We Are At Most A Few Months Out From the Next Coordinated Easing Cycle

The stock market is preparing to enter an inflation-induced melt-up.

The reality is that central bankers and other policy makers, for all their advanced degrees and big ideas, are really capable of doing just one thing…

Printing money.

Quantitative Easing (QE), Yield Curve Control (YCC), Operation Twist, Mortgage-Backed Securities buying programs… all of these phrases are just fancy ways of saying “print money.”

This became obvious during the pandemic, when central banks and governments funneled over $20 trillion into the financial system in the span of 20 months. Sure, the money was dressed up with fancy titles, but it all just boiled down to printing money and giving it away in one form or another.

That unleashed the worst bout of inflation in 40 years. And today, we’re still paying for this.

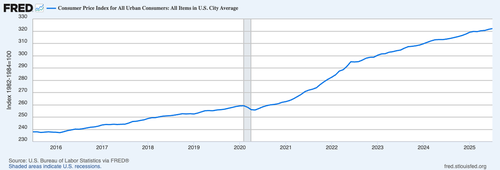

According to the “official” data points, inflation has been defeated. But that’s ONLY because inflation is measured on a Year over Year (YoY) basis. In that context, the pace of price increases is slowing. However, prices are still increasing!

See for yourself. CPI is moving up at a near perfect 45-degree angle. Prices are NOT coming down. Inflation has not disappeared. If anything, it’s about to worsen!

Globally central banks have already embarked on the next round of monetary easing. The Bank of England (BoE) has cut rates FIVE times since August 2024. The European Central Bank (ECB) has cut rates EIGHT times over the same time period. The Bank of Canada (BoC) has cut rates seven times. And in Switzerland, the Swiss National Bank (SNB) has cut rates down to 0% again!

The Fed and the Bank of Japan (BoJ) are the last two hold outs. But they’ll be easing soon enough. The Trump administration has been pressuring the Fed both verbally and legally (the President has actually threatened the Fed with a lawsuit if it doesn’t start cutting rates soon). The BoJ will soon be forced to turn on the printing presses and buy Japanese Government Bonds or risk losing control of its debt markets completely.

Put simply, we are at most a few months away from a coordinated easing cycle among major central banks (the Fed, BoJ, and ECB). And the markets know it.

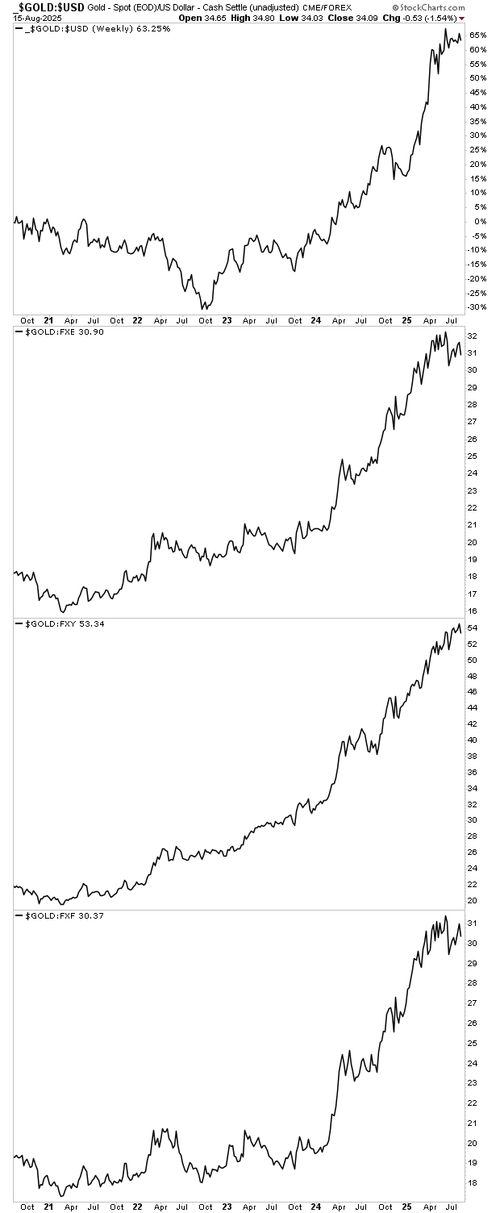

Gold is at or near record highs when priced in every major currency.

Stocks, which are also an inflationary hedge (to a degree) are entering an inflation-induced meltup.

And the $USD, which is the global reserve currency, is on the verge of a MAJOR breakdown.

Put simple, multiple asset classes are all signaling the same thing: inflation is coming back. The time to prepare for this is NOW before it does!

We detail three unique investments that will EXPLODE higher during the next wave of inflation in a Special Investment Report titled How to Profit a Inflation.

Normally this report is only available to our paying clients, but in light of what’s happening in the markets today, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research