Borrow, Bomb, Repeat…

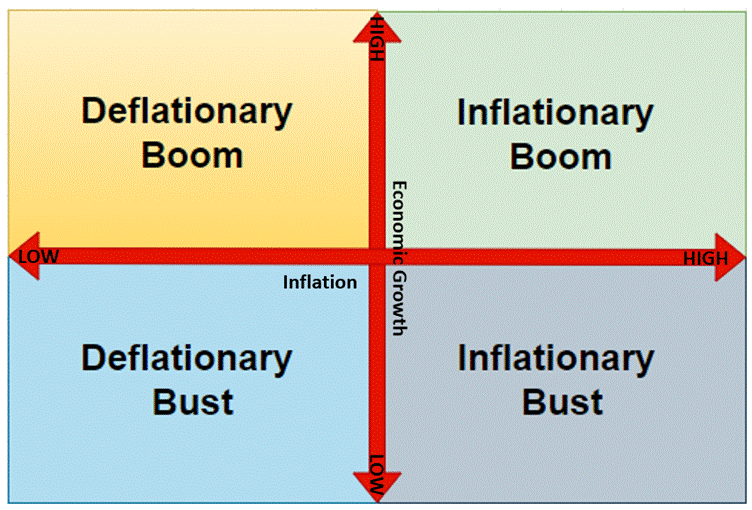

The business cycle is basically Mother Nature’s drama club. Spring is the feel-good comeback story: central bankers cut rates, politicians throw money around, and growth stocks pop up like daisies after a rainstorm. Then comes Summer, when inflation sweats through its shirt and commodities, cyclicals, and emerging markets hog the spotlight like sunburned tourists at a beach bar. By Autumn, the hangover sets in—stagflation arrives, everyone looks miserable, and the only ones still smiling are gold bugs hoarding bullions under their mattresses. Finally, Winter marches in: recession chills the air, inflation hibernates, and suddenly boring old cash get to play the hero, at least until the next act of this never-ending soap opera.

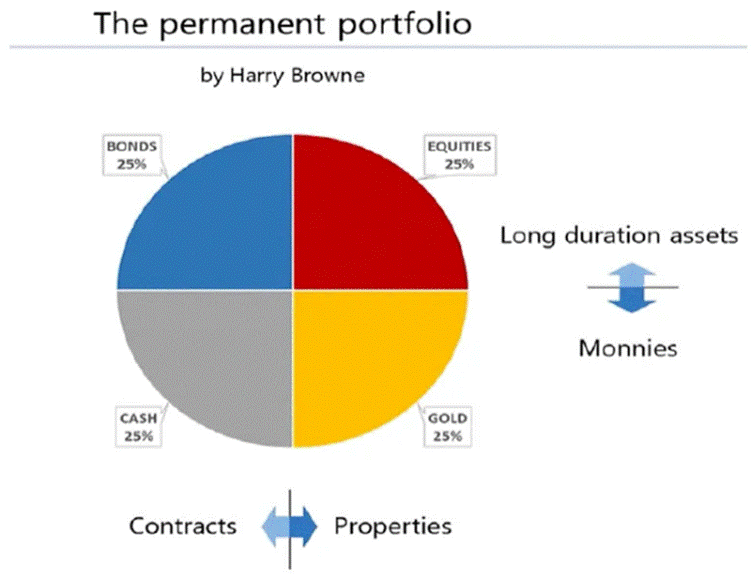

Harry Browne’s “Permanent Portfolio” is basically the financial crockpot—set it, forget it, and let it stew through any economic weather: sunny growth, stormy inflation, icy deflation, or gloomy recession. By mixing a bit of everything—stocks, bonds, cash, and gold—it aims for steady returns without the ulcer-inducing drama of day trading. Think of it as portfolio geometry: contracts vs. properties, short vs. long duration—like drawing a neat little Cartesian grid to keep your money from staging a rebellion.

