The Wise Invest Where Royalty Flows

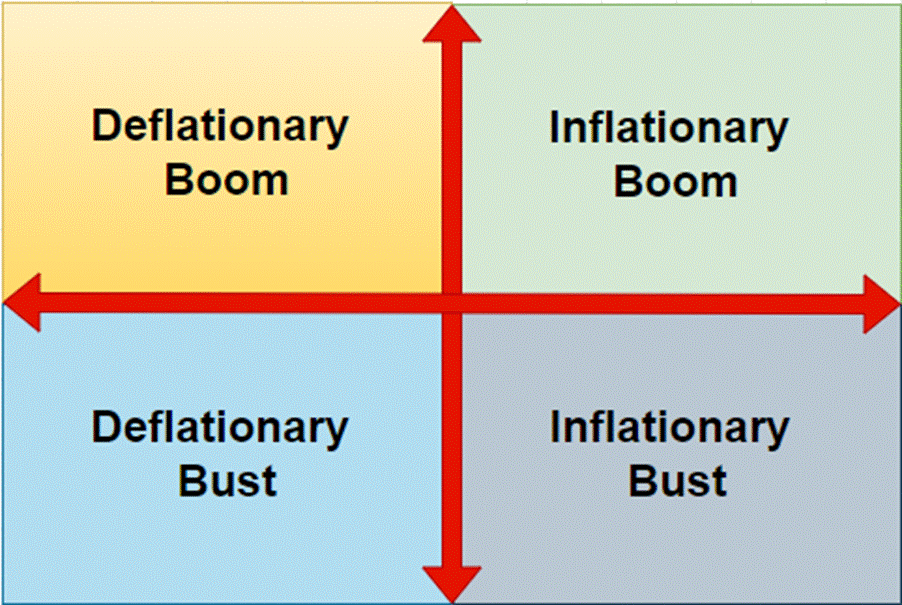

Investors attuned to the business cycle know it has four “seasons.” Spring follows a deflationary bust, with rate cuts and fiscal rescue igniting disinflationary growth—growth stocks bloom here. Summer brings the heat: inflation climbs, and cyclicals, commodities, and emerging markets take the spotlight. Then comes the dreary autumn of stagflation, where almost everything wilts—except gold and cold, hard cash. Finally, the icy winter recession arrives, inflation recedes, and long-term Treasuries enjoy their fleeting reign as the market’s unlikely heroes.

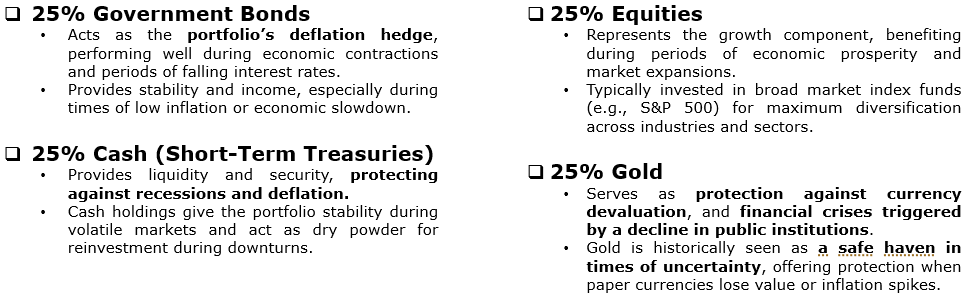

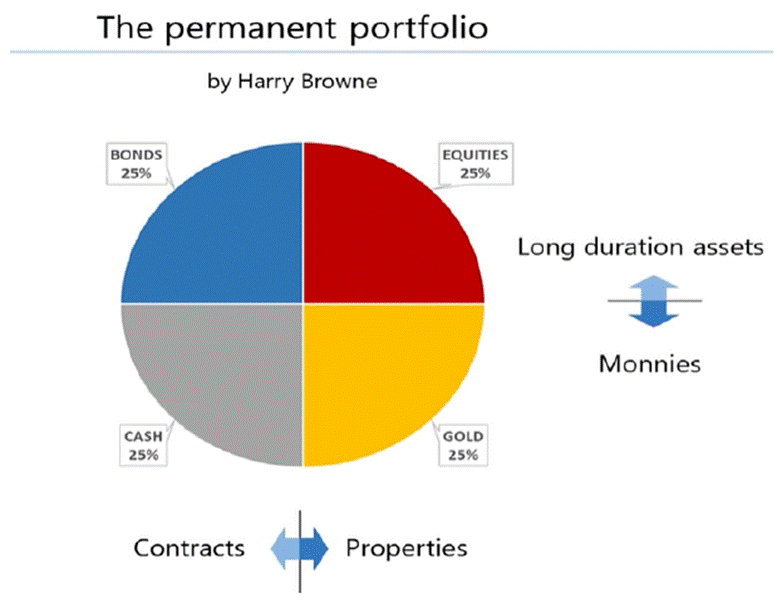

Economist Harry Browne’s Permanent Portfolio offers a conservative, set-and-forget strategy built to weather all economic climates—whether sunny with growth, stormy with inflation, icy with deflation, or bleak with recession. By spreading capital across assets that shine in different conditions, the portfolio aims to deliver steady returns while sidestepping catastrophic losses. It suits investors who value low drama—capital preservation, modest growth, and minimal tinkering—over the thrills (and spills) of constant rebalancing.

