Re-accelerating Markets

Subscribe to our research. www.gmgresearch.com

Market Update

Yields are lower after the data — the market is choosing to focus on weaker jobless claims rather than slightly hotter headline inflation. The narrative remains: Jobs > Inflation. The market is now pricing a 5% chance of a 50bps cut this week.

Equity markets are gaining momentum

China is outperforming while Ex-China EM ETFs are seeing heavy outflows

Relative lows for Staples

Aggressive flows into Gold & Silver

Markets are pivoting back toward the same themes we’ve been highlighting: growth equities, precious metals, crypto, China’s relative strength, and the growing divergence between what the Fed says vs. what the bond market is pricing.

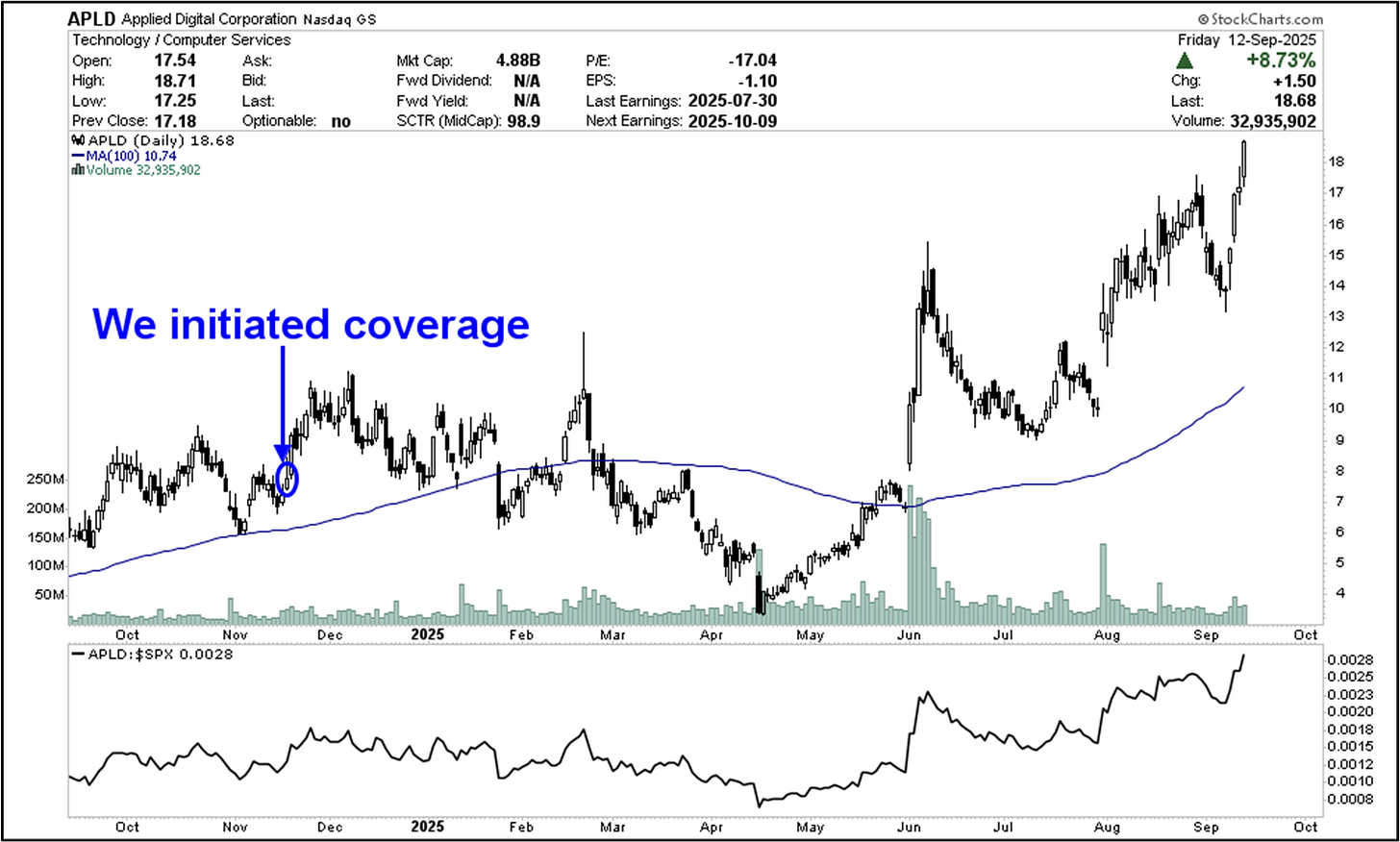

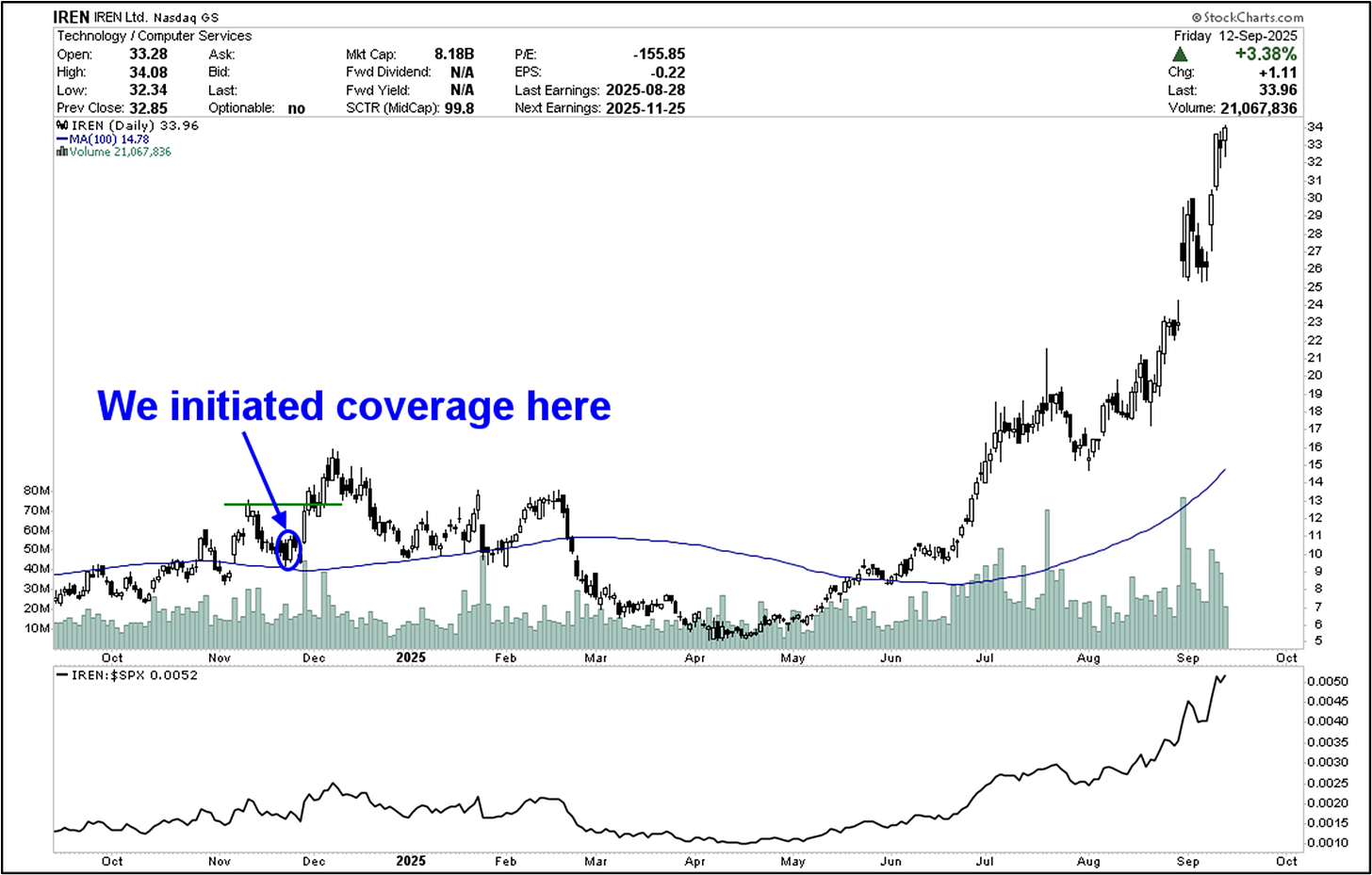

We want to take the time to review some of our recent calls and continue our coverage on key names positioned for this environment:

