Limits of the Milkshake Theory

How the BRICS Could React if the U.S. Pushes Too Far with Tariffs

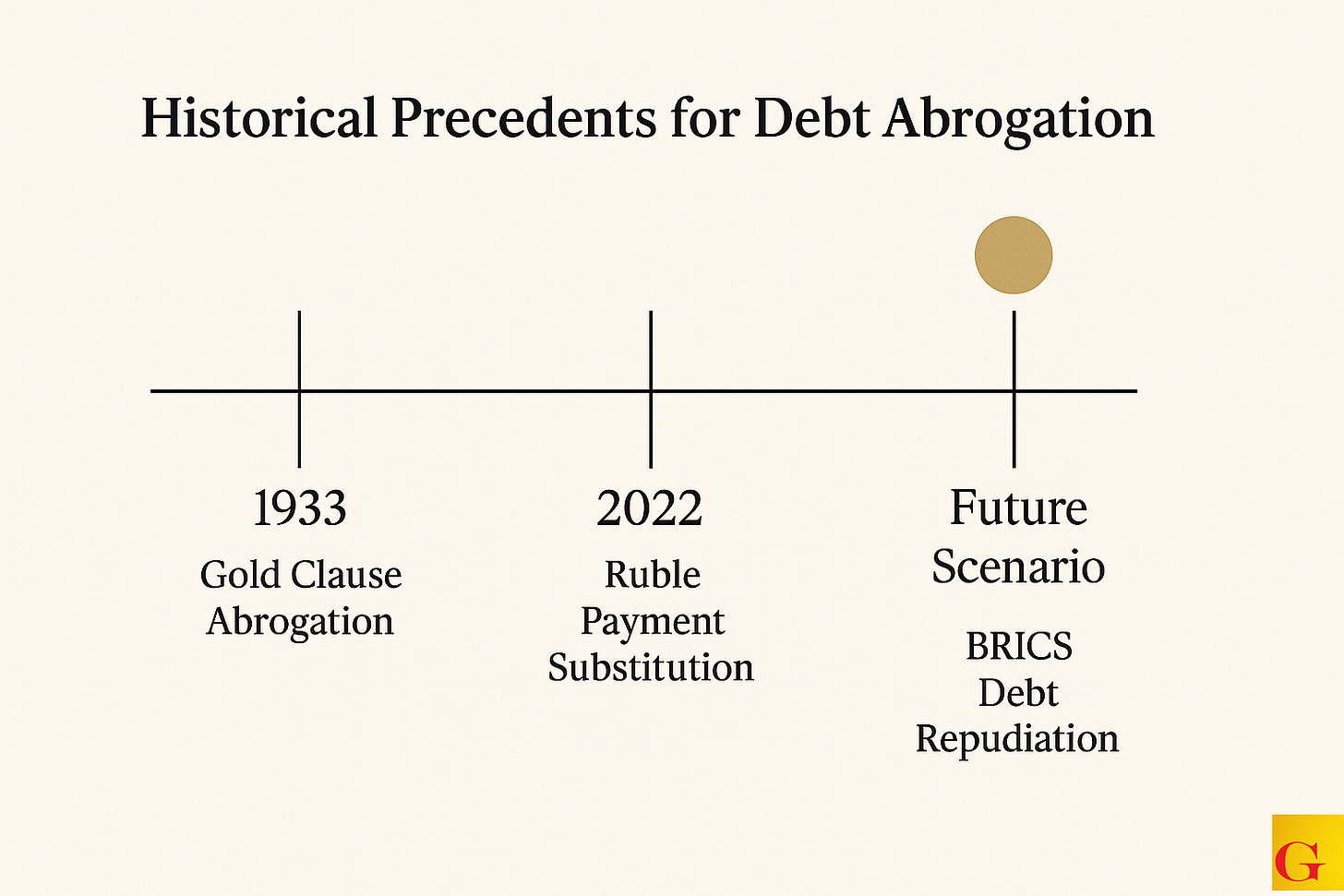

As Washington weaponizes tariffs and sanctions, the world’s reliance on the U.S. dollar reaches a breaking point. This analysis explores how BRICS nations could collectively challenge dollar hegemony, invoking economic self-defense through debt repudiation—a structural limit to the so-called Milkshake Theory of endless global demand for American liquidity.