Financial assets fall into two camps: contracts, such as bonds, which promise future payments, and properties, such as stocks, which represent ownership claims. Both categories can span time horizons—long-duration (government bonds, equities) or short-duration (cash, gold). Put together, the so-called “forever portfolio” neatly divides into four quadrants: contracts vs. properties on one axis, short vs. long duration on the other. Think of it as portfolio geometry—finance with a Cartesian twist.

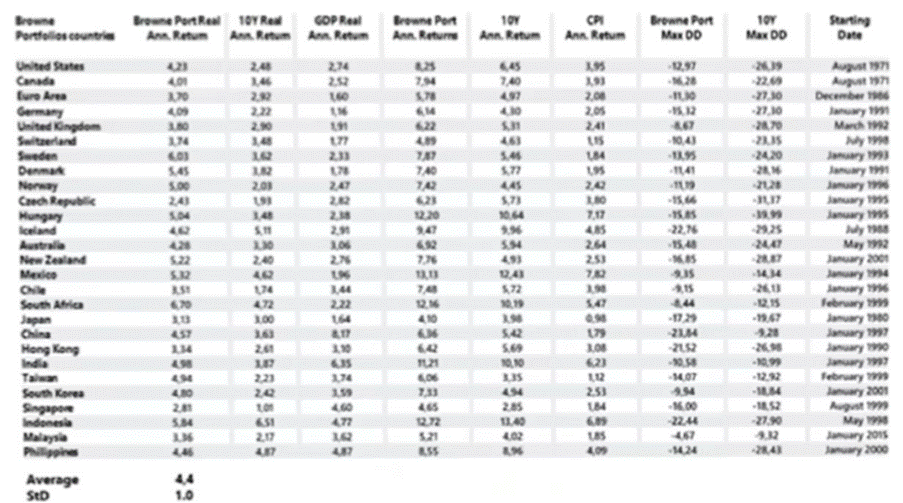

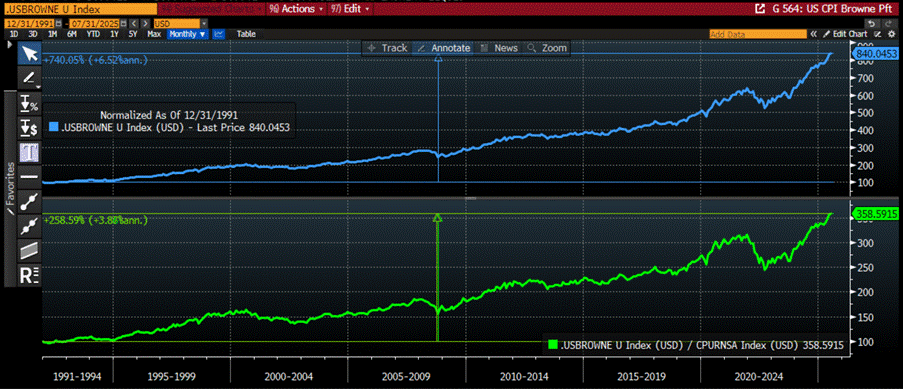

Browne’s Permanent Portfolio delivered a steady 3–4% annual real return across currencies, with volatility so low it made even double-digit drawdowns virtually extinct—a rare case of finance behaving like a sedative rather than a stimulant.

Gavekal Research

For American investors, Browne’s Portfolio has quietly cranked out 6.5% a year in nominal terms over the past 35 years. Adjust for the government’s favourite magic trick—the “CP-Lie”—and you’re left with about 3.9%. Not flashy, but unlike most Wall Street darlings, it won’t give you a heart attack every other cycle.