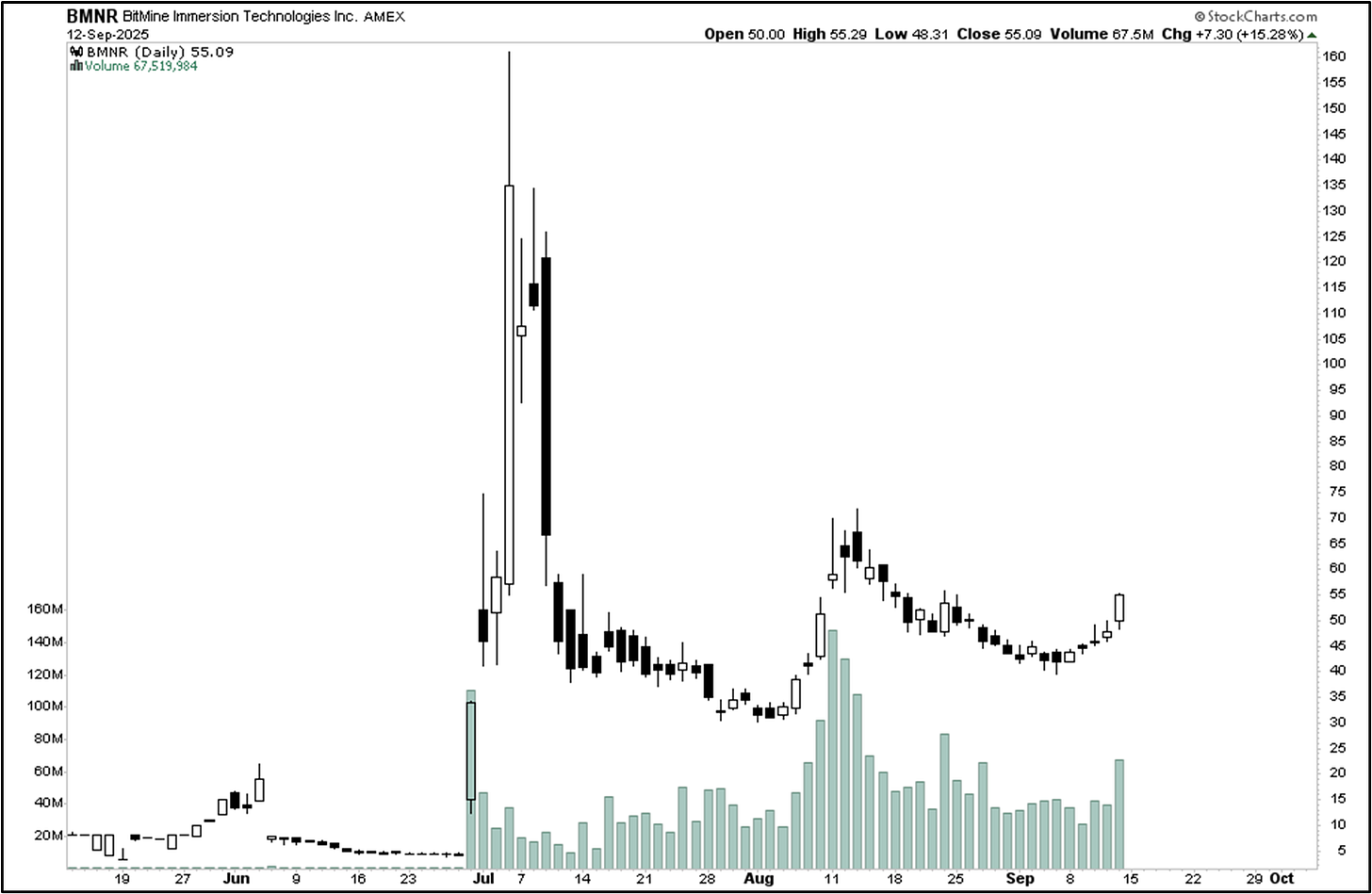

BMNR · TSLA · EOSE · BABA · CC · AMD · OPRA · APLD · ASML