The simple math of it is, if the global balance of payments is at risk of imbalance, then the system is in danger of collapse. And that would be existential risk for all economies, both debtors and creditors.

The use of an increasingly Weaponized dollar can and will eventually bring this problem to a head. As in all negotiation, it has a breaking point.

Contents

- Milkshake Core: Endless Dollar Demand

- Sanctions, Tariffs, and the Mechanics of Constraint

- Balance of Payments: Structural Constraint

- When Policy Creates Default Conditions

- Historical Parallel I: Russia, 2022

- The Collective Power of the BRICS

- The Choice Confronting the United States

- Historical Parallel II: The United States, 1933

- The Structural Limit of the Milkshake

- Final Comment:

- Appendix: Continued Reading

Milkshake Core: Endless Dollar Demand

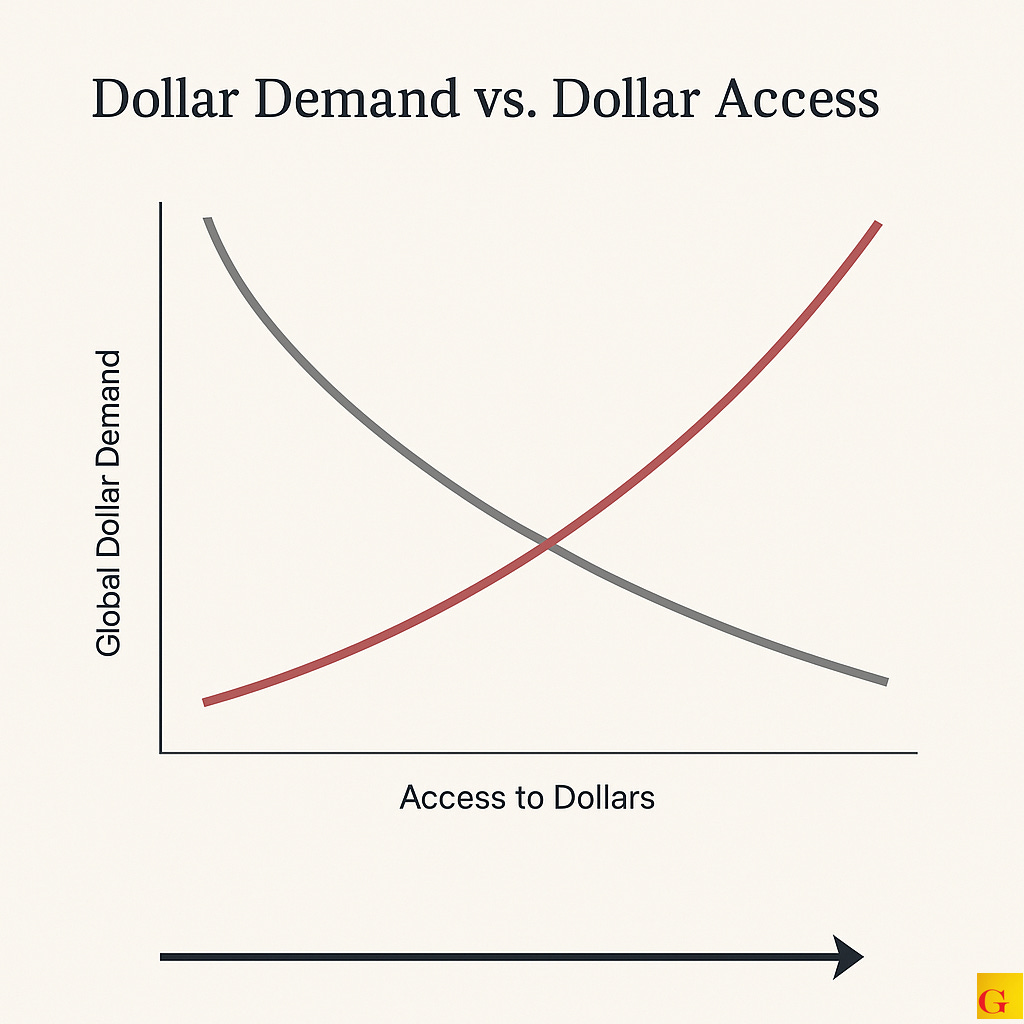

The Milkshake Theory argues that the U.S. dollar will remain dominant because global debt and trade are denominated in dollars. According to this view, financial stress elsewhere increases global demand for dollars, allowing the U.S. to “drink” liquidity from other economies. The flaw in this logic lies in assuming that other nations will always have access to dollars and will always choose to play by U.S. rules. History and current policy suggest that both assumptions have limits.

