UBS Sees New Silver ATH As It Aligns With Gold

Silver: UBS Sees New ATH as Silver Aligns With Gold

Authored by GoldFix exclusively for Scottsdale

Silver Breaks Through 14-Year High

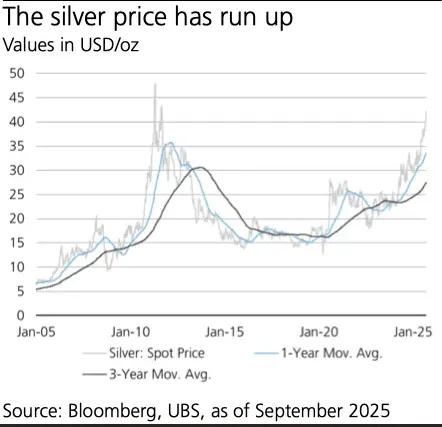

Silver has pushed above USD 45 per ounce, the highest level in fourteen years, supported by record gold prices and strong investor inflows despite a weak patch in global industrial activity. The move follows gold’s advance and reinforces silver’s position as a correlated but more volatile counterpart.

“Silver has surpassed the USD 45/oz mark, marking a 14-year high, supported by record gold prices and strong investment inflows, despite a stumble in global industrial activity.”

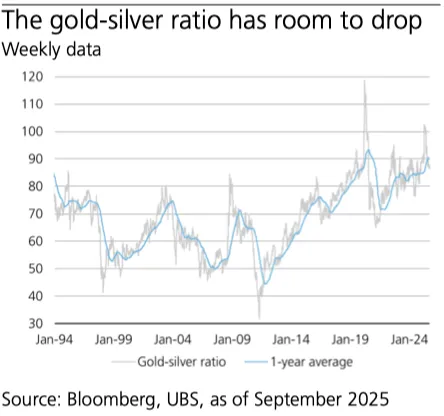

UBS has aligned its silver projections with its recently upgraded gold outlook from September 11. The bank now targets USD 44–47 per ounce by mid-2026. Analysts also see silver outperforming gold as monetary easing takes hold and industrial demand recovers, with the gold-silver ratio potentially falling closer to 80.

The reminder is clear: silver’s historical volatility is twice that of gold. Large pullbacks can occur quickly, yet higher silver prices almost always accompany higher gold prices. Investors entering this market need tolerance for swings, but UBS views the current risk-reward as favorable.

Structural Drivers and Investment Flows

After mid-teens pullbacks in late 2024 and early 2025, silver has staged a decisive rally. UBS expects prices to remain well supported. Geopolitical tensions, U.S. fiscal deficits, weaker U.S. growth, and the likelihood of Federal Reserve rate cuts all contribute to a constructive top-down environment. Silver benefits directly from gold’s safe-haven role, with correlation normally in the 0.5–1.0 range.

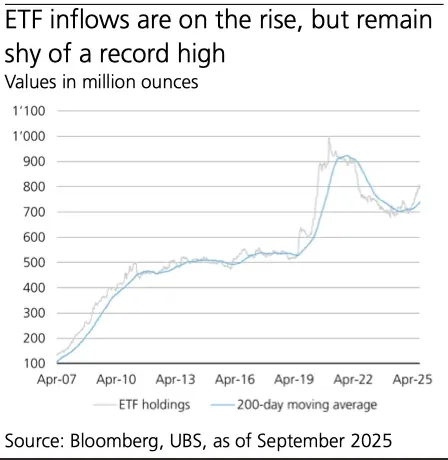

ETF demand illustrates this connection. Silver ETF inflows have topped 20 million ounces in the current quarter, with nearly 80 million ounces added this year. Despite the surge, holdings remain more than 200 million ounces below the 2021 COVID-era peak of just over 1 billion ounces.

“Silver ETF inflows have exceeded 20 million ounces so far this quarter, with total inflows for the year approaching 80 million ounces.”

Policy, Ratios, and Forecast Revisions

The broader macro context underpins the forecast. Lower rates, slowing growth, and large fiscal deficits are expected to sustain flows into precious metals. UBS has lifted its gold forecast to USD 3,900 per ounce, prompting an upward adjustment in silver targets to preserve key ratios.

The gold-silver ratio is projected to hold near 85, with scope to narrow toward 80 as policy eases and growth expectations improve in 2026. Revised silver targets now stand at USD 44, 44, 47, and 47 per ounce through the third quarter of 2026.

This trajectory suggests silver could approach an all-time high. UBS highlights opportunities in long positions or in selling downside risk for yield.

“With this move, we flag that silver prices could reach an all-time high—a view that supports a long position in the metal or selling its downside risk for yield enhancement.”

Continues here unlocked