When The Passive Bid Becomes A Passive Bomb

Submitted by QTR's Fringe Finance

This week I laid out what the financial media won’t: the Jenga Tower economy is swaying, and it won’t take much to knock it over.

In my interview with Adam Taggart of Thoughtful Money, I explained why markets at record valuations aren’t about fundamentals anymore—they’re about flows, passive mechanics, and a generation of speculators who only know options.

The Jenga Tower Economy Is Starting To Topple

A handful of mega-caps hold up the tape, while the rest of the market rots. After decades of nonstop rescues, investors believe nothing bad can happen. They’re wrong.

🔥 70% OFF | Since I’m welcoming a ton of new subscribers this week, I wanted to extend a discount for anyone who subscribes for an annual plan. This 70% off sale ends after this weekend but the discount, if you take advantage of it, remains for as long as you wish to remain a QTR’s Fringe Finance subscriber: Get 70% off forever

Jobs data now matters because when employment cracks, retirement and brokerage accounts get tapped for cash. Funds without liquidity turn into sellers, the passive machine flips, and suddenly valuations matter again.

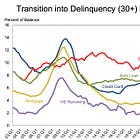

Positive real rates are the time bomb in the plumbing, already showing up in rising delinquencies and weakening housing and CRE. Student loans just accelerate the slide. The tower is one block from collapse.

For those who wanted the short version, I also put out a two-minute macro endgame: growth is stalling, private equity marks are a joke, student loans are back, the passive bid is vulnerable, and the Fed will rescue with QE and YCC. That “rescue” will only widen the wealth gap and hollow out the middle class while financial media cheers nominal highs.

Economic Endgame Explained In 2 Minutes

Outside of markets, I revisited 9/11 with William Anderson of the Mises Institute, who reminded us it was a government failure answered with more government—wars, surveillance, ballooning debt, and a phony recovery.

The 9/11 Attacks Exposed Major Government Failure, But Americans Learned the Wrong Lessons

I also called out MSNBC’s disgraceful framing of Charlie Kirk’s assassination. Whatever you think of his politics, Kirk built his career on dialogue over violence, and smearing him after his murder is the real division.

Charlie Kirk Was Not Divisive, But MSNBC Is

And I wrote about Iryna Zarutska, a Ukrainian refugee murdered in Charlotte, whose death the legacy media chose to ignore. Their silence exposes, once again, the corruption and irrelevance of that entire machine.

Our Nation Failed Iryna

That’s where I net out: markets priced for perfection, an economy sliding toward reality, a political class doubling down on failure, and a media establishment that cannot tell the truth.

Thanks to my incredible subscribers, I also compiled a vibrant list of sectors in the market that could be undervalued amidst an extremely overvalued market. That list can be found in our chat here.

Here’s what else was on the blog recently:

Money Supply Flatlines As Employment Cools And Delinquencies Rise

Trusted Abroad, Blocked at Home: Why Americans Need a Passport for Proven Medicines

Fragile Investors, Fragile Markets: QTR With Michelle Makori

If you missed my full interview this week or want the charts, they’re linked above. Thanks, as always, for reading, sharing, and supporting independent voices.

—QTR

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.