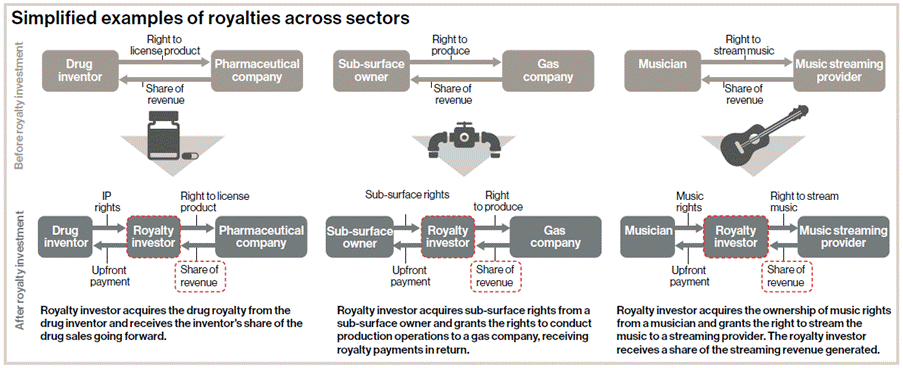

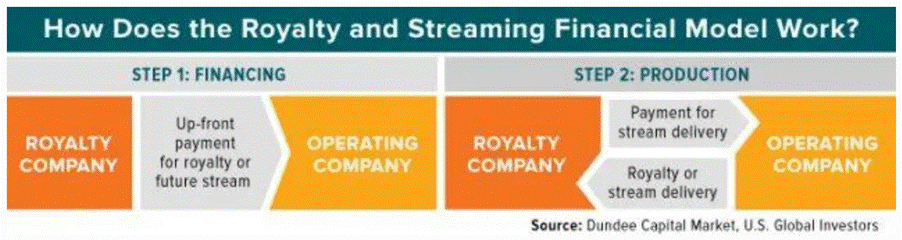

Among equities, royalty companies are the oddballs that investors secretly love. Instead of lending money or taking equity, they hand over cash in exchange for a slice of future revenues—like a financial version of “I’ll take 5% of whatever you make, forever.” Companies get funding without debt shackles or shareholder dilution, while investors get returns tied directly to performance. Popular in mining, pharma, and tech, these deals can run decades—or, in the case of perpetual royalties, until the end of time (or at least the business).

Royalty started as a king’s polite way of saying, “Give me a cut of whatever you dig, grow, or write,” evolved through medieval miners and Renaissance authors begrudgingly handing over a slice, and eventually got a corporate makeover. Today, royalty companies let investors collect a steady stream of cash from everything from gold mines to drug patents—basically making money off other people’s work while wearing a suit instead of a crown.

Royalty financing is basically venturing capital without the drama and debt without the handcuffs. A company gets an upfront “advance,” and in return, investors skim a percentage of future revenues—like financial royalties every time the cash register rings. Entrepreneurs love it because they keep their equity (and egos), avoid securities-law paperwork, and don’t owe fixed payments. Investors love it because the returns rise with sales: slow and steady might net 11%, but if the company booms, it can shoot past 20%. In short, it’s capitalism’s version of “have your cake, and give me a slice every month.”

At its core, a royalty investment is like collecting a toll every time someone uses an asset—whether it’s a patent, a hit song, or a gold mine. Investors can buy existing royalties or “create” them by funding an operator in exchange for a cut of future revenues. The beauty? Investors earn cash based on sales, not the headaches of running the business—no pesky OPEX, CAPEX, or margin worries. Because royalties track revenue rather than profits, they often behave differently from traditional markets, providing steady, predictable cashflows, inflation protection, and low correlation to bonds and even traditional stocks. In short, it’s a way to sip steadily from an asset’s income stream, with upside optional but never mandatory.