Sanctions, Tariffs, and the Mechanics of Constraint

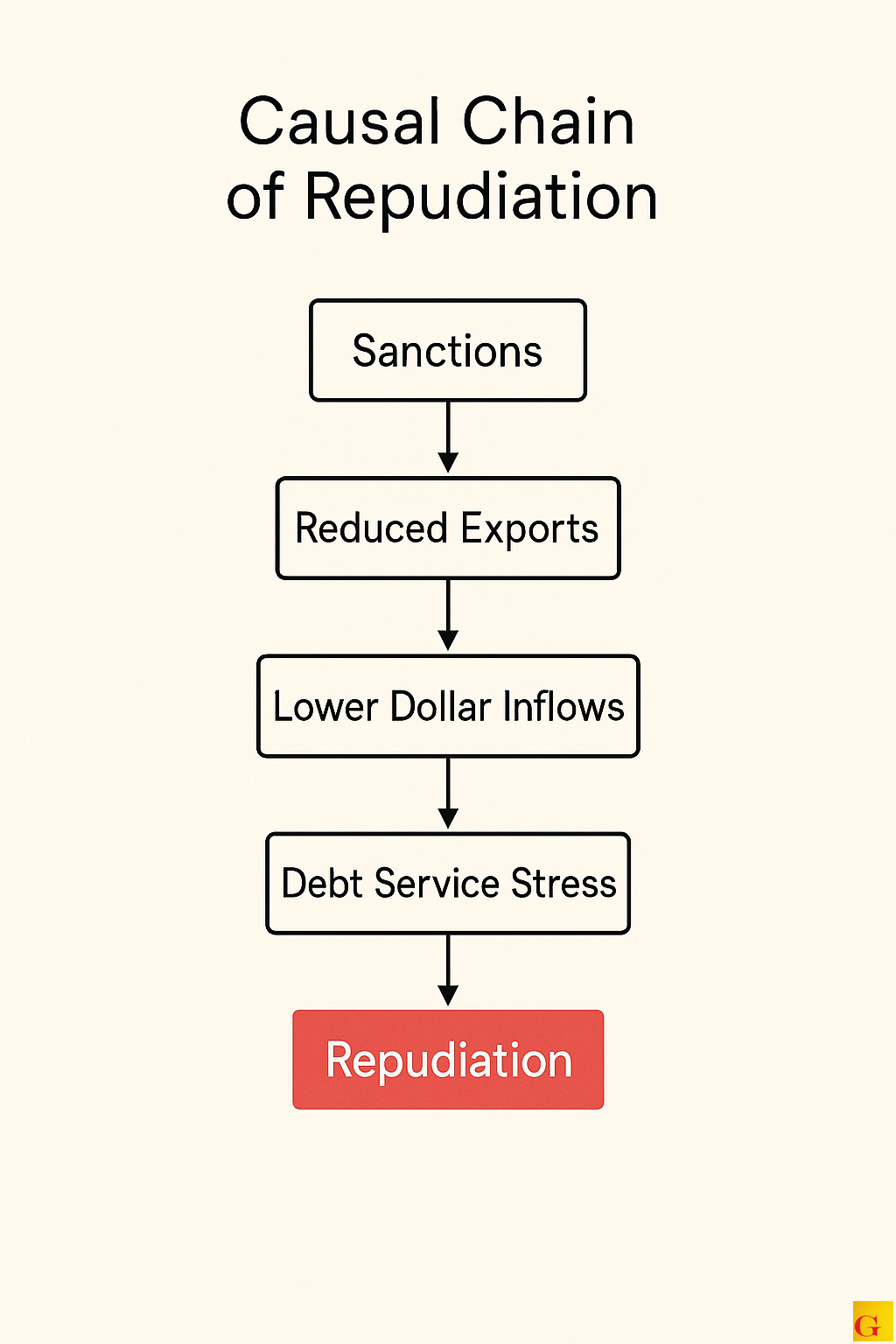

When the U.S. imposes sanctions (blocking financial flows) and tariffs (restricting exports to the U.S.) against other nations, those countries’ ability to earn dollars through trade or capital inflows is restricted. Because most emerging-market debt is denominated in dollars, maintaining the capacity to service that debt depends on a steady inflow of dollar revenue.

