JPMorgan Flags $6,000 Gold Amid Questions on Fed Independence

“[W]e now believe that the target [for gold] is probably closer to $4,200 with a possibility of going as high as $6,000 by the end of 2029.”

Fed Independence: The “Icing on the Cake”

Authored by GoldFix ZH Edit

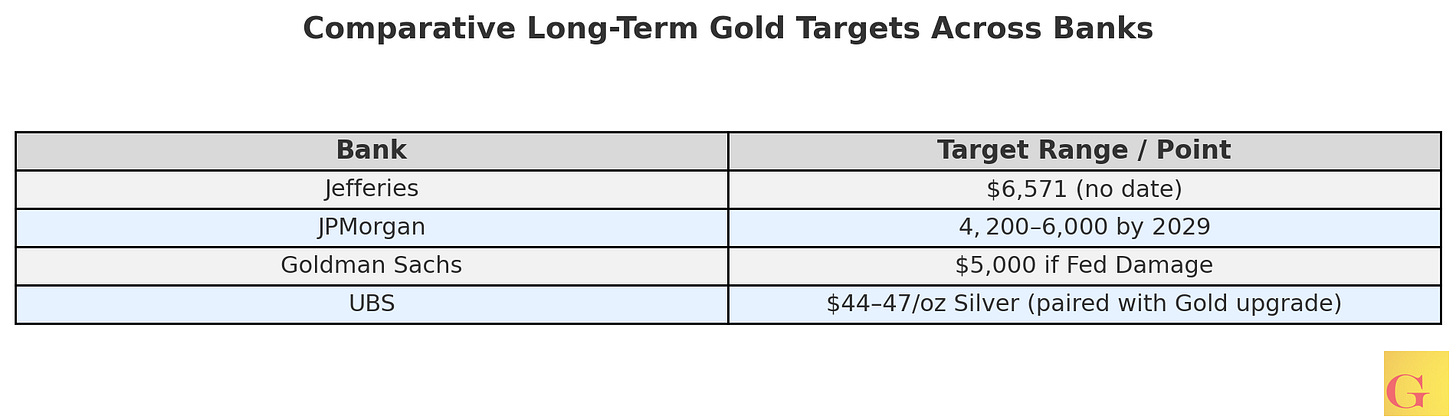

JPMorgan’s internal survey highlights renewed debate on the Federal Reserve’s independence, an issue that has surfaced periodically in Washington and among clients. Researchers point to the upcoming 2026 appointments as focal points for potential political influence, but so far the evidence in markets is limited. This isn’t the first time this has happened. But it is the first time JPM has noted it and similarly to Goldman recently adding $1000 to to their own price projection on the same risk.

Goldman: Gold Price Near $5,000 if Fed Damaged

Sep 6

Goldman Sachs notes that gold could approach $5,000 an ounce if Federal Reserve independence were compromised and investors shifted even a small portion of Treasury holdings into bullion.

