The Last Thing We Need Right Now Is A Fed Rate Cut

By Ryan McMaken, Mises Institute

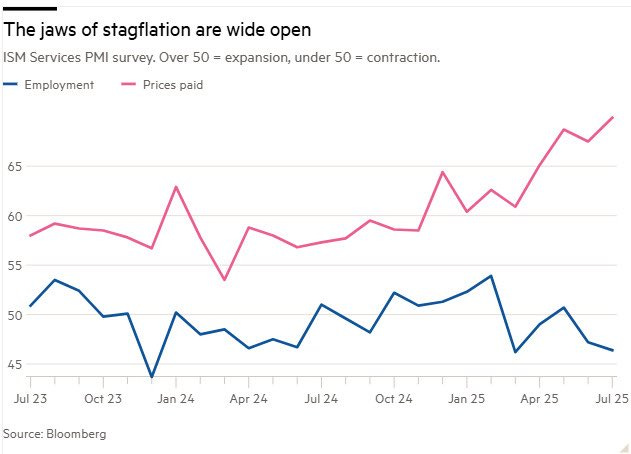

Pressure on Jerome Powell and the Federal Reserve continues to mount as both Wall Street and the White House demand more easy money to keep asset price inflation accelerating ever upward. These inflationists also hope that easy money-policy will somehow reverse the current stagnating trend in employment. In recent months, both President Trump and the usual Wall Street outlets have insisted that the Fed reduce the target policy interest rate to ensure that stock prices and real estate prices continue to skyrocket ever upward.

This is the last thing ordinary Americans need right now. Yes, continually rising asset prices are good for firms and individuals who already own large amounts of assets. These people have been pushing for lower interest rates for decades now, because lower interest rates function as a subsidy for asset owners and fuel rising asset prices. Moreover, since the late 1980s, with the Greenspan put, the Fed’s commitment to manipulating interest rates ever downward has been a boon for Wall Street hedge fund managers and investment bankers.

On the other hand, ordinary people have done less well. As home prices have spiraled upward—fueled by loose monetary policy (i.e., low-interest-rate policy) housing has become increasingly unaffordable for first-time homebuyers and middle-income families.

The politicians, pundits, and lobbyists who now advocate for the Fed to lower the target rate are basically advertising that they couldn’t care less about whether or not ordinary people can afford to buy a home. By this way of thinking, all that matters is that the wealthy asset owners get more of their low-interest subsidy and “number go up”—specifically the S&P 500—for Trump and his Wall Street allies.

Moreover, if the Fed pushes for lower rates right now—which requires more money creation from the FOMC’s open market operations—then the Fed will be “loosening into inflation.” That is, the Fed will be adopting looser, more inflationary monetary policy at the same time that there is an upward trend in price inflation. Not only are CPI and PPI prices accelerating again, but the US is in the midst of a meltup with the S&P 500 near all-time highs, with gold, crypto, and more all ripping to new highs. This is not an economy with too little liquidity. This is an economy with trillions of dollars from the covid-era mega-inflation still sloshing around the economy.

Jerome Powell is hardly a hard-money guy, and his claims that Fed policy is “restrictive” right now, must be viewed with extreme skepticism. Of course an inflationist central banker like Powell would say that his policy is restrictive even when it’s not. But Powell also fears...(READ THIS FULL ARTICLE 100% FREE HERE).