Countdown To Trump Stagflation

Anyone who’s cracked open a economic book knows the script: boom, bust, panic, repeat. Humanity keeps throwing the same party — overpopulating, overproducing, and eventually running out of chairs — cue food shortages, wars, and governments tripping over themselves. Even with AI and fancy algorithms, the world is still stuck on the same economic roller coaster. The business cycle isn’t going away — it’s the universe’s way of keeping us humble — so you’d better be ready for the next drop before it throws your portfolio out of its seat.

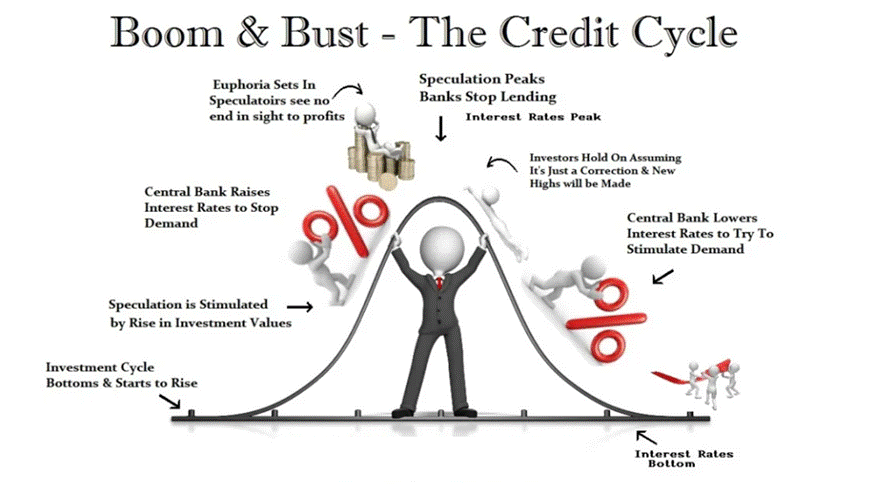

The credit cycle is basically the economy’s gas pedal — when banks are handing out loans like candy, businesses rev up, consumers splurge, and everyone thinks the party will never end. Cheap money fuels risk-taking and pumps up asset prices, creating that “this time is different” illusion. But then the music stops: lending tightens, rates bite, debt feels heavy, and defaults start knocking. Suddenly, the boom looks more like a cliff dive. Credit doesn’t just tag along with the business cycle — it floors the accelerator on the way up and slams the brakes on the way down.

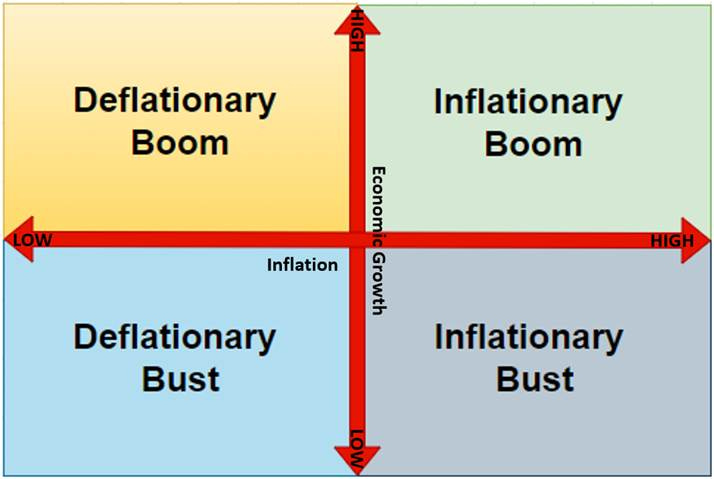

Think of the economy like a drama queen with four moods. Its “spring” arrives after a deflationary bust — central banks slash rates, governments open the money taps, and growth perks up without much inflation. Markets love it, growth stocks rally, and everyone feels clever.

Then comes the “summer,” when the economy gets too hot — inflation flares, cyclicals and commodities party, and emerging markets strut their stuff. But central banks hate fun, so they hike rates until the party collapses into a gloomy “autumn” of stagflation. Growth slows, prices stay high, and almost everything suffers — except gold. Eventually, inflation chills out and we slide into “winter,” a deflationary bust where the only winner is good old cash and anyone who went into hibernation early.

