Silver Soars over $46 as LBMA Free-Float Craters

Silver Surges Over $46 Mark On LBMA Supply Tightness

Submitted by GoldFix, Authored by Chris Marcus

In another stunning day in the precious metals markets, the silver price surged above the $46 level for only the third time in history as the futures rose $1.26 to $46.66.

Here you can see that the spot price is also above $46 now at $46.05.

After today’s move, the futures have rallied from $36.28 on July 30 to $46.66, a move of $10.38 in just under 2 months.

The current rally also isn’t far off the pace of some of the final stages of the run-up in 2011.

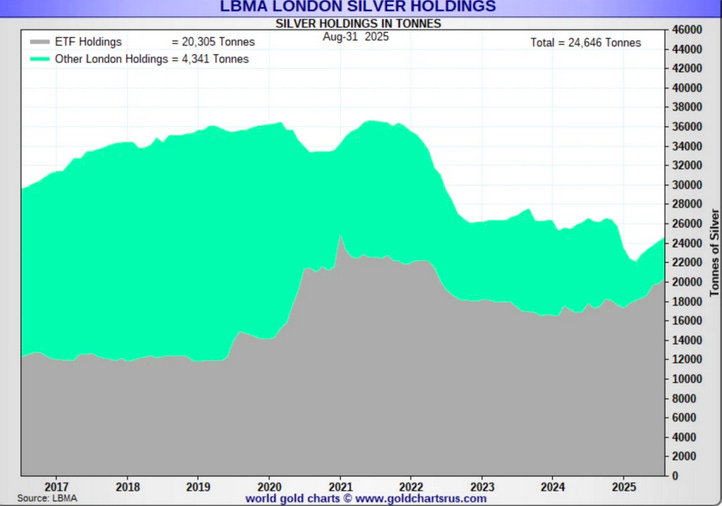

Back in 2011, the rally was fueled by Ben Bernanke’s QE2 program, with one of the more direct drivers being the silver that was added to the ETFs in response. This time, an easy money policy out of the Fed has once again driven metal into the ETFs, at a rate that has brought the LBMA’s underpinning inventory into question. And perhaps that’s the big difference this time.

It’s hard to overstate the impact of Daniel Ghali’s recent report stating that at the current pace of ETF additions, the LBMA is 7 months away from a supply crisis, and at the historic rate of additions during a cutting cycle, that could be as low as 4 months. This week he was out discussing that on Bloomberg, which means this is also what the institutional investing audience is seeing and hearing now.

You also have rather well-known former J.P. Morgan precious metals managing director Robert Gottlieb saying that he was ‘thinking we would see $50 silver by year-end, however, the way this market is reacting, we may see it sooner.’

But what is it that they’re so concerned about?

Fortunately, while the broader investing world is just starting to notice that the silver price has risen to a level it’s only reached twice before in history, much like with The Big Short, the signs that a problem was building have been there for anyone who took the time to look.

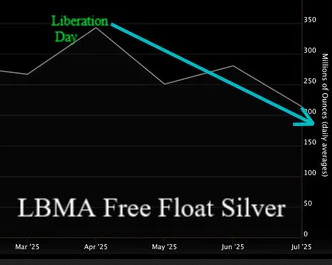

At the heart of it is that the LBMA supply of silver has gotten to what appears to be a dangerously low level. In Ghali’s comments about the silver supply, he was referring to the LBMA’s free float, which is the total vault holdings, minus the silver that is accounted for by the ETFs. This is currently down to 153 million ounces (the green portion of the chart below).

In one of Ghali’s reports from January where he talked about how the silver market was ‘walking into a short squeeze,’ he mentioned that the daily turnover underpinning the LBMA was generally around 250 million ounces.

Now we’re finding out.

