Circularity Argument Is Overblown

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 10,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

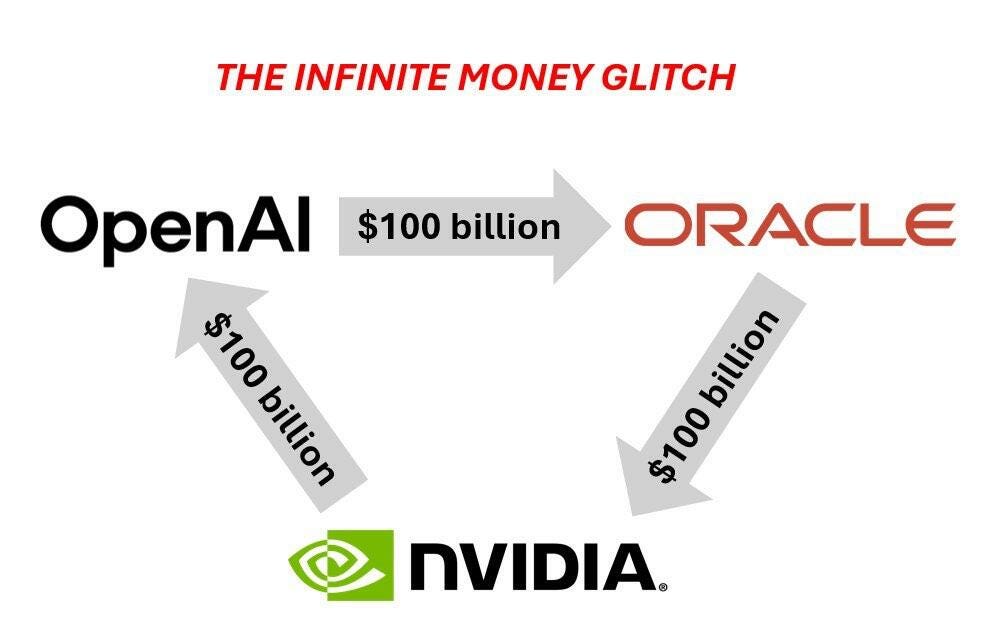

Everyone is freaking out about circularity. We touched on it a bit last week with regards to Nvidia, but the concern this time is with Oracle. They announced a deal with OpenAI (yes, the same OpenAI that also announced a deal with Nvidia) to build AI cloud computing facilities. In return, OpenAI would pay them back with future revenues. The catch is that Oracle themselves needs to borrow money to make this investment happen. So in essence, Oracle is borrowing money, to build equipment for customers, for which they will only get repaid in the future if it’s profitable.

Ok, we get why this looks shady. It looks like these companies are just passing money around in a circle and booking it as revenues. People are comparing this to dot-com-era Cisco and their vendor financing scheme (lending money to customers who buy their products). But here’s the key distinction for us:

Whereas dot-com companies’ business models were unproven, Oracle is the world’s most widely used database company. They have deep expertise and client relationships. They are already entrenched in customer data; now they are pairing it with AI inferencing and injecting it directly into enterprises. Far from speculative, they are using AI to elevate their existing product offering, catapulting it into the new generation. This is the key reason Oracle is investing so heavily into AI cloud.

But wait; it gets better. Up until now, the cloud has been dominated by an oligopoly: Amazon’s AWS, Microsoft’s Azure, and Google’s GCP. Their clouds are CPU-focused (AI is GPU-heavy) which meant that AI investment was nothing more than an afterthought. So they built it slowly using internal funding and kept from rocking the boat.

In comes Oracle upending the cozy oligopoly with a debt-fueled capex spree. In one swoop they could become the largest GPU-first cloud for enterprises and the fourth major cloud player. With their deep entrenchment in customer data, they could easily become the go-to partner for the majority of enterprises globally. And it all starts with this OpenAI investment.

So unlike dot-com internet companies, Oracle is not a speculative, leveraged gamble on nascent tech. They are an entrenched leader that has found a way to leapfrog incumbent cloud players. Investors have it backwards; this is a pivotal moment for Oracle and absolutely warrants the capex and leverage they will deploy.

As for the rest of the industry, the implication is clear: Oracle has shown willingness to leverage up hundreds of billions to seize a piece of market share. The other players must respond in kind or risk losing share. This is what disruption looks like. As the incumbents enter an arms race of debt-fueled expansion, it will spark the next phase of the AI capex bubble.

