UK and EU at the precipice

[Originally published in I-System TrendCompass] Adhering to the strategy of trend following has been an underwhelming experience of late. Global markets seem to have been coasting in the proverbial “eye of the storm” in which things are mostly calm in spite of bad news and risk looming from every direction. Most markets are trading sideways as though they didn’t have a worry in the world. Even the price of gold has been drifting sideways for four long months. At the same time, stocks have only been going from strength to strength (in spite of the brutal correction from February to March this year.

The risks surrounding us aren’t minor, however: equity valuations are at all time highs, interest rates seem to be rising, debt levels are shooting skyward and in addition to that, many developed nations appear to be on the verge of social uprisings and civil wars.

To war!

These are the times when kings customarily cried “barbarians at the gates!!” in order to send the fighting age males to the front, fight the dreaded foreign enemy and die in large numbers. That expedient reliably diffused the risk that their own heads might end up on the chopping block. Accordingly, the war drums have been growing louder and soon it could be time for fighting age males to confront the Russian hordes looming from the East.

Unfortunately for the western leaders, the populace seems to be slow on the uptake, largely thanks to misinformation and disinformation that’s doused the flames of real fear and hatred that’s needed in such circumstances. It does not seem that the ordinary folk are particularly worried about the Russians nor feel disposed to send their children to fight and die on the eastern front.

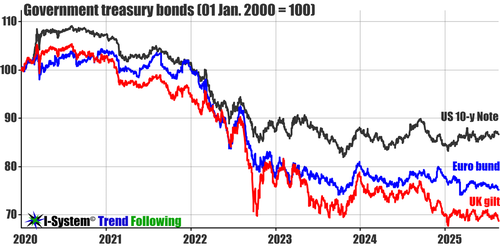

Without war, it will be hard to explain the spectacular financial and economic calamity which will soon inundate the world, especially the old continent. The one indicator suggesting that the placid sailing through the eye of the storm could soon be over are the European bonds:

Gilt’s daily chart looks like that sailing through the eye of the storm - steady as she goes… But as the larger context shows, it is just dead-cat bouncing off the lows established at the end of the 2021/22 bonds Armageddon, clearly pressured to break through them. The Euro bund looks like it’s circling only slightly farther from the drain and only the US seems to be in a substantially better state:

As anticipated, the UK will be the first domino to fall.

These developments appear to be corroborating the hypotheses I’ve published here in the past and which I believe still represent one of the most powerful investable hypotheses anywhere in the markets today. In fact, I put together the Key Markets portfolio exactly in order to provide a relevant navigation guide for these developments which now seem imminent.

For further context, my earlier articles, focused on Britain are linked below:

“The coming collapse of Britain” (August 2024)

“The fall of Britain (part 2)” (January 2025)

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass reports which cover over 200 financial and commodities markets. One-month test drive is always free of charge. To learn more about TrendCompass reports please check our main TrendCompass web page. To start your trial subscription, drop us an email at TrendCompass@ISystem-TF.com, or:

Check out TrendCompass report on Substack, providing daily trend following signals for 18 key global markets, including US, UK and EU treasureis, Bitcoin and gold, for under $1/day!

For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. Further information is at this link