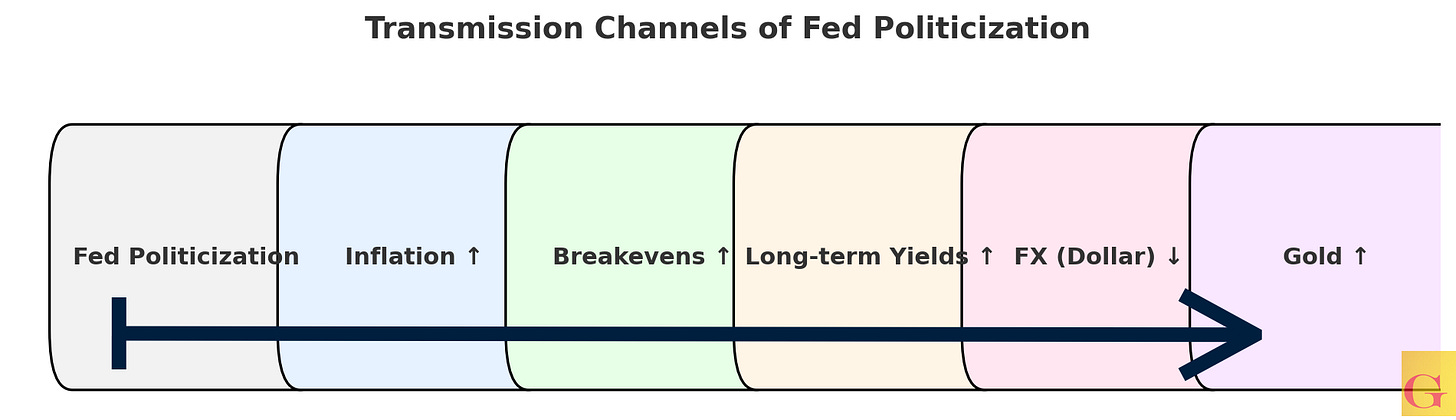

Analysts warn that a loss of Fed independence would likely produce higher inflation, weaker equities and long-dated bonds, and deterioration in the dollar’s reserve-currency role.

JPM’s Mike Feroli notes in addition to (or because of! ) a compromised Fed, rates will be unnecessarily easy going forward

“The biggest risk here is higher inflation, and it could come earlier than the Fed instituting easier policy, or inflation expectations could move higher ahead of policy being unwarrantedly easy.” – Mike Feroli

Feroli emphasizes the historical concern that political actors may seek short-term stimulus ahead of elections, which would undermine the Fed’s mandate and push inflation higher. He also notes that the Fed’s balance sheet, described as “potentially unbounded,” could be used for political ends contrary to constitutional intent.

Jay Barry underscores that in U.S. rates markets, little sign of erosion in Fed independence is visible. Breakevens and long-term yields have not reflected a sustained repricing.

“If we’re worried about the Fed being less committed to its 2% inflation target, not only would breakevens be higher, but we’d also expect long-term rates to be higher, and curves to be steeper.” – Jay Barry

On the FX side, Meera Chandan reports no clear discount in the dollar attributable to these concerns, though clients are increasingly aware.

Gold: The Target Now Stretches to $6,000

“ Fed independence is the icing on the cake for many of the reasons why people would like to buy gold, but that’s not the cake … we now believe that the target is probably closer to $4,200 with a possibility of going as high as $6,000 by the end of 2029.” – Natasha Kaneva via ZH

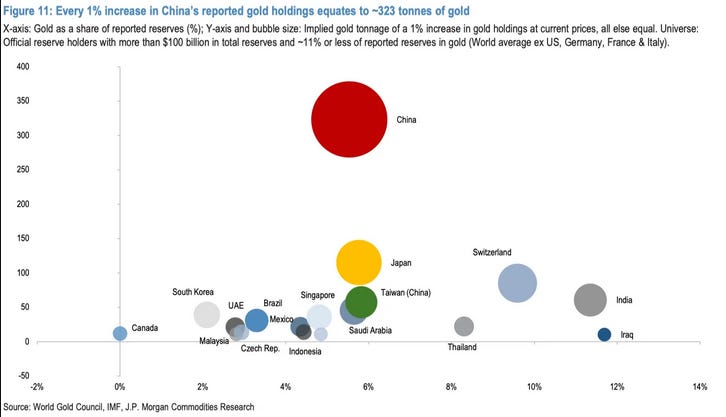

The survey’s most notable outcome is its explicit gold projection. Natasha Kaneva links the Fed debate to broader demand for gold, noting that institutional and retail investors are layering Fed concerns onto a wider set of bullish drivers.

This $6,000 upper bound matters for two reasons. First, it signals JPMorgan’s willingness to publish a dated price path, whereas Jefferies’ earlier $6,571 call just last week was left open-ended. Second, it marks a competitive escalation among banks in formally raising targets, after years of restraint. The sequencing suggests a coordinated but cautious recognition that demand drivers—official sector accumulation, fiscal expansion, and deglobalization dynamics—require higher long-term assumptions.

Note, this is mentioned only months after JPM joined the $4,000 club in Gold with their thorough explanation of why here:

**JPM’s $4,000 Walkthrough and Analysis

Apr 27

The $4,000 Signal

As of April 22nd, JP Morgan has officially added its name to the growing list of institutions forecasting a dramatic repricing in gold. According to the bank’s latest note, gold is set to cross the $4,000 per ounce threshold by the second quarter of 2026. Their base case sees a rise to an average of $3,675/oz by Q4 2025, followed by continued upside momentum.

