The Fed’s Roadmap Matters More Than the Cut

The Fed’s Roadmap Matters More Than the Cut

- Stephen Miran’s board appointment favors rate cuts.

- Recent hiring data points to a rapidly weakening labor market.

- Bowman, Miran, and Waller are likely to support more aggressive easing.

The Federal Reserve’s interest rate outlook is about to grow more dovish…

Today brings a much-anticipated catalyst for investors across the globe. The Federal Reserve is set to release its latest monetary policy decision. Wall Street expects a 25 basis point rate cut, the first since December. It will bring the federal funds target to a range of 4.00% to 4.25%.

But let’s be clear: the cut itself isn’t the story. It’s already priced in. What matters most is the Fed’s outlook on monetary policy moving forward. As you can see from the table above, Wall Street expects the fed funds target range to drop by a total of 75 basis points to a range of 3.25% to 3.50% by December.

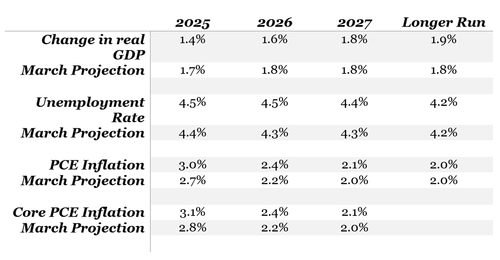

As a result, the most anticipated release tomorrow will be the Summary of Economic Projections (“SEP”) from policymakers. It will show where they believe the path of interest rates is headed over the next few years. The details will indicate the pace of policy easing by year-end and whether Wall Street’s current assumptions are correct.

Based on recent dynamics, it appears the Fed’s outlook should grow more dovish when forward guidance is released. I wouldn’t be surprised if the data endorses a total of three rate cuts by the end of 2025. That should underpin the outlook for economic growth and a steady rally in the S&P 500 Index.

But don’t take my word for it—let’s look at what the data’s telling us…

The Federal Open Market Committee (“FOMC”) meets eight times a year to set rates. It’s made up of seven board members and five rotating regional bank presidents—twelve voting members in total. But once a quarter, all nineteen officials (including non-voting district presidents) submit their forecasts for key economic indicators. These are aggregated and released in the SEP.

Here’s what they projected at the June meeting…

Now compare that to where we are: GDP is tracking close to 1.4%, unemployment sits at 4.3%, PCE inflation is 2.6%, and core PCE is 2.9%. The fed funds rate is currently 4.4%. So, most of the projections aren’t far off, but the rate path is likely to shift lower for two key reasons: weakening employment and a more dovish Fed board.

Let’s start with the labor market.

Earlier this month, the Bureau of Labor Statistics (“BLS”) reported just 22,000 new jobs in August. June’s numbers were revised from a gain of 14,000 to a contraction of 13,000. That marked the first net job loss since December 2020. July’s report also came with downward revisions to May and June totaling 258,000 jobs.

And then came the kicker: the 2025 benchmark revision released last week. The BLS now expects employment gains between April 2024 and March 2025 to be revised lower by 911,000. That’s a flashing red light for policymakers worried about growth.

Several Fed officials have already voiced concern that rates have stayed too high for too long. St. Louis Fed President Alberto Musalem, Boston’s Susan Collins, San Francisco’s Mary Daly, Minneapolis’s Neel Kashkari, and New York’s John Williams, among others, have expressed this view. Board Members Christopher Waller and Michelle Bowman expressed the same concern when they dissented at the July policy meeting in favor of a rate cut. Chairman Jerome Powell himself recently said it may soon be time to ease.

And now there’s a new voice joining the dovish camp: Stephen Miran. He was just confirmed to fill a board vacancy. He’s been vocal about the need for aggressive rate cuts. He’s expected to dissent in favor of a 50-basis-point reduction today.

He won’t be alone. Waller and Bowman have both said they’d support a larger cut if the employment picture worsened since July. Based on the data, it has. As a result, we should expect a growing chorus of dissenters pushing for faster easing.

At least seven of the twelve voting members now appear willing to tolerate a temporary rise in inflation to protect the labor market. Powell has warned that waiting too long could force the Fed to cut more aggressively later. So, a rate cut today is likely a foregone conclusion.

But again, the real story is the outlook.

Since June, about half of the board and regional presidents have shifted more dovish. Bowman, Miran, and Waller all favor cutting to neutral sooner rather than later. Those shifts should pull the 2025 median rate projection down from 3.9% to 3.6%. And if they endorse two to three cuts next year, the median path for 2026 and 2027 could also move lower. Both outcomes would align with Wall Street’s current forecast for rates to drop to roughly 2.9% by next September.

As I said at the top, the rate cut itself isn’t the story. It’s the Fed’s evolving stance that will drive market expectations. If the SEP confirms a lower median path for rates, it signals an improved liquidity outlook. That makes it cheaper for households and businesses to borrow, invest, and spend. That should underpin economic growth, stabilize employment, and support a steady rally in the S&P 500.

If you'd like to receive more commentary like this to your inbox daily or see how I'd invest for any type of market, click here.