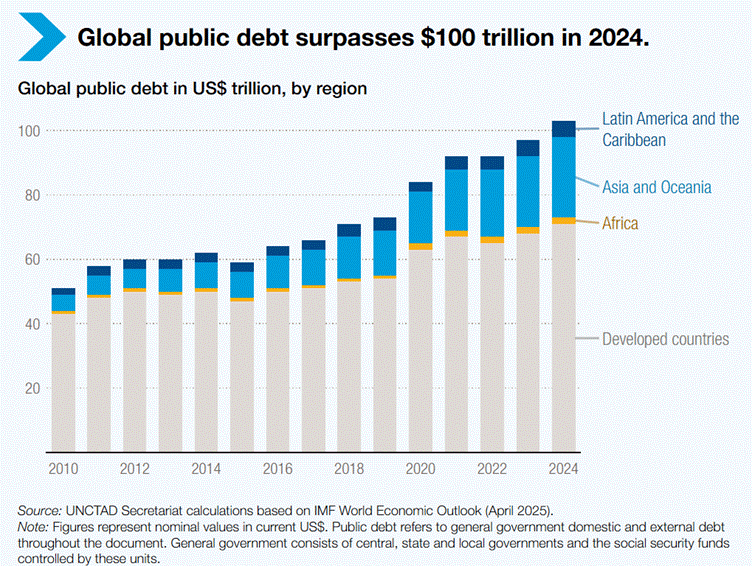

Among the four assets in Harry Browne’s Permanent Portfolio, bonds are the simplest for laymen to grasp—they’re just debt. Debt is borrowed money, whether by an individual, company, or government, with the promise to repay—usually with interest—over time. It’s a way to pull tomorrow’s resources into today, financing everything from a family home to a national war chest. Used wisely, debt is fuel for growth; abused, it’s a ball and chain that drags balance sheets into crisis.

Debt is as old as civilization itself. Long before coins or paper money, early societies relied on credit and obligation. In Mesopotamia around 3000 BC, farmers borrowed grain or silver from temples, paying it back from future harvests. To prevent collapse when debts piled too high, rulers declared “debt jubilees,” wiping the slate clean. As economies grew, debt morphed into an empire-building tool: the Greeks and Romans borrowed to fund trade and wars, medieval Europe produced moneylenders and bonds, and Renaissance cities like Venice and Amsterdam pioneered sovereign debt markets. Fast forward to today, and debt underpins nearly everything—mortgages, corporate loans, government bonds—making it not just a financial instrument, but the very scaffolding of global capitalism.

https://unctad.org/publication/world-of-debt

As summer ended and the Keynesian-funded vacationers shuffle back from their ‘congés payés’, the European political circus resumes right on cue. Brussels’ clowns keep lecturing about “fighting for democracy” in Ukraine while their own citizens can’t stand them. In France, ‘MacroLeon’—the self-styled ‘Petit Napoléon’—looks on as his lame-duck sidekick, ‘Bay-Roue De Secours,’ staggers toward yet another inevitable government collapse.

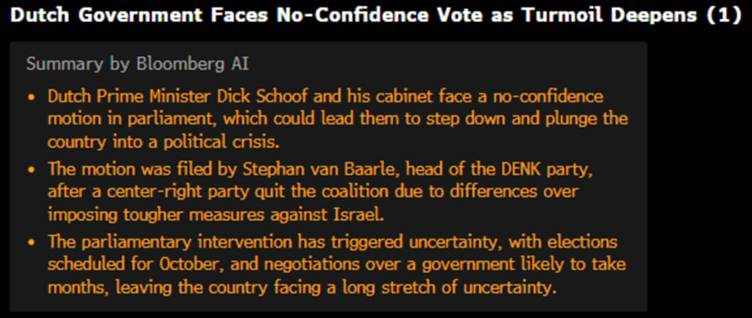

Further north, the Netherlands isn’t faring much better. After the ‘Gouda Warmonger’ traded The Hague for a cushy seat at the North Atlantic Terror Organization, the patchwork coalition he left behind is already unravelling—because even duct tape politics can’t hide a collapsing economy.

France is now batting its eyelashes at the unthinkable—an IMF bailout. Yes, the same “only for banana republics” safety net that the enlightened crowd of Wall Street geniuses swore Paris would never need. But here we are: the government wobbling toward its second implosion in under a year, the finance minister running around with his hair on fire, and bond yields climbing to their highest since 2011 as investors politely suggest they don’t believe in fairy tales about fixing a deficit that’s happily cruising toward 5.4% of GDP.