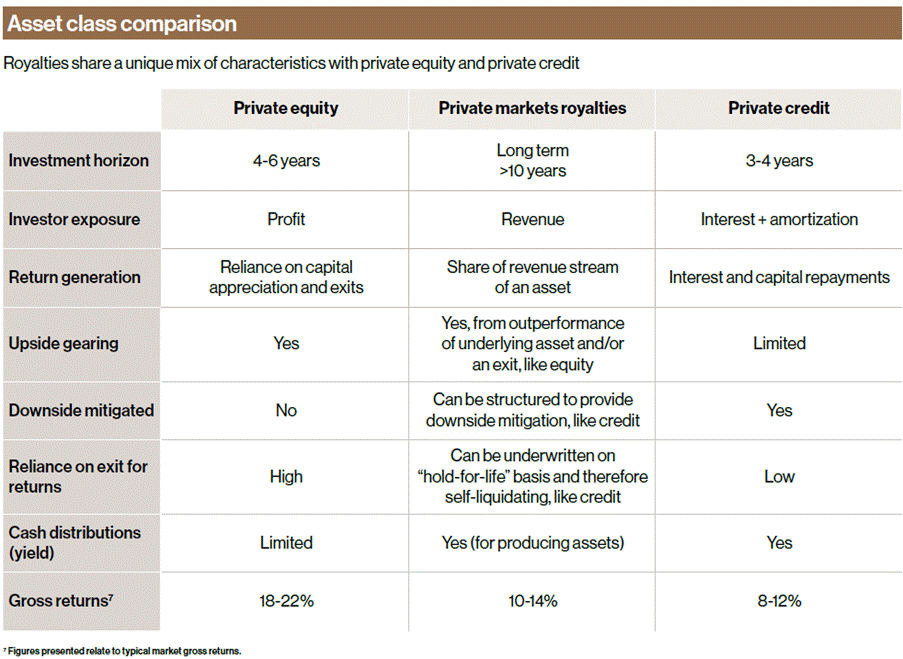

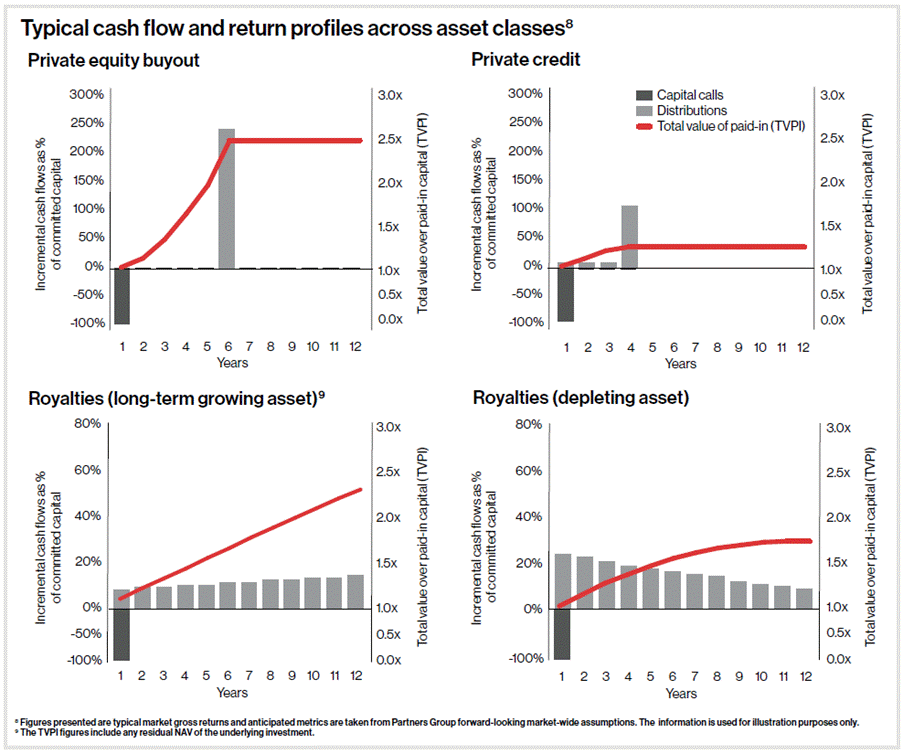

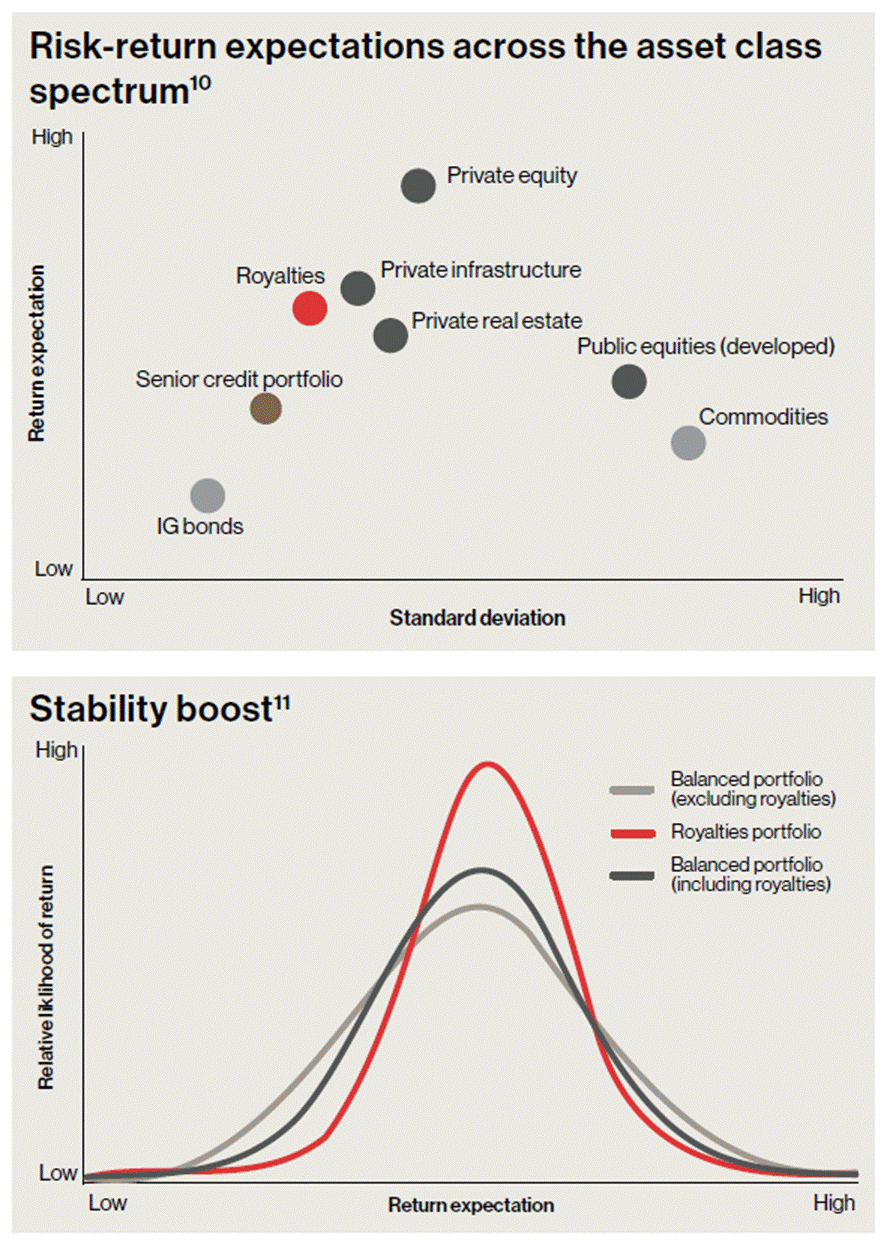

Royalty valuations are usually done via a discounted cashflow (DCF) approach, projecting revenues over the asset’s life—until a patent expires or a mine run dry. Discount rates reflect both market and idiosyncratic risks, and valuations are cross-checked against comparable transactions, much like credit or real assets, but with different weighting. Long-dated royalties favour swap rates aligned to the investment horizon rather than short-term volatility, giving clarity similar to private credit. Unlike credit, however, royalties offer upside tied to asset performance, putting their risk-return profile somewhere between private credit and private equity. Investors start earning cash from day one, boosting the multiple on invested capital, with potential for long-term NAV growth for assets like music catalogues or sub-surface rights. Compared to typical private equity, which often waits years for value realization, royalties deliver steady income while still capturing upside, making them a hybrid of yield and growth.

Like any investment, royalties come with risks. Sector-specific factors—regulatory changes, technological disruption, or shifting consumer tastes—can affect performance, as can counterparty, legal, and diversification risks. At the asset level, operational hiccups, leadership changes, or unexpected impairments may impact returns. While no investment is risk-free, mechanisms like step-up/step-down structures, make-whole payments, and hedging strategies