How To Lose $400 Billion In AI

Submitted by QTR's Fringe Finance

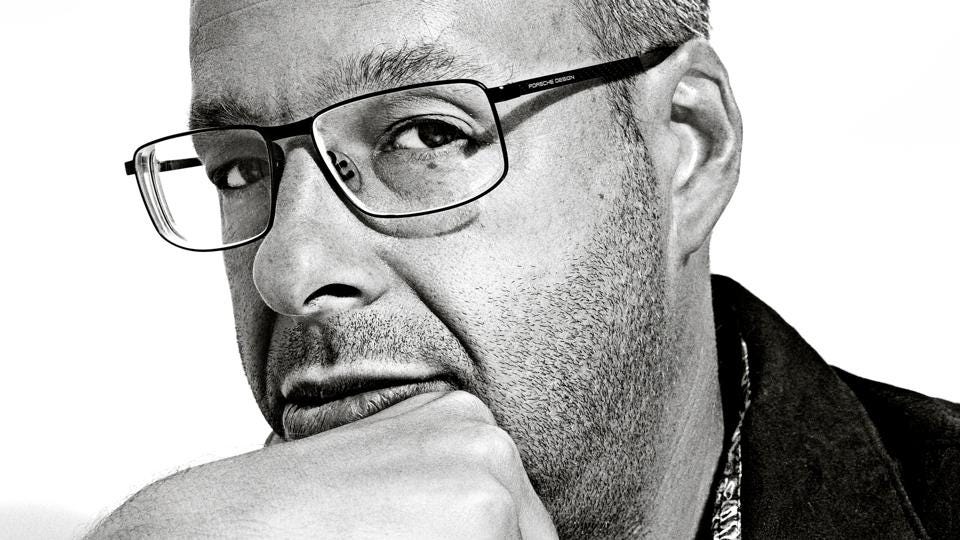

I’ve long admired Harris Kupperman, the founder of Praetorian Capital, for his ability to cut through noise and spot big-picture themes before they become consensus.

He has a knack for finding opportunities where others aren’t looking, blending a sharp macro perspective with a pragmatic investor’s mindset.

Whenever I come across his work, I find myself challenged to think differently, and this latest piece is no exception.

Photo: Forbes

In his latest, he makes his case for why the AI revolution may just be a rerun. I know my subscribers will benefit from his perspective and wanted to share it with you all this morning.

Global Crossing Is Reborn…

I’ve been at this investing game a long time. Long enough to see cycles repeat themselves, cycles that I literally thought I would never again see. Yet in finance, everything repeats. You just need to keep your discipline and recognize things for what they are.

Let’s take a step back and start with a bit of a disclaimer. I’m an old-school investor. If you called me a boomer in my mentality, I wouldn’t really disagree. I still believe that things like cash flow and return on capital matter. In fact, they’re my north star. As a result, I often miss new trends, as I refuse to pay up for profitless prosperity. Sometimes, a hyper-growth company amazes me when it actually grows into its valuation, though that’s rarer than you’d think. Usually, cash flow is king, ROIC is the queen and everything else is simply stock promotion. Hence, my strong sense of skepticism towards anything new.

With that in mind, I’ve watched as AI went from an interesting parlor trick for making memes, to something that’s increasingly integrated into my daily workflow. I use it a lot and get huge value from it. I am not here to belittle AI, it’s the future, and I recognize that we’re just scratching the surface in terms of what it can do. I recognize all of this. I also recognize massive capital misallocation when I see it. I recognize an insanity bubble, and I recognize hubris.

I’m going to use a bunch of numbers here that I believe to be directionally correct, I’ve spoken with industry players who have somewhat confirmed these numbers. I fully expect that other industry insiders will quibble with these numbers, but if I feared criticism, then this blog would be no fun.

Let’s start with total datacenter spend for 2025. Insiders think it’s going to clock in at around $400 billion. If it misses that figure, it’s only because of bottlenecks that slow buildouts. Of course, it could also exceed that number, as those who are spending on these datacenters are beyond desperate to get them operational. For the sake of this piece, let’s use the $400 billion number, though it is likely a bit higher than...(READ THIS FULL ARTICLE HERE).

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

HARRIS’ DISCLAIMER: Information or statements provided in this blog (“Communication”) are opinions of the author and may not represent the opinions of Praetorian PR LLC or its affiliates (collectively, referred to as “Praetorian”). Furthermore, the information is for educational and entertainment purposes only and does not represent investment advice. No information is warranted by Praetorian as to completeness or accuracy, expressed or implied, and Praetorian assumes no obligation to update or revise such information if the information becomes inaccurate or obsolete. Certain information may be based on third party sources and, although believed to be reliable at the time of publication, has not been independently verified and Praetorian is not responsible for third-party errors.

The investments discussed herein are not meant to be indicative or reflective of the portfolio managed by Praetorian but rather meant to exemplify the execution of certain aspects of the investment strategy of the author or Praetorian. While these examples may reflect successful trading, not all trades are successful and profitable. As such, the examples contained herein should not be viewed as representative of all trades made by Praetorian or the author. Nothing set forth herein shall constitute an offer to sell, or a solicitation of an offer to purchase, any securities.

External links, if any, may re-direct you to a privately-owned web page or site (“site”) created, operated and maintained by a third-party, which may not be affiliated with Praetorian. The views and opinions expressed on the site, other than those presented by Praetorian, are solely those of the author of the site and should not be attributed to Praetorian. We have not verified the information and opinions found on the site, nor do we make any representations as to its accuracy and completeness as to the third-party information. Further, Praetorian does not endorse any of the third-party’s products and services, or its privacy and security policies, which may differ from ours. We recommend that you review the third-party’s policies, terms, and conditions to fully understand what information may be collected and maintained as a result of your visit to this web site.