Authored by GoldFix ZH Edit

The recent decision to add silver to the U.S. critical minerals list marks an important shift in how policymakers view the metal. Quoting the Dept of Interior Press release:

The 2025 draft list includes 54 mineral commodities, of which 50 were included based on the results of the economic effects assessment, zirconium was included because of the potential for a single point of failure within the domestic supply chain and three were retained based on a qualitative evaluation. Potash, silicon, copper, silver, rhenium and lead were recommended for inclusion to the list and arsenic and tellurium were recommended for removal.- Source

The designation signals that silver is no longer treated as a simple commodity but as an asset tied to industrial capacity, technological development, and national security. Analysts and policymakers alike emphasize that this recognition places silver in the same category of strategic concern as lithium, uranium, and rare earths.

“Designation of a mineral as critical is bullish because it highlights essential demand, reveals insecure supply, and creates a government-backed floor for consumption.”

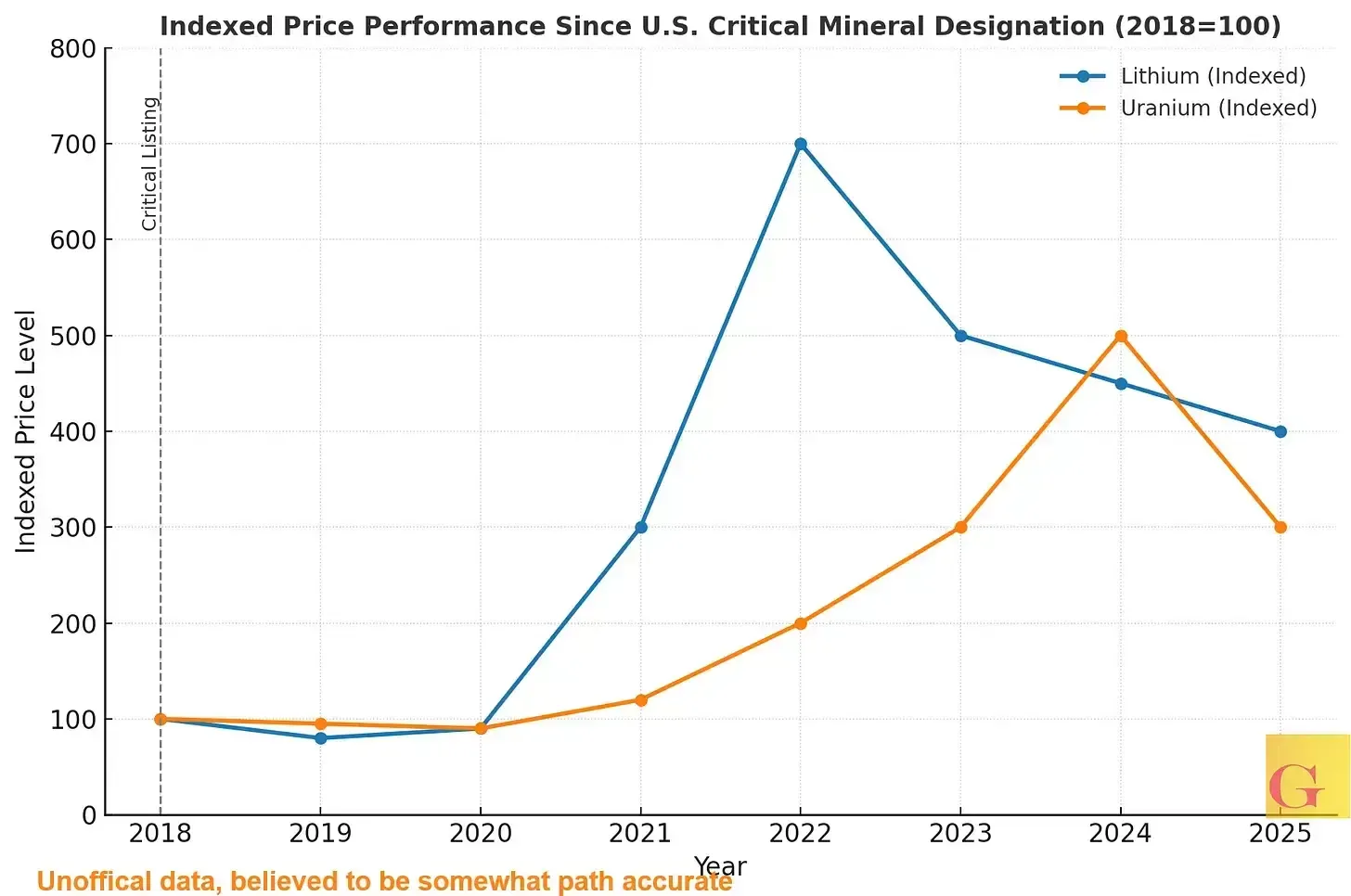

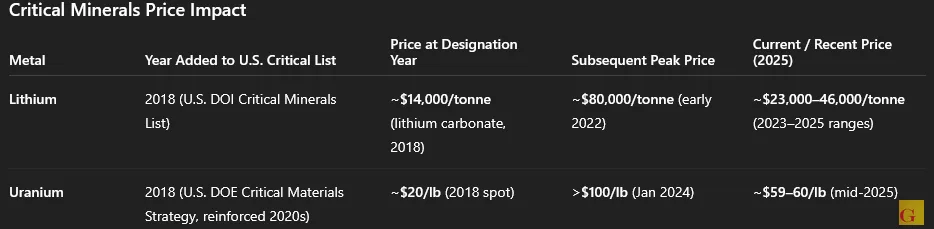

Lessons from Lithium and Uranium

The lithium market provides a clear and very favorable example of how critical designation can lead to higher prices. After the U.S. listed lithium in 2018, automakers and investors rushed to secure access. Supply did increase, but the lag time for new mines allowed demand to run ahead, driving prices from under $10,000 per ton in 2020 to over $70,000 per ton by 2022.

Pic: captures relative trajectories without locking into precise monthly price data.

Uranium illustrates a similar pattern. U.S. efforts to secure non-Russian supply, coupled with the announcement of a strategic uranium reserve, triggered stockpiling and investment. Uranium prices climbed from ~$20/lb in 2018 to over $100/lb in 2024. In both cases, recognition of criticality spurred immediate financial and industrial demand while new supply lagged.

Silver’s Dual Role in Industry and Security