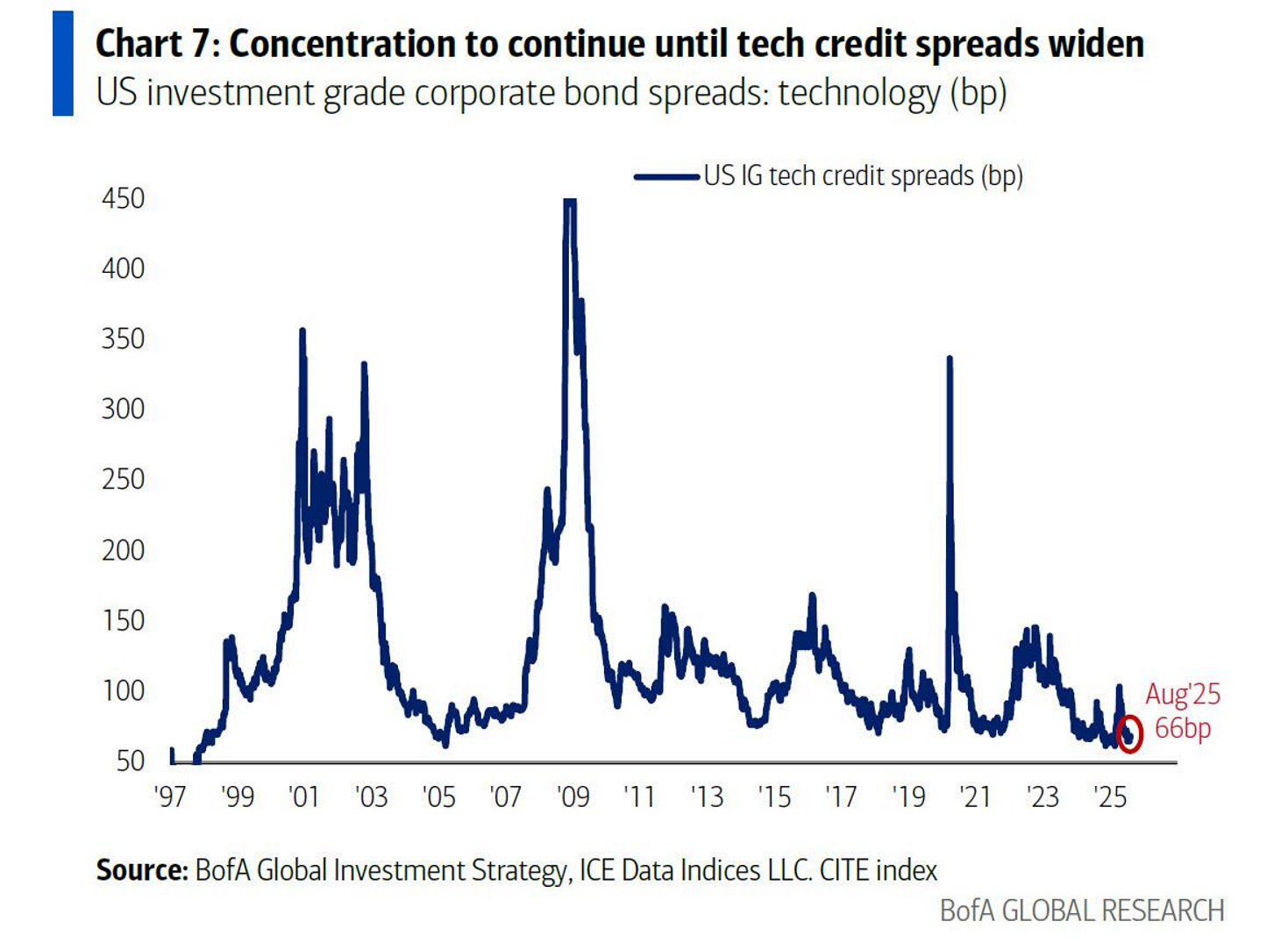

In other words, the bubble is not ending; it has only just begun. Things could get a lot crazier from here once the incumbents wake up. This is all coming at a time when credit spreads (the cost of borrowing) for tech companies is very cheap, enabling a shift in borrowing behavior:

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!