Wall Street loves nothing more than asking “Which stage of the business cycle are we in?” to experts who, let’s be honest, wouldn’t trust themselves with a lemonade stand’s cash box. They pull out every tool — from massaged government stats to market data — to decide whether we’re in “spring” growth or “winter” recession.

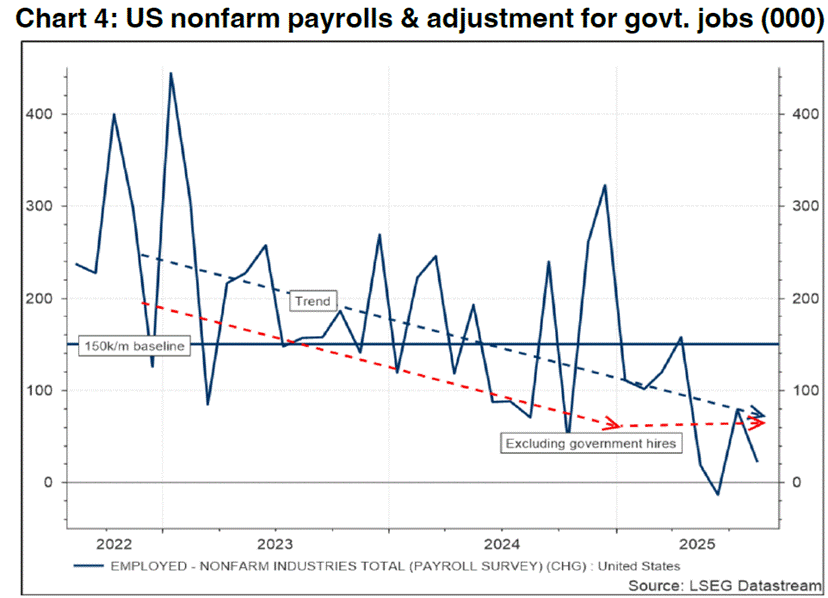

Normally, recessions announce themselves with layoffs, weak job creation, and that ever-famous yield curve inversion. The Fed then wakes up from its nap, panics, and cuts rates like a chef with a dull knife. But this time is odd: unemployment ticked up in mid-2023… and then just sat there, thanks to Yellen and Biden running record peacetime deficits and stuffing 1.5M extra government jobs into the economy. Factor in all the private jobs piggybacking on government spending, and the true unemployment rate might be closer to 5–6%. In short, we may already be in “autumn,” but Washington is still blasting the AC to keep it feeling like summer.

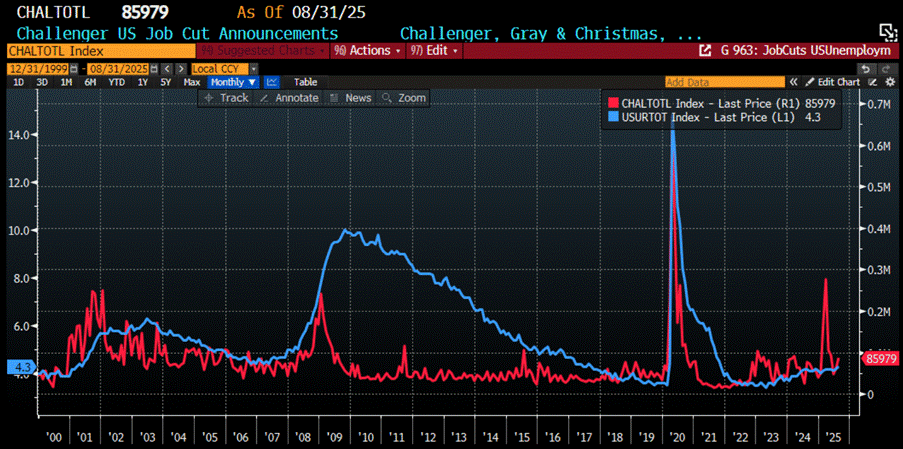

US Unemployment Rate (blue line); US Challenger US Job Cut Announcements (red line).

There’s a decent chance both the Fed and bond investors are being fooled by good old recency bias. If the population isn’t growing like it used to, payroll growth shouldn’t either — yet everyone still acts as if 200k new jobs a month is the “normal” number.