Across the Channel, the ‘Keith’ ’s Labour Keynesian ‘Prime Clown’ has managed to steer Britain straight toward an IMF begging bowl—again. With borrowing costs climbing, deficits ballooning, and debt piling up, even seasoned economists are whispering “1976 déjà vu. The ‘Keith’ ’s fiscal wizardry looks set to deliver the sequel nobody asked for: higher spending, higher taxes, and, if markets slam shut, a good old-fashioned IMF rescue. The UK economy—once mighty, now teetering like a drunk on the edge of the curb—may soon be reduced to pleading for bailouts just to keep the lights on.

So, speculation about IMF bailouts is back—but this time the whispers aren’t about Greece, they’re about Britain and France. London looks wobbly enough to need a foreign lifeline, while France’s own finance minister admits Paris might end up in the same queue. For Britain, of course, this would be a rerun: the once-mighty empire went cap in hand to the IMF in 1976, begging for what was then a record $4 billion loan. That humiliation came with strings attached—brutal austerity and a farewell to Keynesian fantasies—paving the way for Thatcher’s monetarist revolution. Nearly half a century later, it seems history is limbering up for an encore.

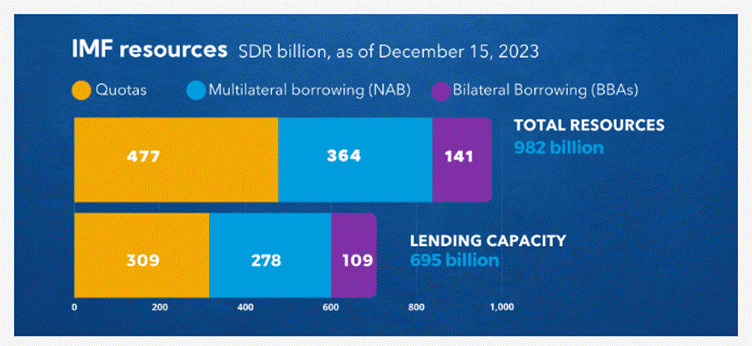

Before exploring the fallout of a European sovereign debt crisis, it’s worth remembering what the IMF actually is. Born at the 1944 Bretton Woods Conference alongside the World Bank, it was designed to prevent the kind of financial chaos that sparked the Great Depression and World War II. Officially launched in 1945, the IMF’s first job was keeping exchange rates “fixed” and lending to countries in temporary trouble. Over time, it morphed into the world’s crisis manager, handing out loans with conditions and keeping an eye on national budgets. It is funded mainly through quotas paid by its 190 members—membership fees scaled to the size of each economy, which also dictate voting power. Big players like the U.S., Japan, and Europe effectively call the shots, while the IMF quietly waits to rescue any country that trips over its own finances—and has implemented policies that serve the globalist agenda of its main contributors by helping extract resources from what the Western world has been calling Emerging Markets over the past 50 years. In short: a club of western globalists to run the global economy, with a polite promise to help everyone else.

https://www.imf.org/en/About/Factsheets/Where-the-IMF-Gets-Its-Money

The grim truth is that Europe and the Western world are marching inexorably toward a sovereign debt crisis, a key chapter in the scenario of the world rule order. Western governments have borrowed relentlessly, year after year, with no intention of ever repaying a single penny. Warnings since 2025 have gone unheeded, and now France and the UK teeter on the edge of an IMF bailout. Yet these same governments demand NATO contributions of 5% of GDP, a spectacle of loyalty while their coffers bleed dry.

https://www.france24.com/en/live-news/20250714-macron-to-raise-defence-targets-citing-russia-threat