can help protect investors. Timing also matters: the stage of an asset’s lifecycle shapes its risk profile. Careful due diligence, favourable contract terms, and diversified exposure across sectors and assets are key to keeping these risks in check—so your royalties behave more like a steady stream than a surprise waterfall.

When considering royalties, investors should align their allocation with their risk-return preferences. Those seeking capital protection and steady yield will find royalties increasingly attractive, while return-hungry investors may find them too tame. Before running portfolio optimization models, it’s important to understand the unique benefits royalties bring—such as non-cyclical cashflows from sectors like music streaming. Diversifying across multiple royalty industries can help dampen exposure to market swings. Incorporating royalties into a balanced portfolio can improve its overall risk-return profile, making steady income feel a bit less boring and a lot more strategic.

Royalty companies started with gold and silver, but they’ve since gone on a world tour. In energy, firms like Texas Pacific Land and PrairieSky just sit back while oil and gas producers do the dirty work and send them checks. In music, Hipgnosis and Round Hill scoop up catalogues and get paid every time someone blasts a hit on Spotify or at karaoke. Pharma got in on the act too—Royalty Pharma fronts cash to drugmakers and then collects a slice of blockbuster revenues, no lab coat required. Even tech and consumer brands play the game, turning patents and trademarks into rent checks.