Balance of Payments: The Structural Constraint

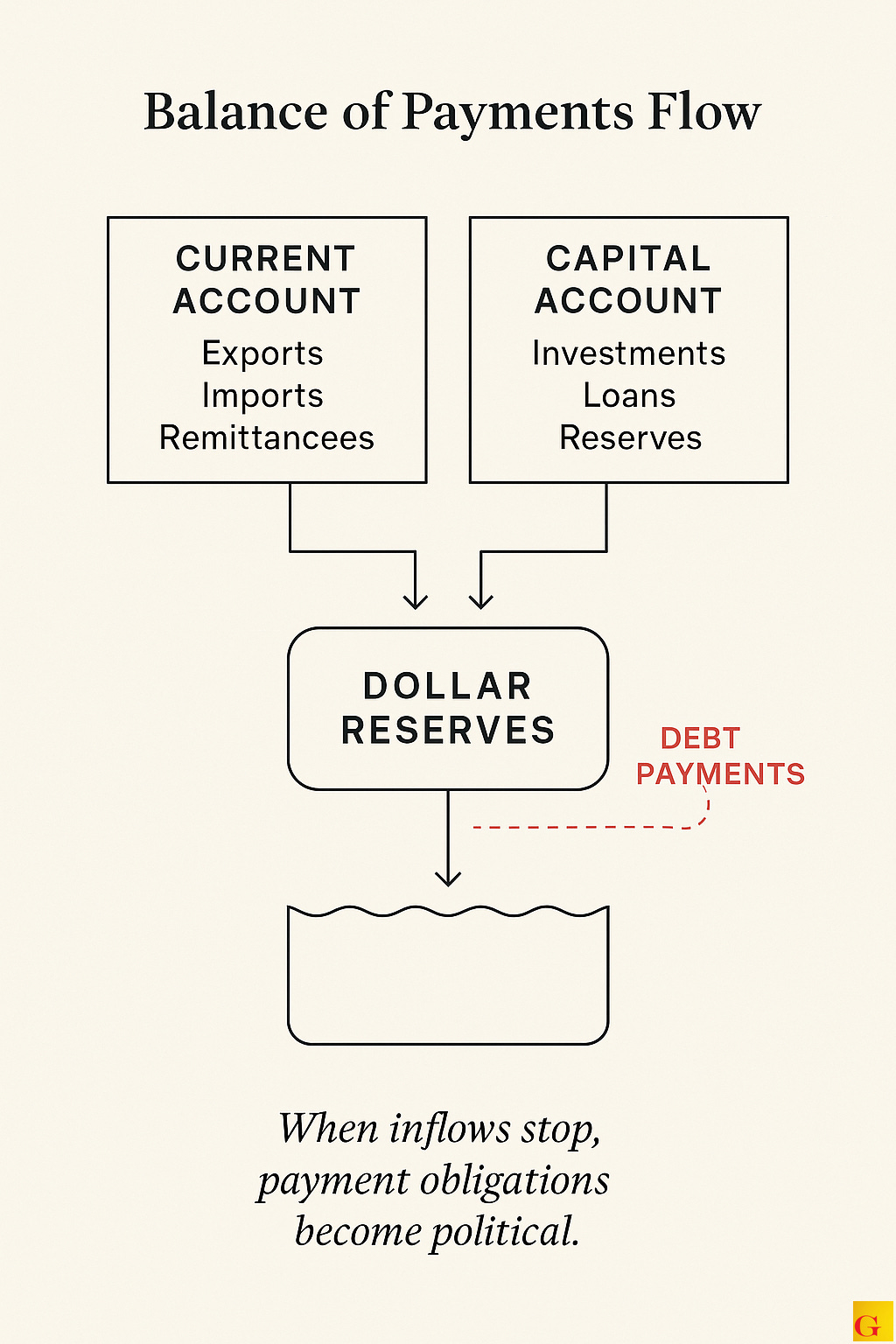

The balance of payments is the accounting framework that tracks all monetary transactions between a nation and the rest of the world. It includes the current account (exports, imports, and income flows) and the capital and financial accounts (investment and lending). For a country with dollar-denominated debt, maintaining balance means earning sufficient dollars from trade and investment inflows to cover obligations.

When sanctions or tariffs block those flows, the current account can no longer generate enough foreign exchange, and the capital account often reverses as investors flee. The result is a self-reinforcing squeeze: fewer dollars in, more owed out. In accounting terms, the balance of payments collapses into deficit; in political terms, that deficit becomes a rationale for repudiation. If nations cannot earn dollars because of U.S. restrictions, the legitimacy of continuing to repay in dollars erodes, transforming a liquidity problem into a structural fault line.

When Policy Creates Default Conditions

When those flows are artificially constrained by U.S. policy, a debtor nation’s financial stress becomes externally imposed rather than self-inflicted. This lays the foundation for an argument of repudiation or suspension of payments under the doctrines of odious debt or force majeure in a sovereign context. There is precedent for such reasoning, although legal theory and political reality are often miles apart.