From 2010–2016, population growth was a healthy +2.25M per year, and payrolls followed at +200k per month. Fast forward to 2017–2024, population growth slowed to +1.7M per year, meaning payroll expectations should have been reset closer to 150k per month. On paper, the Biden years looked strong, with payrolls averaging 192k. But strip out the 51k/month of government hiring and you’re left with just 140k/month from the private sector — below the new “normal.” Combine that with a downward trend, and the economy may have already quietly slipped below the boom/bust line back in mid-2023, masked by overly optimistic data and deficit-fueled job creation.

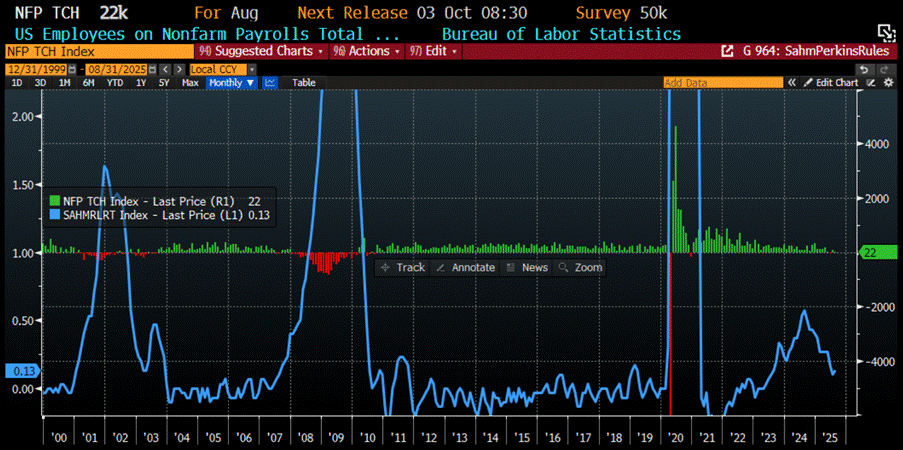

Recession rules used to be as simple as “watch unemployment — if it ticks up, duck.” The Sahm Rule says a recession is likely when the three-month average jobless rate rises 0.5% from its recent low (which it did in June 2024). The Perkins Rule is even twitchier, sounding the alarm after just a 0.3% bump. Both have been reliable canaries in the coal mine. But now we’ve run into Goodhart’s Law — when a measure becomes a target, it stops working. Policymakers know these rules and may be tweaking data, delaying stimulus, or otherwise gaming the system to avoid flashing a “recession ahead” sign. The result? These once-trusty indicators might be less like canaries and more like parrots — just repeating what the Fed wants us to hear.

Sahm Rules Indicator (blue line); US Monthly Change in Non-Farm Payrolls (histogram).

