Brics Gold Buying Secretive (and Growing)

Topics (1700 words)

**Special Minipod Summary

Unreported Official Demand and China’s Central Role

Russian Asset-Freeze Effect

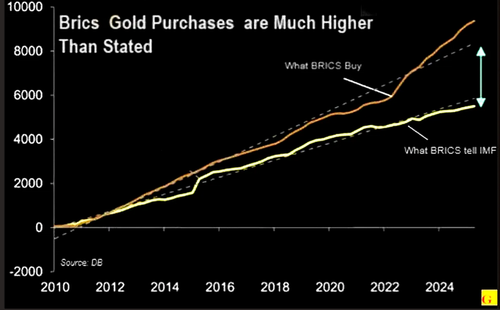

Unreported Demand is Massive

Estimating China’s Contribution

Conclusion: No slowdown yet

GoldFix Comments:

- The Irrelevance of IMF Data

- Fragmenting Hurts The Shorts Now

- Legal Rationalization as Alarm Bell

- EU CYA: A Fishy Pivot on Russia

Unreported Official Demand and China’s Central Role

Authored by GoldFix ZH Edit

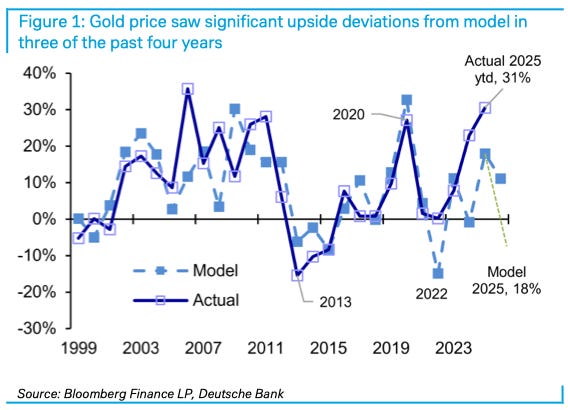

This week’s Deutsche Bank report by Michael Hsueh (h/t ZH) highlights the rising role of official gold demand in driving market performance. Gold has outperformed financial models (which are now useless in the wake of real physical demand) in three of the past four years, and the analysis attributes this to a structural increase in demand from central banks and sovereign wealth funds.

“Two-thirds of official gold demand is now unreported and cannot be linked to individual countries in the IMF data.”

Since 2020, Deutsche Bank estimates that China accounts for 78 percent of these unreported flows. The report further links the post-2022 surge in demand to the immobilization ( as opposed to confiscation, a legal distinction discussed below) of Russian central bank assets, positioning gold as a neutral reserve asset amid geopolitical risk.

Official Demand as the Key Driver

Deutsche Bank’s April upgrade to its gold price forecasts described a doubling of official demand’s share of the market since 2021. This rise has squeezed jewellery consumption while mined and recycled supply maintained balance.

(Figure 1) shows how gold prices diverged from financial models in three of the past four years. As stated here over 18 months ago in Gold the Everything Hedge: Traditional financial correlation models are no good in an environment where they want the gold. DB, GS, BOA, and JPM confirmed this earlier than most (but after us) publicly at least.

A similar dynamic was observed in 1980, when official purchases replaced net sales, pressuring jewellery demand and lifting real prices sharply. The same pattern is evident today, although recent data suggests jewellery demand is lagging its historical relationship with price.

So this explains why we should pay attention to the pace of official gold demand.

Russian Asset Freeze Effect

The link between gold demand and reserve security is emphasized. After Russia’s invasion of Ukraine, EUR 260 billion of its reserves were immobilized by the EU, US, UK, Canada, Japan, and Australia. According to the European Parliamentary Research Service:

“One of the legal bases advanced is the established doctrine of state countermeasures, permitting states lawfully to carry out measures – that would otherwise be illegal – against a state that has violated fundamental rules of international law.”

The UK Parliament noted that immobilization differs from seizure, but also warned that expropriating state assets could violate international law and bilateral treaties. Bruno Le Maire, France’s finance minister, stressed that any legal basis must be globally accepted. Russia has described the actions as a dangerous precedent, and international law expert David Kleimann cautioned:

“We go back to the law of the jungle, and that makes Western assets very much vulnerable to seizure.”

