Why Gold? Why Now?

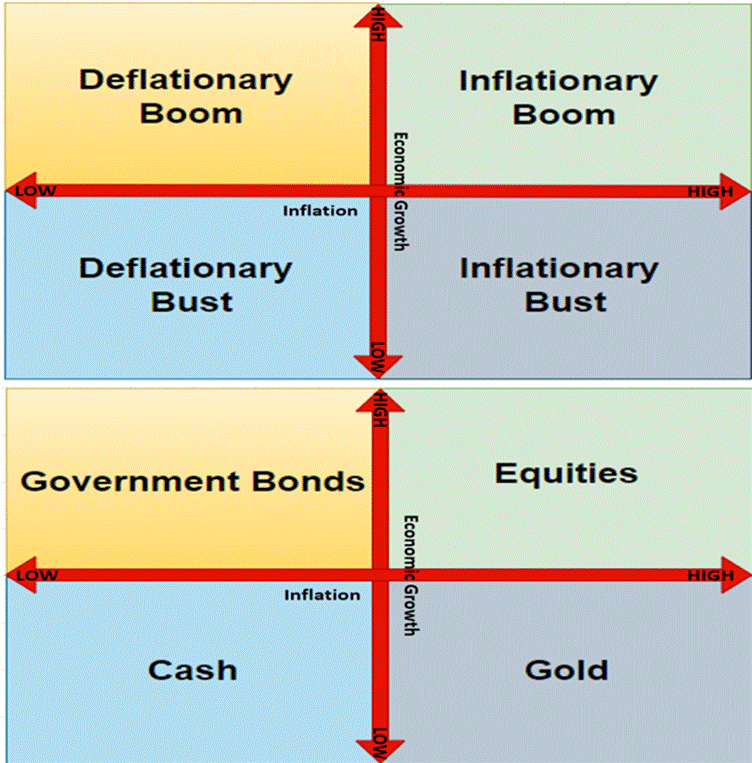

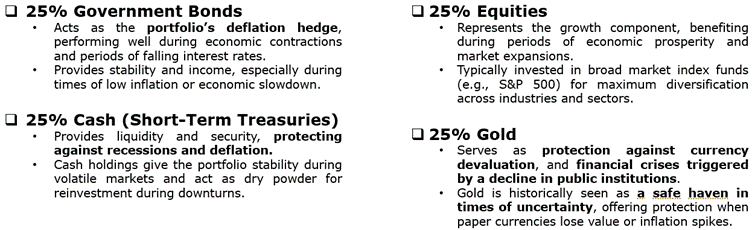

Harry Browne’s Permanent Portfolio is basically a four-course financial meal: stocks for the inflationary sugar rush, bonds for the deflationary nap, gold for the inflationary hangover, and cash for when everything else goes sideways. The genius lies in its balance—no matter what the economy cooks up, at least one dish is always edible. Layer in Schumpeter’s business cycle, and you’ve got a cheat sheet for knowing which plate to pile higher. The trick, of course, is figuring out which course the economy is currently serving—easier said than done.

If Harry Browne’s Permanent Portfolio is the financial slow cooker: toss in stocks, bonds, cash, and gold, then let it simmer through booms, busts, bubbles, and panics, the mix is designed to survive any economic mood swing—without you needing antacids or day-trading stress. Think of it as portfolio geometry: a neat four-square grid where at least one corner always behaves, keeping your wealth from staging a coup.

Financial assets boil down to two tribes: contracts (IOUs like bonds) and properties (ownership claims like stocks). Some play the long game (government bonds, equities), others are short-term sprinters (cash, gold). Put them on a grid—contracts vs. properties, long vs. short—and voilà: the “forever portfolio” splits neatly into four quadrants, like a well-behaved pizza where every slice handles a different economic mood swing.

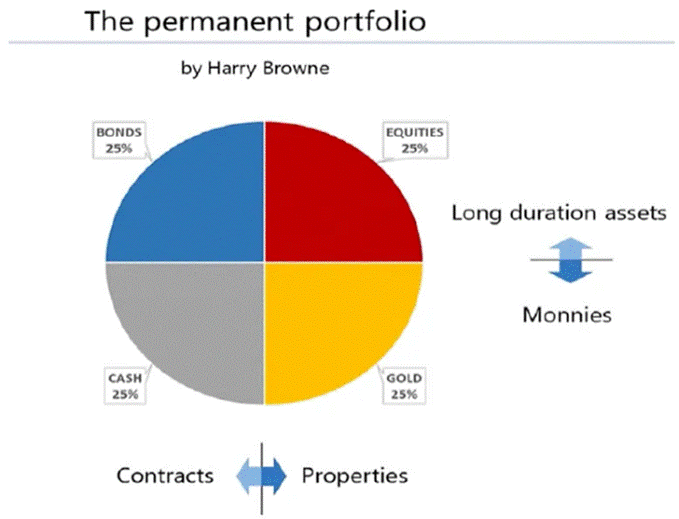

In Browne’s Permanent Portfolio, gold plays the role of timeless trouble-shooter. It’s been money, jewellery, and a shiny obsession for millennia—but in modern finance it’s the ultimate “break glass in case of emergency” asset. Unlike fiat, it can’t be printed on a whim, which makes it scarce, durable, and annoyingly hard to kill. Central banks stash it in vaults, investors cling to it in crises, and whenever inflation, currency shenanigans, or geopolitical chaos hit, gold dusts off its cape and steps in as the safe-haven hero.