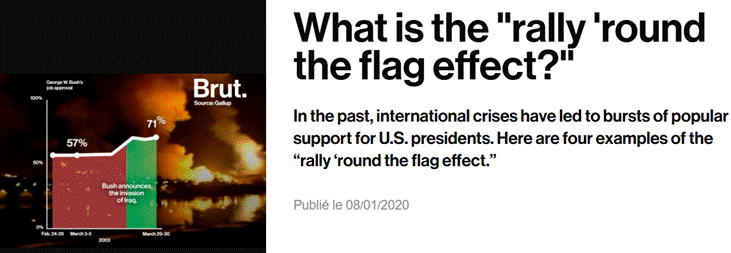

In this climate of economic collapse, Western governments seek a distraction. The ‘Russian Bear’, conveniently framed as a threat, becomes a tool for diversion and control. History and political science have long documented this tactic—the so-called “diversionary theory of war” or “scapegoat theory.” When domestic unrest rises, popularity falls, or the economy teeters, governments manufacture an external enemy. The goal is clear: unify the populace, deflect attention from internal decay, and tighten the grip of power. Western Keynesian opportunists, now masquerading as authoritarian overseers, are perfectly willing to stage—or at least exploit—a foreign attack to consolidate power. Psychologists call it the “Rally ’Round the Flag Effect”: a manufactured crisis sparks patriotism; silences dissent and unites a divided populace behind a lamed duck totalitarian leader. Class, race, and ideological divides vanish in the glow of a common enemy.

https://www.brut.media/us/videos/us/politics/what-is-the-rally-round-the-flag-effect

History is littered with examples of governments using external threats to mask domestic failures and consolidate power. After 9/11, the U.S. government invaded Iraq, passed the Patriot Act, imposed draconian financial controls, and turned airports into ritualized security theatres. Conflict became the excuse to expand state control, divert resources from social programs, and bend the population to obedience, all while citizens cheered, blinded by fear and loyalty.

Not every war is manufactured, and the strategy is risky miscalculation can destroy the regime it was meant to save. Argentina’s 1982 invasion of the Falklands, for instance, sought to unite the public amid economic crisis and social unrest. Initially successful, nationalist fervour collapsed after Britain’s decisive victory, toppling the junta and restoring democracy.

Germany provides a darker lesson: post–World War I humiliation, hyperinflation, and depression left the population desperate. Hitler and the Nazis scapegoated Jews, communists, Roma, and other minorities to create a unifying enemy. This manufactured hatred justified persecution, war, and the Holocaust.

The U.S. invasion of Iraq in 2003 followed a similar blueprint. The Neocons claimed Saddam Hussein had WMDs and ties to Al-Qaeda—a fiction used to redirect public attention and justify a broader Middle Eastern agenda.

Likewise, the Spanish-American War of 1898 capitalized on the USS Maine incident and sensationalist journalism to distract Americans from depression and labour unrest, while giving the U.S. an overseas empire.

Even in antiquity, rulers exploited this tactic. The Roman Senate and generals used foreign wars to suppress internal discord—'bellum externum civile discordiam’: “a foreign war ends civil strife.” The Gracchi brothers’ reforms in the 2nd century BC led to internal conflict, which the Senate deflected through military campaigns. Gaius Marius leveraged the threat of Germanic tribes to consolidate power and reform the army, promising land to soldiers to stabilize society. Augustus built the transition from Republic to Empire on similar principles, manipulating public perception of Cleopatra and Mark Antony. In Sparta, a constant state of militarized vigilance and the ideology of surrounding enemies kept the helot population submissive.

Across time, the pattern is unmistakable: rulers create or exploit external threats to unify populations, distract from economic crises, suppress dissent, and entrench authority. It is a recurring lesson in power—the external enemy is often less about reality than control.

