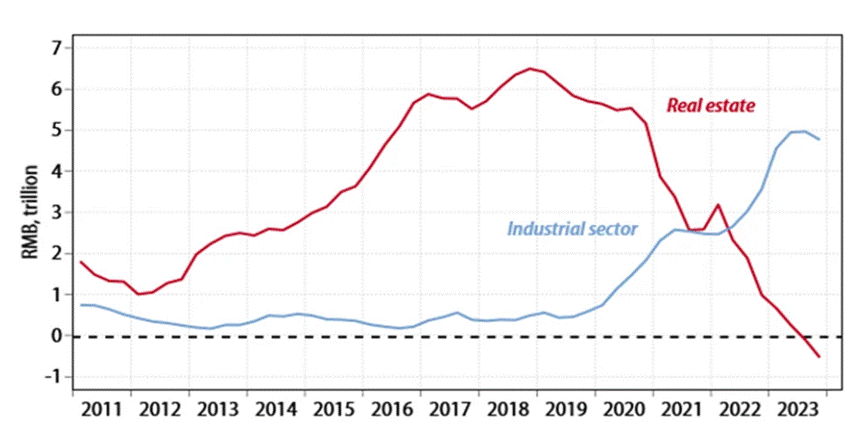

For all the Western “China experts” who’ve never set foot in the Middle Kingdom and churn out papers from their cozy Texan offices: stop obsessing over China’s real estate crisis as if it’s the apocalypse. Unlike the U.S., Chinese companies lean on bank loans—not fickle financial markets—for growth. Since 2019, Beijing has redirected lending from real estate to high-tech industries like EVs, AI, and machinery, spawning global players like BYD, Huawei, and Zoomlion that crush Western competitors on price and quality. Meanwhile, the “real estate crisis” that supposedly dooms China? Beijing doesn’t even blink—Chinese folks are housed, banks are state-controlled, and the government is gearing up for an industrial Blitzkrieg. Meanwhile, the western world is still stuck waiting for the Germans to come through the Maginot Line, distracted by “saving the planet” while China speeds ahead.

For those in the West still clinging to the fantasy that Asia is stuck in trishaws and rice paddies, the 2025 World Robot Conference in Beijing should’ve been a rude awakening—showcasing companies like Unitree, whose humanoid robots outpace anything coming from the U.S., including the pet project of its very own ex–American Rasputin.

Though lacking centralized political power, BRICS+ undeniably hinges on the rise of the Russia-China-India triumvirate—mixing Russia’s vast, cheap natural resources, China’s cutting-edge manufacturing prowess, and India’s booming, hungry consumer market. Together, they form a mercantilist powerhouse that’s reshaping the global economic game.