Gold has been humanity’s go-to money and wealth preserver for millennia—rare, durable, and universally trusted. From Lydia’s first coins to Rome’s solidus to the gold-backed dollars of recent history, it’s outlasted empires and paper promises alike. Unlike fiat that governments can inflate at will, gold keeps its buying power—whether it’s a toga in ancient Rome or a tailored suit today. Through wars, crashes, and revolutions, it stays the same: the ultimate anchor of trust when everything else wobbles.

https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

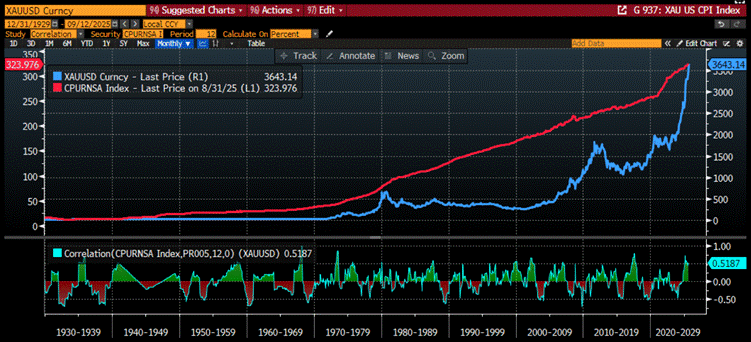

Gold’s place in a portfolio is endlessly debated. While it’s often billed as an inflation hedge, the data says otherwise: over nearly a century, the 12-month correlation between gold prices and U.S. CPI has rarely topped 0.5. In other words, gold is no reliable short-term shield against rising prices. Its value lies less in tracking inflation tick-for-tick, and more in serving as a long-term store of trust when paper money wobbles.

Gold Price in USD (blue line); US CPI Urban Consumers Index (red line) & Correlation since 1929.

Alright, myth-busters, put down your Wall Street popcorn—time to see if gold really dances to the tune of inflation expectations. The “gold = inflation hedge” gospel preached by countless investors? Yeah… not so fast. Even when we ditch the short-term consumer noise and peek at the University of Michigan’s 5–10-year inflation expectations, gold’s correlation with long-term expectations is only slightly better than its laughable link with the U.S. “CP-Lie.” In short: gold might twirl around inflation a bit, but it’s certainly not leading the conga line.

Gold Price in USD (blue line); University of Michigan Expected Change in Prices During the Next 5-10 Years (red line) & Correlation since 1979.

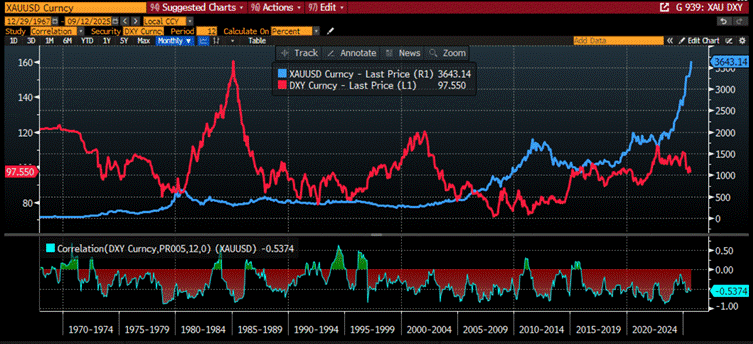

So, if gold isn’t dancing to the inflation beat, what is moving the shiny metal? Enter another Wall Street myth: the idea that the dollar calls the shots. Sure, gold is priced in USD, so when the dollar flexes its muscles against other fiat currencies, gold tends to sulk. Case in point: the 1980s and 1990s—strong dollar, even with inflation lurking, and gold basically shrugged. Look at the numbers: since 1967, gold and the USD Index (DXY) have mostly been frenemies, negatively correlated with a typical correlation below -0.5. Translation: when the dollar struts, gold often sits it out.

Gold Price in USD (blue line); US Dollar Index (red line) & Correlation since 1967.