For countries outside the G7, the episode reinforced gold’s neutrality. Recent repatriations of reserves highlight this risk-averse trend (Figure 7).

Unreported Demand is Massive

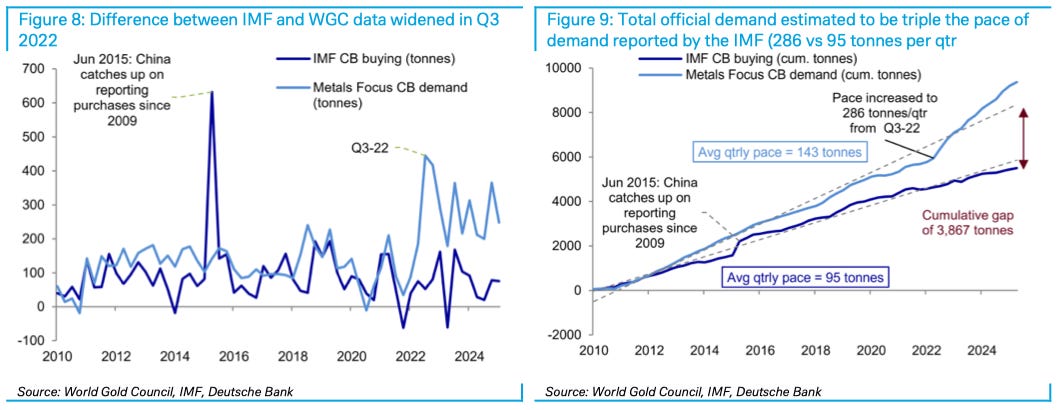

Unreported official demand is defined as the difference between IMF reserve data and World Gold Council (WGC) estimates. Since 2022 this gap has widened sharply.

Sovereign wealth fund activity and delayed central bank reporting explain much of the discrepancy. The WGC itself noted in 2024:

“The IMF IFS data only reflects 34% of our total official sector demand estimate for 2024 – down from 47% last year.”

The WGC methodology combines IMF statistics, confidential information, and trade flows. It cautions that not all reported changes represent purchases or sales, as shown in 2024 when Thailand’s reduction reflected a definitional adjustment rather than selling.

Estimating China’s Contribution

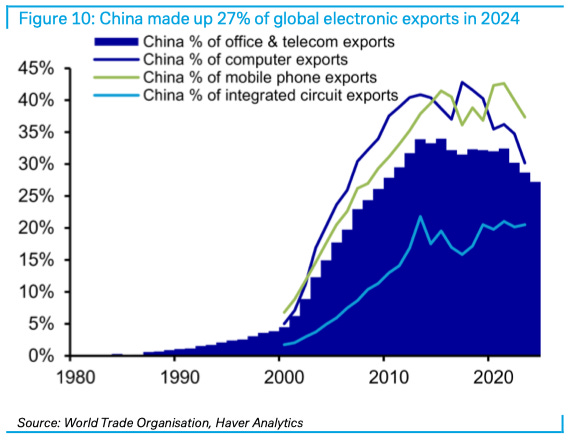

China’s role is estimated by subtracting bar, coin, jewellery, ETF, industrial, and reported official purchases from imports and domestic production. Industrial demand is approximated through China’s share of electronics exports, which account for 83 percent of global industrial gold use. In 2024, China controlled 27 percent of office and telecom exports, consistent with its 28 percent share of global manufacturing value added (Figure 10).

The remainder is labelled “other investment demand” (Figure 11 and Figure 12).

This measure aligns closely with unreported demand, though discrepancies exist:

- In 2017–2019, demand exceeded WGC estimates, likely due to private buying.

- In 2020–2021, Chinese investors sold despite expectations of steady accumulation.

- In late 2024, divergences suggest either offsetting private sales in China or increased non-China official demand.

Overall, Deutsche Bank calculates that since 2020, China explains 78 percent of unreported global demand. Regression analysis from 2017 shows that China accounts for 33 percent of quarterly variability; excluding 2017–2019, the explanatory power rises to 66 percent (Figure 13).

Continues here