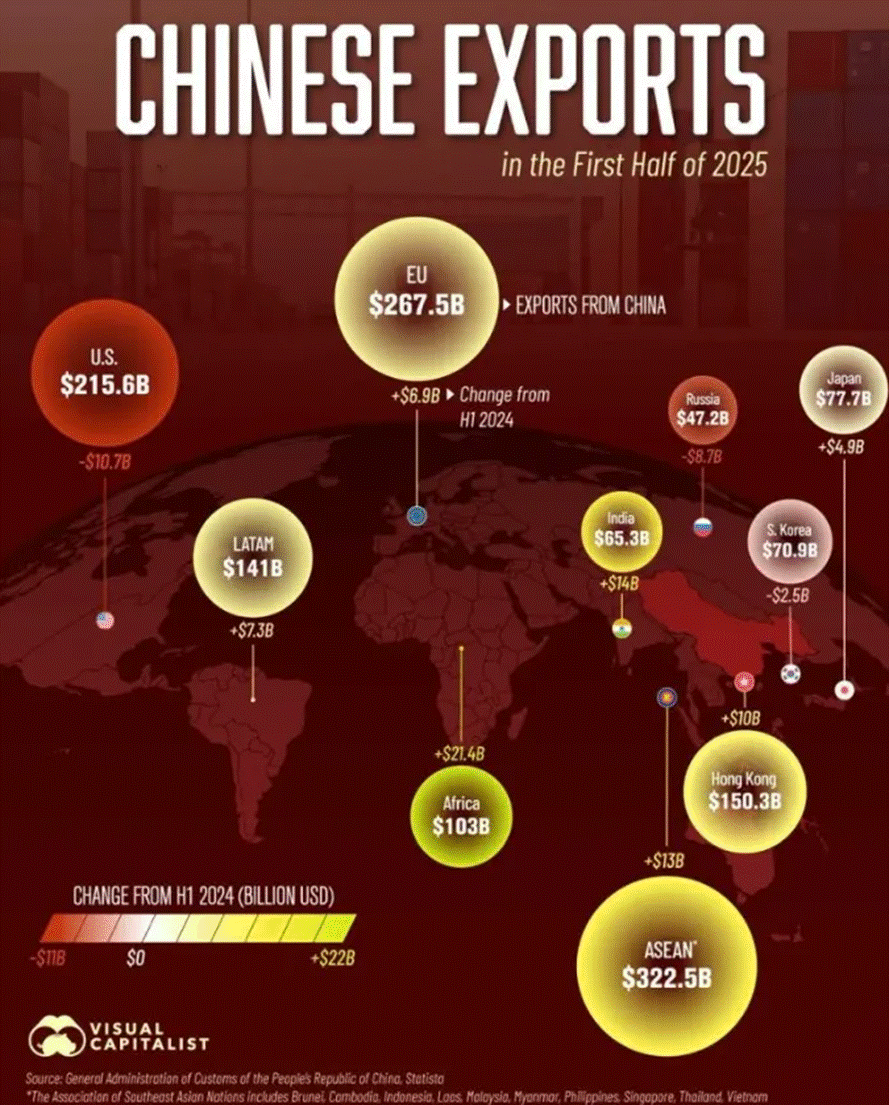

In the first half of 2025, China’s exports tell a story: the Global South is now the hottest dance floor, while the West is sitting out. ASEAN leads the party with $322.5B in imports, Africa’s exports surged by $21.4B, India’s shopping spree grew by $14B, and Latin America kept the rhythm going with $7.3B more. Meanwhile, the U.S. and Wester Europe are showing the cold shoulder. China’s clearly hedging its bets, cozying up to resource-rich, less picky partners in the Global South to dodge Western trade tantrums. It’s a savvy geopolitical pivot—less drama, more diversified shopping carts. Looks like the future of Chinese exports isn’t Wall Street, it’s Main Street… somewhere around the equator.

So, while cutting back on trade with the U.S. and even Europe, BRICS+ nations are cozying up and trading more with each other. Take India’s love affair with Russian oil: imports skyrocketed from a modest 68,000 barrels per day pre-USD weaponization to over 2 million—because why pay full price when you can snag a discount? Nearly 40% of India’s crude now comes from Russia, at $10–$20 cheaper per barrel than Middle Eastern oil. Meanwhile, U.S.-India trade hits $118 billion, with the U.S. running a $45 billion deficit—so sure, slap on tariffs and threaten jobs, but India’s smirking behind the scenes. China’s still guzzling Russian oil too, and other Asian exporters can’t fill the void. G7 and EU sanctions may have rerouted oil flows but didn’t crimp global supply or demand, especially not in India. India oil imports from Russia grew steadily, replacing expensive, high-shipping-cost crude from the U.S., Africa, and South America. Most of the Russian discounts come from shipping headaches, not refinery sweetheart deals. Indeed, India swapped pricey imports from afar for cheaper Russian barrels closer to home—making the sanctions and U.S. threats look like a pricey game of musical chairs nobody wanted to play.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/brics-gold-glory-the-dawn-of-a-new

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.