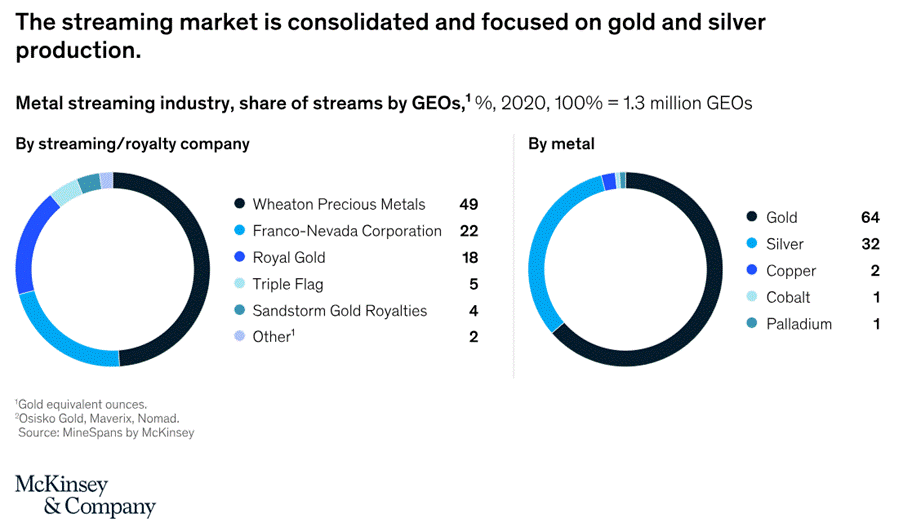

Royalty and streaming companies occupy a unique niche in the commodities sector, acting more like financiers than traditional miners. Instead of running mines, they provide upfront capital to operators in exchange for a share of future revenues (royalties) or the right to purchase production at a fixed, often discounted, price (streams). This approach lets them stay lean, avoid operational, environmental, and labour risks, and still benefit from rising commodity prices. Diversification across multiple mines, operators, and jurisdictions further smooths project-specific risks, while top-line revenue collection generates high-margin, scalable cash flows with minimal additional investment. Notable leaders—Franco-Nevada, Wheaton Precious Metals, and Royal Gold—have compounded returns over decades, making royalty companies a strategic core for long-term commodity-focused portfolios.

Relative Performance of Franco Nevada (FNV US) to Van Eck Gold Miners ETF (GDX US) between December 31st 2007 and July 31st, 2025.

Streaming deals typically involve specific commodities from a particular project, with the investor paying upfront and receiving the product at a discounted price. Royalty deals are commodity-agnostic, paying a percentage of total project revenue in cash. While streaming is settled physically, royalties are cash-based.

Since the 1980s, mining royalties and streams have grown steadily—from $2.1 billion in 2010 to over $15 billion in 2019—accelerating as traditional capital markets became less favourable. For mining companies, streaming-and-royalty deals offer advantages over debt and equity: flexible, long-dated payments without cash obligations or covenants, minimal dilution, and no ownership changes, making them ideal for funding growth, M&A, or debt reduction. Typically, large and mid-cap miners use these deals to improve leverage, while juniors use them to finance specific projects. Precious metals dominate—gold and silver account for over 90% of streamed volumes—but interest in other commodities is rising.

Streaming and royalty companies have carved out a compelling niche for investors seeking commodity exposure with lower risk. Streamers offer leverage to commodity prices while locking in predetermined delivery payments, providing cost predictability and contractually defined per-unit costs—protecting them from overruns. They also enjoy exploration upside at minimal cost and access to broad, diversified asset bases, generating sustainable cash flows and dividends. While competition or greater access to capital could challenge future returns, the space still represents only a small fraction of total mining financing—around 1–3% of debt and equity —with streaming covering roughly 14% of gold by-products and under 6% of silver by-products. Expansion into other high-demand metals like cobalt and nickel, plus untapped regions such as Australia, Southeast Asia, and Africa, points to significant growth potential.