It seems like banks ar ein a slight rush now; all having various/different reasons, but coming to the same conclusion- Gold will rise more

Tariffs and Fiscal Policy: The OBBBA and Market Effects

“We are expecting some fiscal thrust, most likely to be realized early next year. The OBBBA didn’t really change much spending in the big picture.” – Mike Feroli

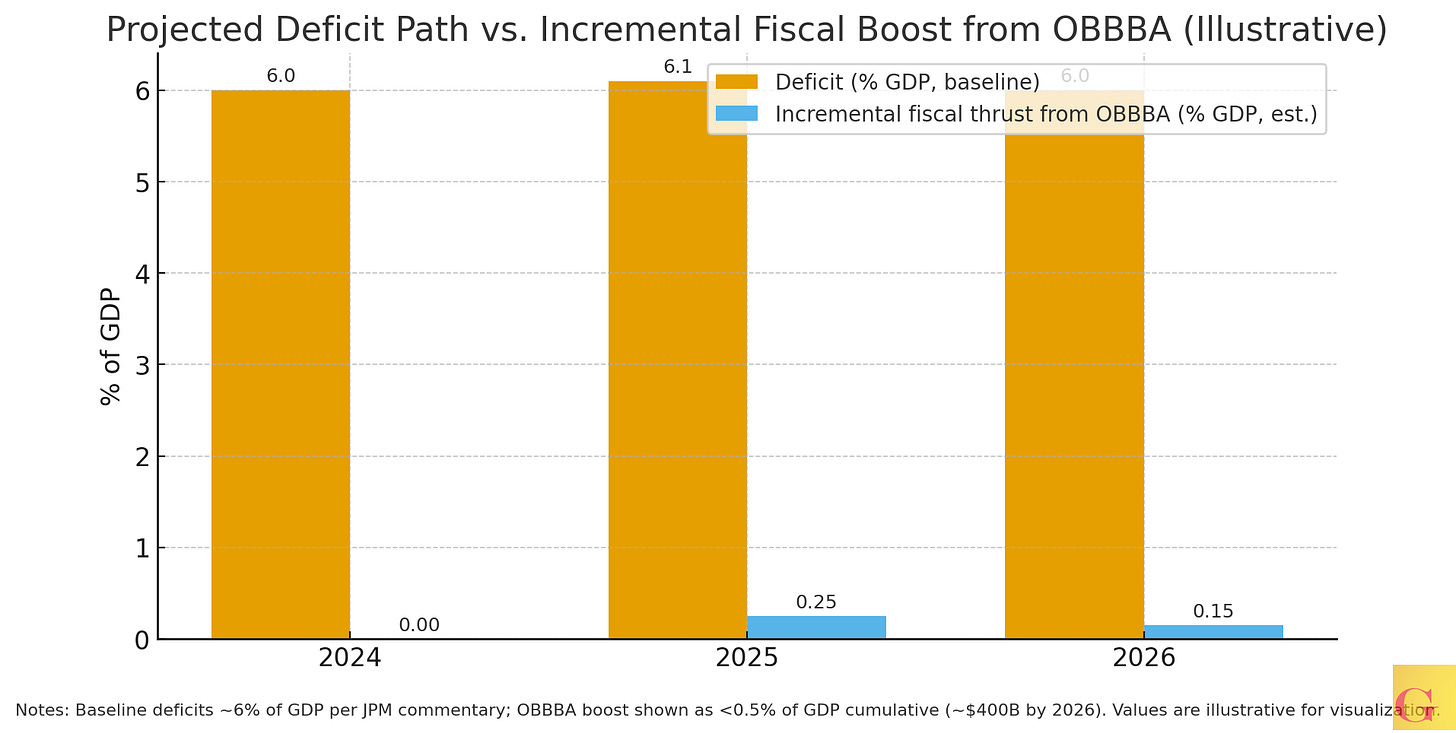

Feroli describes the bill as primarily an extension of existing tax law, with add-ons such as standard deduction changes, SALT cap revisions, and tweaks on tips. He estimates the net impact at less than half a percent of GDP.

Jay Barry highlights that while Treasury revenues are rising, deficits remain around 6% of GDP under forecasts, requiring continued heavy issuance. The shift in investor base away from foreign buyers toward U.S. investors necessitates higher term premiums.

Kamal Tamboli frames OBBBA as an “underappreciated source of stimulus,” pointing to provisions that allow retroactive expensing for capex and R&D. Analysts estimate about $400 billion of net spending by 2026, half of which ties directly to corporate deductions.

Continues here