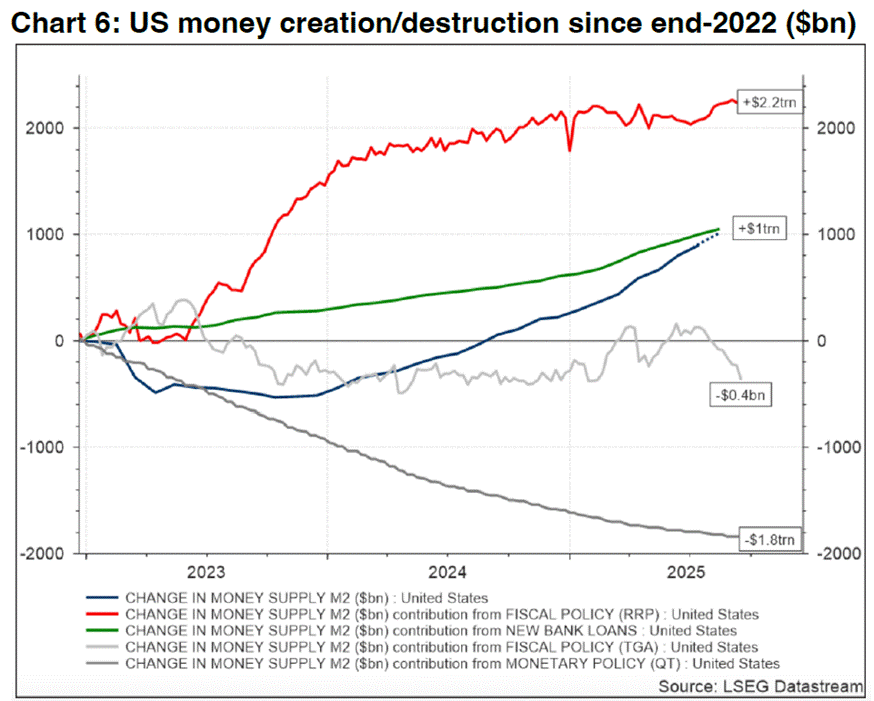

Over the past five years, the economy has been less “free market” and more “policy playground.” First came the Covid-era fiscal binge — turbocharged by the Fed’s money-printing spree — which delivered the predictable hangover of inflation and capital misallocation. The Fed tried to sober things up with rate hikes and QT, but just as the economy was bracing for a proper recession, Washington decided to throw another stimulus keg party, running record peacetime deficits to keep things looking rosy before the election. This was funded not with fresh Fed money, but by draining the $2.3T parked in reverse repos — now basically down to pocket change. The Treasury even raided its General Account, but that’s already been refilled and is no longer a piggy bank. With those tricks exhausted, the only lever left is a slowdown in QT and a new QE, which Powell has quietly done (arguably more potent than rate cuts). Add in bank lending running hot at $700B a year — and likely to accelerate with rates falling — and we’re looking at M2 money supply growth of roughly $500B a year. Translation: the policy spigot is still open, and liquidity isn’t going anywhere anytime soon.

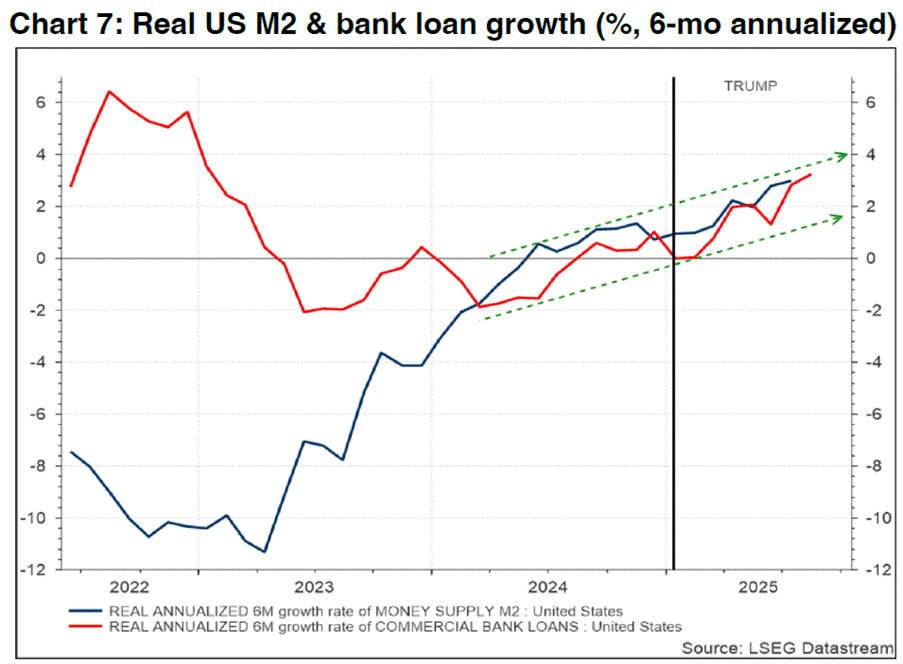

After five years of policy gymnastics, the money supply is finally trying to play by the rules: roughly matching bank loan growth (+$700B) minus QT (-$212B), leaving us with +$500B in M2 growth. Not as flashy as the +$850B average over the past 18 months, and barely enough to keep the economy moving in real terms, but there’s reason to cheer. Everyone knows that the more people a government hires, the greater the GDP growth. That is an illusion since taxes rise, and it is reducing actual productivity for government employees. Governments DO NOT ADD to the nation’s wealth any more than hiring a live-in maid increases a household income.

First, Donald Copperfield has trimmed the government payroll by 24,000 since January, freeing up space for the private sector to actually work. Second, bank lending is back on steroids — +$850B since February, and after -75bps in rate cuts, $1T by year-end isn’t crazy. Third, slower payroll growth? Blame the immigration policy, not a recession panic.