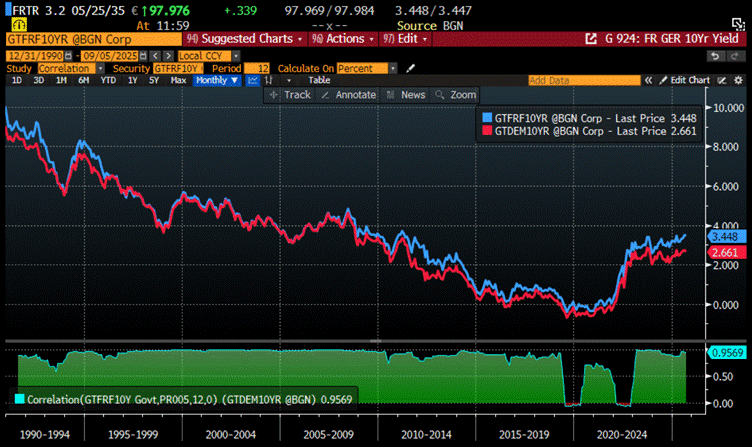

By September 2025, the European Union—run by reckless Keynesians pushing a Malthusian agenda of wars, scarcity, and control—is hurtling toward a major sovereign debt crisis. This collapse threatens to dismantle the EU itself, the very symbol of globalism, whose policies are drafted by unelected bureaucrats to serve a plutocratic elite entrenched in the Brussels swamp. Nobody needs to be a fixed income fund manager to notice that long-dated yields in major EU countries like Germany and France have been structurally rising since the start of the decade—a direct reflection of the acceleration of the globalist agenda, justified under the twin pretexts of the COVID ‘plandemic’ and the theatrics of “green” policies invented by politicians playing Dr. Jekyll and their Green Zealot doubles.

France 10-Year Yield (blue line); Germany 10-Year Yield (red line) & Correlation since 1990.

France teeters once again on the brink of political chaos. Lamed Duck Prime Minister ‘Bay-Roue de Secours’ gambled on a confidence vote, offering little hope for a swift solution to the nation’s crumbling public finances—whether through a new government or a snap parliamentary election. Amid the turmoil, fears are mounting that President ‘Macro-Leon’, cornered and desperate, may invoke Article 16 of the French Constitution. This clause grants extraordinary emergency powers in the event of a “grave and immediate threat” to the Republic’s institutions, national independence, or territorial integrity—effectively allowing him to rule as a dictator in a modern democracy, much like the ‘Cokehead Dancer on High Heels’ in Ukraine. One of the most potent executive powers in any contemporary state, Article 16 could transform France’s political crisis into a historic centralization of authority.

‘Macro-Leon’ better known as ‘Le Petit Napoleon’ may look powerful on paper—controlling foreign policy, defence, and EU affairs—but running France at home? That’s another story. Domestic governance depends on a prime minister who can survive Parliament’s mood swings. Lose ‘Bay-roue de Secour’ on September 8, and Macro-Leon’s centrist alliance faces yet another hung parliament headache, stalling budgets, reforms, and debt plans. Cue caretaker-mode president. Snap elections are an option, but good luck: they could hand the far-right or radical left even more leverage. Sure, Macro-Leon can’t be ousted easily—impeachment requires a two-thirds vote in both chambers for a “breach manifestly incompatible” with his duties—but practically speaking, repeated government collapses make him a glorified figurehead while the real chaos runs the show.

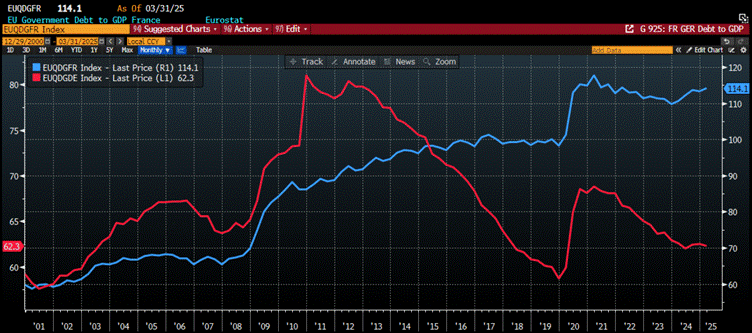

The truth is obvious to anyone with even a basic grasp of finance: France has been running a Keynesian Ponzi scheme for decades. As of March 2025, Eurostat reports—propaganda notwithstanding—show French debt at over 114% of GDP, compared with Germany’s 62.3%.

France Debt to GDP (blue line); Germany Debt to GDP (red line).

