Gold Hits All Time Highs..How I'm Trading The Next Leg

Submitted by QTR's Fringe Finance

If you read my blog, I’m sure you’ve already heard that gold has hit new all-time highs tonight. This, as I often joke, means that every single person who has ever recommended gold to go up in the history of forever—in nominal U.S. dollar terms—has been proven right as of this second.

Of course, I’m being a little bit hyperbolic, but what fun would it be to have a great year and crush the gold-and-silver miner trade if we can’t joke about it?

Over the weekend, I had two conversations that made me think about how I could modify my gold trade going forward. It feels like we’re at the beginning of a serious realization by global investors that the precious metals are officially in a bull market.

I’d even say we’re in the very early stages of it becoming a consensus trade—though I still think there’s significant runway left, as I discussed with Peter Schiff in my interview with him on Saturday.

On Tuesday, I plan to make a couple of moves in gold and silver that I hope will capture some additional upside as the bull market continues and potentially becomes a more mainstream story if prices hold these levels.

The first thing I’m considering

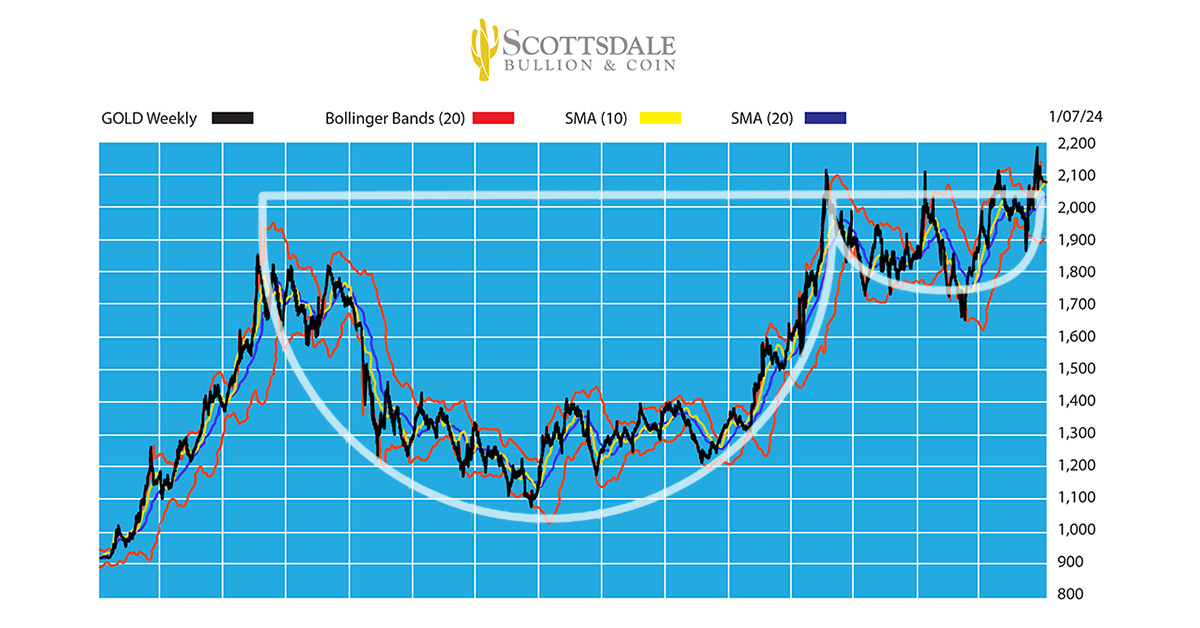

I’m thinking about adding some additional exposure to silver miners. If you look at the cup-and-handle formation forming in silver right now, it looks almost exactly like gold did a year or two ago before its breakout.

This was gold back when it was $2,100 — barely a year and a half ago. It’s up more than 50% since then.

If the technicals follow through on silver, it’s easy to make a case for silver hitting $80 relatively soon, just based on the chart.

As always, technical analysis is backward-looking—but it has a way of becoming a self-fulfilling prophecy the more people pay attention to it.

I also spoke with my good friend Larry Lepard today. We talked about how to capture some profits and possibly reposition slightly for the next leg higher. Larry suggested First Majestic Silver (AG), which another person on my Twitter spaces also suggested to me last night, which he thinks hasn’t moved enough relative to other silver miners.

My subscribers know I own SIL and Pan American Silver (PAAS) —now both near 10 year highs—but First Majestic hasn’t moved nearly as much. It could be a position I nibble on when the market opens Tuesday.

Another idea

When I spoke with Peter Schiff on Saturday, he mentioned that his fund was loaded with...(READ THIS FULL ARTICLE HERE).

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.