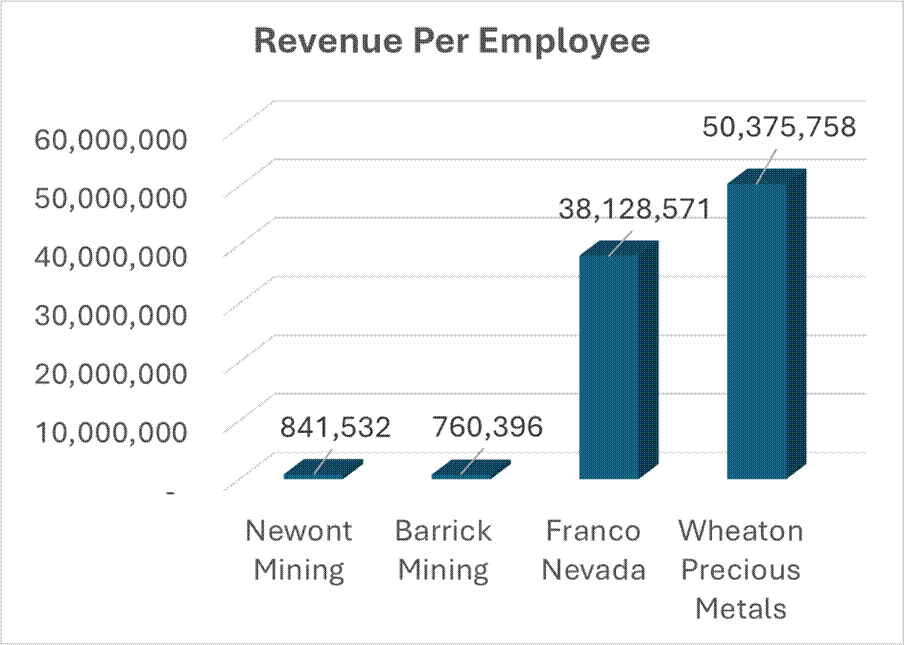

Royalty companies consistently punch above their weight by capturing production economics without operational risks. Mining royalty firms collect payments tied to ounces produced or revenue generated, avoiding capex, labour, or energy volatility. The same logic applies in energy, music, pharmaceuticals, and technology: royalties generate predictable income while operators bear operational burdens. This model delivers asymmetric upside with limited downside, embedded diversification, steady income, inflation protection, and leveraged exposure to sector growth—essentially a hybrid of private credit and equity. Their light, capital-efficient business model shines in capital-intensive sectors. For instance, Wheaton Precious Metals employs only ~33 people but generates more than $1.2 billion of revenue in 2024. On the other hand, Newmont has 22,200 employees for a 2024 revenue of $18.6 billion, illustrating just how efficient royalties can be at converting capital into cash flow.

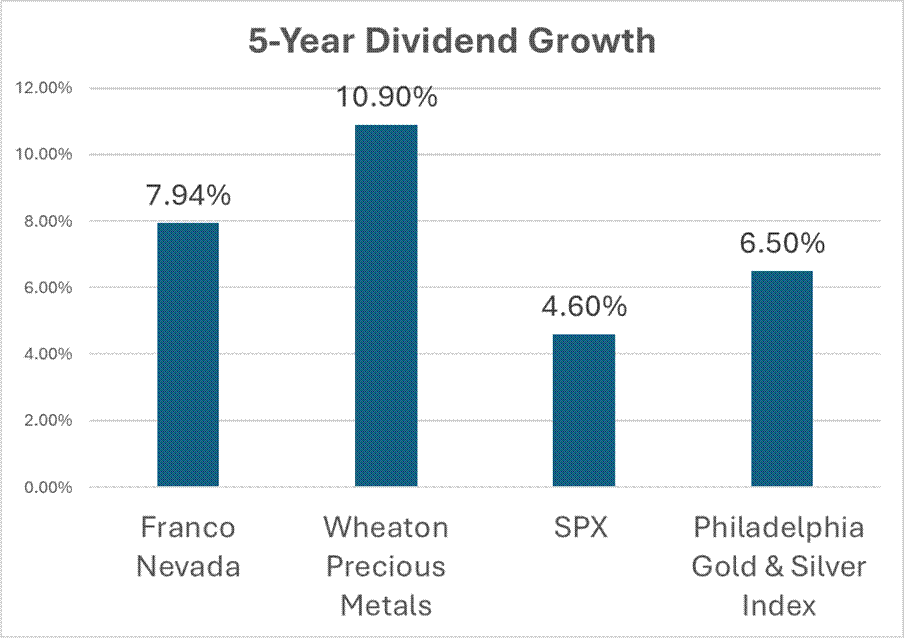

Dividends are like a company’s love letters to investors—proof that there’s real cash in the bank and not just fancy PowerPoint slides. And when those dividends keep growing? That’s basically roses and champagne. Over the past five years, royalty giants like Franco-Nevada and Wheaton Precious Metals have been writing love notes with 8% to 11% annual growth, while the S&P 500 only managed a modest 4.6%. Even the Philadelphia Gold & Silver Index squeaked out 6.5%. The message is clear: royalties know how to treat their shareholders, while miners… well, they’re still figuring out if it’s a boom or bust kind of date.