Silver is unique in that it straddles both industrial and monetary roles. It is a key input for solar panels, electronics, and defense technologies, while also functioning as a quasi-monetary metal historically tied to financial reserves. This dual role amplifies the effect of critical designation: not only will manufacturers and governments secure supply for production, but investors are also likely to treat the status change as confirmation of silver’s structural importance.

Keeping in mind that Goldfix has been asserting (based on evidence and belief) that Silver is being stockpiled by China, Russia, and other nations (since the 2023 BRICS summit) using sovereign wealth funds; then witness the behavior of the Saudi sovereign wealth fund in acquiring SLV to see this manifest.

Pic: Bob Coleman, and SRS Rocco

Stockpiling and Policy Tailwinds

Critical status brings policy tools that can directly impact demand. The Defense Production Act and federal subsidies will favor domestic mining and refining. More importantly, designation makes silver eligible for strategic stockpiling. Government entities and private actors anticipating higher official demand will likely increase purchases in advance. This stockpiling dynamic has historically been a strong driver of price when applied to other critical minerals.

“Critical status often leads to synchronized buying and subsidy races, with demand realized immediately while supply expansion lags.”

Outlook for Prices

History suggests that critical listing is inherently bullish for price. The recognition of supply insecurity creates a premium, and the time required to bring new production online means the market adjusts quickly on the demand side while supply remains constrained. Silver’s critical designation places it firmly within this framework. The result is a structural case for higher prices supported by precedent in other markets, especially lithium and uranium.

Critical Mineral Analog for Silver and Copper pic.twitter.com/YewJyb6916

— VBL’s Ghost (@Sorenthek) August 26, 2025

Here are some (quite literally) back of napkin numbers composed and organized using lithium and uranium for potential price effects on Silver and Copper.

Continues here