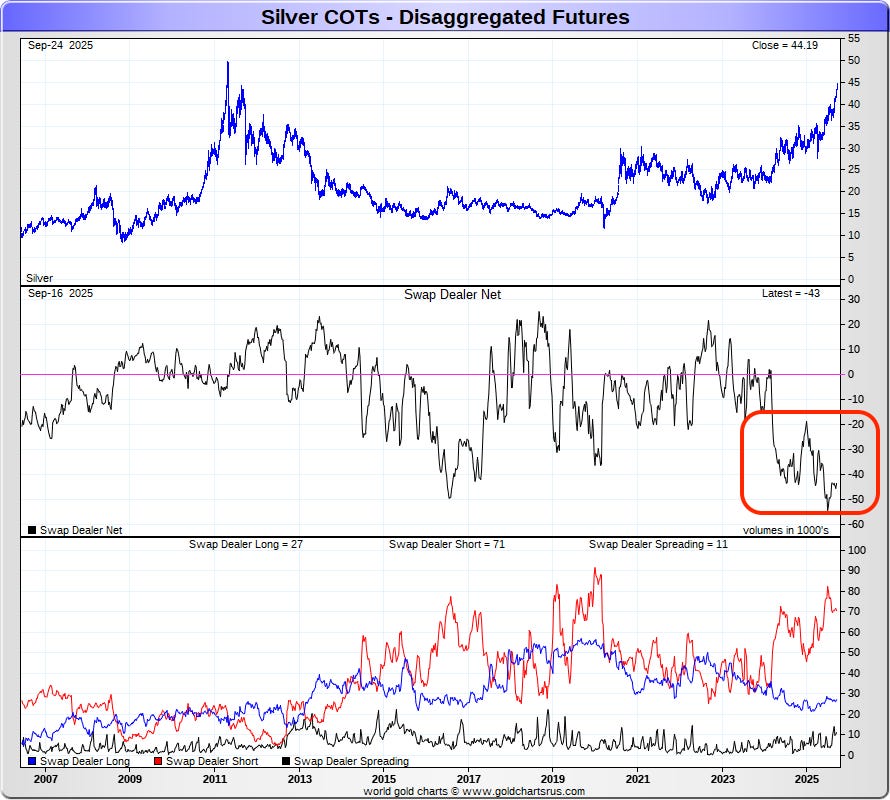

Of course, the short position collectively held by the banks remains on the high end of their range. The bullion banks often say that they aren’t really net short, because these are the hedges offsetting their London holdings. Although to whatever degree that’s the case, that would mean that the true free float is even lower than the 153 million ounces shown on the latest report.

There is the possibility that some of the silver that went to the COMEX eventually heads back to London. But we haven’t seen that so far, and the overall COMEX inventory has actually continued to rise even in recent months.

We don’t know exactly who holds that silver, for what purpose, or at what price they would be willing to send it back to London, but it hasn’t happened yet. And now with the Fed forecasting more rate cuts than previously expected, while we’re getting closer to Trump picking an even more dovish Fed chairman, if the ETF inflows continue, and some of that COMEX silver doesn’t go back to London, that’s why even the bullion bankers are getting a bit concerned.

Fortunately, to help explain the amazing story of what got us to this point, what’s happening beneath the surface, and the various outcomes that are possible, we did just release our silver report, which is free to download and available here. [EDIT- it covers 2H of 2025 in context of the current supply deficit and is institutional grade research- VBL]

The report also addresses several of the key questions on the minds of silver investors that rarely get addressed, but are more important to consider than ever, including:

- The risks to the market posed by the ongoing deficits

- The reason the deficits are more likely to continue, or even increase

- Why the issues facing the silver supply don’t get resolved, even at $50-$100 silver

- How silver has actually performed over time relative to inflation, and whether silver has actually fulfilled its role as an inflation hedge

- Why the silver price declined during a decade of QE and 0% rates

- And several of the other fascinating dynamics that have left the silver market on the verge of some potentially unusual and asymmetric outcomes in the years ahead

Sincerely,

Chris Marcus for Arcadia

Free Posts To Your Mailbox