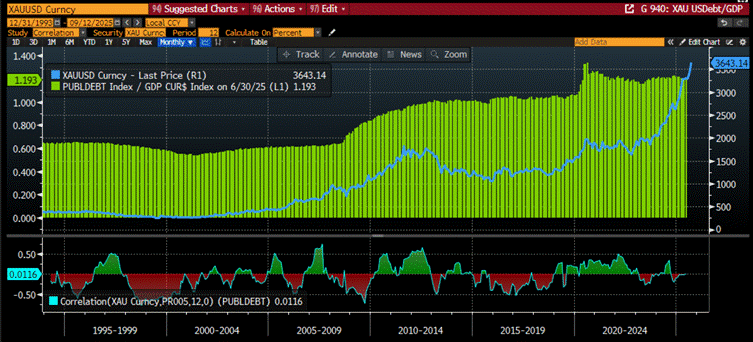

Gold is the original “don’t-need-a-boss” asset. No counterparty, no middleman, just pure antifragile rebellion against monetary chaos and authoritarian governments. Unsurprisingly, debt-heavy governments hate it—Roosevelt confiscated it, the Soviets banned it, Venezuela hawked it abroad—because nothing cramps a ruler’s style like a shiny metal they can’t inflate away. And yet, gold persists. Meanwhile, if you look at its correlation with U.S. debt-to-GDP, investors occasionally glance at it as a hedge… but mostly, they just admire it from afar.

Gold Price in USD (blue line); US Total Debt to GDP (green histogram) & Correlation since 1993.

Well, who could’ve guessed? The one asset that’s managed to outlive empires, currencies, and a thousand government IOUs—gold—just so happens to be the only thing investors can actually trust. Shocking, right. And lo and behold, for the past 17 years, its price in USD has danced pretty closely with the US CDS rate, that little metric that supposedly tells us the “true” risk of Uncle Sam defaulting. But sure, keep pretending government paper is risk-free.

Gold Price in USD (blue line); US Credit Default Swap (red line) & Correlation since 2008.

Naturally, the U.S. will nobly wait its turn to be the last Western government to default—such manners! And as for the charts showing gold moving in lockstep with French, British, and Japanese bond yields? Just happy accidents, like spilled wine on a white shirt. After all, who still would trust debt-bloated governments to keep everything perfectly under control?

Upper Panel: Gold Price in EUR (blue line); 30-Year French Government Bond Yield (red line); Middle Panel: Gold Price in GBP (green line); UK 30-Year UK Government Bond Yield (purple line); Lower Panel: Gold Price in JPY (Magenta line); 30-Year Japan Government Bond Yield (orange line).

To be clear, caution is essential: it’s all too easy to mistake coincidence for causation—or to cling to a pattern that suddenly collapses. Remember when everyone swore real yields dictated gold prices? Then came 2023, and—surprise! —the theory fell flat.

Gold Price in USD (blue line); US 10-Year Real Yield (axis inverted; red line) & correlation since 1997.

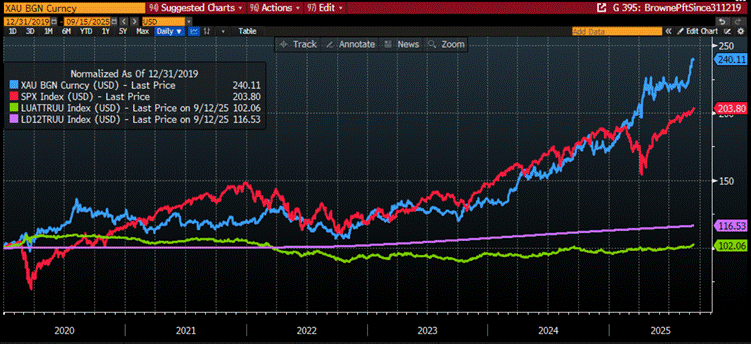

Lately, gold’s been the belle of the investment ball—outshining most other assets that mere mortals and institutions can actually buy. Its recent price rise? A cocktail of macro chaos, structural quirks, and geopolitical drama—basically everything that makes investors clutch shiny rocks like they’re life preservers.

Nominal (not ‘CP-Lie’ adjusted) performance of $100 invested in physical gold (blue line); S&P 500 index (red line); Bloomberg US Treasury Index (green line); Bloomberg US Treasury Bill: 1-3 Months Index (purple line) since 31/12/2019.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/why-gold-why-now

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Persistent chaos, weaponization of USD assets make gold look like the ultimate “don’t let your wealth melt” asset. Throw in trade spats, and regional conflicts, and voilà—gold became the crowd’s favourite safe haven. Some investors bought it for diversification; others just hopped on the momentum bandwagon—because nothing says “smart portfolio move” like chasing shiny rocks. Central banks, retail, and institutions piled in, pushing gold ETFs past USD 375 billion by mid-2025—up sixfold from a decade ago. Inflows in the first half of 2025 alone hit USD 40 billion, matching the panic-buying frenzy of early COVID, proving that when fear strikes, gold still steals the show.