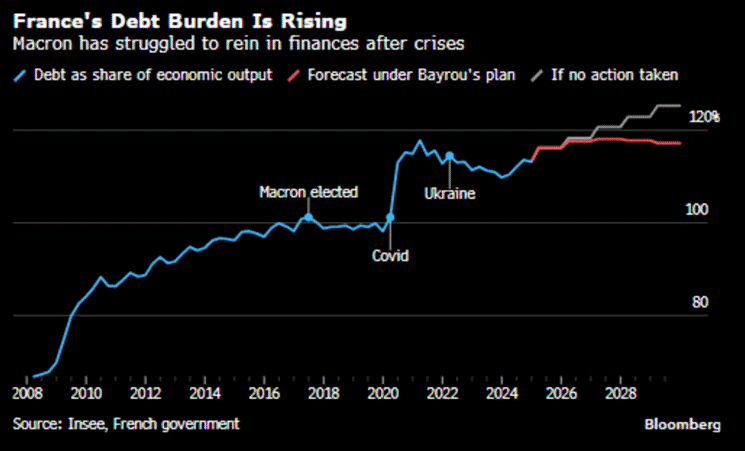

France faces a looming fiscal catastrophe. Public debt is projected to reach 120% of GDP in 2025, with the IMF forecasting a 6.1% deficit by 2030—the worst in the Eurozone. Political instability under President ‘Macro-Leon’ only worsens the situation. A projected debt explosion could push liabilities to EUR3.2 trillion, fuelled by unchecked spending and stalled reforms.

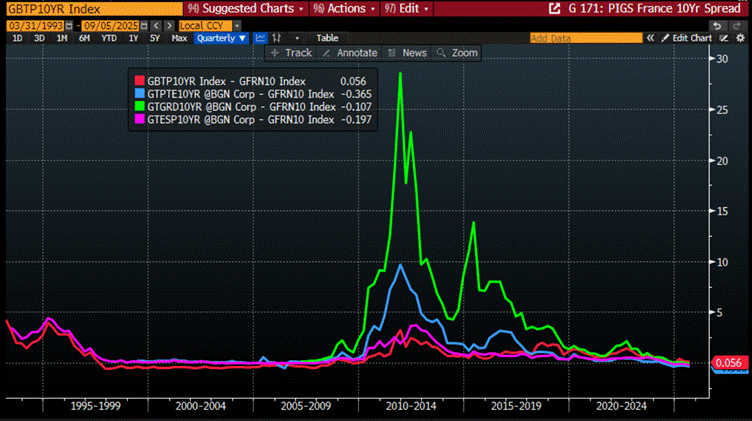

Borrowing costs are rising, leaving France as one of Europe’s weakest economic links despite its status as a cornerstone of the Union. With the European PIGS able to borrow at cheaper yields than France, markets have already anticipated the inevitable fall of the French Fifth Republic, which will shift toward greater financial repression and authoritarian measures within the Hexagon.

Spread of Portugal (blue line); Italy (red line); Greece (green line); Spain (purple line) 10-Year Yield to France 10-Year Yield.

Since the start of the jubilee year, Wall Street’s brain-dead pundits and their media parrots have tried to sell investors the myth of a heroic euro rescuing a decaying West. Propaganda claims that Donald Copperfield poses a greater threat than the Malthusian Keynesian globalists running European governments—puppets of the men of Davos—while investors are coaxed into believing their savings are safer in the Eurozone than in the United States. Anyone with a basic understanding of capital flows knows the supposed outperformance of the Euro Stoxx 50 versus the S&P 500 was a mirage, fuelled by retail YOLO investors chasing a fantasy “safe haven.” In reality, it was all about shifts in German bond yields relative to U.S. bonds. With the French crisis worsening and threatening the wider Eurozone, even Germany is no longer immune. The outperformance of German bonds versus U.S. Treasuries has already reversed, and equity investors are about to learn the hard way: when the dust settles, the United States remains the only place to hide capital from the chaos looming over Europe.

Relative performance of S&P 500 index to Euro Stoxx 50 Index (blue line); Relative performance of the Bloomberg US Treasury Index to the Bloomberg Germany Treasury Bond Index (red line).

At the end of the day, FX investing—like most investment—is essentially a beauty contest: the “less ugly” candidate outperforms the one that looks worse. What drives the relative performance of bond markets, and ultimately currencies, is how economic data appears at a given point in time. In this regard, the Citi US Economic Surprise Index versus the Citi Euro Economic Surprise Index has proven to be a reliable indicator of trends in both bond market performance and FX exchange rates.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/borrow-bomb-repeat

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.