Intel: The Next Solyndra?

Is Intel The New Solyndra?

Today's guest post, by our friend David Janello, PhD, CFA, addresses that question.

Dr. Janello is the founder of SpreadHunter, and the author of The Nuclear Option: Trading To Win With Options Momentum Strategies.

Before we get to Dr. Janello's post, two quick programming notes.

- We've got another attractive trade set up for today, where we we use expensive options on an AI stock to our advantage, collecting a premium while we wait for a potential ~150% gain. If you want a heads up when we place it, you can subscribe to our trading Substack/occasional email list below.

- If you want to hedge market risk here, as the Goldman Sachs options desk suggests, you can use the Portfolio Armor website or iPhone app to scan for the optimal ones given your risk tolerance and time frame.

Now on to Dr. Janello's post.

Authored by David Janello at The Nuclear Option

The Next Solyndra Trade

Revenge of Jerry Sanders III

The big news hitting the wires yesterday was that legendary investor The United States Treasury was contemplating an equity investment in a Major US Chipmaker, with the goal of bringing factories back to the United States and saving jobs. The Chipmaker promptly rallied 7% on the news.

Many younger readers missed out on seeing some of our earlier US Government investments, mainly because they weren’t born yet and also, that many of these embarrassing investments were memory holed by journalists, historians, and Internet Gatekeepers. As a refresher course here is a video of what your parent’s and grandparent’s Taxpayer Dollars were invested in. Here is more recent and much trendier example.

Disclosure: Unlike Most Investments, Whenever the US Government Is Involved, Past Performance DOES Indicate Future Results. Hint: It Usually Isn’t Good.

And if the US Government had a tough time in the relatively laid back auto business, where its Corinthian Leather Investment promptly went into bankruptcy and was later acquired by the Germans, wait till you see what happens when .Gov tries to play the semi-conductor game. Let alone the even more ruthless semiconductor manufacturing game.

Time out for a lesson from Lisa Su’s distinguished predecessor and co-founder at Advanced Micro Devices, Jerry Sanders III. Or as the technology tabloids of the 1980s and 1990s called him, Jerry Sanders !!!.

Here is what Sanders said about the chip business:

“Designing microprocessors is like playing Russian roulette. You put a gun to your head, pull the trigger, and find out four years later if you blew your brains out.”

Note to fact checkers: Brylcream Bob Palmer from Digital Equipment Corp. did NOT say this quote. It was Sanders all the way.

Sanders' key point is that there is a four year cycle that is required to bring semiconductors from the design phase, test and tape out phase, and then to market. If you make a mistake, it takes a minimum of four years and tens of billions of dollars in capital equipment to correct it.

Unfortunately for semiconductor equipment manufacturers who make mistakes, their customers are on a one year budgeting and purchasing cycle. There is enormous pressure to upgrade servers based on electricity cost alone: a more efficient server can pay for its purchase cost very quickly compared to an older server that guzzles energy. That is why dumpsters at data centers are filled with rack mount servers. The older gas guzzlers (er, electricity guzzlers in this case) cost more to keep alive than it is to junk them and replace them with newer, more energy efficient units.

Unfortunately for the Chip Company that the US Government is contemplating an investment in, it is locked into one or two generations of inefficient server designs that are about to go in the dumpster. And the replacements are not as energy efficient as its #1 Competitor. Which explains the big smile on Mr. Sanders in the picture above. He saw it coming.

What is the best way to trade this situation?

Clearly, the big risk for bearish speculators is that the stock in question (Intel Corp. symbol INTC) will pop again if the US Government follows through on its promised investment. There is also not unreasonable chance that the US Government will flake, which is becoming the unofficial default option on most domestic and foreign policy issues.

The rough guide to betting againt Intel is to put a small position on now and make a big profit if the US Government changes its mind. And if the investment comes through as promised, put on the much bigger position then.

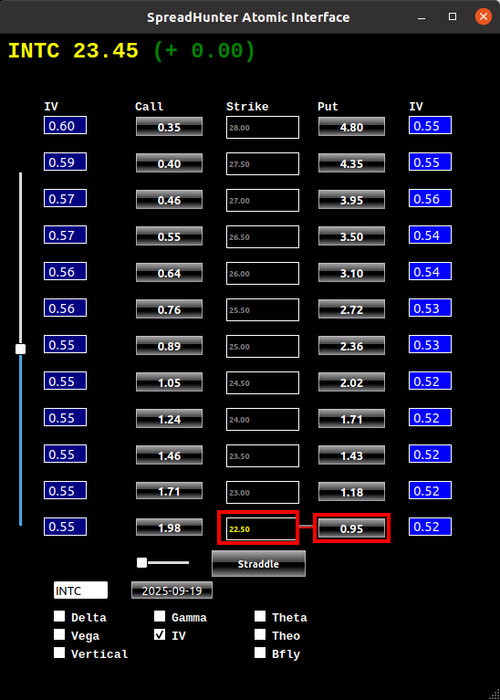

Here is the SpreadHunter Matrix for INTC on the Sept 19 expiration, with Implied Volatility highlighted. Note how the OTM calls are quoted at higher implied volatility than the puts.

When I started this article I bought the 23.00 Strike Puts expiring Sept 19 for 1.08, they are up a bit since then so the 22.50 strike looks like a better choice now.

If you are long AMD stock and want to hold on for the long run, consider cross hedging with INTC puts and put vertical spreads as well as short call verticals and short calls directly against AMD stock.

Disclaimer : All Content on the Nuclear Option Substack is for Education and Information Purposes only. It does not a soliciatation or recommendation to buy or sell any security. Before trading, consult with your Professional Financial Advisor and read the booklet Characteristics and Risks of Standardized Options Contracts, available from the Options Clearing Corporation.