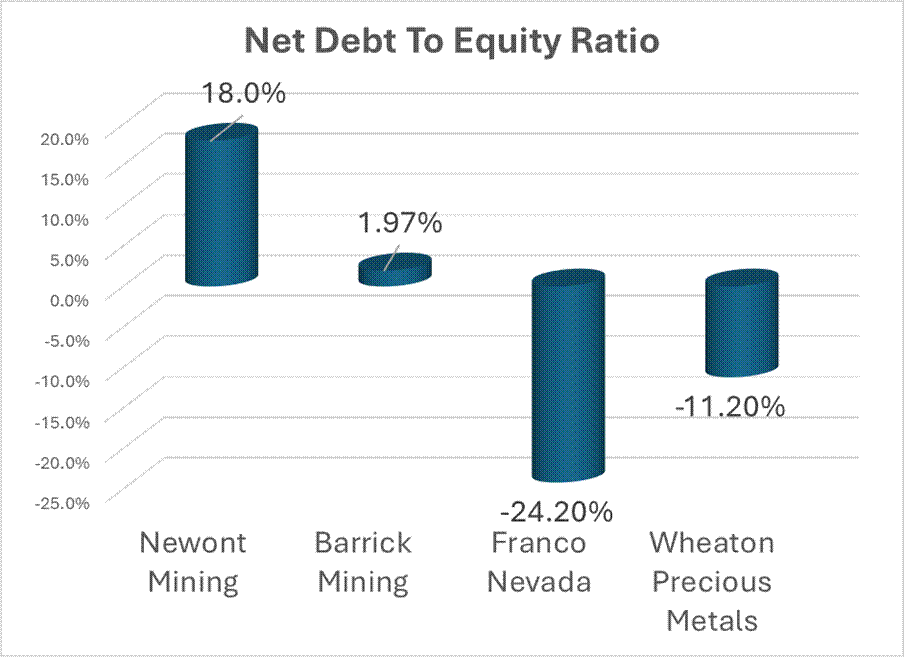

Royalty companies know how to handle money better than most gold miners. Take Newmont—still lugging around a 20% debt-to-equity ratio, even after riding gold’s record highs quarter after quarter. Barrick, to its credit, is basically net cash. But royalty firms? They’re the straight-A students of capital discipline—Franco-Nevada doesn’t even acknowledge debt exists. Miners look like they’re juggling bills, while royalty companies are the ones who clear their Amex balance before the statement even hits. Small wonder investors can’t help but admire them.

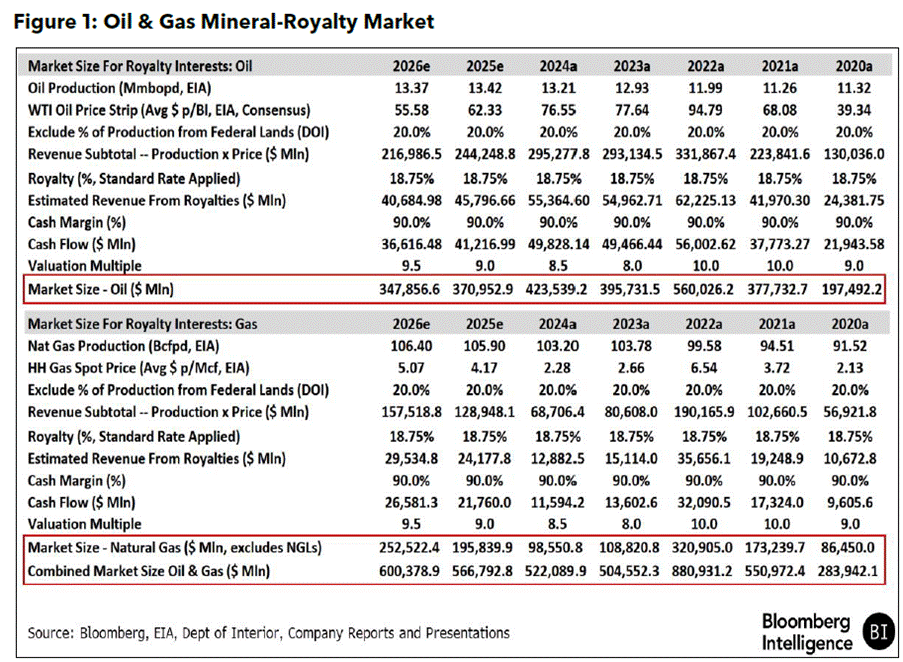

The oil-and-gas royalty space is especially juicy: a $600 billion market, with only $42 billion tied up in public names like Black Stone, Kimbell, and Texas Pacific Land. That leaves half a trillion in private hands, waiting for consolidation. With rates lower, tax breaks flowing, and trillions in “dry powder” sloshing around, it’s like Wall Street just discovered a treasure chest buried under Midland.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/the-wise-invest-where-royalty-flo…

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Mineral-royalty companies play it safer than drillers. They barely touch federal land, don’t live off quirky tax perks like intangible drilling costs, and generally dodge the political whiplash that E&Ps face. The recent Viper-Sitio tie-up shows how royalty aggregators thrive in a market that’s still scattered among mom-and-pop landowners. The catch? Grandma doesn’t always want to sell the family acreage. Still, barriers to entry are low, and private equity sharks are circling with plenty of cash. The juiciest prizes? Oil-rich Texas acres and Haynesville gas assets, where the economics shine brightest.