Historical Parallel I: Russia, 2022

The Collective Power of the BRICS

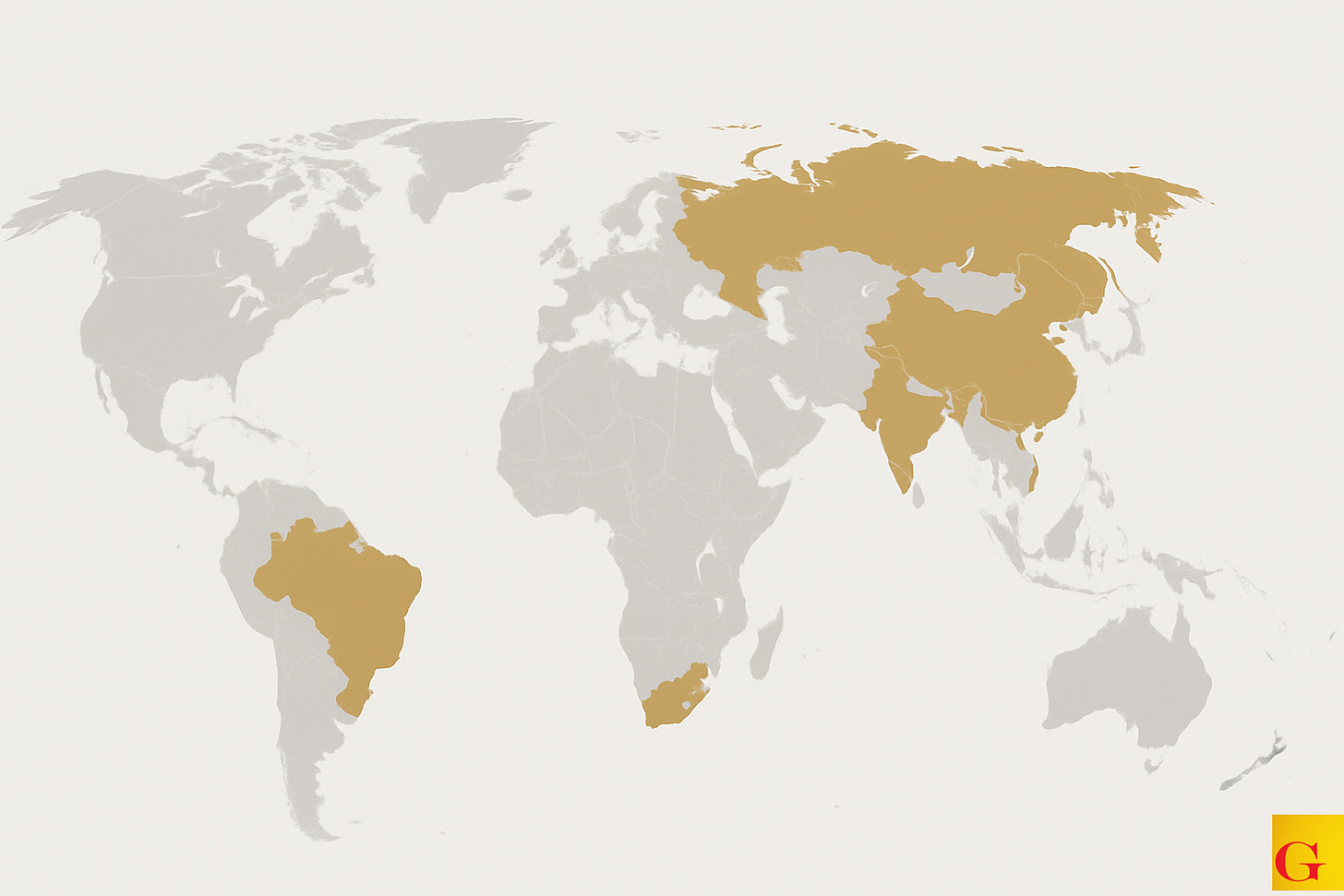

In practice, for a modern challenge to succeed, BRICS nations would need to act collectively. A single country repudiating its debt would be isolated and punished. If a coalition of major economies acted in unison, the dynamics would change. The U.S., which controls much of the global dollar payment network through which these nations service their obligations, would face accusations of restraint of trade if it restricted access. Such restrictions would directly undermine those nations’ ability to repay, lending credibility to classifying the affected obligations as “odious.”

The Choice Confronting the United States

If such a coordinated repudiation were to occur, the U.S. would face a stark choice:

- Negotiate on debt, tariffs, and sanctions, acknowledging the limits of dollar-based hegemony; or

- Enforce dollar dominance through military or geopolitical coercion.

That implicit threat of enforcement has long underpinned the dollar’s strength and the global eurodollar system. Yet the U.S. has not faced a unified bloc with comparable economic scale challenging that order. The BRICS collective represents such a bloc.

Historical Parallel II: The United States, 1933

President Franklin Roosevelt suspended gold convertibility for domestic obligations and abrogated gold clauses in U.S. contracts. The policy effectively redefined payment terms to safeguard national economic stability. Although the context differs from sanctions, the episode shows that even core monetary commitments can be subordinated to political and survival imperatives when the framework shifts.

The Structural Limit of the Milkshake

This does not mean a BRICS repudiation is imminent, but it does highlight the limits of the Milkshake Theory, which assumes perpetual global demand for dollars regardless of U.S. policy choices. There are political, economic, and moral thresholds beyond which nations can and will push back. If those thresholds are crossed, the United States may be forced to choose between being a reasonable custodian of the global system or defending the dollar’s dominance through coercion. The BRICS have both the motive and the capacity to default collectively if pushed far enough.

Continues here

Free Posts To Your Mailbox