Of course, it’s not all sunshine: job cuts are spiking, vacancies are dropping, and construction/housing is still in rough shape. The economy is walking a tightrope between a restructuring recession and a private sector rebound. Fed cuts and the end of QT will only delay the inevitable Trump Stagflation which will be driven by war and social unrest related shortages.

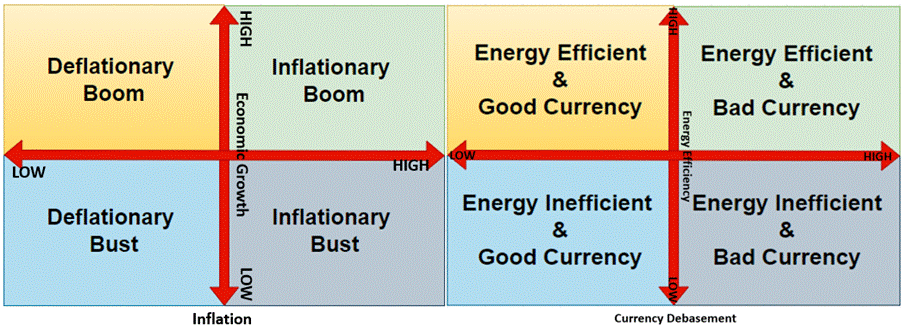

Let’s face it: official economic data is about as reliable as a weather forecast from a magic 8-ball. If you actually want to navigate the business cycle, market data does a much better job — especially if you judge the economy by energy efficiency and currency sanity.

Stocks tell the story of productive energy: if equities outpace oil, the economy’s humming; if oil outpaces stocks, growth stalls. Forget ‘CP-Lie’ — it’s useless for real-world inflation. Instead, watch gold and bonds. A strong currency protects its holders; a weak one doesn’t. The gold-to-bond ratio tells you if your money’s getting roasted or preserved.

For a longer-term perspective, compare the country’s broad equity index to oil prices against their 7-year moving average: above the line, the economy is energy-efficient and booming; below, it’s wasting energy and struggling.

For currency health, check gold versus government bonds: below the 7-year average, bonds hold value and deflation rules; above it, your currency’s being debased, and inflation is lurking. Simple, clean, and far more useful than trusting the latest “official” propaganda.

Some folks argue AI has saved the US economy from an inevitable bust — the tech fairy tale that keeps Wall Street dreaming. But signs suggest the “Money AI-st” phase of the past two years is running out of tricks, replaced by Kabuki accounting worthy of the Paypal mafia. Take September 24, 2025: Nvidia, led by its rockstar CEO, teams up with “nonprofit” OpenAI for the latest sleight-of-hand — a chip-leasing scheme. OpenAI sidesteps capex, Nvidia keeps the GPUs (and collateral), and everyone pretends this is cutting-edge innovation rather than dot-com-era financial theatre.

Call it cynical, but let’s be honest: we’ve seen this movie before, and it never ends with a happy sequel.

https://sherwood.news/tech/report-nvidia-may-lease-its-chips-to-openai-as-part-of-deal/

Nvidia’s no stranger to circular economics. Remember CoreWeave? They invested in a startup that used Nvidia chips as collateral to borrow money… to buy more Nvidia chips. Genius, or dot-com deja vu.

Fast forward to OpenAI leasing scheme, and it’s the same playbook: a loop of money and hardware masquerading as innovation. OpenAI burns cash and leans on Microsoft, Nvidia keeps the hype alive — everyone pretends this is progress. Spoiler: it’s just end-of-cycle kabuki.

Nvidia isn’t just selling GPUs; it’s sprinkling cash like confetti — six major deals in 2025 alone, including stakes in Intel, OpenAI, ElevenLabs, Gretel, Lepton AI, and CentML. The pace is dizzying, like a corporate rock band trying to headline every news cycle.

And this isn’t some scrappy startup. Nvidia is embedded in every ETF and retirement account. If the magic fades, the fallout won’t be limited to one company — it’ll rattle the whole market. Leasing GPUs? Sure, because fast-depreciating hardware is perfect for a subscription treadmill — customers run, Nvidia collects rent.

At the end of the day, when chip execs sign merch like rockstars, you’re not in a golden age — you’re at the top, and gravity is already circling.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/countdown-to-trump-stagflation

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.