Gold, Silver Soar as India Buys Metal, Dumps Treasuries

India Adds Gold, Cuts Treasury Bills in Forex Reserve Shift

India’s central bank has stepped up gold purchases while reducing its exposure to U.S. Treasury bills, signaling a strategy to strengthen foreign exchange reserves through diversification beyond the dollar. The shift aligns with a global trend of central banks recalibrating reserve portfolios amid geopolitical tensions and volatility in the greenback.

Recall in December 2024 Goldfix noted that India’s gold demand was inelastic to price. In that post, we used a chart to show that India purchased its gold by tonnage not by rupees spent. So they did not participate in dollar cost averaging. They bought the same amount of gold whether the price was high or low by thousands of dollars. That post is right here:

India Wants The Gold

“Since 2022, India's gold demand has not appreciably fluctuated with gold price, whereas before 2022, it fluctuated frequently and usually in line with gold price changes. This change signals inelastic demand at a higher price replacing elastic demand at different prices.” India’s Demand Turns Inelastic Goldman Sachs confirms that thesis.

From their report:

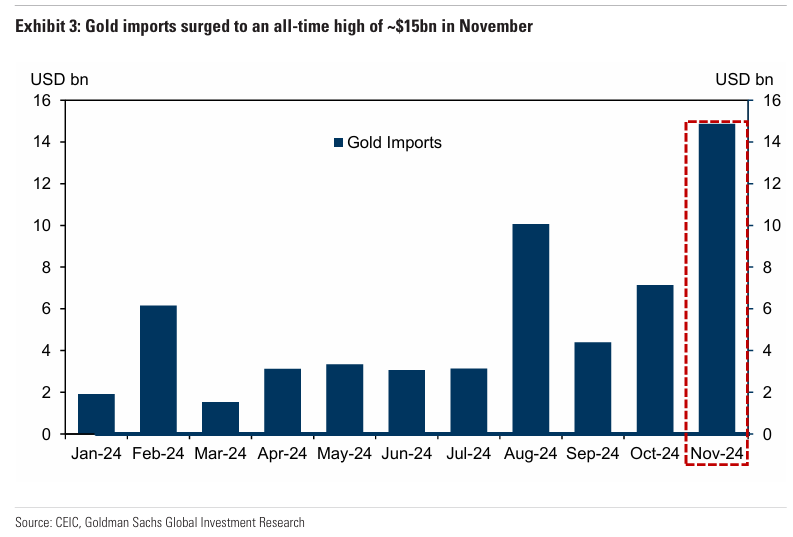

We are currently tracking gold imports at $59bn in January-November 2024, 48% yoy higher than the same period a year ago on the back of stronger than expected festive demand. [ EDIT- In July 2024, the Indian government significantly reduced import duties on gold, lowering the total customs duty from 15% to 6%.] This marked the most substantial reduction in over a decade,Read full story

In retrospect, it’s obvious now that they were spending dollars to buy gold and now are in a better more flexible position enabling them to sell treasuries. According to the Economic Times (Sangita Mehta, Sept. 1, 2025), the latest data from the U.S. Department of Treasury and the Reserve Bank of India (RBI) show India’s investments in U.S. T-bills dropped to $227 billion in June 2025, compared with $242 billion a year earlier. At the same time, gold reserves rose to 879.98 metric tonnes from 840.76 tonnes, with RBI purchasing about 39.22 tonnes over the period.

India remains among the top 20 holders of U.S. Treasury bills, ahead of Saudi Arabia and Germany, but the change in allocation underlines a clear preference for bullion. “Indian reserves have witnessed progressively a higher buildup of gold reserves which has been accompanied by diversification in forex currency assets,” said Madan Sabnavis, chief economist at Bank of Baroda.

Continues here